Title: New York Sale or Return: An In-depth Overview of Its Definition, Types, and Benefits Introduction: New York Sale or Return is a business model that specifies the terms and conditions for the sale and return of goods between a supplier or manufacturer and a retailer. This concept empowers retailers to showcase products without committing to a purchase, allowing them to assess market demand before making a final decision. In this article, we will discuss the meaning of New York Sale or Return, explore its various types, and highlight the benefits it offers to both parties involved. Keywords: New York, sale or return, business model, supplier, manufacturer, retailer, goods, market demand, purchase decision, types, benefits. I. Definition of New York Sale or Return: New York Sale or Return is a contractual agreement between suppliers or manufacturers and retailers, primarily related to the sale and return of goods. This agreement allows retailers to stock merchandise without immediate financial commitment, thus mitigating the risks associated with unsold inventory. It provides retailers with the flexibility to return unsold items to the supplier, typically within an agreed-upon timeframe. Keywords: contractual agreement, merchandise, financial commitment, unsold inventory, flexibility, return. II. Types of New York Sale or Return: 1. Consignment Arrangement: In a consignment-based New York Sale or Return, retailers receive goods from suppliers and display them in their stores. They only pay the supplier for the items that are sold, while unsold goods can be returned. 2. Trial Basis Agreement: In this type, a retailer receives a small quantity or limited assortment of goods from the supplier. The retailer has a predetermined period to evaluate the market response and decides whether to purchase the items. 3. Seasonal Stock Arrangement: Under this arrangement, retailers receive seasonal goods or products intended for specific occasions. After the completion of the season, unsold items can be returned to the supplier. 4. Book & Media Industry Variation: Commonly used in the book and media industry, this variant of New York Sale or Return allows retailers to return unsold books or media products to the supplier within a particular timeframe. Keywords: consignment arrangement, trial basis agreement, seasonal stock, market response, limited assortment, book industry, book return, media products. III. Benefits of New York Sale or Return: 1. Reduced Risk for Retailers: By adopting the New York Sale or Return model, retailers minimize financial risks associated with their inventory since they can return unsold goods. This arrangement ensures a better cash flow and avoids excess stock. 2. Market Testing and Sampling: Retailers can gauge market demand and assess the popularity of products without committing to full purchases. This allows them to refine their product offerings based on customer preferences. 3. Enhanced Relationship with Suppliers: By offering Sale or Return agreements, suppliers can build stronger relationships with retailers. The flexibility and trust established through this model foster long-term collaboration and mutual growth. 4. Minimized Costs and Inventory Management: Retailers can avoid costs associated with storing and disposing of unsold products. They can maintain optimal inventory levels and meet customer demands more efficiently. Keywords: reduced risk, financial risks, market testing, sampling, customer preferences, relationship building, collaboration, mutual growth, inventory management. Conclusion: New York Sale or Return presents a mutually beneficial arrangement between suppliers or manufacturers and retailers. It allows retailers to minimize financial risks, while suppliers can build stronger relationships and reduce inventory challenges. By embracing this model, businesses can adapt to evolving market conditions, enhance customer satisfaction, and optimize profit potential. Keywords: New York Sale or Return, mutually beneficial, financial risks, relationships, inventory challenges, market conditions, customer satisfaction, profit potential.

