An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New York Assignment by Beneficiary of a Percentage of the Income of a Trust

Description

How to fill out Assignment By Beneficiary Of A Percentage Of The Income Of A Trust?

Are you in a situation where you need documents for both business or specific purposes almost every day.

There are numerous legal document templates accessible online, but finding ones you can rely on isn’t simple.

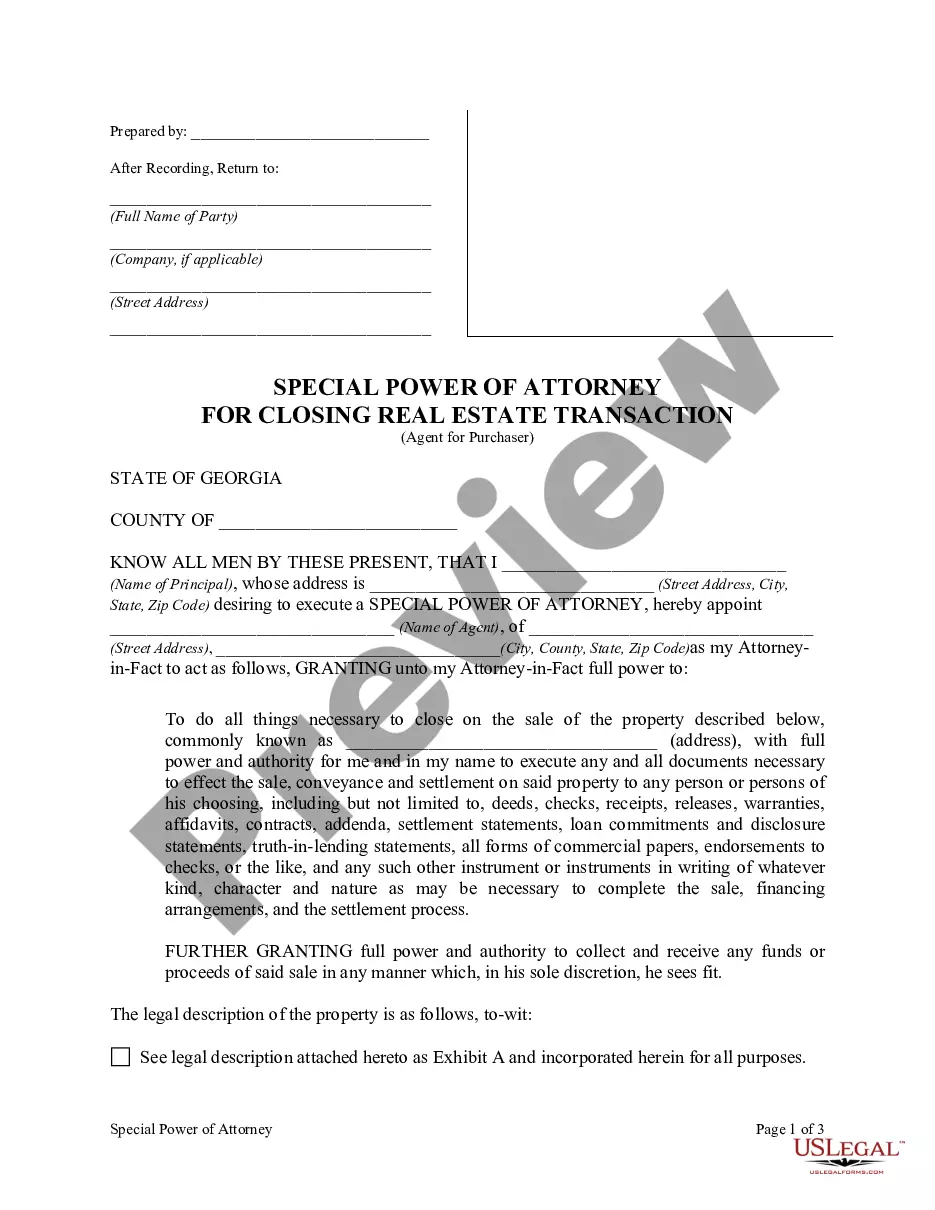

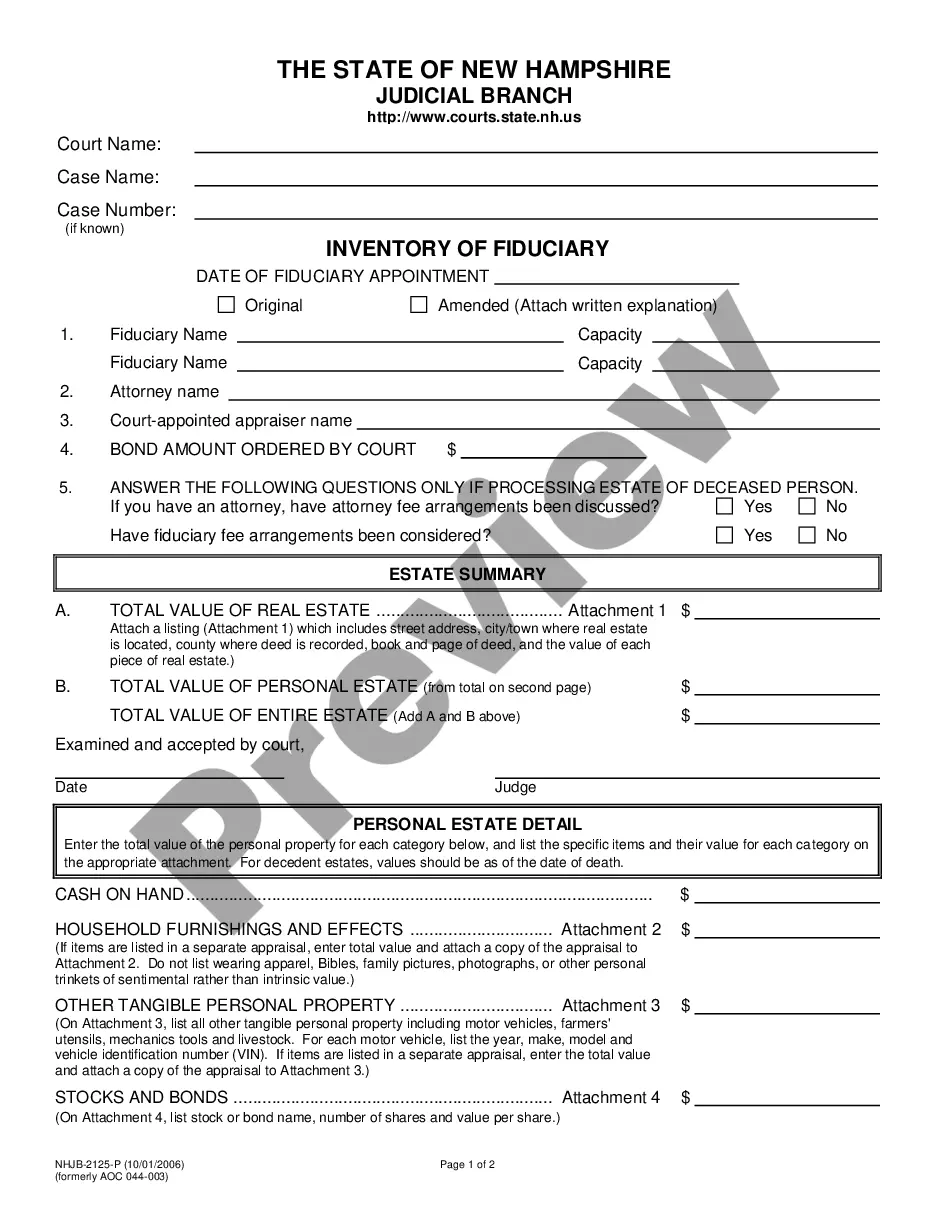

US Legal Forms provides a wide range of form templates, including the New York Assignment by Beneficiary of a Percentage of the Income of a Trust, which can be generated to meet federal and state standards.

