Title: Understanding New York Letter to Lender for Produce the Note Request Keyword focus: New York, letter to lender, produce the note request, mortgage documentation, foreclosure defense Description: A New York Letter to Lender for Produce the Note Request is a formal and crucial communication sent by homeowners or their legal representatives to request the original loan documents from lenders or mortgage services. This request is particularly relevant in the context of foreclosure defense cases or disputes related to mortgage documentation. Key Features: 1. Importance of the Produce the Note Request: In New York, homeowners facing foreclosure have the right to challenge the validity of their loan documents. The Produce the Note Request is an effective tool utilized to request lenders to produce the original promissory note as proof of legal ownership and authority to initiate foreclosure proceedings. 2. Detailed Information Required: The letter should include specific details, such as the borrower's name, property address, loan number, and any relevant loan agreement details. These specifics ensure accurate identification of the mortgage in question, facilitating the lender's search for the original note. 3. Legal Implications: The New York Letter to Lender for Produce the Note Request has significant legal implications. If the lender fails to provide the original note, it can hinder their ability to proceed with foreclosure or legal action. In such instances, borrowers may be able to raise valid defenses to challenge the foreclosure and potentially negotiate alternative resolutions. 4. Multiple Types of Letters: a) Standard Produce the Note Request: The standard letter requests lenders to produce the original promissory note in compliance with New York State's laws and regulations governing loan documentation. This type of letter illustrates the borrower's intention to challenge foreclosure based on the absence or potential irregularities related to the note. b) Letter from Legal Professionals: In more complex foreclosure defense cases, borrowers often seek assistance from legal professionals. Attorneys or law firms may draft and send the letter on behalf of the borrower, highlighting any legal nuances or strategies to strengthen the request for producing the note. c) Post-Foreclosure Request: In some cases, borrowers may file a produce the note request even after the foreclosure has taken place. This type of letter seeks to verify the legitimacy of the foreclosure and may be used to initiate legal actions for voiding the foreclosure sale or pursuing potential claims against the lender. Remember, if you find yourself in a situation requiring a New York Letter to Lender for Produce the Note Request, it is crucial to consult an experienced attorney or foreclosure defense professional to ensure the correct procedures are followed and your interests are protected.

New York Letter to Lender for Produce the Note Request

Description

How to fill out New York Letter To Lender For Produce The Note Request?

Are you in a situation where you occasionally require documents for company or specific intentions almost every day.

There is a plethora of legal document templates accessible online, but finding reliable ones is not easy.

US Legal Forms offers numerous form templates, such as the New York Letter to Lender for Produce the Note Request, which can be customized to adhere to state and federal regulations.

Select a convenient file format and download your version.

Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the New York Letter to Lender for Produce the Note Request whenever necessary. Just click on the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Subsequently, you can download the New York Letter to Lender for Produce the Note Request template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct area/state.

