A New York triple net lease for residential property is a type of lease agreement where the tenant is responsible for paying not only the rent but also the property's operating expenses, including real estate taxes, insurance, and maintenance costs. This lease structure is commonly used in commercial real estate, but it can also apply to residential properties in certain circumstances. In a New York triple net lease for residential property, the tenant assumes most of the financial burdens associated with the property, making it an attractive option for landlords looking to minimize their expenses. The lease terms are typically longer and include specific provisions outlining the tenant's responsibility for these additional costs. This lease arrangement allows landlords to transfer some financial risks associated with property ownership to the tenant. There are different types of triple net leases for residential property in New York, depending on the level of responsibility assigned to the tenant. These include: 1. Absolute Triple Net Lease: In this type of lease, the tenant assumes responsibility for all costs related to the property, including repairs, maintenance, taxes, insurance, and utilities. The tenant is responsible for these expenses regardless of the property's condition or usage. 2. Double Net Lease: Under a double net lease, the tenant is responsible for paying property taxes and insurance premiums, while the landlord takes care of maintenance costs. This lease structure offers a balance of financial responsibility between the landlord and the tenant. 3. Modified Gross Lease: In a modified gross lease, the landlord covers certain expenses, such as property taxes and insurance, while the tenant pays for maintenance, repairs, and utilities. This lease type allows for more negotiation between the parties regarding the distribution of costs. It is important to note that triple net leases for residential property in New York may not be as common as in commercial real estate. Residential properties often have different legal requirements and considerations compared to commercial ones. Therefore, it is advisable for both landlords and tenants to consult with legal professionals to ensure compliance with all applicable laws and regulations. Overall, a New York triple net lease for residential property shifts the financial responsibilities typically held by landlords to tenants. It is crucial for both parties to carefully review and understand the lease terms before entering into such an agreement to avoid any potential disputes or misunderstandings.

