A promoter is a person who starts up a business, particularly a corporation, including the financing. The formation of a corporation starts with an idea. Preincorporation activities transform this idea into an actual corporation. The individual who carries on these preincorporation activities is called a promoter. Usually the promoter is the main shareholder or one of the management team and receives stock for his/her efforts in organization. Most states limit the amount of "promotional stock" since it is supported only by effort and not by assets or cash. If preincorporation contracts are executed by the promoter in his/her own name and there is no further action, the promoter is personally liable on them, and the corporation is not.

Under the Federal Securities Act of 1933, a pre-organization certificate or subscription is included in the definition of a security. Therefore, a contract to issue securities in the future is itself a contract for the sale of securities. In order to secure an exemption, all stock subscription agreements involving intrastate offerings should contain representations by the purchasers that they are bona fide residents of the state of which the issuer is a resident and that they are purchasing the securities for their own account and not with the view to reselling them to nonresidents. A stock transfer restriction running for a period of at least one year or for nine months after the last sale of the issue by the issuer is customarily included to insure that securities have not only been initially sold to residents, but have "come to rest" in the hands of residents.

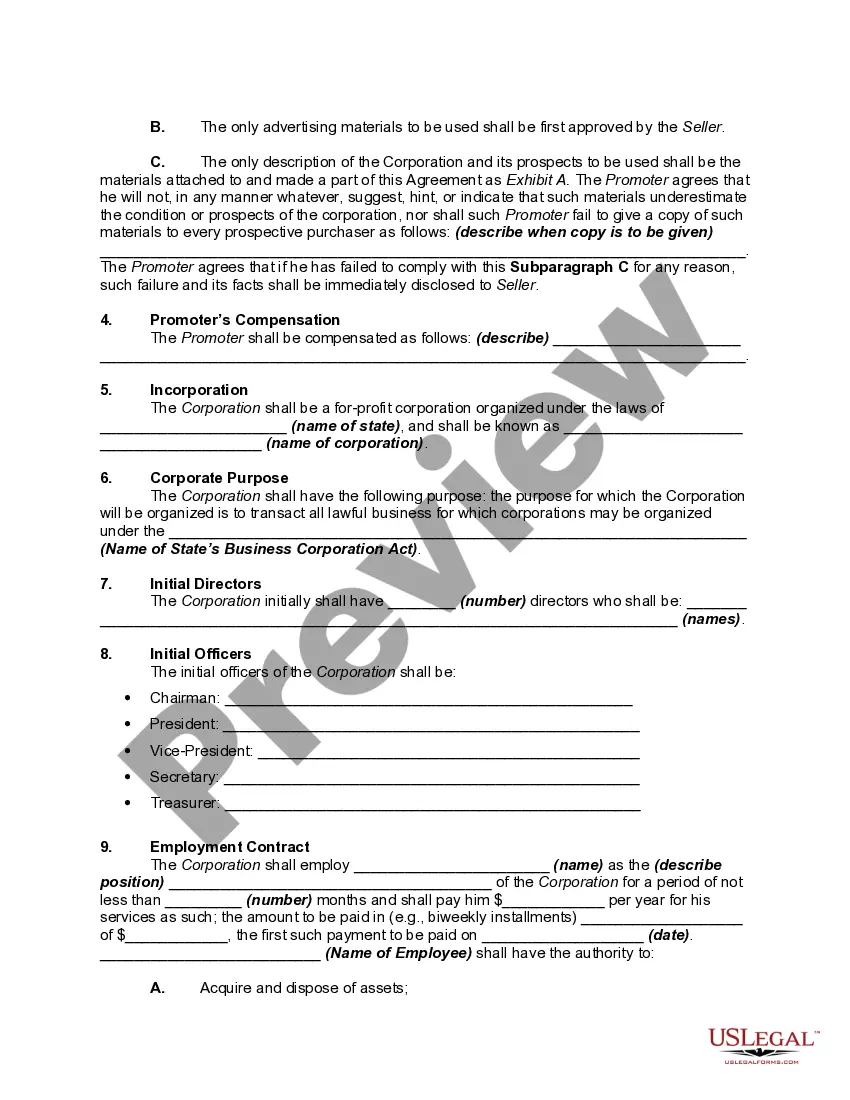

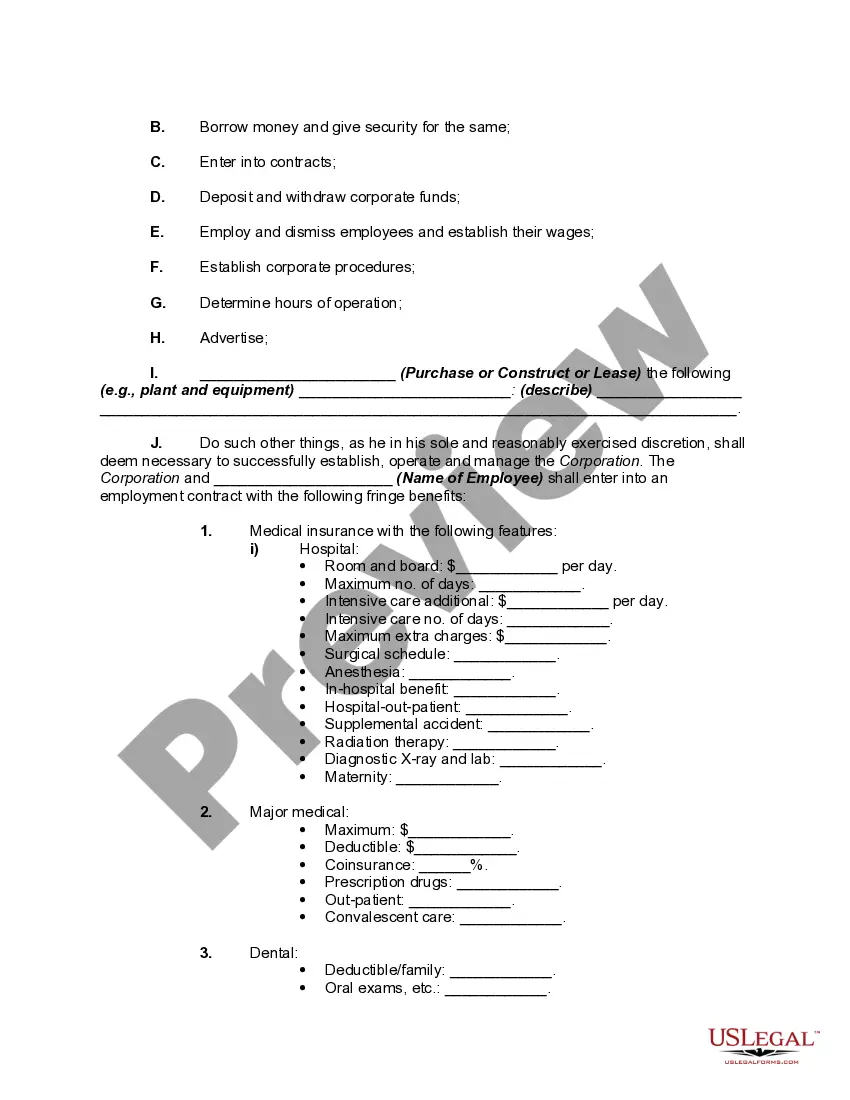

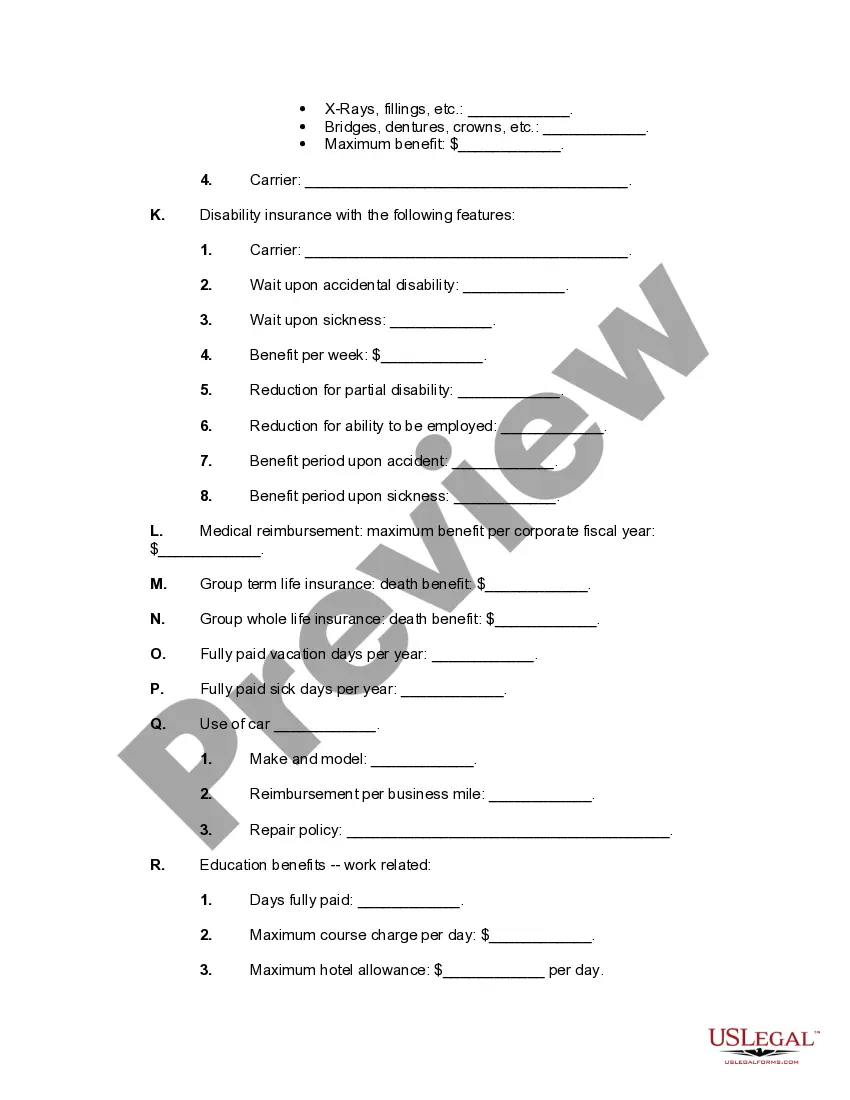

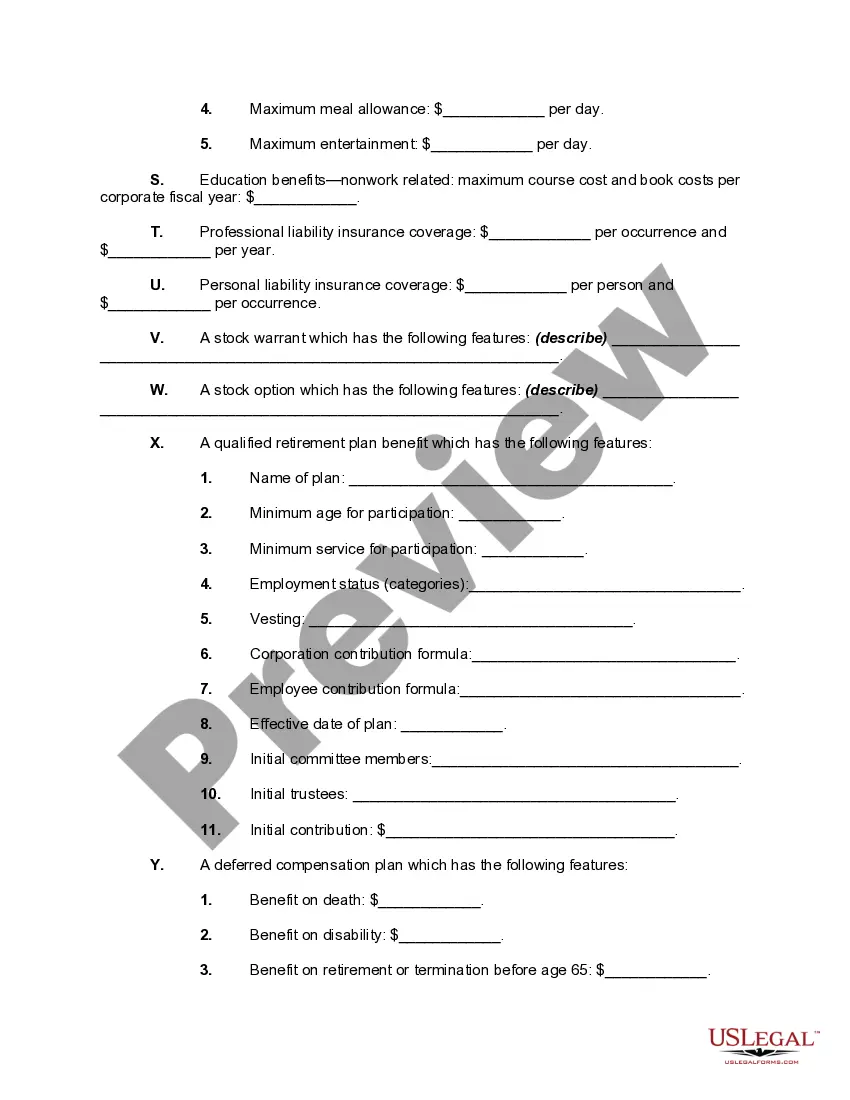