Once you find the appropriate form, click Buy now.

Choose the pricing plan you prefer, fill in the required information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the New York Assignment by Beneficiary of a Percentage of the Income of a Trust template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Utilize the Preview button to review the document.

- Examine the description to confirm you have selected the correct form.

- If the form isn’t what you're looking for, use the Search field to locate the form that suits your needs.

Form popularity

FAQ

To allocate trust income effectively in the context of a New York Assignment by Beneficiary of a Percentage of the Income of a Trust, you must first understand the trust terms and provisions. The trust document typically outlines the income distribution plan, which specifies how income is divided among beneficiaries. It is crucial to adhere to these guidelines to maintain compliance with legal standards. For detailed assistance, you can utilize the US Legal Forms platform, which provides resources and forms to streamline the allocation process.

To report inheritance income, you list the income on your tax return for the year it was received. While inheritance itself is generally not taxable, any earnings generated by that inheritance, such as interest or dividends, need to be reported. For those utilizing the New York Assignment by Beneficiary of a Percentage of the Income of a Trust, we recommend consulting resources on the USLegalForms platform to navigate the complexities of reporting this income accurately.

Beneficiaries typically receive a Form 1099 if the income distributed from the trust meets certain thresholds. This form reports the income earned, and you must use it when filing your tax return. When dealing with the New York Assignment by Beneficiary of a Percentage of the Income of a Trust, understanding when and how these forms are issued can help you stay organized and informed about your tax responsibilities.

Yes, you must report beneficiary income on your tax return. The IRS requires beneficiaries to declare any income received from a trust, as it may be subject to income tax. Utilizing the New York Assignment by Beneficiary of a Percentage of the Income of a Trust helps you effectively manage your reporting obligations and ensures compliance with tax regulations.

The beneficiary income of a trust is the portion of the trust's earnings that beneficiaries receive. This income can include interest, dividends, and capital gains generated from the trust's assets. Understanding the New York Assignment by Beneficiary of a Percentage of the Income of a Trust can help you clarify how and when this income may be distributed to you, ensuring transparency and consistency in financial planning.

Trust income taxes depend on the distribution policy of the trust. If you receive a New York Assignment by Beneficiary of a Percentage of the Income of a Trust, the income you receive is generally taxed as ordinary income. Therefore, it appears on your tax return and may affect your overall tax rate. For clarity, consult US Legal Forms for resources on understanding the tax implications and managing your trust income.

To report beneficiary income from a New York Assignment by Beneficiary of a Percentage of the Income of a Trust, you need to use IRS Form 1040. As a beneficiary, you must include your share of the trust's income on your individual tax return. Be sure to review the final K-1 form provided by the trust, as it details your earnings. For further assistance, consider using US Legal Forms, which can provide the necessary templates and guidance.

A current income beneficiary is entitled to receive the income generated by the trust assets during the trust's lifespan. This designation is quite relevant when considering a New York Assignment by Beneficiary of a Percentage of the Income of a Trust. Understanding the rights of current income beneficiaries helps all parties involved to navigate the distribution process effectively.

Generally, income received from a trust is taxable to the beneficiary, depending on how the income is classified. For example, a New York Assignment by Beneficiary of a Percentage of the Income of a Trust might impact the taxation process. It's crucial for beneficiaries to stay informed about their tax obligations and seek professional advice to ensure compliance.

A life income beneficiary is a person who receives income from a trust for the duration of their life. Upon their passing, the trust's assets may then be distributed to other beneficiaries. This arrangement can often include a New York Assignment by Beneficiary of a Percentage of the Income of a Trust, influencing how income is handled during the beneficiary's lifetime.