This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

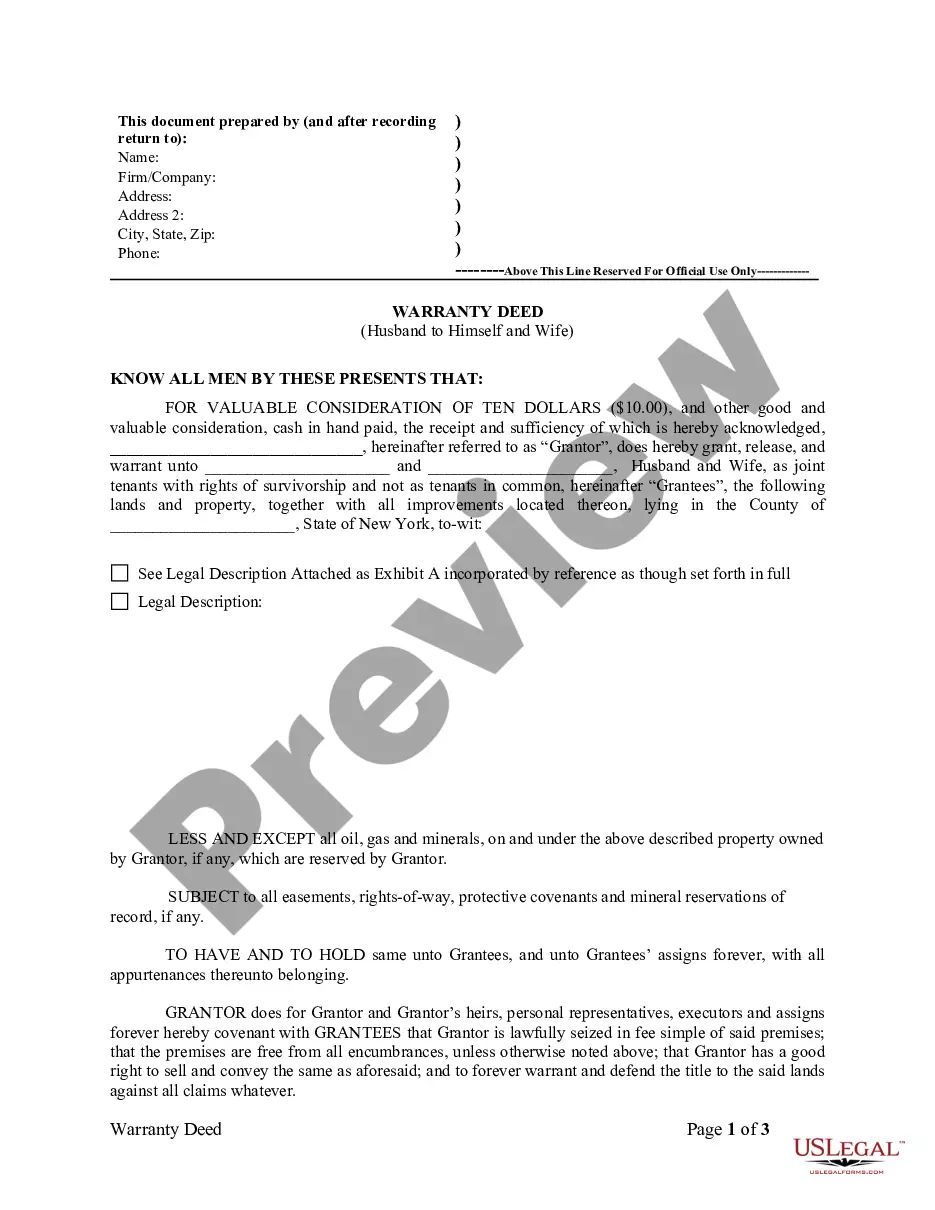

New York Contract for the Sale of Residential Property - Owner Financed with Provisions for Note and Purchase Money Mortgage

Description

How to fill out Contract For The Sale Of Residential Property - Owner Financed With Provisions For Note And Purchase Money Mortgage?

US Legal Forms - among the largest libraries of authorized types in the United States - provides an array of authorized record web templates it is possible to acquire or print. Utilizing the site, you may get a huge number of types for business and person functions, sorted by types, states, or keywords and phrases.You can find the most up-to-date types of types such as the New York Contract for the Sale of Residential Property - Owner Financed with Provisions for Note and Purchase Money Mortgage within minutes.

If you already possess a membership, log in and acquire New York Contract for the Sale of Residential Property - Owner Financed with Provisions for Note and Purchase Money Mortgage from your US Legal Forms local library. The Obtain switch can look on every type you view. You gain access to all previously acquired types in the My Forms tab of your account.

If you would like use US Legal Forms the very first time, listed below are basic guidelines to help you started:

- Be sure to have picked out the proper type for the town/area. Go through the Review switch to examine the form`s content. Look at the type information to ensure that you have selected the appropriate type.

- In case the type doesn`t satisfy your needs, take advantage of the Search discipline at the top of the monitor to obtain the one who does.

- If you are pleased with the form, validate your choice by simply clicking the Purchase now switch. Then, choose the prices plan you prefer and offer your credentials to sign up on an account.

- Process the transaction. Utilize your credit card or PayPal account to complete the transaction.

- Choose the formatting and acquire the form on the system.

- Make changes. Load, modify and print and indication the acquired New York Contract for the Sale of Residential Property - Owner Financed with Provisions for Note and Purchase Money Mortgage.

Every format you included in your account lacks an expiry particular date and it is the one you have eternally. So, if you want to acquire or print one more copy, just go to the My Forms section and then click around the type you will need.

Get access to the New York Contract for the Sale of Residential Property - Owner Financed with Provisions for Note and Purchase Money Mortgage with US Legal Forms, by far the most extensive local library of authorized record web templates. Use a huge number of expert and express-specific web templates that fulfill your business or person needs and needs.

Form popularity

FAQ

The Contemporary Law Dictionary defines standard clauses as any rules or conditions that have been prepared and pre-determined unilaterally by business actors, which are made into a binding document or agreement and must be fulfilled by the consumers.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.

These include indemnification, limit of liability, copyright, use restrictions, and more. Without these clauses, the parties may be exposed to unnecessary risks, since they may not have the legal rights to resolve certain issues if disputes arise.

WHAT IS AN ?AS-IS? PROVISION? An ?as-is? provision is a (commonly misunderstood) provision in a real estate sales contract providing that the buyer of the property takes the property in the condition visually observable to the buyer.

7 Real Estate Contract Buyer Clauses Checklist 7 Real Estate Contract Buyer Clauses Checklist. ?And/or assigns? or ?and/or Nominees.? As the buyer, you want to have the right to assign your contract. ... Inclusions and Exclusions. ... Earnest Money. ... Closing. ... Possession. ... Warranties. ... ?Weasel? Clauses.

In real estate contracts, there are contract clauses that outline the terms of the agreement and responsibilities of each party. The contract clauses address all aspects of the sale terms and are legally binding once both parties sign the document.

A major drawback of a contract for deed for buyers is that the seller retains the legal title to the property until the payment plan is completed. On one hand, this means that they're responsible for things like property taxes. On the other hand, the buyer lacks security and rights to their home.

Common Contract Clauses Severability Clause. This clause dictates if any of the provisions in the contract are illegal, invalid, or enforceable. ... Governing/Jurisdiction Clause. ... Force Majeure Clause. ... Limitations on Liability Clause. ... Confidentiality Clause. ... Damages Clause.