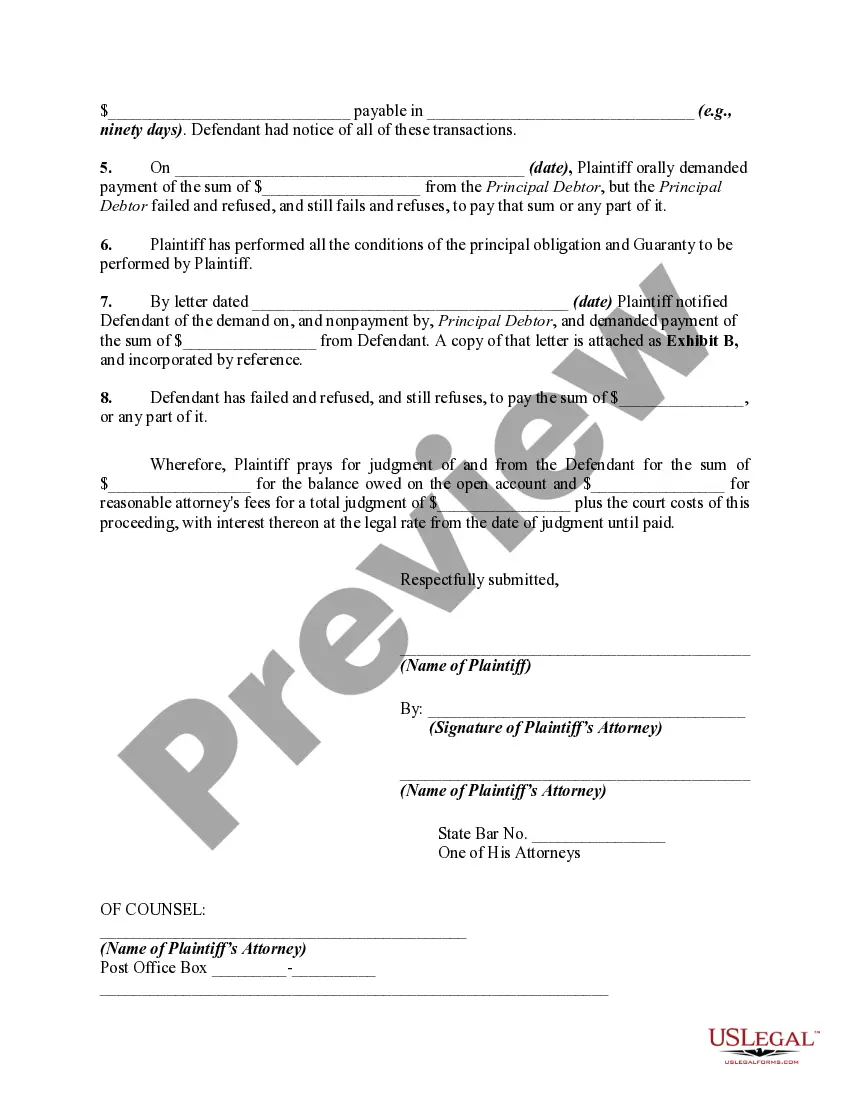

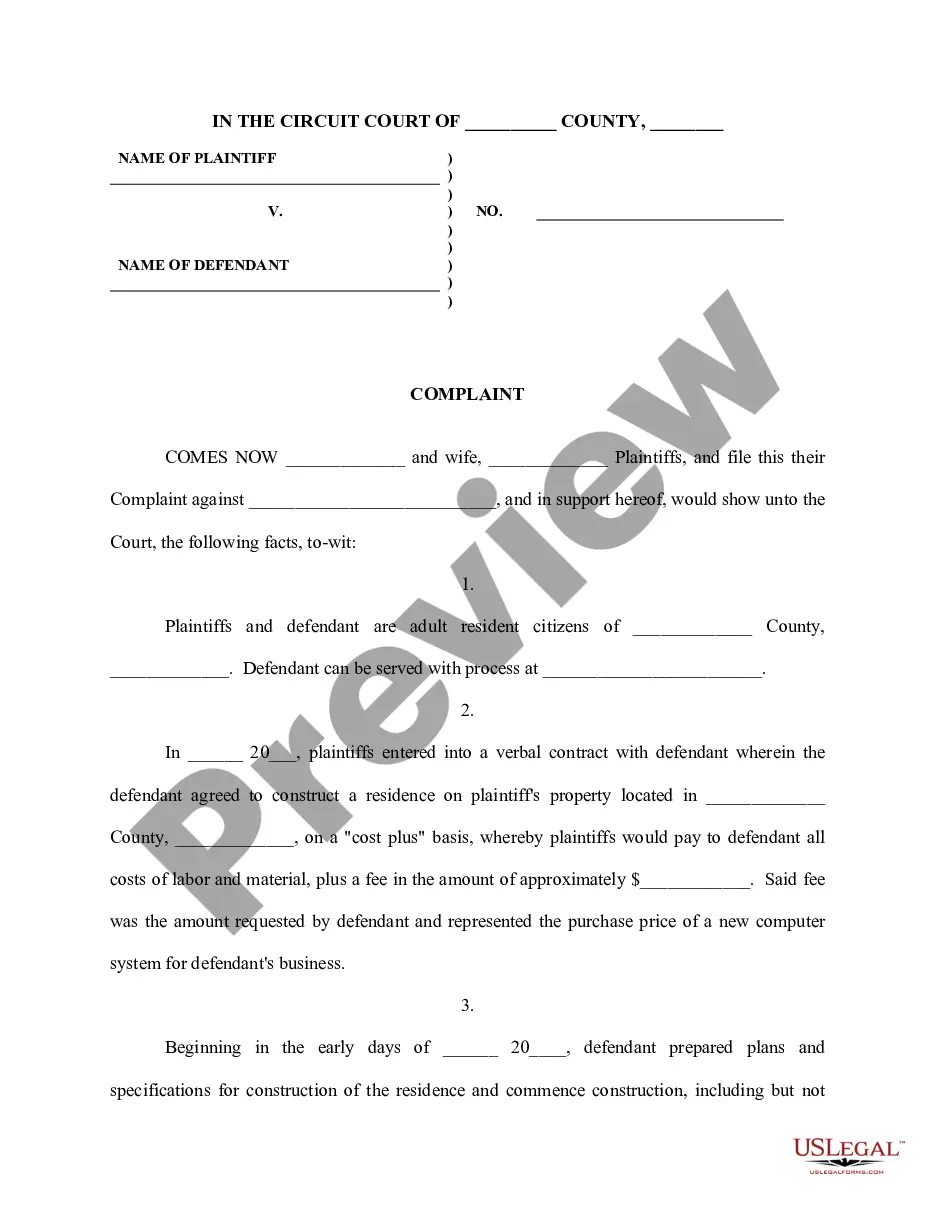

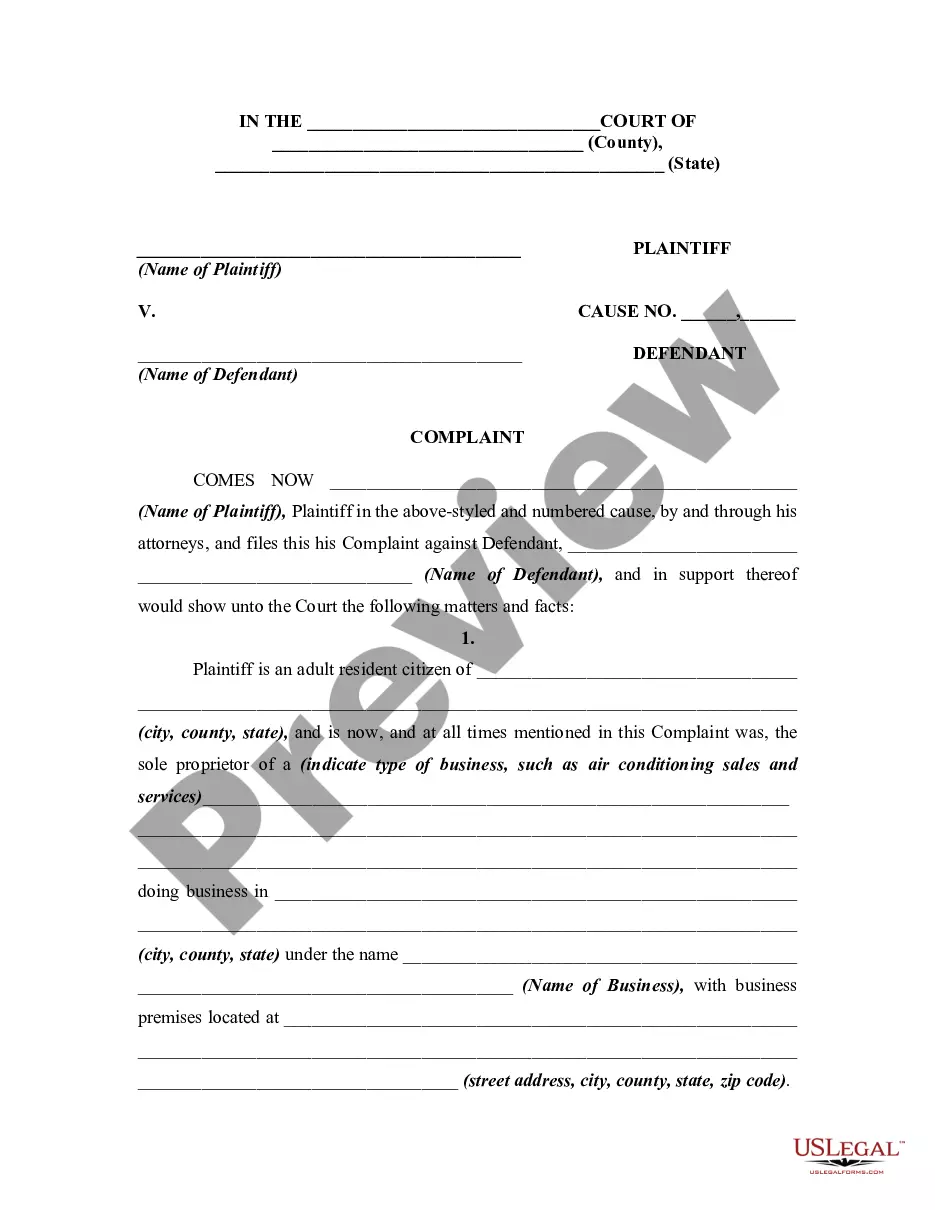

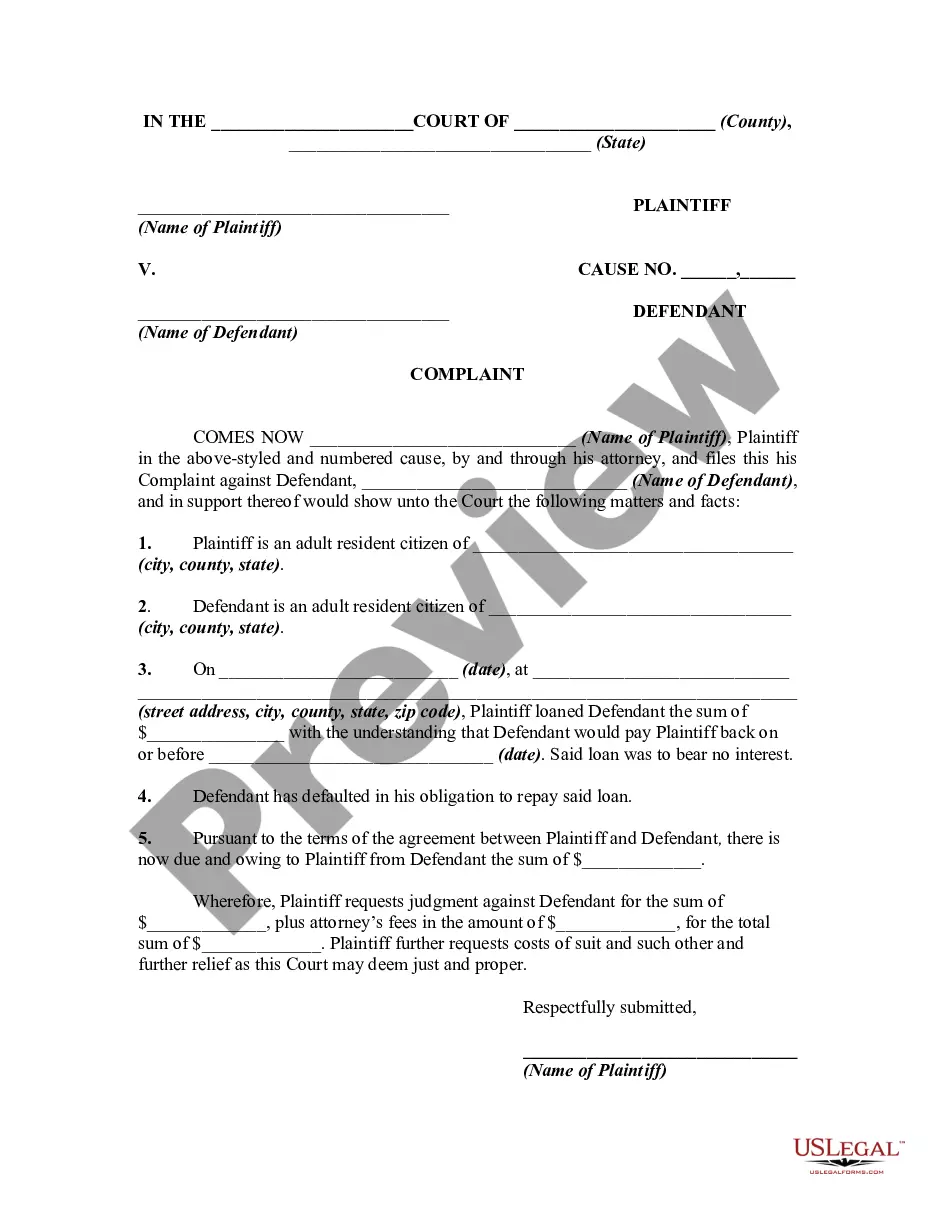

Are you in a position that you require documents for both organization or individual functions almost every day time? There are a lot of authorized document layouts available online, but finding kinds you can depend on is not effortless. US Legal Forms gives a large number of form layouts, such as the New York Complaint Against Guarantor of Open Account Credit Transactions - Breach of Oral or Implied Contracts, which are written to satisfy federal and state requirements.

If you are previously acquainted with US Legal Forms site and also have a free account, just log in. Following that, you are able to acquire the New York Complaint Against Guarantor of Open Account Credit Transactions - Breach of Oral or Implied Contracts design.

Should you not offer an bank account and wish to begin to use US Legal Forms, follow these steps:

- Get the form you want and make sure it is for that right area/county.

- Make use of the Review button to review the form.

- Look at the explanation to actually have selected the right form.

- If the form is not what you are seeking, take advantage of the Research area to discover the form that meets your needs and requirements.

- If you obtain the right form, click Get now.

- Choose the prices strategy you want, complete the necessary information to generate your bank account, and pay for the transaction using your PayPal or charge card.

- Decide on a convenient paper file format and acquire your duplicate.

Find all of the document layouts you might have bought in the My Forms menus. You can get a more duplicate of New York Complaint Against Guarantor of Open Account Credit Transactions - Breach of Oral or Implied Contracts anytime, if needed. Just click the required form to acquire or print the document design.

Use US Legal Forms, by far the most substantial assortment of authorized kinds, to save efforts and steer clear of faults. The assistance gives expertly made authorized document layouts that can be used for an array of functions. Produce a free account on US Legal Forms and begin generating your lifestyle a little easier.