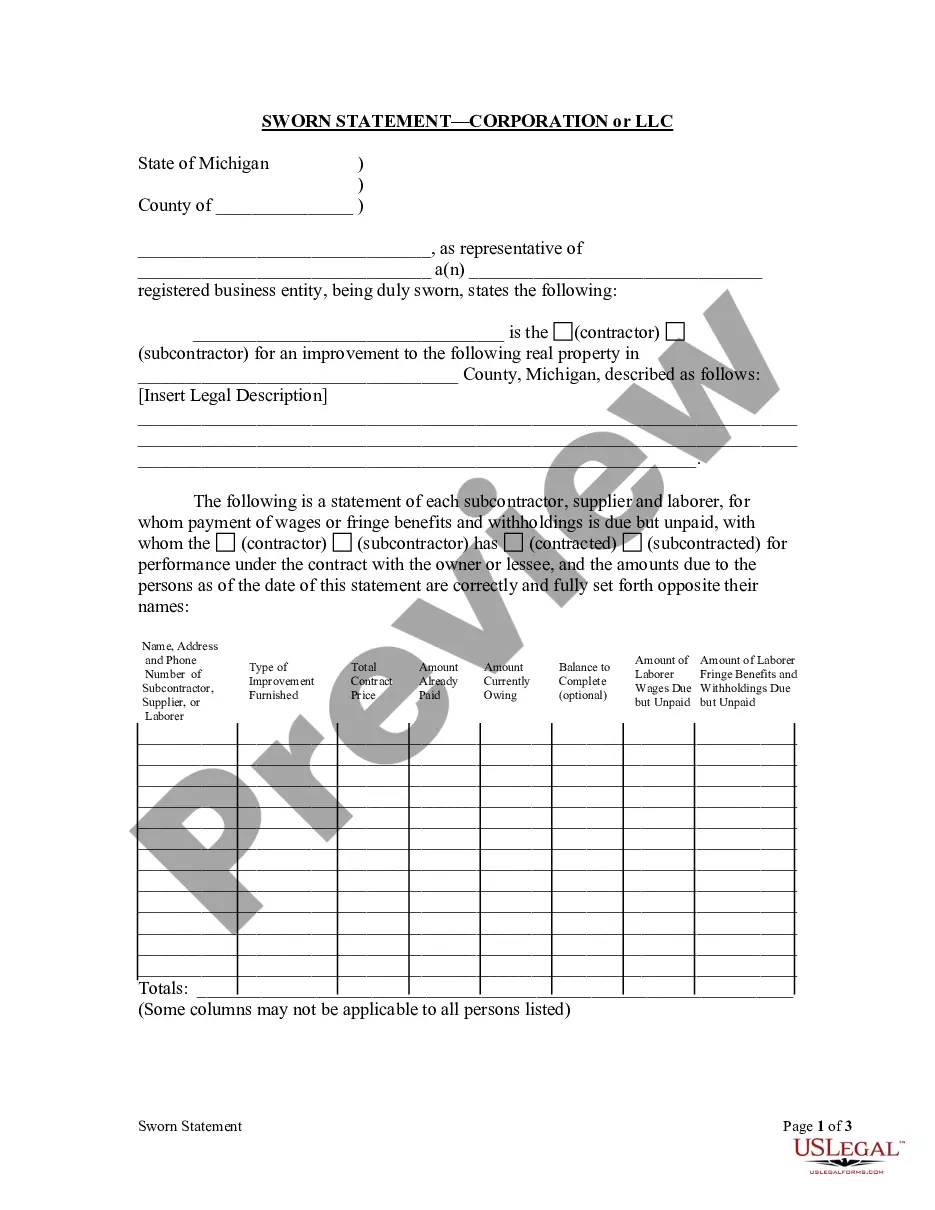

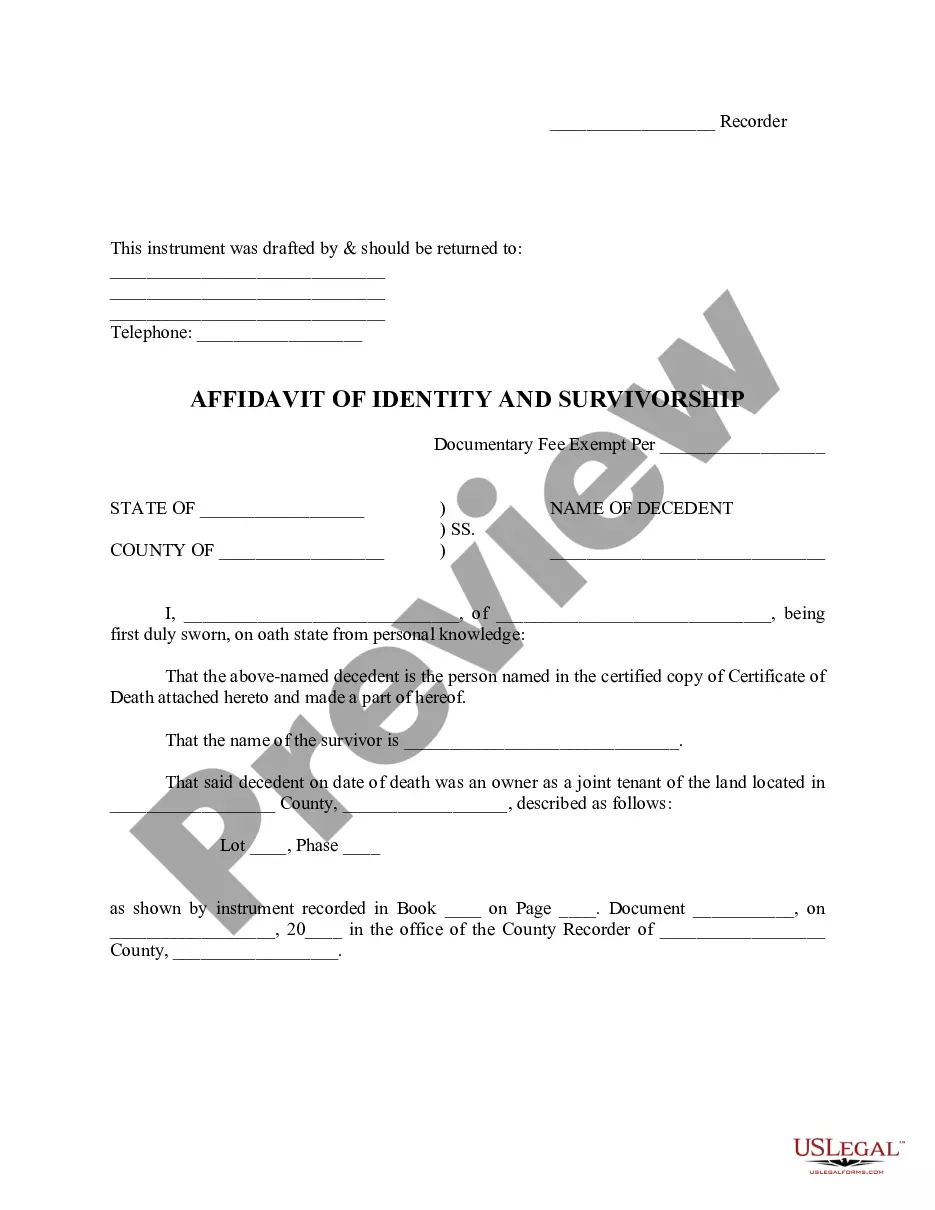

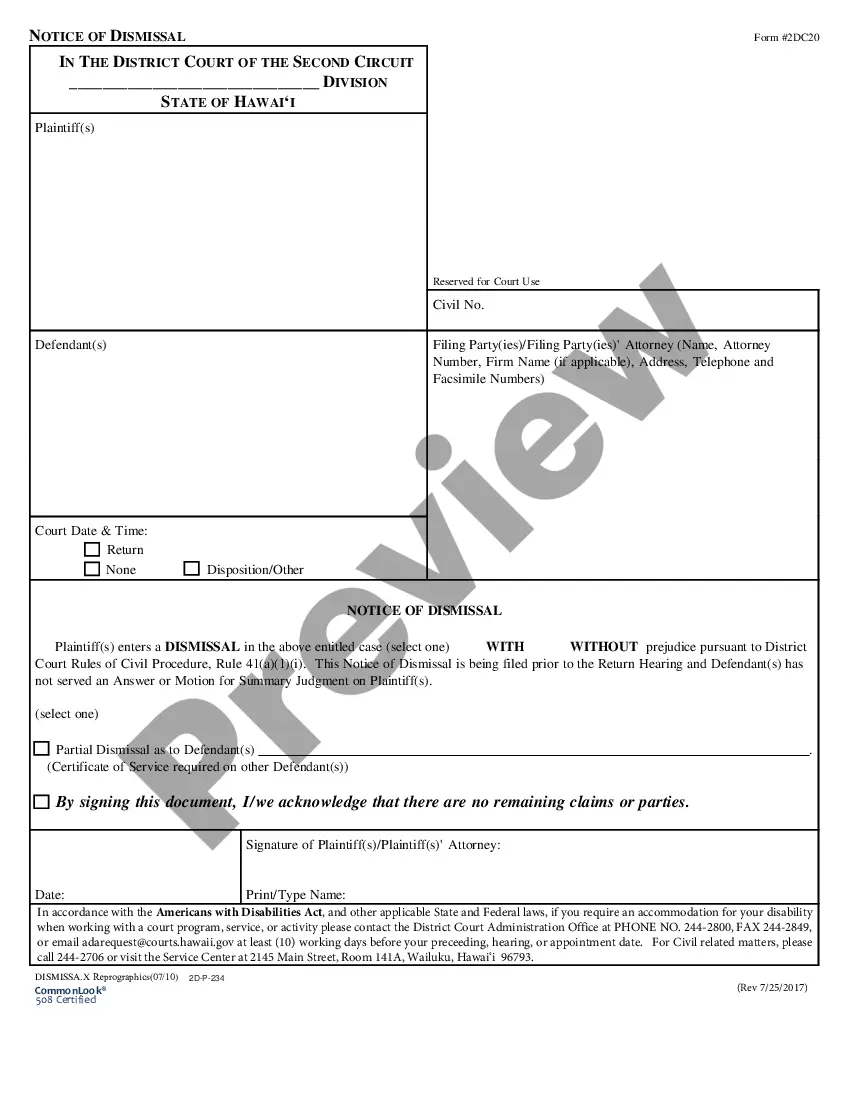

- Utilize the Preview option to review the form.

- Check the description to ensure you have selected the appropriate form.

- If the form is not what you are looking for, use the Lookup field to find the form that fits your requirements.

- Once you locate the suitable form, click on Get now.

- Choose the pricing plan you want, fill in the necessary information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

Form popularity

FAQ

Even if a promissory note is lost, the legal obligation to repay the loan remains. The lender has a right to re-establish the note legally as long as it has not sold or transferred the note to another party.

When a lender cannot produce a note, then they are not able to prove when they took ownership or assignment of the note. A court may dismiss the case as a result.

To collect on a demand promissory note, you will need to send a demand for payment letter to the lender. This lets the lender know that you want the loan paid back now and that the repayment period is ending. This demand letter should include the following: The date of the letter.

If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest. Even if the note had been originally valid, you can void it by altering it.

Generally, promissory notes do not need to be notarized. Typically, legally enforceable promissory notes must be signed by individuals and contain unconditional promises to pay specific amounts of money.

When you take out a mortgage, or any other kind of loan, the law requires you to sign a document that signifies your agreement to repay the money. The promissory note represents a binding legal document, enforceable in a court of law.

A New York promissory note does not need to be notarized. To execute the document, it must be signed and dated by the borrower. If there is a co-signer, they must also sign and date the promissory note.

You should demand to see your original promissory note if you are facing foreclosure of your home because only the party that holds the original note is allowed to sue you. If you bought a home, you probably didn't pay cash for it unless you are wealthy or you did a great job of saving money.

In any event, a promissory note does not have to be notarized to be binding. The private respondents have admitted signing the two notes and they have not succeeded in proving that they did so "under duress, fear and undue influence."

Interesting Questions

More info

Leaders Bond Investments.