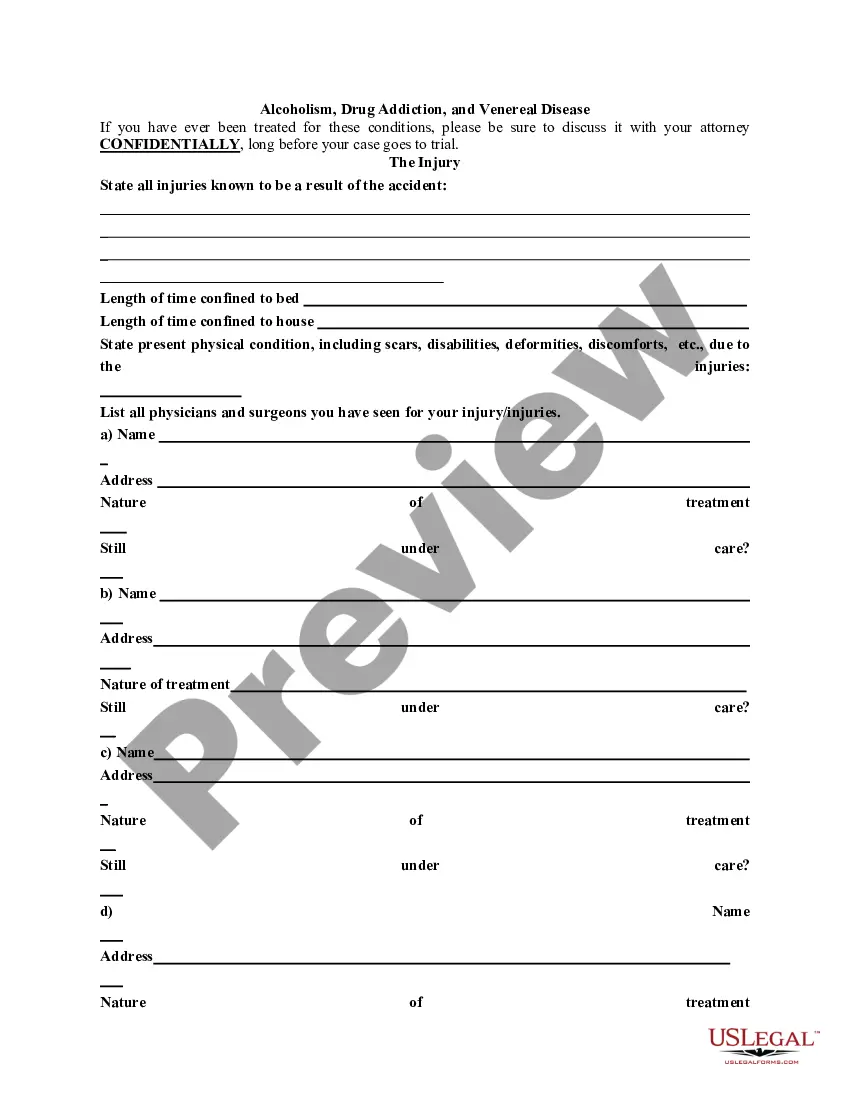

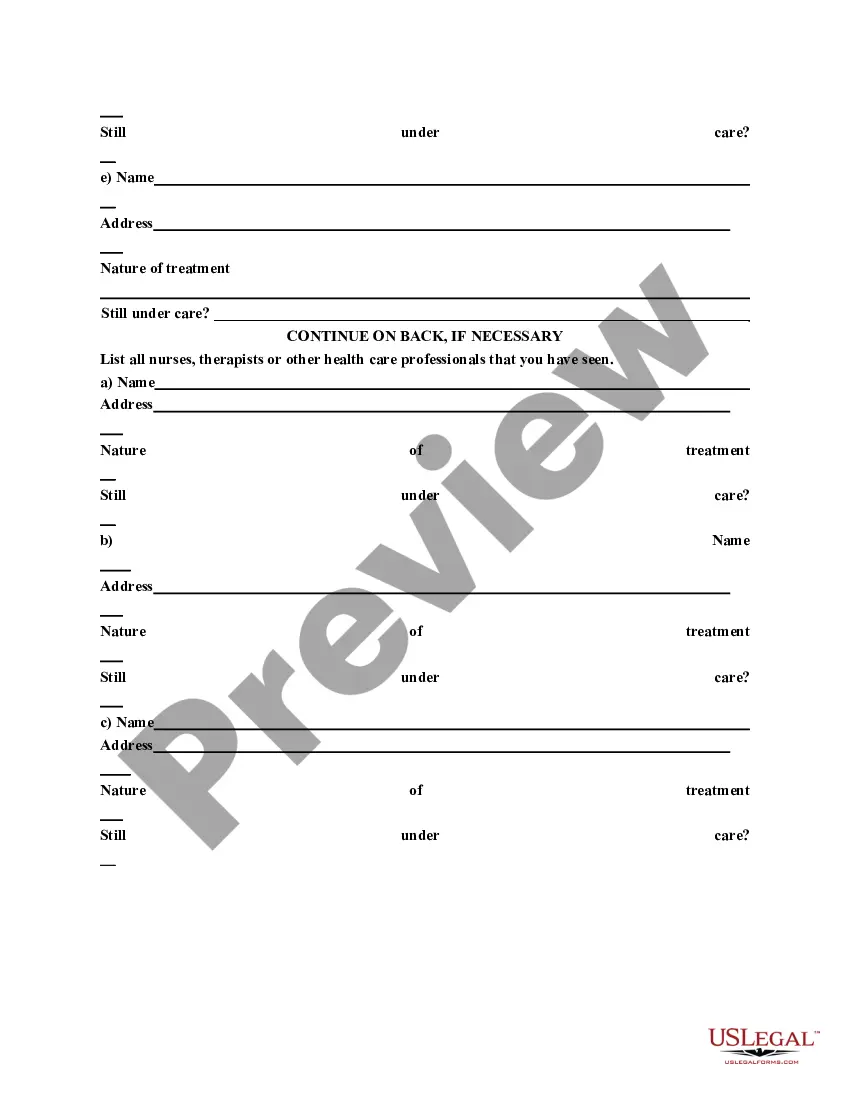

The first part of this questionnaire is designed to be useful in most civil and criminal representations. The last part can be used when screening prospective personal injury litigation clients. The questionnaire can be completed by the attorney during a first meeting with prospective clients or mailed to the client in advance and reviewed at a first meeting.

New York General Information Questionnaire

Description

How to fill out General Information Questionnaire?

If you have to comprehensive, down load, or produce legitimate file web templates, use US Legal Forms, the greatest selection of legitimate forms, that can be found on the web. Use the site`s simple and handy lookup to discover the paperwork you will need. Numerous web templates for enterprise and specific functions are sorted by groups and states, or key phrases. Use US Legal Forms to discover the New York General Information Questionnaire with a handful of click throughs.

Should you be currently a US Legal Forms customer, log in to the accounts and click on the Acquire key to obtain the New York General Information Questionnaire. Also you can access forms you in the past acquired in the My Forms tab of your own accounts.

If you are using US Legal Forms the first time, follow the instructions below:

- Step 1. Ensure you have selected the shape for that right city/region.

- Step 2. Utilize the Preview option to examine the form`s information. Never forget about to read the explanation.

- Step 3. Should you be not happy together with the form, utilize the Lookup industry near the top of the screen to locate other variations from the legitimate form template.

- Step 4. Upon having discovered the shape you will need, click on the Buy now key. Pick the pricing plan you choose and add your references to register for an accounts.

- Step 5. Approach the purchase. You can utilize your credit card or PayPal accounts to finish the purchase.

- Step 6. Find the structure from the legitimate form and down load it in your device.

- Step 7. Complete, edit and produce or indicator the New York General Information Questionnaire.

Every legitimate file template you purchase is the one you have for a long time. You have acces to every single form you acquired within your acccount. Go through the My Forms portion and decide on a form to produce or down load again.

