New York UCC-1 for Personal Credit

Description

How to fill out UCC-1 For Personal Credit?

Are you in a circumstance where you consistently require documents for either organizational or individual purposes? There are numerous sanctioned document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms provides thousands of document templates, such as the New York UCC-1 for Personal Credit, that are crafted to meet federal and state standards.

If you are already familiar with the US Legal Forms site and possess an account, just Log In. After that, you can download the New York UCC-1 for Personal Credit template.

Select a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the New York UCC-1 for Personal Credit at any time if necessary. Just select the needed form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and confirm it corresponds to the correct area/state.

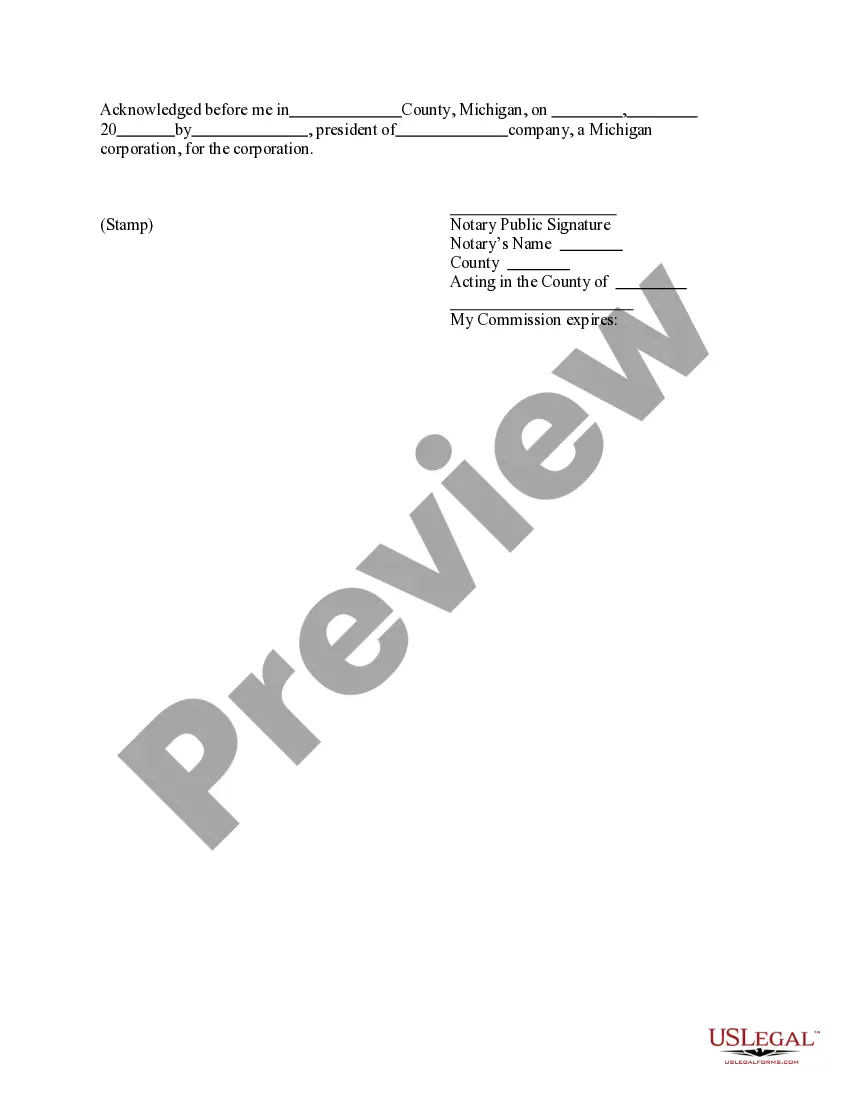

- Utilize the Preview button to examine the form.

- Review the description to ensure you have selected the right form.

- If the form is not what you’re looking for, use the Search field to find the form that meets your needs and requirements.

- Once you find the correct form, click Get now.

- Choose the pricing plan you want, complete the required information to create your account, and pay for your order using PayPal or credit card.

Form popularity

FAQ

You can file the New York UCC-1 for Personal Credit at the New York Department of State, Division of Corporations. It's crucial to ensure that you submit your form to the correct office, as this establishes your security interest in the property. Additionally, you can use online services through platforms like USLegalForms to make the filing process easier and more efficient. By filing the UCC-1 properly, you protect your rights and interests effectively.

Yes, the UCC does apply to personal property, which is often referred to as collateral in financing situations. The New York UCC-1 for Personal Credit specifically covers various types of personal property, ensuring that lenders can protect their interests. This legal framework helps in establishing clear ownership and rights over the assets involved. With uslegalforms, filing a UCC for personal property becomes an easy and reliable process.

Yes, you can file a UCC against an individual under specific circumstances. The New York UCC-1 for Personal Credit allows creditors to secure a legal claim on personal property. This process ensures that creditors have priority over others regarding the individual's assets. Using uslegalforms simplifies this filing, making it accessible and straightforward.

Yes, a UCC filing can appear on a personal credit report. This notation signals to potential lenders that there is a secured interest in your personal assets. While it may not directly affect your credit score, it can influence lending decisions. Therefore, understanding the implications of the New York UCC-1 for Personal Credit is beneficial to maintaining your financial health.

UCC filings provide detailed information about secured transactions. They reveal the nature of the collateral and the parties involved in the agreement. This information assists lenders in assessing risk and can impact one's ability to secure additional credit. Exploring the details of the New York UCC-1 for Personal Credit can help individuals manage their financial profile more effectively.

On a credit report, UCC refers to Uniform Commercial Code filings. This notation indicates that a UCC-1 has been filed, outlining a lender's claim against certain assets. It serves to inform potential creditors about existing secured debts. Knowing the implications of the New York UCC-1 for Personal Credit can help you make informed decisions.

A UCC filing can have implications for personal credit. When a UCC-1 is filed against you, it serves as a public notice of a secured interest in your assets. While it may not directly lower your credit score, it can raise concerns among lenders. Therefore, understanding how the New York UCC-1 for Personal Credit works is crucial.

To file a UCC-1, you need to provide details such as the name of the debtor, their address, and a description of the collateral. Additionally, the filing must be signed and dated by the secured party. The New York UCC-1 for Personal Credit specifically requires adherence to these details to serve as a valid notice of security interest. Utilizing USLegalForms can simplify this process, ensuring you meet all requirements effortlessly.

Filing a UCC in New York is a straightforward process that begins with the preparation of your UCC-1 form. You can file it online or submit a paper form to the appropriate state office. It’s important to provide accurate information about the debtor and the collateral to ensure proper registration. Consider using USLegalForms, as they offer user-friendly templates and guidance for filing a New York UCC-1 for Personal Credit.