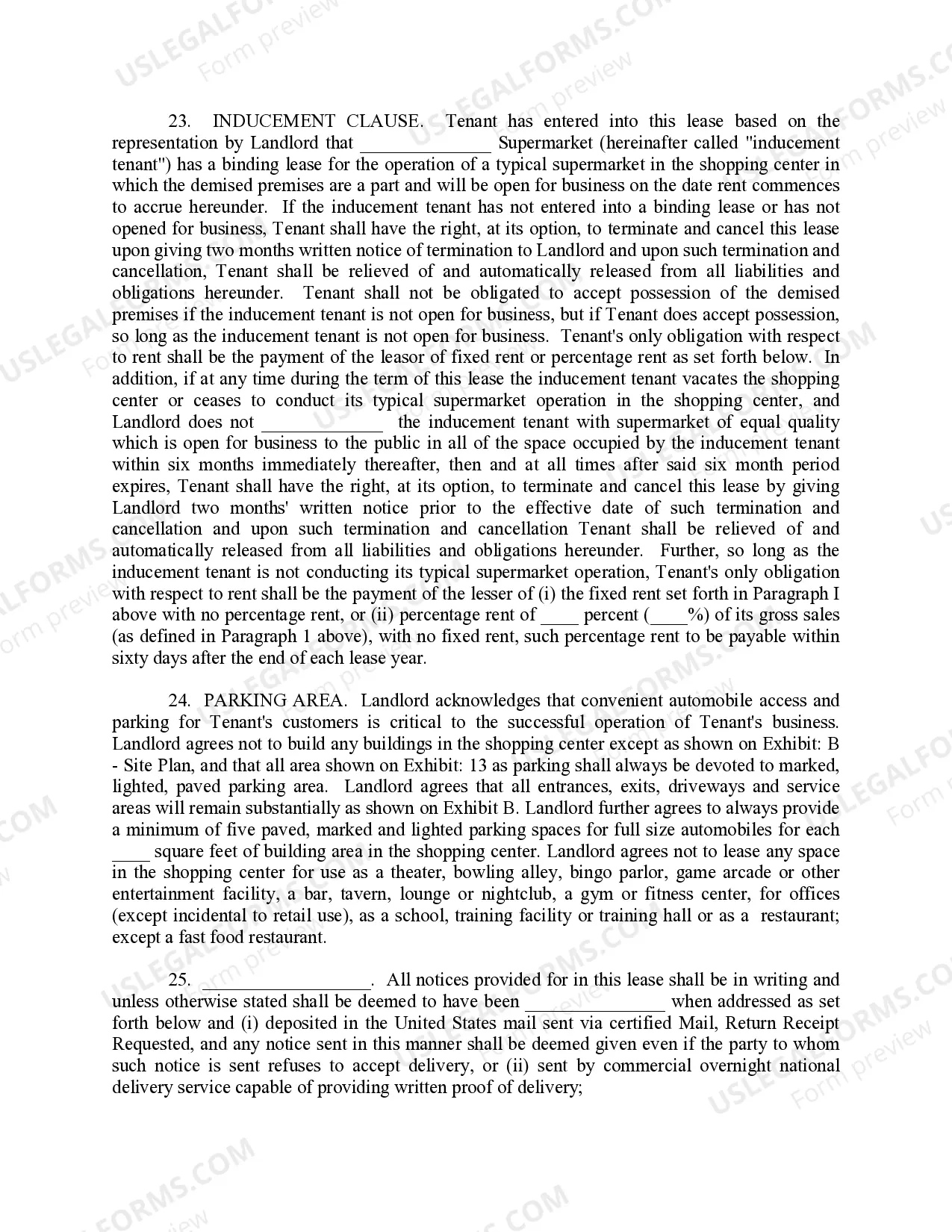

New York Percentage Shopping Center Lease Agreement is a legally binding contract between a landlord and a tenant regarding the leasing of space in a shopping center located in New York. This agreement outlines the terms and conditions under which the tenant can operate their business within the shopping center and specifies the financial obligations of both parties. The main characteristic of the New York Percentage Shopping Center Lease Agreement is that the tenant's rent is calculated based on a percentage of their gross sales or revenue generated from their business operations within the shopping center. This shared risk and profit arrangement allows tenants to pay a percentage of their income as rent, which is often more favorable for startups or businesses with fluctuating sales. Key terms and provisions that are commonly included in the New York Percentage Shopping Center Lease Agreement include: 1. Percentage Rent: The agreement specifies the percentage of the tenant's gross sales that will be paid as rent in addition to any minimum or base rent. 2. Tenant Responsibilities: The agreement outlines the tenant's obligations, such as maintaining the leased premises, making necessary repairs, paying supplemental charges like common area maintenance fees, insurance, property taxes, etc. 3. Lease Term: The agreement includes the duration of the lease, including the start and end dates, renewal options, and any termination clauses. 4. Permitted Use: It defines the specific purpose for which the leased space can be utilized by the tenant, such as retail, restaurant, or services. 5. Common Area Maintenance (CAM) Charges: It describes the tenant's proportionate share of the expenses incurred by the landlord in maintaining and operating the common areas of the shopping center. Types of New York Percentage Shopping Center Lease Agreements: 1. Basic Percentage Lease: In this type of agreement, the tenant pays a percentage of their gross sales as rent, along with a base rent, if applicable. 2. Graduated Percentage Lease: With this arrangement, the percentage of rent paid by the tenant increases gradually over the lease term, usually based on predetermined sales thresholds. 3. Step-Up Lease: This lease agreement involves predetermined increases in the rent at specific intervals, regardless of the tenant's sales performance. 4. Stated Percentage Lease: Here, the lease specifies a fixed percentage amount that the tenant will pay as rent throughout the entire term. In conclusion, the New York Percentage Shopping Center Lease Agreement is a crucial document that formalizes the relationship between landlords and tenants in shopping centers. It outlines the financial obligations, lease terms, and conditions, allowing both parties to understand their rights and responsibilities in operating and maintaining a profitable business within the shopping center.