New York Triple Net Lease for Residential Property

Description

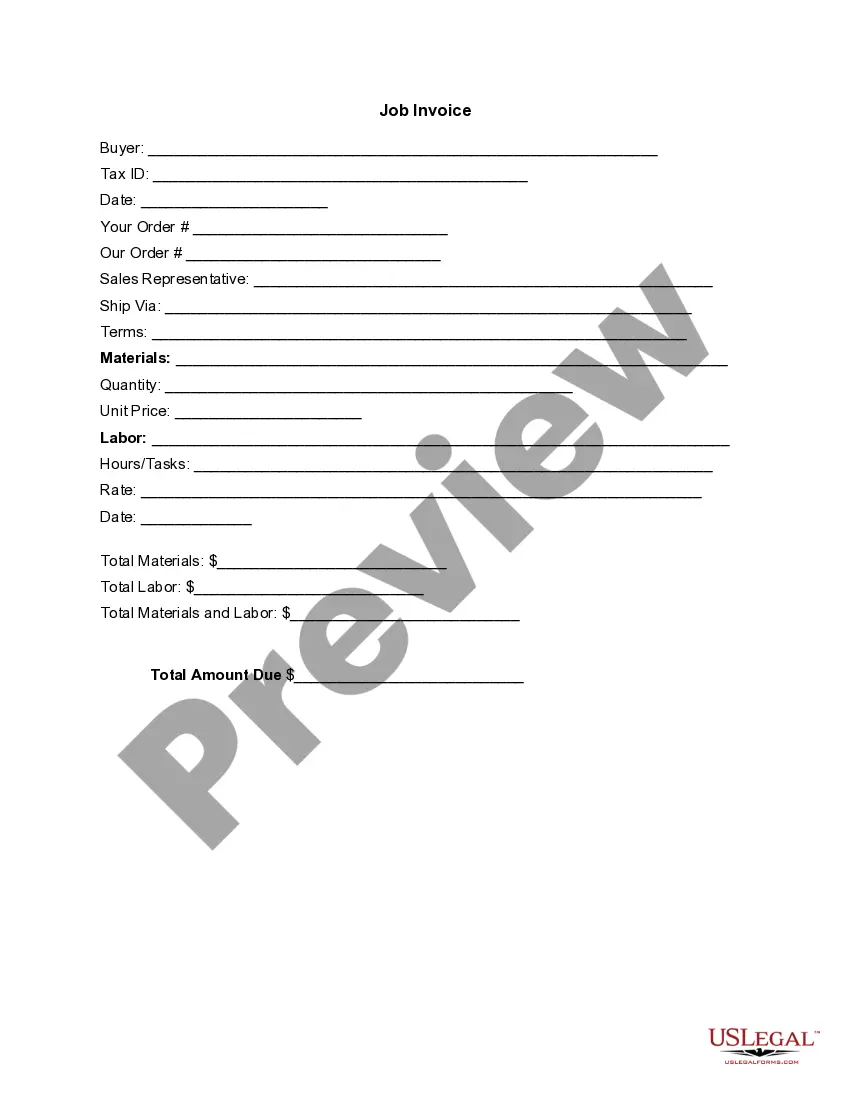

How to fill out Triple Net Lease For Residential Property?

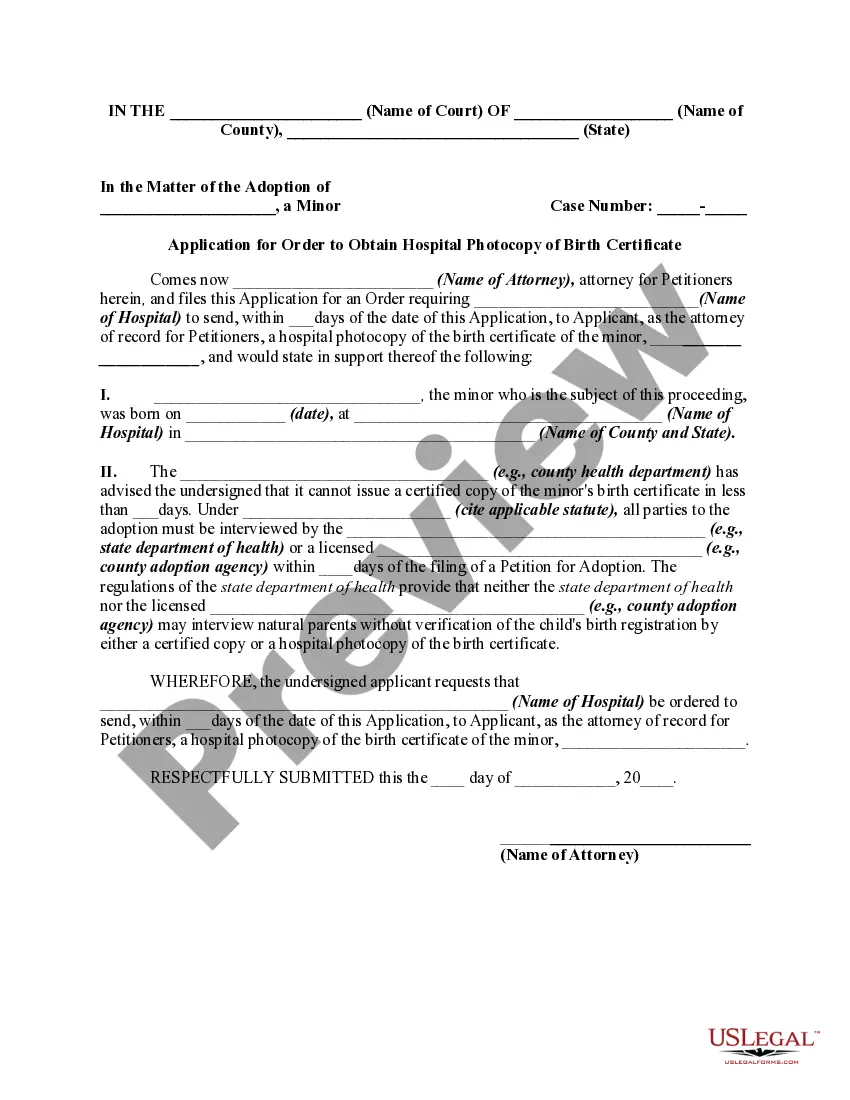

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast selection of legal document templates available for download or printing.