The New York Preincorporation Agreement between Incorporates and Promoters is a legally binding document that outlines the terms and conditions agreed upon by the parties involved in the process of forming a new corporation in the state of New York. This agreement is crucial for clarifying the roles, responsibilities, and rights of both incorporates and promoters before the actual incorporation takes place. By specifying the agreement details, this document ensures a smooth transition from the initial planning stage to the final incorporation process. Various types of New York Preincorporation Agreement between Incorporates and Promoters can be categorized based on the specific details and provisions included. Some common types include: 1. Standard Preincorporation Agreement: This type of agreement establishes the foundation for incorporating a new company, covering essential elements such as the purpose of the corporation, business name, initial directors and officers, authorized stock issuance, and any special provisions. 2. Vesting Preincorporation Agreement: This type of agreement addresses the allocation and vesting of shares among the incorporates and promoters, determining the ownership percentage each party will hold post-incorporation. It also lays out the conditions under which these shares may be forfeited or transferred. 3. Non-Disclosure Preincorporation Agreement: This agreement focuses on the protection of confidential and proprietary information shared between the incorporates and promoters during the preincorporation stage. It prevents disclosure or unauthorized use of such information by either party and may include penalties for violation. 4. Voting Agreement: This type of agreement dictates how the incorporates and promoters will exercise their voting rights regarding specific matters, such as the election of directors, major business decisions, or any other significant corporate action. It ensures a unified approach and avoids conflicts among the parties involved. 