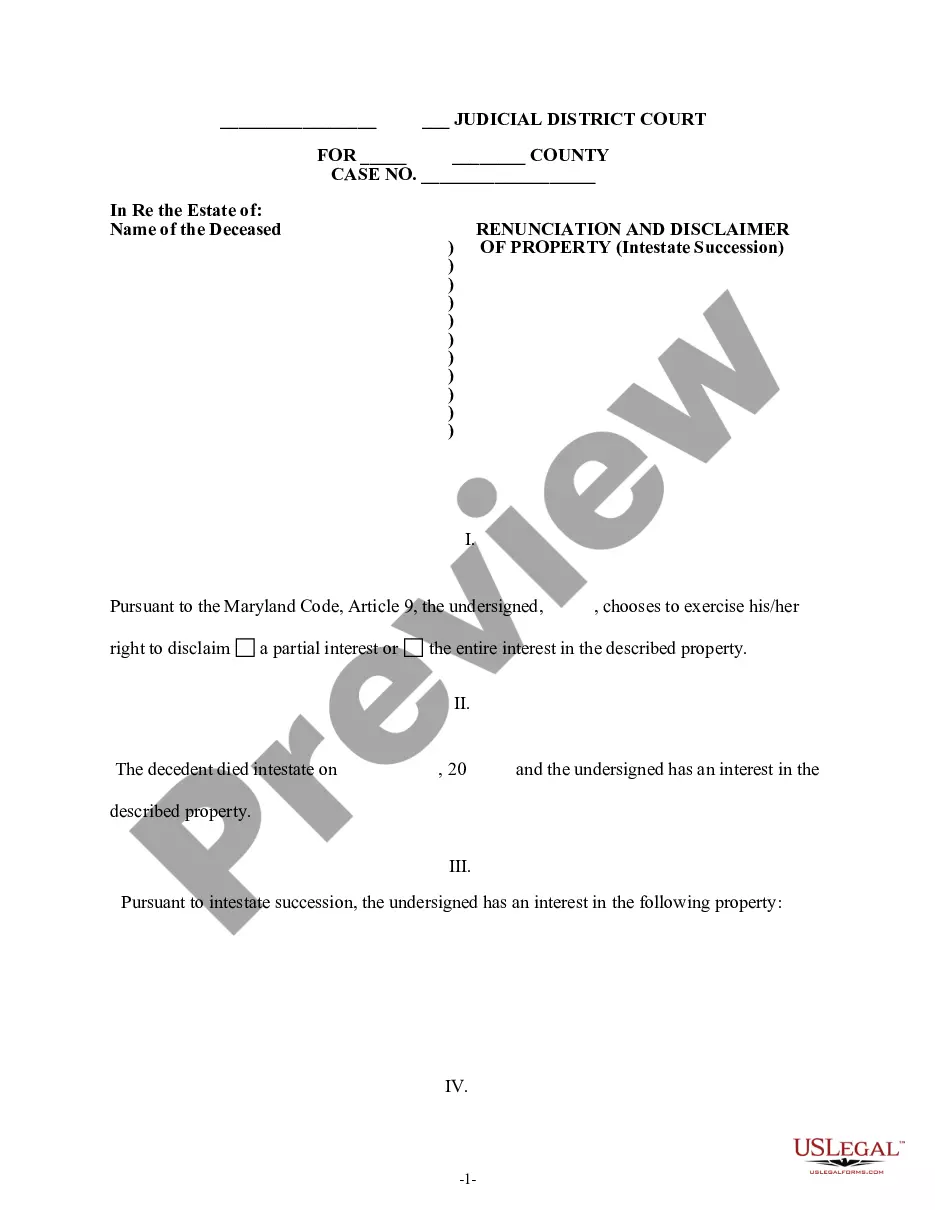

This form is an irrevocable trust established to provide funds in order to continue a family tradition of giving birthday presents to members of grantor's immediate family and is to continue after grantor's death. The term heirs as used in this trust are those people who would inherit the estate of a deceased person by statutory law if the deceased died without a will. When a person dies without a will, the heirs to their estate are determined under the rules of descent and distribution. The term heirs-at-law is used to refer to those who would inherit under the state statute of descent and distribution if a decedent dies intestate (without a will), and they may or may not be beneficiaries under a will.

