This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

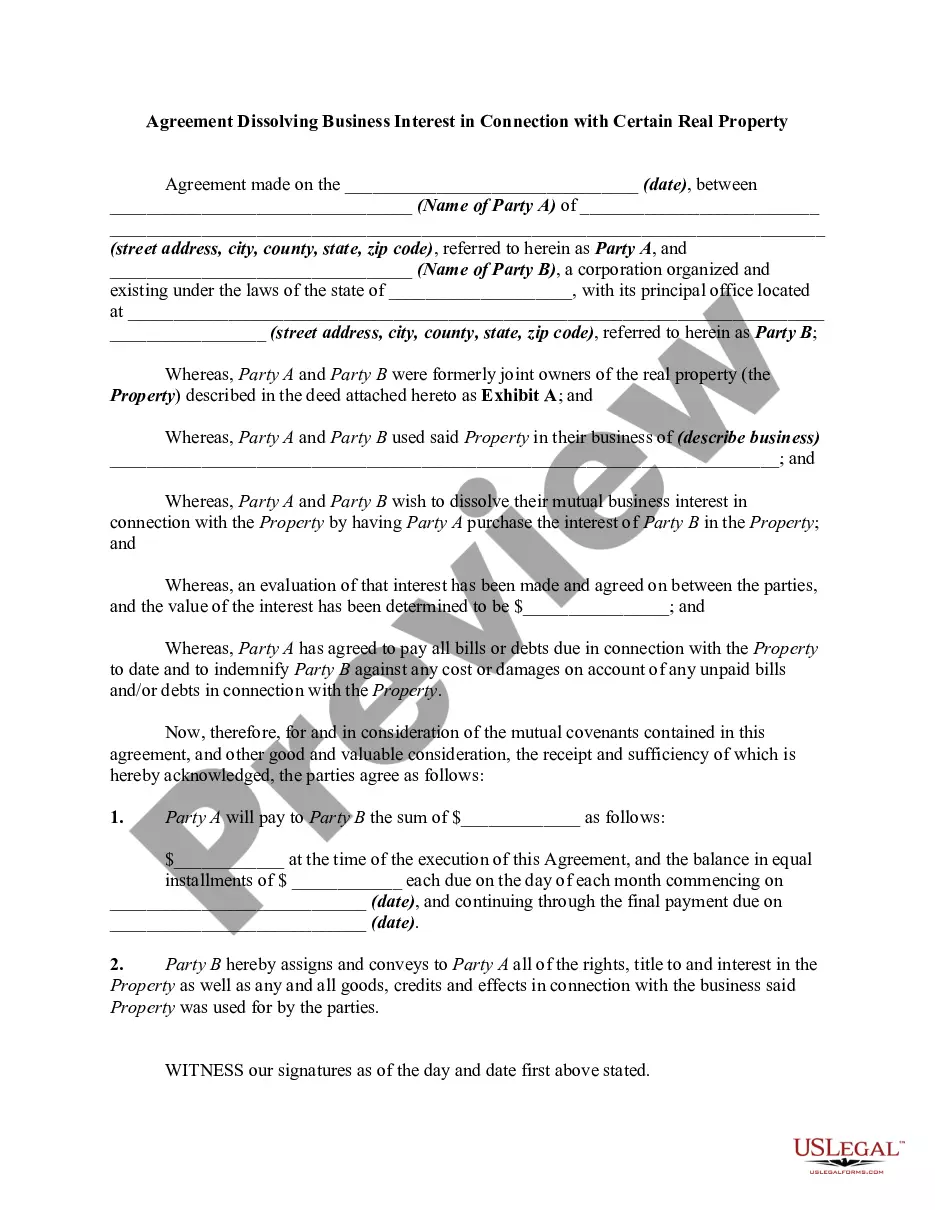

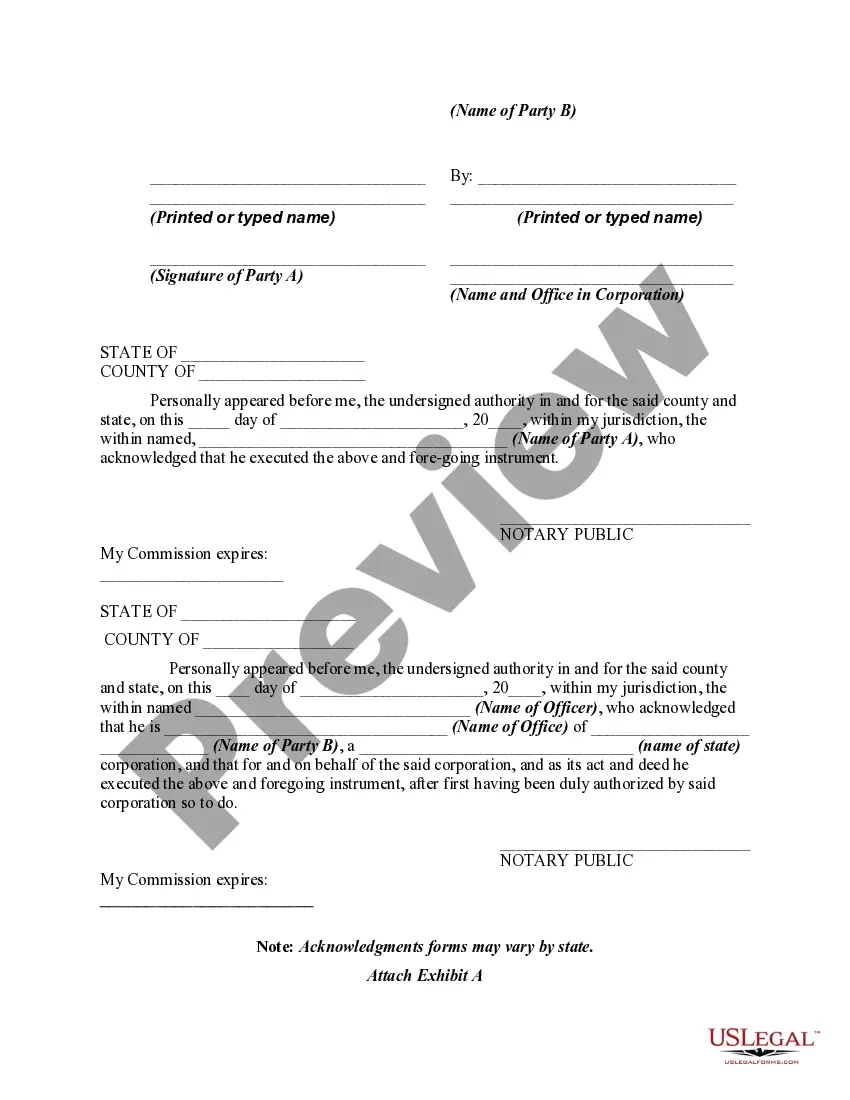

The New York Agreement Dissolving Business Interest in Connection with Certain Real Property is a legal document that outlines the process and terms for terminating the business interest in real property located in New York. This agreement is especially relevant for individuals or entities seeking to dissolve their partnership, joint venture, or limited liability company (LLC) that holds ownership or leases real estate in the state of New York. The agreement covers various aspects related to the dissolution, including the identification of the parties involved, the specific property or properties affected, and the agreed-upon timeline for the termination. It also addresses the distribution of assets, liabilities, and any outstanding obligations related to the real estate holdings. This dissolution agreement is crucial for ensuring a smooth transition and avoiding any potential disputes between the parties involved. By detailing the process step-by-step, it provides a clear framework for settling financial matters, including the repayment of debts, the allocation of profits or losses, and the transfer of titles. In the case of different types of New York Agreement Dissolving Business Interest related to certain real property, there can be specific agreements tailored to different business entities. For example: 1. Partnership Dissolution Agreement: This type of agreement is used when a partnership that owns or leases real property in New York is being dissolved. It outlines the responsibilities of each partner, the distribution of assets, the disposal of the property, and the release of any liability. 2. Joint Venture Dissolution Agreement: This agreement is employed when a joint venture involving multiple parties comes to an end. It outlines how the real estate assets will be divided among the parties, the termination of any leases or contracts, and the resolution of any outstanding disputes or obligations. 3. LLC Dissolution Agreement: In the case of an LLC that holds real property in New York, this agreement sets out the procedures for winding up the company's affairs, including the sale or transfer of the property, the settlement of outstanding debts, and the dissolution of the LLC itself. In summary, the New York Agreement Dissolving Business Interest in Connection with Certain Real Property is a crucial legal document that provides a structured framework for terminating business interests in real estate within the state of New York. It is essential for ensuring a smooth and fair dissolution process while addressing financial