New York Bill of Transfer to a Trust

Description

How to fill out Bill Of Transfer To A Trust?

Finding the appropriate legal document template can be challenging. Indeed, there are numerous templates accessible online, but how can you find the legal form you require? Utilize the US Legal Forms website.

The platform offers thousands of templates, including the New York Bill of Transfer to a Trust, suitable for business and personal use. All forms are reviewed by professionals and adhere to federal and state regulations.

If you are currently registered, Log In to your account and click the Download button to obtain the New York Bill of Transfer to a Trust. Use your account to search for the legal forms you have purchased previously. Visit the My documents tab in your account to retrieve another copy of the document you need.

Choose the file format and download the legal document template to your device. Finally, complete, edit, and print and sign the acquired New York Bill of Transfer to a Trust. US Legal Forms is the largest library of legal forms where you can find a variety of document templates. Use the service to download properly crafted paperwork that complies with state regulations.

- Initially, ensure you have selected the correct form for the city/region.

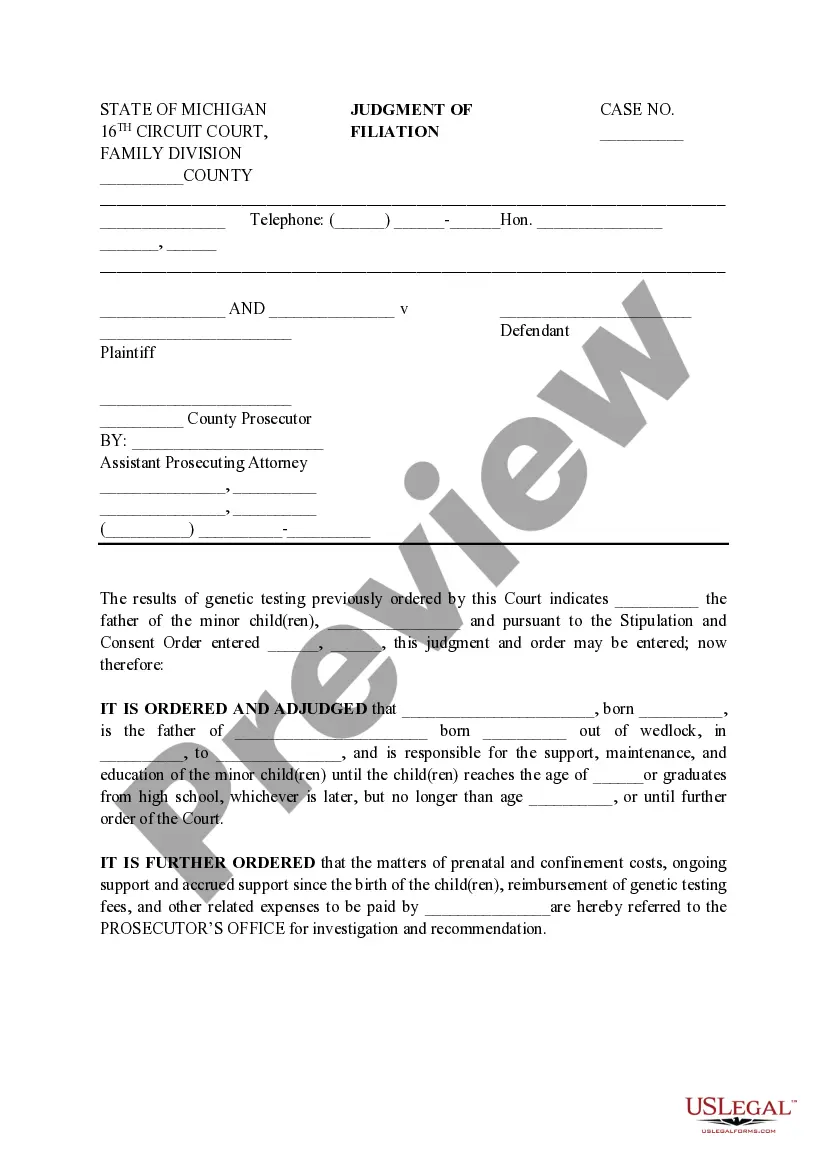

- You can preview the form using the Preview option and read the form description to verify it is the right one for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

- Once you are convinced that the form is correct, click on the Buy now button to obtain the form.

- Select the pricing plan you need and enter the necessary information.

- Create your account and pay for your order using your PayPal account or Visa or Mastercard.

Form popularity

FAQ

Yes, placing bank accounts in a trust can be a wise decision. When you establish a trust under the New York Bill of Transfer to a Trust, you protect your assets from probate and potential creditors. This can simplify the management of your accounts and ensure they are distributed according to your wishes. By using the resources available on the US Legal Forms platform, you can easily create a trust that meets your financial objectives.

To transfer your property into a trust in New York, you typically need to prepare a New York Bill of Transfer to a Trust. This document must clearly identify the property and the trust's terms. It is advisable to consult with a legal professional to ensure compliance with state laws and to properly execute the transfer. Utilizing platforms like uslegalforms can simplify this process by providing templates and guidance tailored to your needs.

While creating a trust can offer protection and tax advantages, there are some disadvantages to consider. The New York Bill of Transfer to a Trust may involve legal fees and ongoing administrative costs, which could add up over time. Additionally, transferring property into a trust may remove your control over the asset, as the trust's terms dictate how the property is managed. Always carefully weigh these factors before deciding to proceed with a trust.

Certain assets are typically not suitable for inclusion in a trust, such as retirement accounts or life insurance policies that have designated beneficiaries. Additionally, personal items that you plan to pass on informally may not need to be included. Evaluating which assets to include in your New York Bill of Transfer to a Trust helps optimize the management and distribution of your estate, benefitting your heirs.

To transfer property to a trust in New York, you generally need to execute a deed that designates the trust as the new owner. This process also requires the appropriate tax documents and may need to be recorded with the county clerk. A New York Bill of Transfer to a Trust simplifies this function by providing the framework for asset ownership transfer within the trust, ensuring clarity and compliance.

Transferring assets to a trust after death requires a legal process, often handled through probate court. The process typically involves validating your will, if one exists, and ensuring that the terms of the trust are executed according to your wishes. A New York Bill of Transfer to a Trust helps specify how your assets should be handled, but it’s advisable to consult professionals to navigate the intricacies of this process.

One of the biggest mistakes parents often make is not updating their trust to reflect changes in their family dynamics or financial situations. This oversight can lead to unintended distributions that may not align with your intentions. Utilizing the New York Bill of Transfer to a Trust can help you maintain clarity and control over your assets as your circumstances change.

A bill of transfer in a trust is a legal document that facilitates the transfer of assets into a trust. This instrument is key for ensuring that property is managed according to your wishes during your lifetime and after your death. In New York, a New York Bill of Transfer to a Trust can clearly outline how assets will be distributed, offering peace of mind to you and your beneficiaries.

Assets are added to a trust through a formal process of transferring ownership. This often involves creating a New York Bill of Transfer to a Trust that specifies the assets and beneficiaries. Keeping track of receipts and documentation during this process is vital, and considering consulting a professional can simplify the legalities involved.

You can transfer accounts to a trust by contacting your financial institutions, such as banks or brokerage firms. Provide them with the necessary documentation, including the New York Bill of Transfer to a Trust, to facilitate the change. Follow their specific procedures, and ensure that all trustees are recorded accurately in their systems to prevent complications.