This form is a sample of an agreement to renew (extend) the term of a trust agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New York Agreement to Renew Trust Agreement

Description

How to fill out Agreement To Renew Trust Agreement?

You can invest several hours online trying to locate the legal document template that fulfills your state and federal requirements.

US Legal Forms offers a vast array of legal documents that have been reviewed by experts.

You can easily download or print the New York Agreement to Renew Trust Agreement from this service.

If available, utilize the Review button to examine the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the New York Agreement to Renew Trust Agreement.

- Each legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click the relevant button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your state/region of preference.

- Check the form description to ensure you have chosen the right document.

Form popularity

FAQ

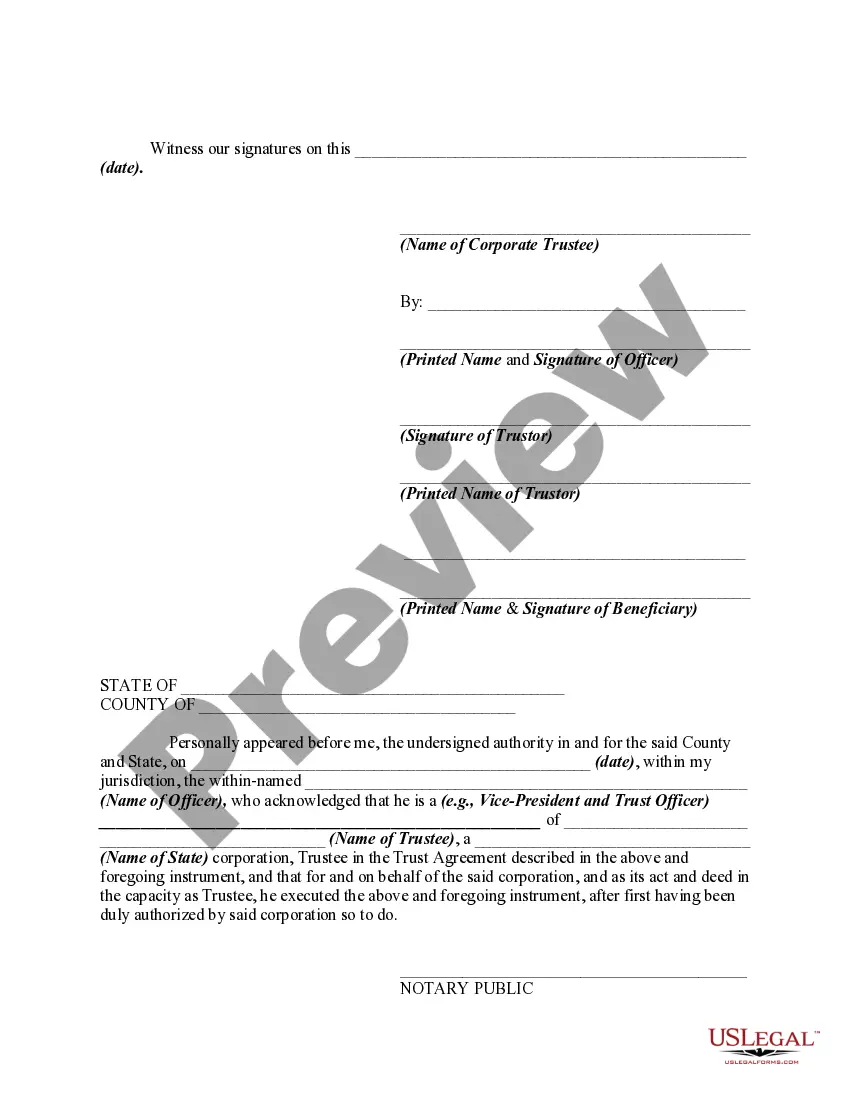

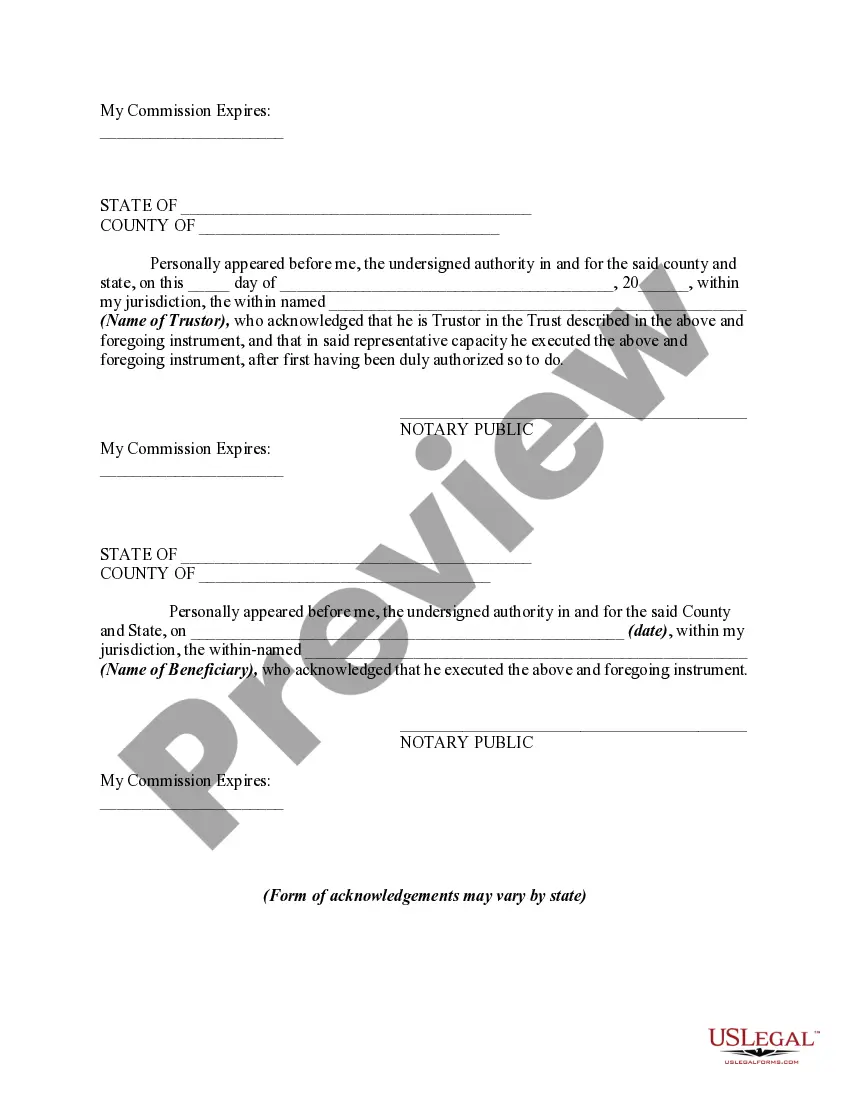

The agreement and declaration of trust is a comprehensive document that establishes the trust's legal parameters, including the roles of trustees and beneficiaries. In a New York Agreement to Renew Trust Agreement, this document articulates the trust's objectives and the rights of all parties involved, creating a clear framework for managing the entrusted assets.

Yes, a trust can be extended, but the process typically involves creating a New York Agreement to Renew Trust Agreement that formally amends the existing trust. This allows the trustee to continue managing and distributing assets according to updated wishes. Consulting a legal expert can provide guidance on ensuring the extension is valid and meets all requirements.

One major mistake parents often make is failing to clearly define the trust's purpose and conditions. Without a well-structured New York Agreement to Renew Trust Agreement, the trust can become confusing, leading to potential disputes or mismanagement of assets. Clear communication and documentation can prevent these issues and ensure that parental intentions are honored.

The primary difference lies in their scope; a declaration of trust focuses on the specific duties and powers of the trustee, while a trust agreement encapsulates the entire arrangement of the trust. This distinction is significant in legal contexts, especially when dealing with a New York Agreement to Renew Trust Agreement, as it can affect asset management and distribution.