considerations, liabilities, and the distribution of assets among the parties involved.The New York Agreement Dissolving Business Interest in Connection with Certain Real Property is a legal document that outlines the process and terms for terminating the business interest in real property located in New York. This agreement is especially relevant for individuals or entities seeking to dissolve their partnership, joint venture, or limited liability company (LLC) that holds ownership or leases real estate in the state of New York. The agreement covers various aspects related to the dissolution, including the identification of the parties involved, the specific property or properties affected, and the agreed-upon timeline for the termination. It also addresses the distribution of assets, liabilities, and any outstanding obligations related to the real estate holdings. This dissolution agreement is crucial for ensuring a smooth transition and avoiding any potential disputes between the parties involved. By detailing the process step-by-step, it provides a clear framework for settling financial matters, including the repayment of debts, the allocation of profits or losses, and the transfer of titles. In the case of different types of New York Agreement Dissolving Business Interest related to certain real property, there can be specific agreements tailored to different business entities. For example: 1. Partnership Dissolution Agreement: This type of agreement is used when a partnership that owns or leases real property in New York is being dissolved. It outlines the responsibilities of each partner, the distribution of assets, the disposal of the property, and the release of any liability. 2. Joint Venture Dissolution Agreement: This agreement is employed when a joint venture involving multiple parties comes to an end. It outlines how the real estate assets will be divided among the parties, the termination of any leases or contracts, and the resolution of any outstanding disputes or obligations. 3. LLC Dissolution Agreement: In the case of an LLC that holds real property in New York, this agreement sets out the procedures for winding up the company's affairs, including the sale or transfer of the property, the settlement of outstanding debts, and the dissolution of the LLC itself. In summary, the New York Agreement Dissolving Business Interest in Connection with Certain Real Property is a crucial legal document that provides a structured framework for terminating business interests in real estate within the state of New York. It is essential for ensuring a smooth and fair dissolution process while addressing financial considerations, liabilities, and the distribution of assets among the parties involved.