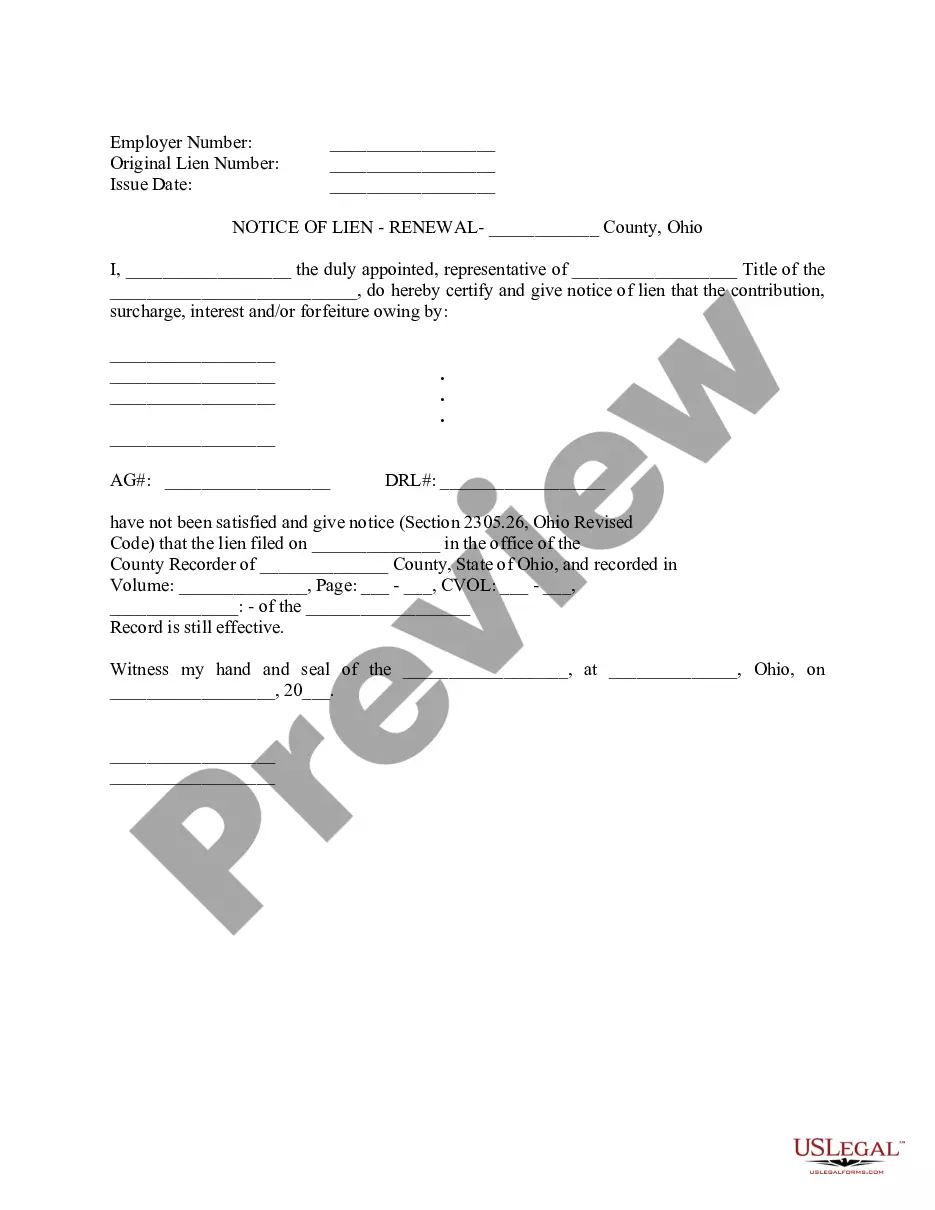

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A New York Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness is a legal document that allows a debtor to assign a specific portion of their interest in an estate to pay off a certain debt. This assignment can be made in order to settle any outstanding debts owed to creditors. In New York, there are different types of Assignments of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness, which include: 1. Assignments for Mortgage Liens: This type of assignment allows a debtor to assign a portion of their interest in an estate to cover unpaid mortgage debts. It ensures that the creditor receives the necessary funds from the debtor's estate to settle the mortgage debt. 2. Assignments for Credit Card Debts: Individuals with outstanding credit card debts can use this type of assignment to allocate a portion of their interest in an estate towards paying off those debts. It provides a way for creditors to secure payment for the debts owed. 3. Assignments for Personal Loans: When a debtor has borrowed a specific amount of money from a lender, this assignment allows them to assign a portion of their interest in an estate as collateral to repay the lender. It provides assurance to the lender that they will receive the repayment they are owed. 4. Assignments for Medical Bills: In cases where a debtor has accumulated substantial medical bills that they are unable to pay, this assignment can be used to assign a portion of their future interest in an estate towards settling those bills. It offers a way to ensure medical providers receive payment for their services. The New York Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness is a crucial legal instrument that provides a feasible solution for debtors to settle their outstanding debts by leveraging their interest in an estate. It protects the rights and interests of both creditors and debtors by facilitating a fair and structured approach to debt repayment.A New York Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness is a legal document that allows a debtor to assign a specific portion of their interest in an estate to pay off a certain debt. This assignment can be made in order to settle any outstanding debts owed to creditors. In New York, there are different types of Assignments of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness, which include: 1. Assignments for Mortgage Liens: This type of assignment allows a debtor to assign a portion of their interest in an estate to cover unpaid mortgage debts. It ensures that the creditor receives the necessary funds from the debtor's estate to settle the mortgage debt. 2. Assignments for Credit Card Debts: Individuals with outstanding credit card debts can use this type of assignment to allocate a portion of their interest in an estate towards paying off those debts. It provides a way for creditors to secure payment for the debts owed. 3. Assignments for Personal Loans: When a debtor has borrowed a specific amount of money from a lender, this assignment allows them to assign a portion of their interest in an estate as collateral to repay the lender. It provides assurance to the lender that they will receive the repayment they are owed. 4. Assignments for Medical Bills: In cases where a debtor has accumulated substantial medical bills that they are unable to pay, this assignment can be used to assign a portion of their future interest in an estate towards settling those bills. It offers a way to ensure medical providers receive payment for their services. The New York Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness is a crucial legal instrument that provides a feasible solution for debtors to settle their outstanding debts by leveraging their interest in an estate. It protects the rights and interests of both creditors and debtors by facilitating a fair and structured approach to debt repayment.