5. Buy-Sell Preincorporation Agreement: This agreement outlines the provisions for purchasing or selling shares among the incorporates and promoters, establishing a mechanism for handling future transfers or buyouts within the corporation. It safeguards the interests of all parties in case of disagreements or changes in circumstances. Regardless of the type, a comprehensive New York Preincorporation Agreement between Incorporates and Promoters typically includes clauses related to the purpose, capitalization, management structure, decision-making processes, ownership rights, dispute resolution, termination, and any additional provisions necessary for the smooth establishment of the new corporation. Note: It is always advisable to consult with a legal professional or attorney when drafting or entering into any agreement to ensure compliance with relevant laws and regulations.The New York Preincorporation Agreement between Incorporates and Promoters is a legally binding document that outlines the terms and conditions agreed upon by the parties involved in the process of forming a new corporation in the state of New York. This agreement is crucial for clarifying the roles, responsibilities, and rights of both incorporates and promoters before the actual incorporation takes place. By specifying the agreement details, this document ensures a smooth transition from the initial planning stage to the final incorporation process. Various types of New York Preincorporation Agreement between Incorporates and Promoters can be categorized based on the specific details and provisions included. Some common types include: 1. Standard Preincorporation Agreement: This type of agreement establishes the foundation for incorporating a new company, covering essential elements such as the purpose of the corporation, business name, initial directors and officers, authorized stock issuance, and any special provisions. 