Contend and down load, and produce the New York General Information Questionnaire with US Legal Forms. There are many skilled and condition-distinct forms you can utilize for your enterprise or specific requirements.

Form popularity

FAQ

Ing to Form IT-203-I, you must file a New York part-year or nonresident return if: You have any income from a New York source and your New York AGI exceeds your New York State standard deduction. You want to claim a refund for any New York State, New York City, or Yonkers taxes that were withheld from your pay.

As a nonresident, you only pay tax on New York source income, which includes earnings from work performed in New York State, and income from real property located in the state.

Creating the New York Part-Year/Nonresident return (IT-203 Form) To allocate your income, first create the New York part-year or nonresident return (Form IT-203). State Section. New York part-year or nonresident return. Income Subject to Tax.

Request for Information letters We may send you a Request for Information (Form DTF-948 or DTF-948-O) letter if we need documentation to support what you claimed on your personal income tax return.

You must complete Schedule C and attach Form IT-203-B to your return if you are claiming the college tuition itemized deduction. Note: If a student is claimed as a dependent on another person's New York State tax return, only the person who claims the student as a dependent may claim the itemized deduction.

Do I need to file? As a nonresident, you pay tax on your taxable income from California sources. Sourced income includes, but is not limited to: Services performed in California.

North Carolina imposes a tax on the taxable income of every nonresident who received income from: the ownership of any interest in real or tangible personal property in North Carolina; a business, trade, profession, or occupation carried on in North Carolina; or. gambling activities carried on in North Carolina.

To non-residents, living in the city for less than half the year means you won't have to fork out the cash to cover personal income tax, even if you have a residence there. The bad news is that unless you're well-off or own two homes, this is difficult to achieve and impossible for most people.