The New York Agreement to Incorporate by Partners Incorporating Existing Partnership is a legal document that outlines the process of converting a partnership into a corporation in the state of New York. This agreement allows partners to transfer the assets, liabilities, and operations of the existing partnership into the newly formed corporation. There are several types of New York Agreements to Incorporate by Partners Incorporating Existing Partnership, each requiring different considerations and procedures: 1. General Partnership to C Corporation: This type of agreement is used when partners of a general partnership decide to form a C corporation. The agreement will outline how the partnership's assets, including business contracts, real estate, and intellectual property, will be transferred to the corporation. 2. Limited Partnership to S Corporation: In this scenario, the partners of a limited partnership choose to convert their business into an S corporation. The agreement will specify the transfer of partnership interests, assets, and liabilities, as well as any changes in management and governance. 3. Limited Liability Partnership (LLP) to LLC: If partners in an LLP wish to reorganize as a limited liability company (LLC), this agreement will detail the steps involved. It will cover the conversion of partnership interests, allocation of profits and losses, and the establishment of an operating agreement for the new LLC. 4. Professional Partnership to Professional Corporation: Professionals, such as lawyers or doctors, who operate as a partnership can use this agreement to convert their business into a professional corporation. The agreement will address the transfer of professional licenses, clients, and other assets, as well as compliance with state regulations. In addition to these variations, the New York Agreement to Incorporate by Partners Incorporating Existing Partnership typically includes the following key elements: — Identification of the partners and their respective ownership interests in the partnership and the future corporation. — A statement of the intent to convert the partnership into a corporation, specifying the type of corporation to be formed. — A detailed description of the assets, both tangible and intangible, that will be transferred to the new corporation. — An allocation of the partnership's liabilities and obligations, including debts, contracts, and pending legal matters. — A plan for the distribution of shares or ownership interests in the new corporation. — Provisions for the continuity of the business, including employee contracts, customer relationships, and lease agreements. — Any required tax filings, notifications, or consents from governmental authorities. — A timeline for the completion of the conversion process, including the filing of necessary documents with the state. Overall, the New York Agreement to Incorporate by Partners Incorporating Existing Partnership is a crucial legal document that facilitates the smooth transition from a partnership to a corporation. Professional legal assistance is highly recommended ensuring compliance with applicable laws and regulations, as well as to protect the rights and interests of all partners.

New York Agreement to Incorporate by Partners Incorporating Existing Partnership

Description

How to fill out New York Agreement To Incorporate By Partners Incorporating Existing Partnership?

US Legal Forms - one of the most significant libraries of legitimate varieties in the USA - gives a wide array of legitimate papers themes you are able to download or print. While using web site, you may get thousands of varieties for organization and specific uses, sorted by categories, suggests, or search phrases.You can get the most up-to-date models of varieties just like the New York Agreement to Incorporate by Partners Incorporating Existing Partnership within minutes.

If you already possess a subscription, log in and download New York Agreement to Incorporate by Partners Incorporating Existing Partnership in the US Legal Forms catalogue. The Download button will show up on every single develop you look at. You have access to all earlier saved varieties in the My Forms tab of your account.

In order to use US Legal Forms the very first time, allow me to share simple directions to obtain started off:

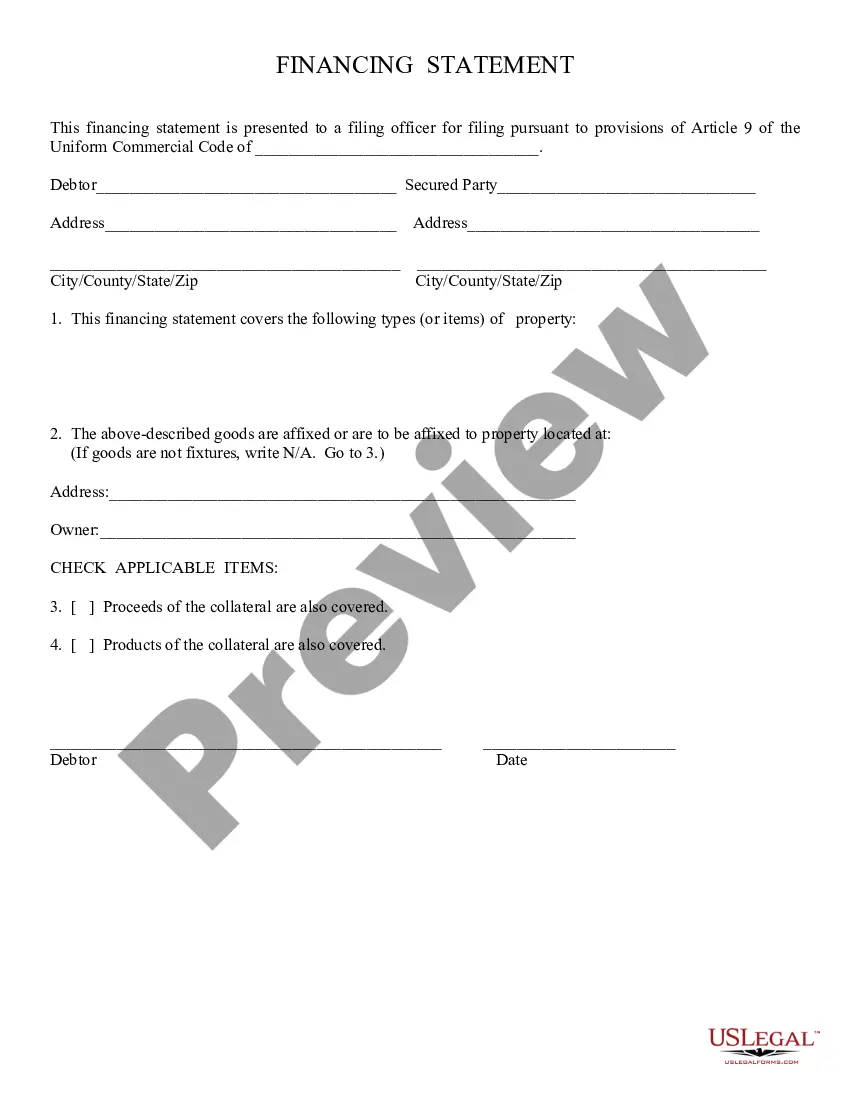

- Be sure you have chosen the right develop for your personal metropolis/county. Click the Review button to check the form`s content. Look at the develop description to ensure that you have selected the appropriate develop.

- When the develop does not satisfy your requirements, take advantage of the Look for area near the top of the display screen to find the one who does.

- Should you be pleased with the form, validate your choice by clicking on the Get now button. Then, choose the rates plan you prefer and provide your references to sign up for the account.

- Procedure the transaction. Make use of credit card or PayPal account to finish the transaction.

- Find the formatting and download the form in your system.

- Make changes. Fill up, modify and print and sign the saved New York Agreement to Incorporate by Partners Incorporating Existing Partnership.

Every web template you put into your account lacks an expiry date and it is your own permanently. So, if you want to download or print yet another duplicate, just proceed to the My Forms section and click on on the develop you will need.

Obtain access to the New York Agreement to Incorporate by Partners Incorporating Existing Partnership with US Legal Forms, probably the most extensive catalogue of legitimate papers themes. Use thousands of professional and state-particular themes that satisfy your company or specific needs and requirements.