An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New York Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage

Description

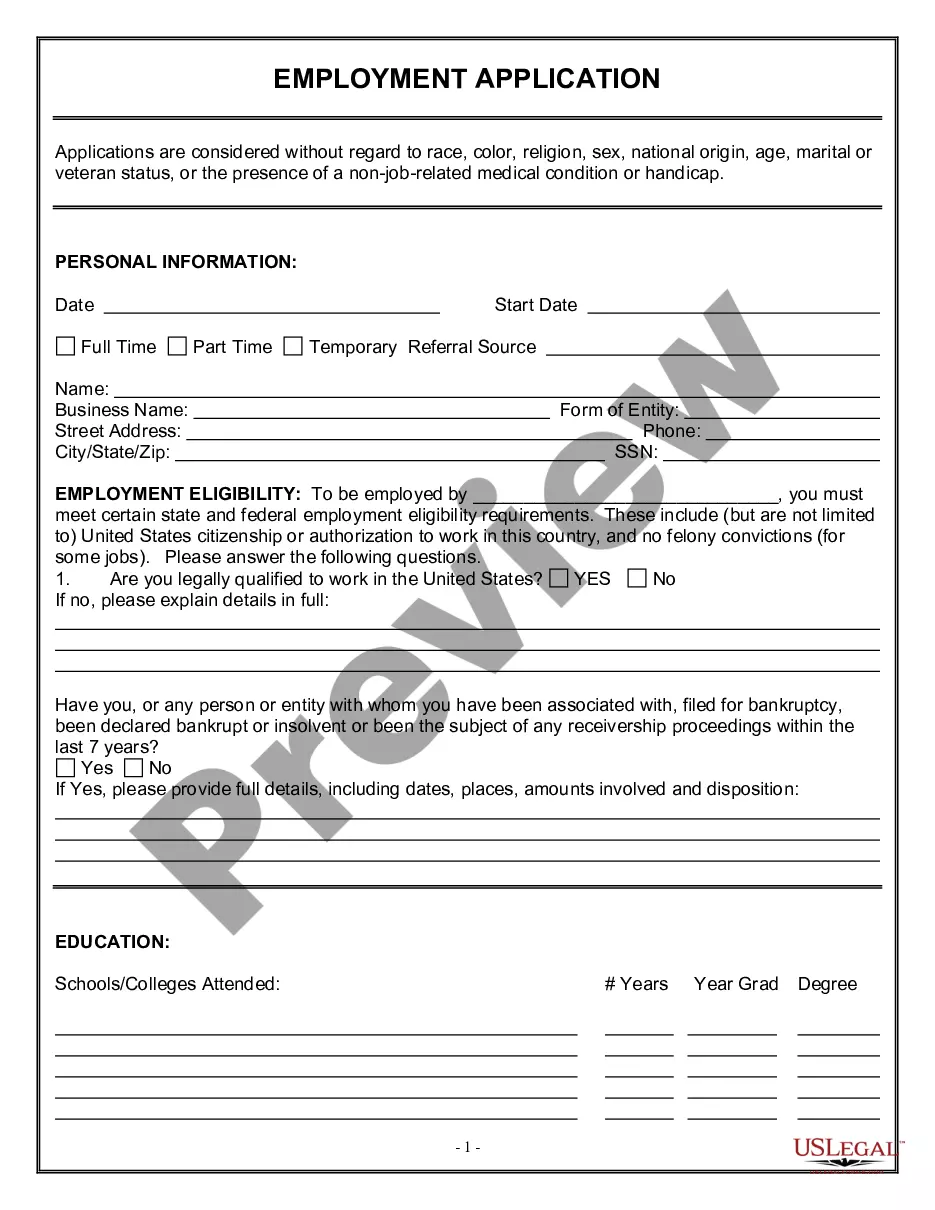

How to fill out Agreement To Modify Interest Rate, Maturity Date, And Payment Schedule Of Promissory Note Secured By A Mortgage?

Are you currently in a scenario where you require documents for various business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a plethora of form templates, including the New York Agreement to Alter Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage, which are crafted to meet federal and state regulations.

Once you find the appropriate form, click Buy now.

Select the pricing plan you prefer, complete the required information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the New York Agreement to Alter Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it corresponds to the correct city/state.

- Utilize the Review button to examine the form.

- Read the description to ensure you have selected the correct document.

- If the form is not what you're looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

The maturity date of the note is the date the loan is due and payment must be received. It depends on the wording of the promissory note as to how the maturity date is calculated. If it states that the term of the note is in months, then the maturity date is simply counted on months.

When the loan date and number of days of the loan are known, the maturity date can be found by subtracting the days remaining in the first month from the number of days of the loan. Continue subtracting days in each succeeding whole month until you reach a month with a difference less than the total days in that month.

A maturity date is the date when the final payment is due for a loan, bond or other financial product. It also indicates the period of time in which investors or lenders will receive interest payments. Here's how maturity dates work for loans and investments.

Loan maturity date refers to the date on which a borrower's final loan payment is due. Once that payment is made and all repayment terms have been met, the promissory note that is a record of the original debt is retired. In the case of a secured loan, the lender no longer has a claim to any of the borrower's assets.

For example, you might agree to change the interest rate or the length of the loan. Always put promissory note changes in writing and have the borrower sign off on them, as oral changes can't be enforced in court. Changing a note without the borrower's written agreement makes a promissory note invalid.

A promissory note is a written and signed promise to repay a sum of money in exchange for a loan or other financing. A promissory note typically contains all the terms involved, such as the principal debt amount, interest rate, maturity date, payment schedule, the date and place of issuance, and the issuer's signature.

If you lend money to someone and the borrower later wants more time to pay, or lower monthly payments, you can use this form to make changes to the original promissory note.

The maturity date is when a debt comes due and all principal and/or interest must be repaid to creditors. A bondholder is an individual or other entity who owns the bond of a company or government and thus becomes a creditor to the bond's issuer.