New York Percentage Shopping Center Lease Agreement

Description

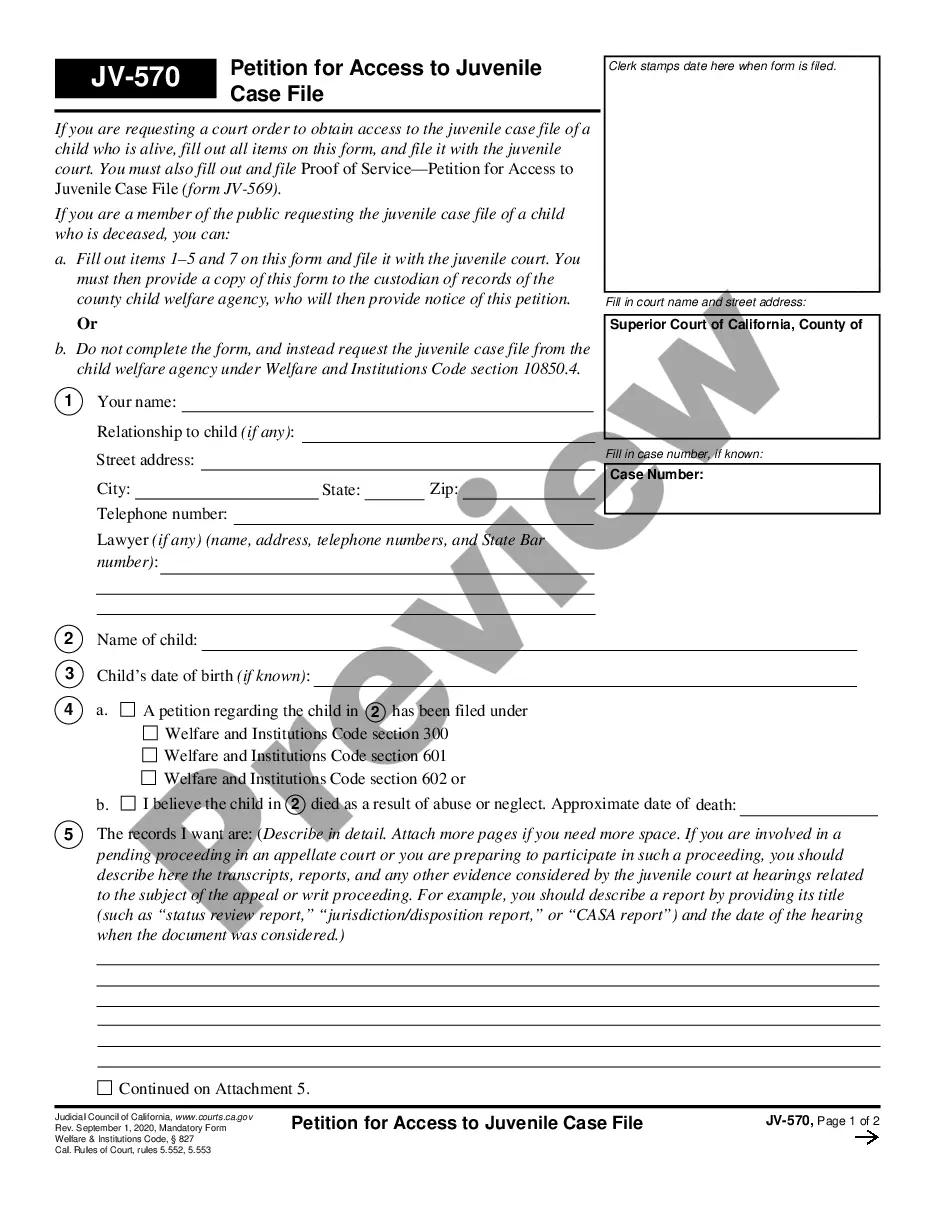

How to fill out New York Percentage Shopping Center Lease Agreement?

