The federal benefits that are exempt from garnishment include:

" Social Security Benefits

" Supplemental Security Income (SSI) Benefits

" Veterans' Benefits

" Civil Service and Federal Retirement and Disability Benefits

" Military Annuities and Survivors' Benefits

" Student Assistance

" Railroad Retirement Benefits

" Merchant Seamen Wages

" Longshoremen's and Harbor Workers' Death and Disability Benefits

" Foreign Service Retirement and Disability Benefits

" Compensation for Injury, Death, or Detention of Employees of U.S. Contractors Outside the U.S.

" Federal Emergency Management Agency Federal Disaster Assistance.

Other exempt funds include:

" unemployment income,

" some social security disability income payments,

" some workman's compensation payments, and

" some joint account funds if the account is held by spouses as tenants by the entirety and the judgment is against only one spouse.

Even if the bank account is in just your name, there are some types of funds that are considered "exempt" from debt collection under state or federal law. The rationale behind these laws is to allow people to preserve the basic necessities for living. Exempt funds remain exempt when deposited in checking, savings or CD accounts so long as they are readily available for the day to day needs of the recipient and have not been converted into a "permanent investment."

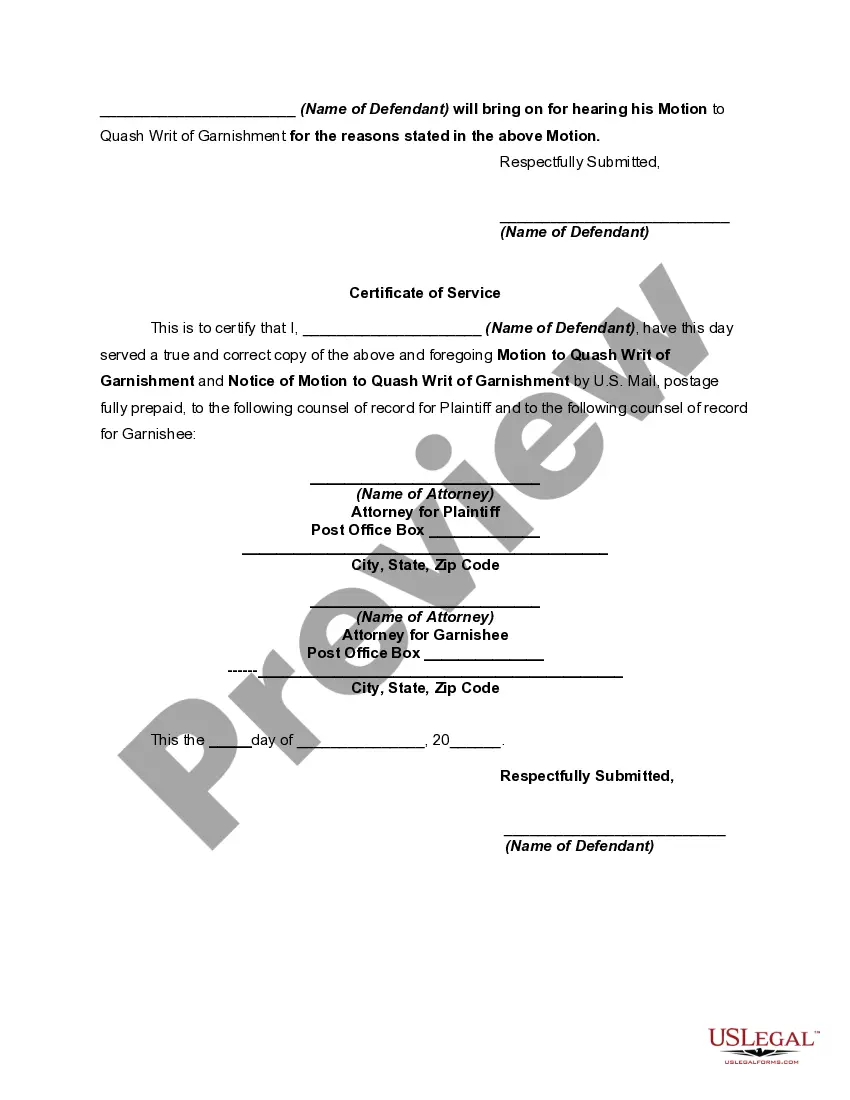

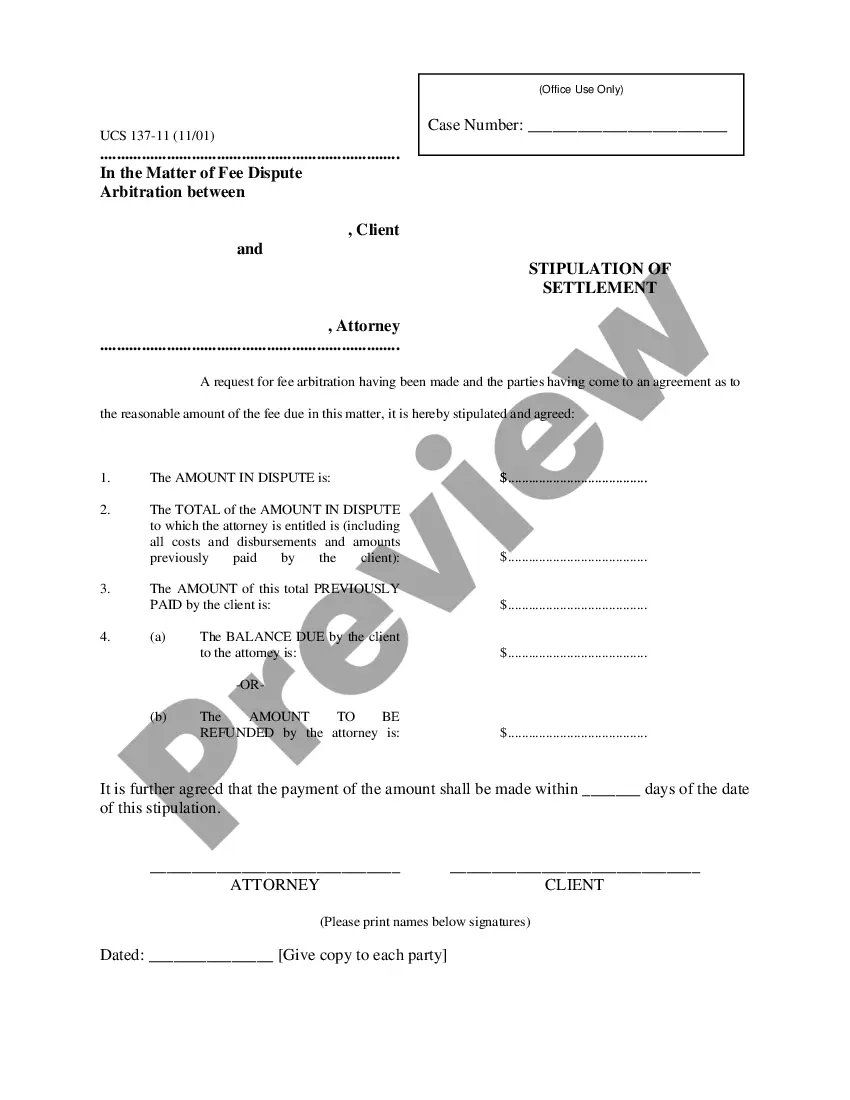

A New York motion of defendant to discharge or quash a writ of garnishment is a legal procedure used in response to a creditor's attempt to collect a debt by garnishing the defendant's funds. In this motion, the defendant seeks to have the garnishment order discharged or quashed based on various grounds, including funds that are exempt from being garnished by law. Keywords: New York, motion, defendant, discharge, quash, writ of garnishment, notice of motion, funds exempt by law, garnishment. Different types of New York motions of defendant to discharge or quash a writ of garnishment and notice of motion — funds exempt by law from garnishment may include: 1. Assertion of Exempt Funds: In this motion, the defendant argues that the funds being targeted for garnishment are exempt under state or federal laws. These laws typically protect certain types of income such as Social Security benefits, child support payments, retirement benefits, disability income, and public assistance. 2. Lack of Proper Service: The defendant may file a motion claiming that they did not receive proper notice or service of the garnishment order, which could invalidate the entire proceeding. They might argue that they were not served personally, or that the service did not meet the required legal standards. 3. Procedural Errors: This type of motion challenges any procedural errors committed during the garnishment process. It may include mistakes made by the creditor, such as failing to follow proper court procedures or failing to provide accurate information about the defendant's financial situation. 4. Lack of Jurisdiction: A motion based on lack of jurisdiction argues that the court does not have the authority to issue the garnishment order. This could be due to the defendant residing outside the court's jurisdiction or conducting business in a different jurisdiction that should handle the matter. 