A trust agreement is a broader document that outlines the entire framework of the trust, while a declaration of trust specifically details the terms and conditions set by the creator. In many cases, the declaration is a component of the overall trust agreement. To fully grasp the intricacies, especially in a New York Agreement to Renew Trust Agreement, it helps to understand both elements.

A restated trust agreement revises and restates the original trust document while incorporating all amendments made over time. This process ensures that all terms are clear and up to date, consolidating changes into a single document. For those navigating the complexities of a New York Agreement to Renew Trust Agreement, a restated trust can simplify administration responsibilities.

A declaration of trust is often referred to as a trust declaration. This document outlines the terms of the trust and specifies how the assets will be managed. In the context of a New York Agreement to Renew Trust Agreement, it serves a crucial role in ensuring the document accurately reflects the intentions of the trust's creator.

Certain assets should generally be excluded from a revocable trust to avoid complications. For example, retirement accounts and life insurance policies typically have designated beneficiaries, making them unnecessary within the trust. Additionally, you may also want to leave out personal property that might require special management. Understanding what to include and exclude in your New York Agreement to Renew Trust Agreement is crucial for effective estate planning.

Writing up a revocable trust requires you to structure the document clearly and accurately. Begin by identifying the grantor, trustee, and beneficiaries. Next, specify how you want your assets to be managed and distributed during your lifetime and after death. Utilizing services like US Legal Forms can simplify this process with templates designed for creating a valid New York Agreement to Renew Trust Agreement.

A trust restatement is an updated version of an existing trust document that incorporates changes or clarifications. For instance, if you want to modify beneficiaries or adjust distribution terms, you would create a restatement to reflect these changes. This process is often simpler than drafting a new trust. Using a New York Agreement to Renew Trust Agreement offers a structured way to formalize adjustments to your trust.