If you require to sum up, download, or print authorized document templates, utilize US Legal Forms, the largest compilation of legal forms accessible on the web.

Employ the site’s straightforward and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have identified the form you need, click the Get now button. Select the pricing plan you prefer and input your credentials to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to locate the New York Percentage Shopping Center Lease Agreement with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to acquire the New York Percentage Shopping Center Lease Agreement.

- You can also access forms you previously obtained from the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Confirm you have chosen the form for the correct city/state.

- Step 2. Use the Review option to examine the form’s content. Be sure to check the details.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form format.

Form popularity

FAQ

A percentage rent lease clause is a critical part of a New York Percentage Shopping Center Lease Agreement. This clause states that the tenant pays a base rent plus a percentage of their sales revenue once sales hit a specific threshold. This arrangement benefits both landlords and tenants; landlords gain income that scales with the tenant's success, while tenants enjoy lower initial costs. If you need to create or review this type of lease, consider using US Legal Forms for reliable templates and guidance.

A landlord may prefer a percentage lease with a retail tenant because it aligns their interests with the tenant's sales performance. In a New York Percentage Shopping Center Lease Agreement, the landlord gains a steady income based not just on fixed rent, but also on a share of the tenant's revenue. This arrangement incentivizes landlords to support their tenants' success, ultimately benefiting the entire shopping center. By utilizing uslegalforms, landlords can easily create and customize percentage leases to suit their specific needs.

The most common lease type for retail property is the percentage lease, as it closely aligns the rent with the tenant’s sales performance. This is especially relevant in a New York Percentage Shopping Center Lease Agreement, where both tenant success and landlord interests are connected. This model can support sustainable business growth and provide landlords with a steady income stream. An informed approach to this leasing structure can enhance partnership opportunities.

Percentage rent in retail leasing is calculated based on a tenant's gross sales exceeding a specified threshold, which is outlined in the lease agreement. This structure promotes growth for tenants and incentivizes landlords since increased sales lead to higher rents. In the context of a New York Percentage Shopping Center Lease Agreement, it creates a partnership dynamic between retailers and property owners. This clarity can foster a productive leasing relationship.

The percentage of rent in retail usually varies, commonly ranging from 5% to 10% of gross sales, depending on the terms negotiated in the lease. In a New York Percentage Shopping Center Lease Agreement, this percentage incentivizes retailers to maximize their sales. It’s important to consider how sales projections impact the rent. Careful negotiation of this rate can lead to mutually beneficial terms.

Percentage rent in retail leasing is typically based on a tenant's gross sales after reaching a pre-defined sales threshold. This structure allows for flexibility and aligns the landlord's interests with the tenant’s performance. In a New York Percentage Shopping Center Lease Agreement, this is essential for tenants aiming to scale their operations. Understanding this dynamic can significantly impact both parties' profitability.

To calculate rent for a retail space, factor in the square footage and the rental rate per square foot. In a New York Percentage Shopping Center Lease Agreement, you would also consider any base rent plus percentage rent based on sales. Additionally, reviewing market rates helps ensure your rent aligns with current trends. An informed calculation can secure a more favorable lease for your business.

Percentage rent can be calculated by taking the gross sales of a tenant over a predetermined threshold and multiplying it by the agreed-upon percentage rate. In your New York Percentage Shopping Center Lease Agreement, the threshold and percentage are typically defined in the lease terms. Calculating this rent aids in understanding how much you owe based on your sales. Thus, it’s a vital aspect of managing your retail expenses.

To calculate percentage leased, divide the total rented square footage by the total available square footage and then multiply by 100. For a shopping center, this calculation helps determine its occupancy rate, crucial for a New York Percentage Shopping Center Lease Agreement. Understanding this percentage can provide insights into your space's profitability and market standing. Take advantage of this metric in assessing your investment.

Shopping centers usually utilize percentage leases, which link rent to a tenant's sales earnings. This structure creates symmetry between the landlord and tenant, especially in a New York Percentage Shopping Center Lease Agreement. It benefits landlords by maximizing their rental income when tenants succeed, while tenants appreciate paying rent that correlates with their sales. Overall, it fosters a collaborative business environment.

Interesting Questions

More info

The guidelines are aimed at beginners and those who have acquired a basic understanding of the key concepts and the various types of information involved in a financial transaction. You can go through the following steps from the very beginning to get familiar with the various concepts in securities, loans and derivatives: 1) What is Stable Value? “Stable value” is often defined as fair market value if the fair value is a multiple of the outstanding shares or debt. In other words, if a company has a stock that is worth 100 dollars, but that 100 dollars are the worth of only 50 shares, then the stock is generally held in the bank's accounts at 100 times its original value. In other words, if there are 100 dollars of outstanding shares, then you can say that the company's capitalization is 100 dollars, and the market value is 100 dollars. “Stable value” is often defined as fair market value if the fair value is a multiple of the outstanding shares or debt.