A free trader agreement is often used between spouses when one spouse wants to purchase property without putting their spouse on the deed. It is also used to ensure that the spouse does not obtain an interest in the property. The spouses typically agree that neither will create any obligation in the name of or against the other, nor secure or attempt to secure any credit upon or in connection with the other, or in his or her name. This form only deals with a particular piece of real property.

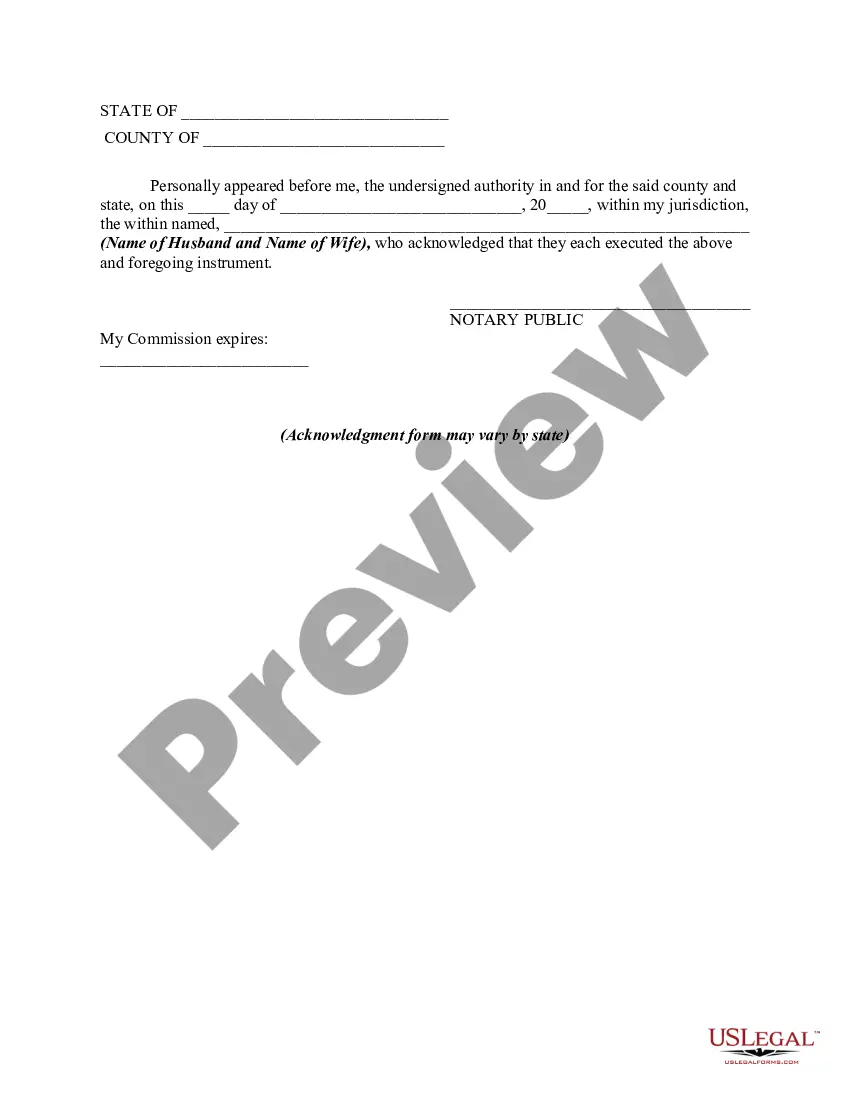

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New York Designation of Separate Property and Release of Marital Property Rights Regarding Certain Real Property — Free Trader Agreement as to Certain Real Property is a legal document used in New York State to designate and protect separate property rights in the event of a divorce or separation. This agreement allows married couples to specify certain real property as separate property, meaning that it will not be subject to division or distribution during a divorce. It provides a means for individuals to protect their personal assets and maintain ownership of specific real estate even if it was acquired during the marriage. The agreement also includes a release of marital property rights, which means that both spouses are waiving any claim or right to the designated property. This release ensures clarity and prevents future disputes regarding ownership. Some types of New York Designation of Separate Property and Release of Marital Property Rights Regarding Certain Real Property — Free Trader Agreements include: 1. Residential Property Agreement: This type of agreement is commonly used by couples who own residential property, such as a house or condominium, and want to designate it as separate property. It allows them to protect their individual ownership rights and prevent the property from being divided during a divorce. 2. Commercial Property Agreement: In cases where couples own commercial properties, such as office buildings or retail spaces, this type of agreement can be used to designate the property as separate and release marital property rights. It ensures that the business assets remain in the hands of the designated owner. 3. Vacant Land Agreement: For individuals who own vacant land or undeveloped property, this agreement can be utilized to designate it as separate property. It safeguards the landowner's rights and prevents any claims on the property by the other spouse. 4. Rental Property Agreement: When couples own rental properties, such as apartments or houses that generate rental income, this agreement can be employed to designate the property as separate and release marital property rights. It protects the property owner's rights and ensures the continued income stream. In summary, the New York Designation of Separate Property and Release of Marital Property Rights Regarding Certain Real Property — Free Trader Agreement as to Certain Real Property is a vital legal document for married couples in New York State looking to protect and designate certain properties as separate assets. It allows individuals to safeguard their ownership rights, prevent property division during divorce, and maintain control over their real estate investments.New York Designation of Separate Property and Release of Marital Property Rights Regarding Certain Real Property — Free Trader Agreement as to Certain Real Property is a legal document used in New York State to designate and protect separate property rights in the event of a divorce or separation. This agreement allows married couples to specify certain real property as separate property, meaning that it will not be subject to division or distribution during a divorce. It provides a means for individuals to protect their personal assets and maintain ownership of specific real estate even if it was acquired during the marriage. The agreement also includes a release of marital property rights, which means that both spouses are waiving any claim or right to the designated property. This release ensures clarity and prevents future disputes regarding ownership. Some types of New York Designation of Separate Property and Release of Marital Property Rights Regarding Certain Real Property — Free Trader Agreements include: 1. Residential Property Agreement: This type of agreement is commonly used by couples who own residential property, such as a house or condominium, and want to designate it as separate property. It allows them to protect their individual ownership rights and prevent the property from being divided during a divorce. 2. Commercial Property Agreement: In cases where couples own commercial properties, such as office buildings or retail spaces, this type of agreement can be used to designate the property as separate and release marital property rights. It ensures that the business assets remain in the hands of the designated owner. 3. Vacant Land Agreement: For individuals who own vacant land or undeveloped property, this agreement can be utilized to designate it as separate property. It safeguards the landowner's rights and prevents any claims on the property by the other spouse. 4. Rental Property Agreement: When couples own rental properties, such as apartments or houses that generate rental income, this agreement can be employed to designate the property as separate and release marital property rights. It protects the property owner's rights and ensures the continued income stream. In summary, the New York Designation of Separate Property and Release of Marital Property Rights Regarding Certain Real Property — Free Trader Agreement as to Certain Real Property is a vital legal document for married couples in New York State looking to protect and designate certain properties as separate assets. It allows individuals to safeguard their ownership rights, prevent property division during divorce, and maintain control over their real estate investments.