5. Disproportionate Garnishment Amount: The defendant may present a motion claiming that the amount being garnished is excessive or disproportionate to the unpaid debt. They may argue that the garnishment would cause significant financial hardship, making it impossible to meet basic living expenses. 6. Payment Agreement or Settlement: If the defendant has reached a payment agreement or settlement with the creditor, they may file a motion to halt or modify the garnishment order accordingly. This motion would aim to demonstrate that ongoing garnishment is unnecessary due to the agreed-upon payment terms. It is important to consult with an attorney to determine the specific type of motion that best applies to a particular situation and to ensure accurate compliance with New York law and court procedures.A New York motion of defendant to discharge or quash a writ of garnishment is a legal procedure used in response to a creditor's attempt to collect a debt by garnishing the defendant's funds. In this motion, the defendant seeks to have the garnishment order discharged or quashed based on various grounds, including funds that are exempt from being garnished by law. Keywords: New York, motion, defendant, discharge, quash, writ of garnishment, notice of motion, funds exempt by law, garnishment. Different types of New York motions of defendant to discharge or quash a writ of garnishment and notice of motion — funds exempt by law from garnishment may include: 1. Assertion of Exempt Funds: In this motion, the defendant argues that the funds being targeted for garnishment are exempt under state or federal laws. These laws typically protect certain types of income such as Social Security benefits, child support payments, retirement benefits, disability income, and public assistance. 2. Lack of Proper Service: The defendant may file a motion claiming that they did not receive proper notice or service of the garnishment order, which could invalidate the entire proceeding. They might argue that they were not served personally, or that the service did not meet the required legal standards. 3. Procedural Errors: This type of motion challenges any procedural errors committed during the garnishment process. It may include mistakes made by the creditor, such as failing to follow proper court procedures or failing to provide accurate information about the defendant's financial situation. 4. Lack of Jurisdiction: A motion based on lack of jurisdiction argues that the court does not have the authority to issue the garnishment order. This could be due to the defendant residing outside the court's jurisdiction or conducting business in a different jurisdiction that should handle the matter. 5. Disproportionate Garnishment Amount: The defendant may present a motion claiming that the amount being garnished is excessive or disproportionate to the unpaid debt. They may argue that the garnishment would cause significant financial hardship, making it impossible to meet basic living expenses. 6. Payment Agreement or Settlement: If the defendant has reached a payment agreement or settlement with the creditor, they may file a motion to halt or modify the garnishment order accordingly. This motion would aim to demonstrate that ongoing garnishment is unnecessary due to the agreed-upon payment terms. It is important to consult with an attorney to determine the specific type of motion that best applies to a particular situation and to ensure accurate compliance with New York law and court procedures.