A New York Security Agreement involving the sale of collateral by a debtor is a legal contract that outlines the terms and conditions of a financial arrangement between a borrower (debtor) and a lender. The agreement serves to protect the lender's interests by granting them a security interest in the borrower's collateral, which can be sold in the event of default. Importantly, a New York Security Agreement involving the sale of collateral by a debtor must adhere to the relevant laws and regulations in the state of New York. These agreements are typically governed by the Uniform Commercial Code (UCC) Article 9. Different types of New York Security Agreements involving the sale of collateral by a debtor may include: 1. Traditional Security Agreement: This is one of the most common types of New York Security Agreements. It establishes a lien on the borrower's collateral, enabling the lender to seize and sell the collateral to recover any unpaid debts. 2. Purchase Money Security Agreement (PSA): In this type of agreement, the lender provides funds to the borrower specifically for the acquisition of collateral, such as purchasing equipment or inventory. The lender then acquires a security interest in that collateral. If the borrower defaults, the lender can sell the collateral to recover the outstanding debt. 3. Floating Lien: A floating lien allows the borrower to continue using and selling collateral in the ordinary course of business until a default occurs. Once the default triggers the lender's rights, they can seize and sell any collateral held under the floating lien. The New York Security Agreement involving the sale of collateral by a debtor includes several key elements. It specifies the identities of both parties involved, describes the collateral being used to secure the debt, defines the obligations of the debtor, and outlines the rights and remedies of the lender. The agreement also covers the conditions under which the lender can sell the collateral, including default scenarios or breaches of the contract terms. Any proceeds from the sale of collateral are typically used to repay the outstanding debt, while any excess funds are returned to the debtor. Furthermore, a New York Security Agreement may include clauses related to insurance requirements, indemnification, and the debtor's responsibility for maintaining the collateral's value. These provisions further protect the lender's interests and minimize the risks associated with the agreement. In conclusion, a New York Security Agreement involving the sale of collateral by a debtor protects the rights of lenders by establishing a legal framework for the use and potential sale of collateral in case of default. Understanding the different types of security agreements and their specific provisions is crucial for borrowers and lenders alike when entering into financial agreements.

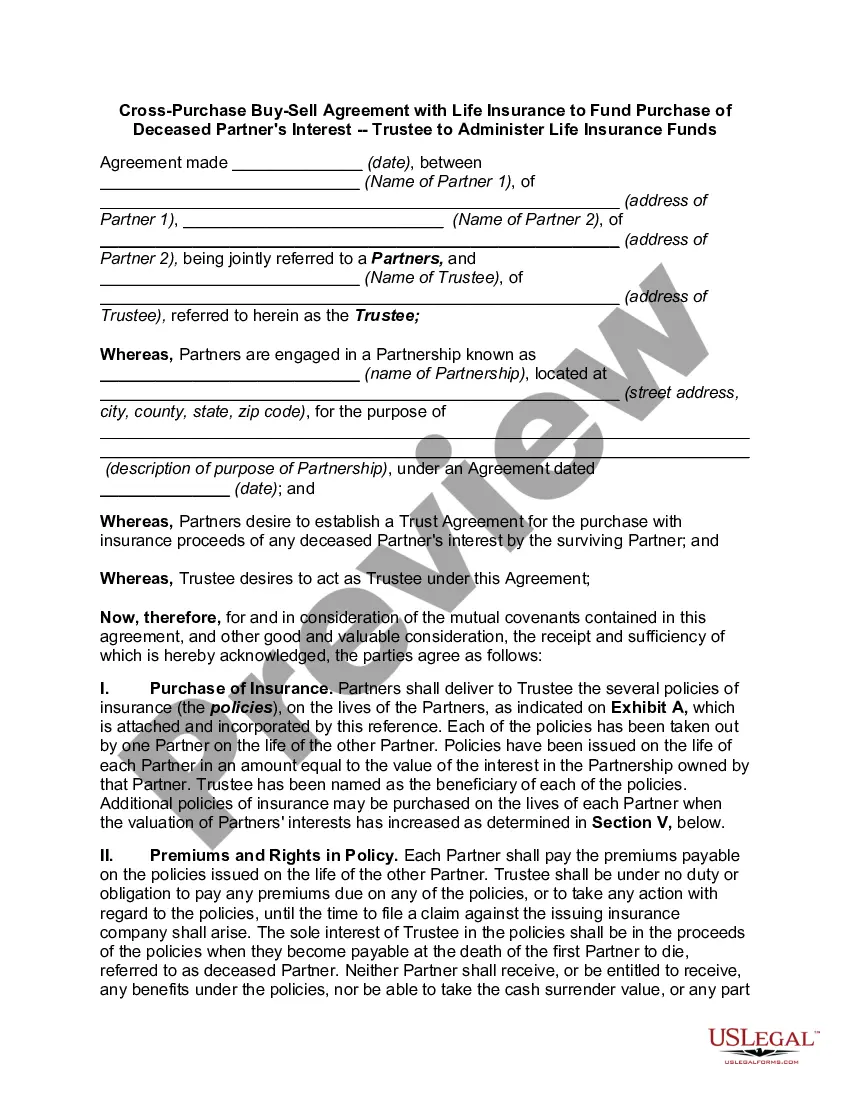

New York Security Agreement involving Sale of Collateral by Debtor

Description

How to fill out New York Security Agreement Involving Sale Of Collateral By Debtor?

Are you within a place where you will need files for both business or individual reasons just about every time? There are a variety of lawful record themes available on the Internet, but finding versions you can rely is not easy. US Legal Forms gives 1000s of develop themes, such as the New York Security Agreement involving Sale of Collateral by Debtor, that happen to be written in order to meet federal and state specifications.

When you are previously acquainted with US Legal Forms site and possess an account, basically log in. Next, you can obtain the New York Security Agreement involving Sale of Collateral by Debtor template.

Unless you come with an accounts and need to begin using US Legal Forms, adopt these measures:

- Get the develop you need and make sure it is for your appropriate metropolis/state.

- Take advantage of the Review button to check the shape.

- Look at the outline to ensure that you have selected the correct develop.

- If the develop is not what you are searching for, take advantage of the Look for area to get the develop that suits you and specifications.

- When you discover the appropriate develop, just click Acquire now.

- Select the costs strategy you want, submit the specified information to generate your account, and pay for your order making use of your PayPal or Visa or Mastercard.

- Select a hassle-free paper format and obtain your copy.

Locate all the record themes you have bought in the My Forms menus. You can get a more copy of New York Security Agreement involving Sale of Collateral by Debtor at any time, if possible. Just go through the essential develop to obtain or print out the record template.

Use US Legal Forms, by far the most considerable collection of lawful varieties, to conserve efforts and prevent blunders. The assistance gives expertly made lawful record themes that can be used for a selection of reasons. Generate an account on US Legal Forms and begin making your life easier.