2. Vesting Preincorporation Agreement: This type of agreement addresses the allocation and vesting of shares among the incorporates and promoters, determining the ownership percentage each party will hold post-incorporation. It also lays out the conditions under which these shares may be forfeited or transferred. 3. Non-Disclosure Preincorporation Agreement: This agreement focuses on the protection of confidential and proprietary information shared between the incorporates and promoters during the preincorporation stage. It prevents disclosure or unauthorized use of such information by either party and may include penalties for violation. 4. Voting Agreement: This type of agreement dictates how the incorporates and promoters will exercise their voting rights regarding specific matters, such as the election of directors, major business decisions, or any other significant corporate action. It ensures a unified approach and avoids conflicts among the parties involved. 5. Buy-Sell Preincorporation Agreement: This agreement outlines the provisions for purchasing or selling shares among the incorporates and promoters, establishing a mechanism for handling future transfers or buyouts within the corporation. It safeguards the interests of all parties in case of disagreements or changes in circumstances. Regardless of the type, a comprehensive New York Preincorporation Agreement between Incorporates and Promoters typically includes clauses related to the purpose, capitalization, management structure, decision-making processes, ownership rights, dispute resolution, termination, and any additional provisions necessary for the smooth establishment of the new corporation. Note: It is always advisable to consult with a legal professional or attorney when drafting or entering into any agreement to ensure compliance with relevant laws and regulations.