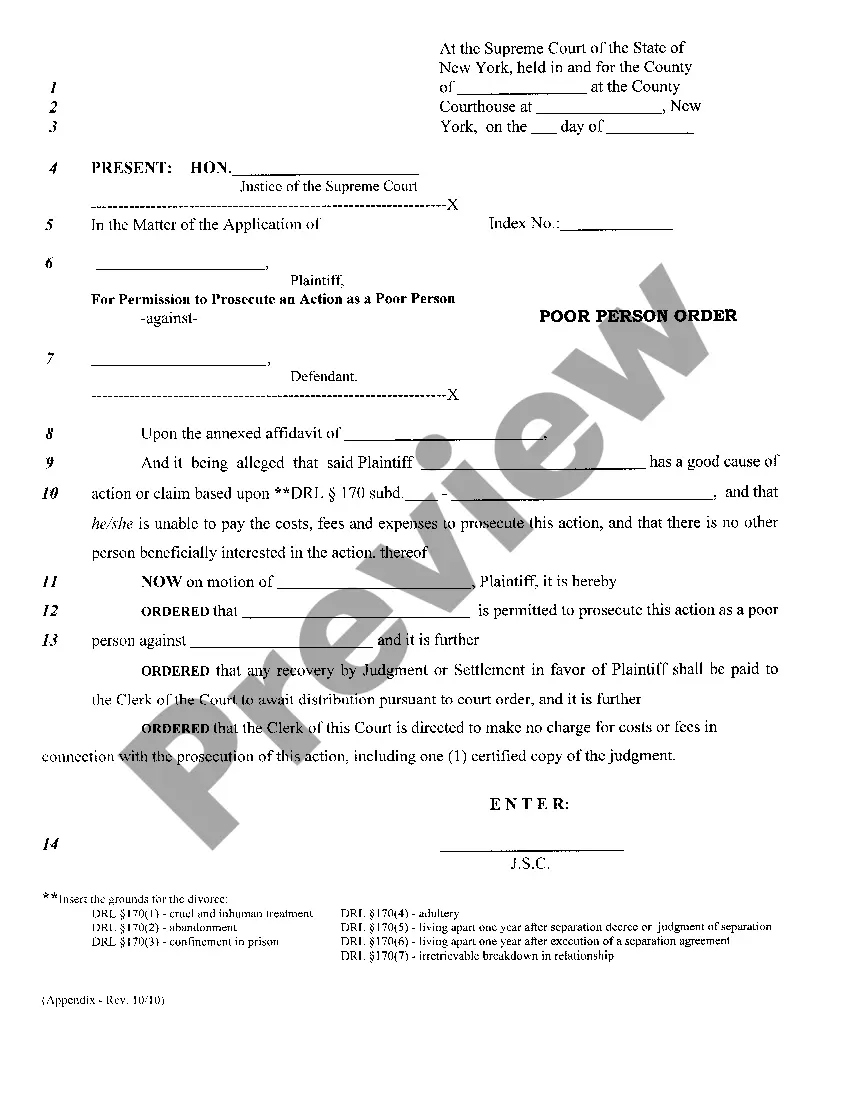

A New York Trust is a legal arrangement where an individual, called the granter, sets aside funds to be used for purchasing birthday presents for the members of their family even after the granter's death. This type of trust ensures that the tradition of giving thoughtful gifts to family members can continue long after the granter has passed away. There are several types of New York trusts that can be established to provide funds for the purchase of birthday presents. Some common ones include: 1. Revocable Trust: This type of trust allows the granter to modify or revoke the trust during their lifetime. It provides flexibility for the granter to make changes to the beneficiary list or the amount of funds dedicated to birthday presents. 2. Irrevocable Trust: In contrast to a revocable trust, an irrevocable trust cannot be modified or revoked once it is established. It provides greater asset protection and ensures that the funds allocated for birthday presents remain devoted to this purpose. 3. Testamentary Trust: A testamentary trust is created through the granter's will and only goes into effect upon their death. It allows the granter to continue providing funds for birthday presents even when they are no longer alive. 4. Family Trust: This type of trust can be established to benefit multiple generations of the granter's family. It ensures that the tradition of purchasing birthday presents can continue for years to come, providing funds for the enjoyment and celebration of family members. 5. Spendthrift Trust: A spendthrift trust is designed to protect the assets from being mismanaged or squandered by the beneficiaries. It can be utilized to ensure that the funds allocated for birthday presents are used wisely and for their intended purpose. The New York Trust to Provide Funds for the Purchase of Birthday Presents for Members of Granter's Family to Continue after Granter's enables the granter to create a lasting legacy of love and celebration within their family. By establishing a trust specifically designated for birthday presents, the granter ensures that their family members will always be remembered and cherished on their special day. This type of trust offers a thoughtful and meaningful way to continue the tradition of gift-giving while providing financial security for its execution.