New York Sale or Return

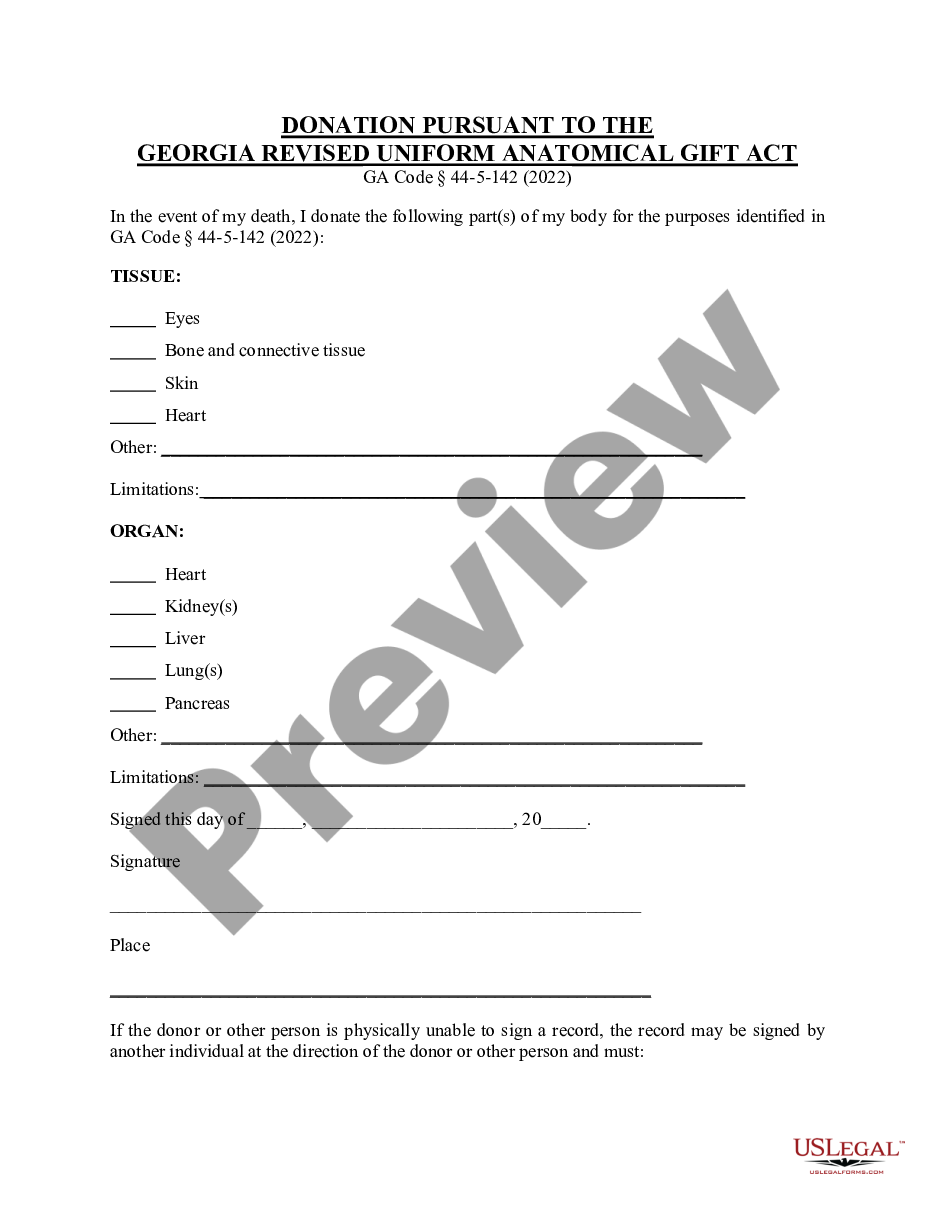

Description

How to fill out New York Sale Or Return?

If you want to aggregate, download, or print legal document templates, utilize US Legal Forms, the largest array of legal forms accessible online.

Utilize the site’s simple and convenient search to locate the documents you require.

A selection of templates for professional and personal purposes are organized by categories and states, or keywords.

Each legal document format you purchase is yours indefinitely. You will have access to every form you saved in your account.

Click on the My documents section and select a form to print or download again. Be proactive and download, and print the New York Sale or Return with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to find the New York Sale or Return in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the New York Sale or Return.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct region/state.

- Step 2. Utilize the Preview option to review the form’s content. Remember to check the summary.

- Step 3. If you are unsatisfied with the form, use the Search section at the top of the screen to find other variations of the legal form template.

- Step 4. After you have found the form you want, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the New York Sale or Return.

Form popularity

FAQ

The easiest way to fill out a tax return is to use tax preparation software or online services. These platforms provide step-by-step guidance and can help you identify deductions, ensuring you comply with the New York Sale or Return tax regulations. Alternatively, consider consulting a tax professional to streamline the process.

To fill out a New York State resale certificate, start by entering your business name and address. You should also provide a detailed description of the goods you plan to resell. Furthermore, be sure to sign and date the certificate before giving it to the seller, aligning with the New York Sale or Return stipulations.

Filling out a New York resale certificate requires you to complete specific sections accurately. Include your name, the seller's details, and a declaration that the purchased items are for resale only. Double-check your information to ensure compliance with the New York Sale or Return guidelines.

To verify a New York resale certificate, you can contact the seller or check their credentials via the New York Department of Taxation and Finance. It's important to ensure that the certificate is valid and up to date. This verification will protect you from potential tax liability associated with invalid or expired certificates, aligning with the New York Sale or Return approach.

Filling out a sales tax exemption certificate involves providing key information about your business. You need to include your name, address, and the reason for the exemption. Make sure to write the seller's details accurately and sign the form. Utilizing resources like the New York Sale or Return guide can simplify this process.

To get a New York State vendor ID number, you must first register as a vendor with the New York State Office of General Services. This registration can often be completed online, providing details about your business. Having a vendor ID streamlines your interactions with state agencies and is essential for certain transactions, especially if you engage in New York Sale or Return activities.

No, the New York sales tax ID is not the same as an Employer Identification Number (EIN). The sales tax ID is specifically for handling sales tax, while an EIN is for identifying your business for federal tax purposes. You may need both for different aspects of your business operations. Understanding this distinction helps clarify your responsibilities under New York Sale or Return guidelines.

To get a tax ID number in New York, you typically need your Social Security number, business details, and proof of identity. Depending on your business structure, additional documentation may be required. It's crucial to provide accurate information to avoid delays. By obtaining a tax ID, you position yourself better for managing your obligations with New York Sale or Return.

To obtain a New York sales tax ID number, you need to register your business with the New York State Department of Taxation and Finance. This can be done online through their Business Online Services portal. Make sure to have your business information and personal identification ready, as this will streamline the registration process. Having a sales tax ID number is essential for complying with New York Sale or Return regulations.

To get a copy of your New York State tax return, you can start by visiting the New York State Department of Taxation and Finance website. They provide an option to request a copy online, by mail, or even by fax. It's important to have your identification ready, as they will require your Social Security number and other personal information. This process can help ensure you have all necessary documents for your New York Sale or Return activities.

Interesting Questions

More info

Last Update: August 1, 2018.