By using the website, you can access numerous forms for business and personal purposes, organized by categories, states, or keywords.

You can find current document types like the New York Triple Net Lease for Residential Property in just seconds.

Read the document details to ensure you have selected the appropriate one.

If the document does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you already have an account, Log In to retrieve the New York Triple Net Lease for Residential Property from the US Legal Forms library.

- The Download button will appear on every document you view.

- You will have access to all previously saved documents in the My documents section of your account.

- To use US Legal Forms for the first time, follow these simple instructions to get started.

- Ensure you have selected the correct document for your city/state.

- Click the Review button to examine the content of the document.

Form popularity

FAQ

Not all residential leases are structured as New York Triple Net Leases for Residential Property; however, some can be. Typically, single-family homes or multi-unit properties may adopt this lease type to share property expenses between landlord and tenant. It’s important to review the terms of any lease before signing. If you're uncertain, platforms like USLegalForms can help clarify the specifics of your lease agreement.

To secure a New York Triple Net Lease for Residential Property, start by searching for properties that offer this type of lease. Prepare your application, ensuring that you can meet the financial requirements outlined by the landlord. When you find a suitable property, express your interest and provide a clear and comprehensive application. Using services like USLegalForms can help you navigate the paperwork effectively.

NNN stands for 'Triple Net Lease,' which is a type of real estate lease agreement. In this arrangement, the tenant pays base rent plus additional costs for property maintenance, taxes, and insurance. In the context of New York Triple Net Lease for Residential Property, it's important to fully understand these additional responsibilities. Clarity in lease terms prevents future misunderstandings.

To determine if a lease is a New York Triple Net Lease for Residential Property, look for specific terms indicating tenant obligations. The lease should specify that the tenant is responsible for property taxes, insurance, and maintenance costs. If you are unsure about your lease, consider consulting a legal expert or using the resources available on platforms like USLegalForms. This can provide clarity and peace of mind.

Commercial properties, like retail spaces and office buildings, are most likely to utilize a New York Triple Net Lease for Residential Property format. However, some residential leases, particularly those with multiple rental units, may also adopt this structure. This arrangement appeals to landlords as it minimizes their financial responsibilities. Always review the lease terms to understand the specific property type.

While New York Triple Net Leases for Residential Property can seem daunting, they are not inherently bad for tenants. These leases provide fixed base rent but shift responsibility for property expenses, like taxes and maintenance, to the tenant. This can result in lower initial rent payments. However, it's crucial for tenants to understand their responsibilities and budget for the additional expenses.

Finding a New York Triple Net Lease for Residential Property requires some research and outreach. Start by exploring online real estate platforms that specialize in leases, or consult with local real estate agents who understand your needs. Networking within your community can also uncover potential lease opportunities. Additionally, US Legal Forms offers helpful resources and documents to guide you through the leasing process.

To qualify for a New York Triple Net Lease for Residential Property, you typically need to demonstrate financial stability and a solid credit history. Landlords want assurance that you can meet your lease obligations, including rent and additional costs. Providing documentation such as tax returns, bank statements, and references can strengthen your application. Platforms like US Legal Forms can help you access templates and resources to prepare your lease agreement efficiently.

To structure a New York triple net lease for residential property, both parties should clearly outline their responsibilities in the lease agreement. Start by specifying which expenses the tenant will cover, such as property taxes, insurance, and maintenance costs. It is also essential to define the duration of the lease and any renewal options. Consulting with a legal expert can ensure that all terms are fair and transparent, making for a smoother leasing process.

A tenant might choose a New York triple net lease for residential property to enjoy lower base rent. This lease structure allows tenants greater control over property management and operational expenses. Additionally, tenants can benefit from potential tax advantages and the opportunity to negotiate lease terms directly with the landlord. This flexibility makes triple net leases appealing for many residential tenants.