New York Nonresidential Simple Lease

Description

How to fill out Nonresidential Simple Lease?

Locating the appropriate legal document template can be challenging.

Certainly, there are many templates available online, but how can you find the legal form you require.

Utilize the US Legal Forms website. This platform offers thousands of templates, including the New York Nonresidential Simple Lease, which are suitable for both commercial and personal use.

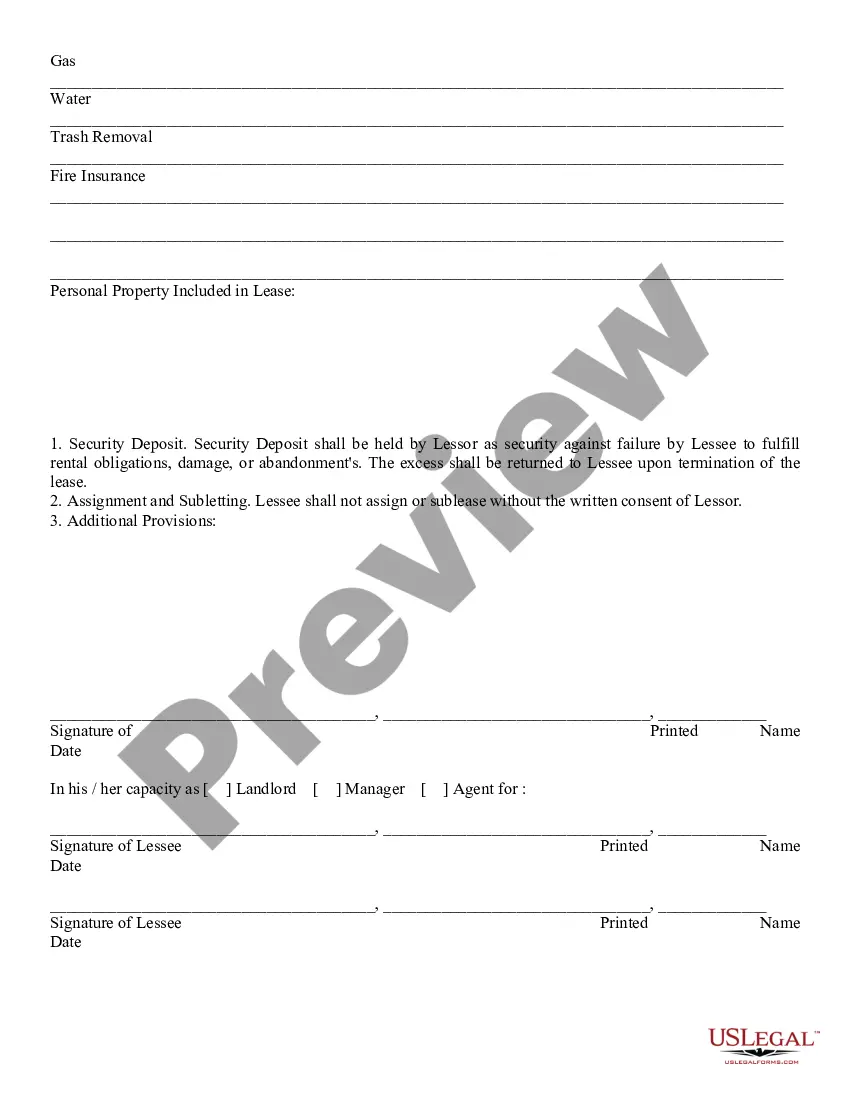

First, ensure you have chosen the correct form for your city/region. You can review the document with the Preview button and read the form description to confirm it suits your needs.

- All forms are vetted by professionals and comply with state and federal regulations.

- If you are already a member, Log In to your account and hit the Download button to obtain the New York Nonresidential Simple Lease.

- You can use your account to browse the legal forms you have previously obtained.

- Visit the My documents section of your account to retrieve another copy of the document you require.

- If you are a new user of US Legal Forms, here are some simple steps you can follow.

Form popularity

FAQ

Anyone who earns income from New York sources must file a New York State tax return, regardless of residency. This includes both residents and nonresidents with qualifying income. If your income derives from a New York Nonresidential Simple Lease, it’s vital to fulfill your tax obligations properly.

Any partnership conducting business in New York must file a New York partnership tax return. This includes partnerships consisting of nonresidents earning income from New York activities. If associated with a New York Nonresidential Simple Lease, ensure all income is accurately reported on your partnership return.

If you are a nonresident who earns income from New York while living abroad, you may still need to file New York State taxes. This requirement often stems from income generated through New York sources. Consider how your New York Nonresidential Simple Lease income impacts your tax obligations as an expatriate.

Yes, if you are a nonresident earning income from New York sources, you must file a NY state tax return. The return reflects the income attributable to your activities in New York. Utilizing a New York Nonresidential Simple Lease can help clarify rental income sources, ensuring compliance with state tax regulations.

If the estate is valued above the New York estate tax exemption threshold, the executor must file a New York estate tax return. This applies regardless of the location of the deceased's residence during their lifetime. It’s crucial to understand your obligations regarding assets tied to a New York Nonresidential Simple Lease in these circumstances.

If you earn income from New York sources but do not reside in the state, you must file NY IT 203. This form is specifically for nonresidents who receive income from New York. You should carefully review your income sources to determine if you meet the filing requirements related to a New York Nonresidential Simple Lease.

Yes, a foreigner can rent in New York without any issues. While some landlords might have specific requirements, many are open to renting to international tenants. It's beneficial to have a good rental history or references to enhance your application. When entering a New York Nonresidential Simple Lease, be informed about your rights and responsibilities as a tenant to make the most of your leasing experience.

A foreigner can successfully rent in New York by preparing essential documents, such as identification and income statements. Many landlords appreciate transparency and a clear understanding of your financial situation. Renting through real estate agents familiar with international clients can ease the process. Consider using uslegalforms to ensure your New York Nonresidential Simple Lease meets all legal requirements.

To obtain a lease in New York, start by searching properties that fit your needs. Once you find a suitable location, complete a rental application provided by the landlord. The landlord may request background information to process your approval. If you're eyeing a New York Nonresidential Simple Lease, be sure to review the terms and negotiate if necessary to align with your business needs.

US citizen can rent an apartment by providing necessary documentation, such as a passport, visa, and proof of income. Many landlords require a credit check, but alternatives like paying a higher security deposit may be accepted. It's advisable to have a guarantor if your income isn't verified in the US. For those considering a New York Nonresidential Simple Lease, utilizing services like uslegalforms can simplify the process.