If you want to full, acquire, or print out lawful file layouts, use US Legal Forms, the most important selection of lawful forms, which can be found on-line. Utilize the site`s basic and hassle-free research to discover the paperwork you will need. Various layouts for enterprise and personal functions are sorted by categories and claims, or search phrases. Use US Legal Forms to discover the New York Notice of Lien to a Subdivision Lot Owner For Unpaid Assessment in a handful of click throughs.

In case you are already a US Legal Forms consumer, log in in your account and click on the Download key to find the New York Notice of Lien to a Subdivision Lot Owner For Unpaid Assessment. You may also access forms you earlier delivered electronically in the My Forms tab of your respective account.

If you use US Legal Forms initially, refer to the instructions under:

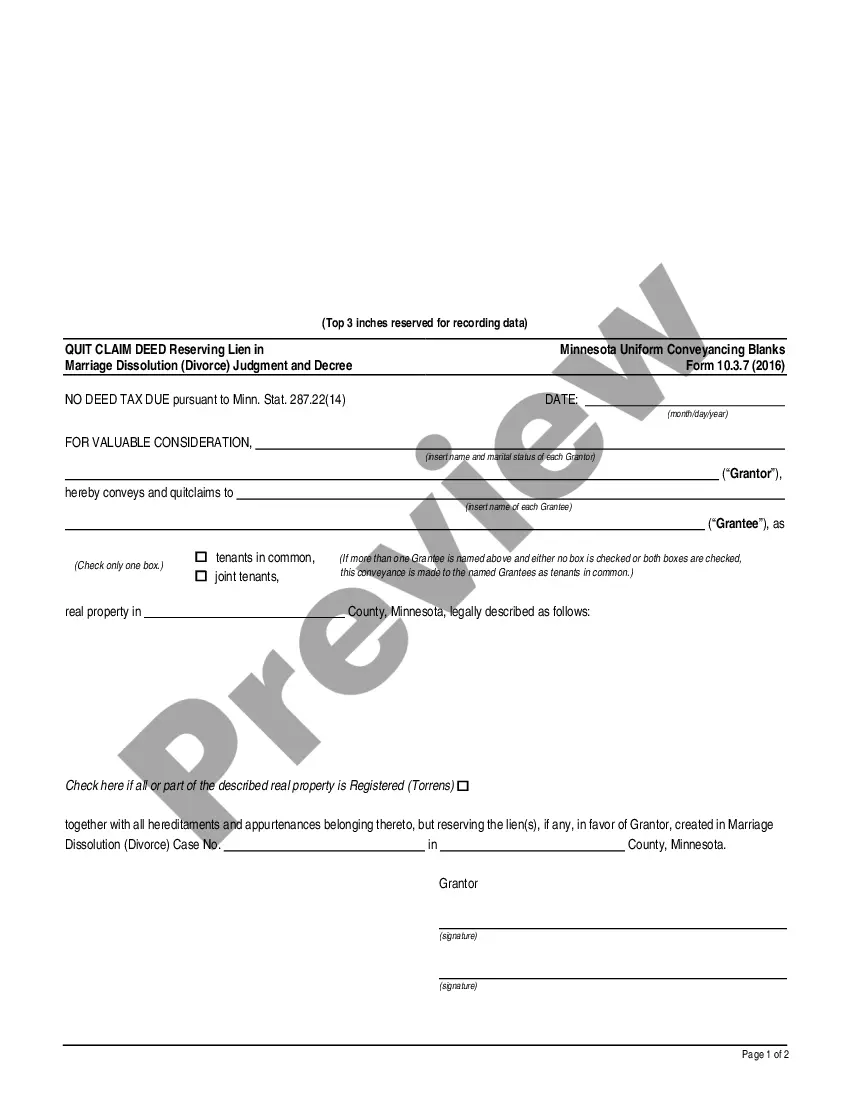

- Step 1. Be sure you have chosen the form for your correct town/nation.

- Step 2. Use the Preview option to look through the form`s content material. Never neglect to learn the explanation.

- Step 3. In case you are unhappy using the type, take advantage of the Look for industry on top of the display to get other variations of the lawful type web template.

- Step 4. Upon having discovered the form you will need, go through the Buy now key. Select the costs strategy you favor and add your accreditations to register to have an account.

- Step 5. Process the deal. You may use your charge card or PayPal account to finish the deal.

- Step 6. Pick the formatting of the lawful type and acquire it on your own product.

- Step 7. Complete, modify and print out or signal the New York Notice of Lien to a Subdivision Lot Owner For Unpaid Assessment.

Each and every lawful file web template you purchase is your own property permanently. You have acces to each and every type you delivered electronically within your acccount. Click the My Forms portion and choose a type to print out or acquire yet again.

Compete and acquire, and print out the New York Notice of Lien to a Subdivision Lot Owner For Unpaid Assessment with US Legal Forms. There are millions of expert and status-specific forms you may use for the enterprise or personal requires.