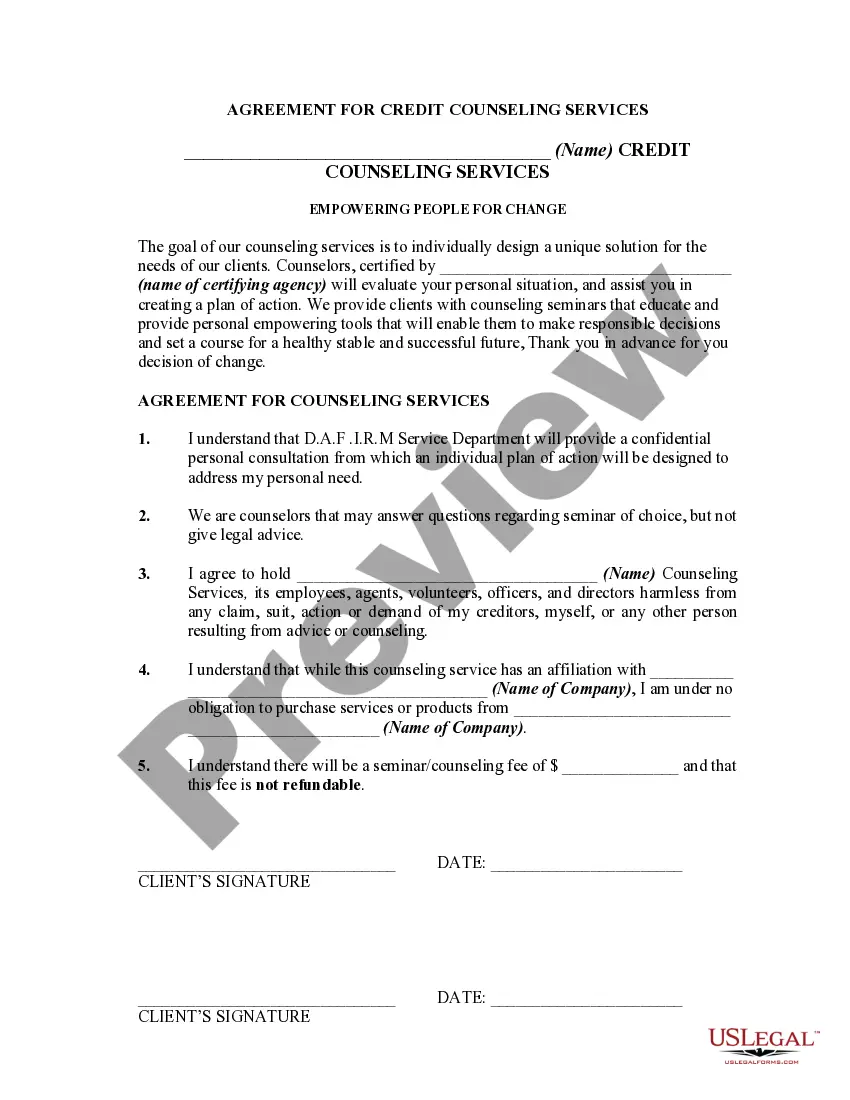

This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The New York Agreement for Credit Counseling Services is a legal document that outlines the terms and conditions for individuals or organizations seeking credit counseling services in the state of New York. This agreement aims to protect the rights of consumers and ensure that they receive fair and transparent financial counseling. Credit counseling services refer to the process of providing guidance, education, and assistance to individuals who are facing financial difficulties or seeking advice on managing their debts. These services are typically offered by nonprofit organizations or agencies that specialize in financial counseling. Under the New York Agreement for Credit Counseling Services, various key aspects are covered to establish a clear framework for both the service providers and the clients. These include: 1. Services Provided: The agreement specifies the range of counseling services that the credit counseling agency will offer. This may include budgeting advice, debt management plan creation, financial education, and other related services. 2. Fees and Charges: The agreement outlines the fees and charges associated with the credit counseling services. It ensures that the agency discloses all fees upfront and that clients are aware of the costs involved. 3. Confidentiality: Client confidentiality is a crucial aspect of the New York Agreement. It guarantees that all personal and financial information shared during the counseling process will be kept confidential and will not be disclosed to any unauthorized parties. 4. Qualifications and Certifications: The agreement may also require the credit counseling agency to meet certain qualifications and certifications as mandated by the state of New York. This ensures that the agency is reputable, knowledgeable, and compliant with relevant regulations. Types of New York Agreements for Credit Counseling Services: 1. Individual Credit Counseling Agreement: This type of agreement is designed for individuals seeking credit counseling on a personal basis. It addresses the specific needs and concerns of an individual borrower. 2. Group Credit Counseling Agreement: This agreement is applicable when credit counseling services are provided collectively to a group of people facing similar financial challenges. It may include workshops, seminars, or group counseling sessions to educate and assist multiple clients at once. 3. Debt Management Plan Agreement: In situations where individuals require a debt management plan to repay their debts systematically, this agreement outlines the terms and conditions of the plan. It includes details such as the total debt amount, repayment schedule, and the agency's role in facilitating the debt management process. In conclusion, the New York Agreement for Credit Counseling Services is a comprehensive legal document that protects the rights of consumers seeking financial counseling in New York. Its purpose is to ensure transparency and fair practices in the provision of credit counseling services, ultimately helping individuals overcome financial difficulties and achieve greater financial stability.