Agreements among family members for the settlement of an intestate's estate will be upheld in the absence of fraud and when the rights of creditors are met. Intestate means that the decedent died without a valid will. The termination of any family controversy or the release of a reasonable, bona fide claim in an intestate estate have been held to be sufficient consideration for a family settlement.

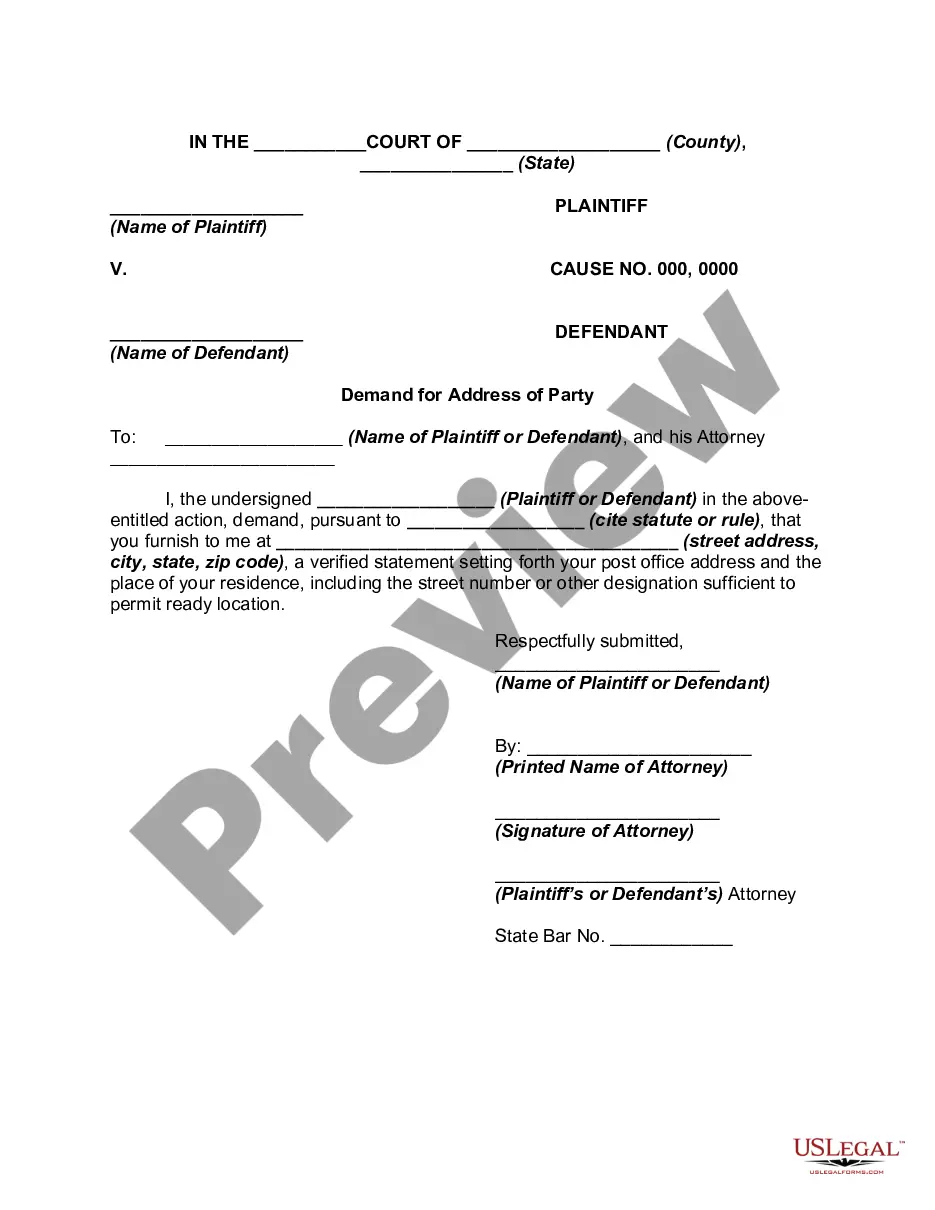

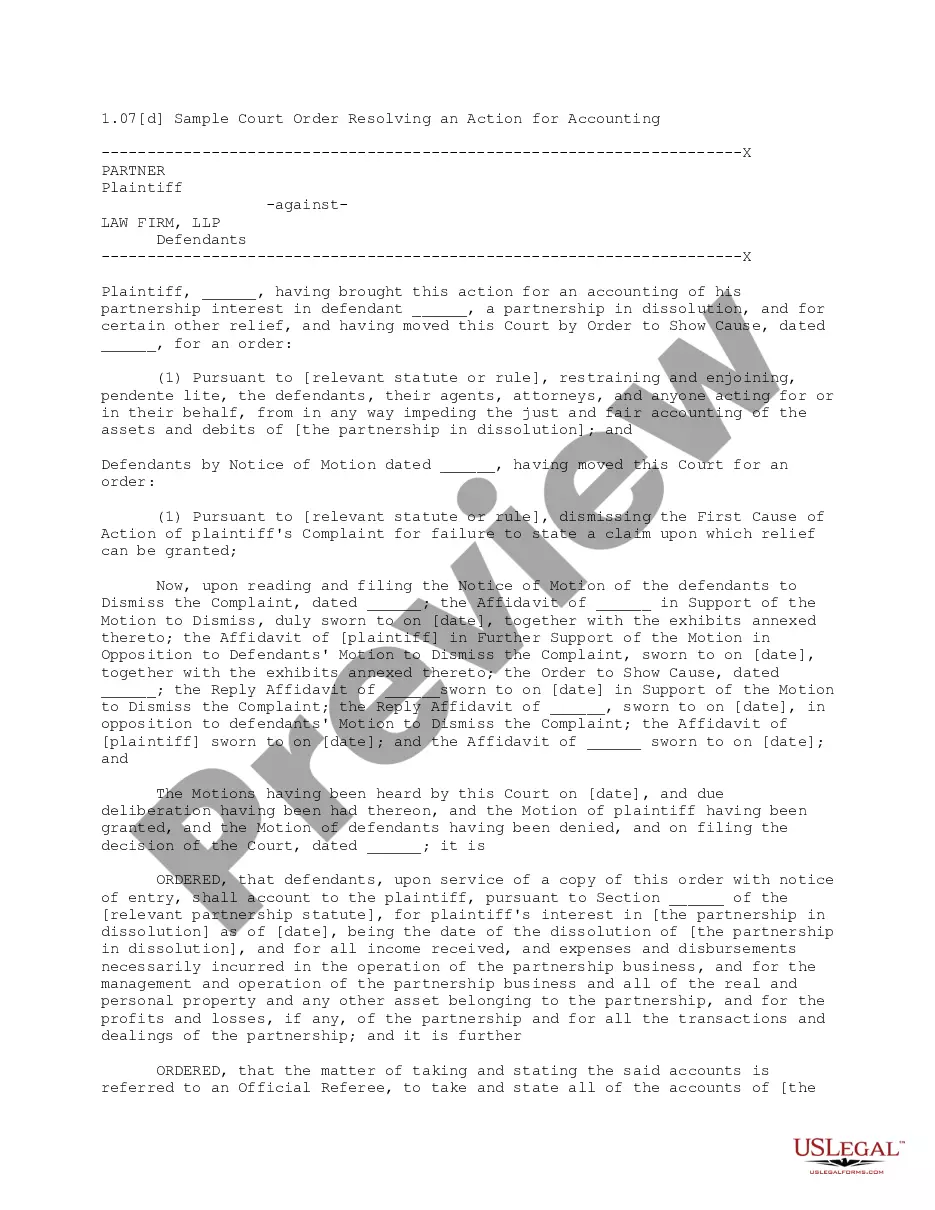

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The New York Agreement Between Widow and Heirs as to Division of Estate refers to a legal document that outlines the terms and conditions regarding the division of an estate between a widow and the deceased's heirs in the state of New York. This agreement is crucial for establishing a fair and amicable distribution of assets, ensuring the wishes of the deceased are respected, and resolving any potential disputes among beneficiaries and the surviving spouse. Within the context of estate planning and wealth distribution, several types of New York Agreements Between Widow and Heirs as to Division of Estate might exist. Some key variations include: 1. New York Agreement Between Widow and Heirs as to Division of Real Estate: This specific agreement focuses on the equitable division of real estate properties or assets, such as residential homes, commercial buildings, or land. 2. New York Agreement Between Widow and Heirs as to Division of Financial Assets: This agreement specifically addresses the allocation of financial assets such as cash, bank accounts, stocks, bonds, investment portfolios, and retirement funds among the widow and heirs. 3. New York Agreement Between Widow and Heirs as to Division of Personal Property: In this case, the agreement concentrates on the fair distribution of personal belongings, including furniture, artwork, jewelry, vehicles, collections, and other valuable items. 4. New York Agreement Between Widow and Heirs as to Division of Business Interests: When the deceased individual held ownership in a business or had extensive business-related assets, this type of agreement determines how the business interests are to be divided between the widow and heirs. It may include shares, partnership holdings, intellectual property, or other pertinent aspects. When drafting a New York Agreement Between Widow and Heirs as to Division of Estate, it is essential to consider various crucial aspects. These may include the fair market valuation of assets, the intentions expressed in the deceased's will, any debts or liabilities associated with the estate, and the individual circumstances of each beneficiary and the surviving spouse. By thoughtfully considering and addressing such factors in the agreement, the chances of a smooth estate division process and reduced conflicts among heirs and the widow are considerably heightened.