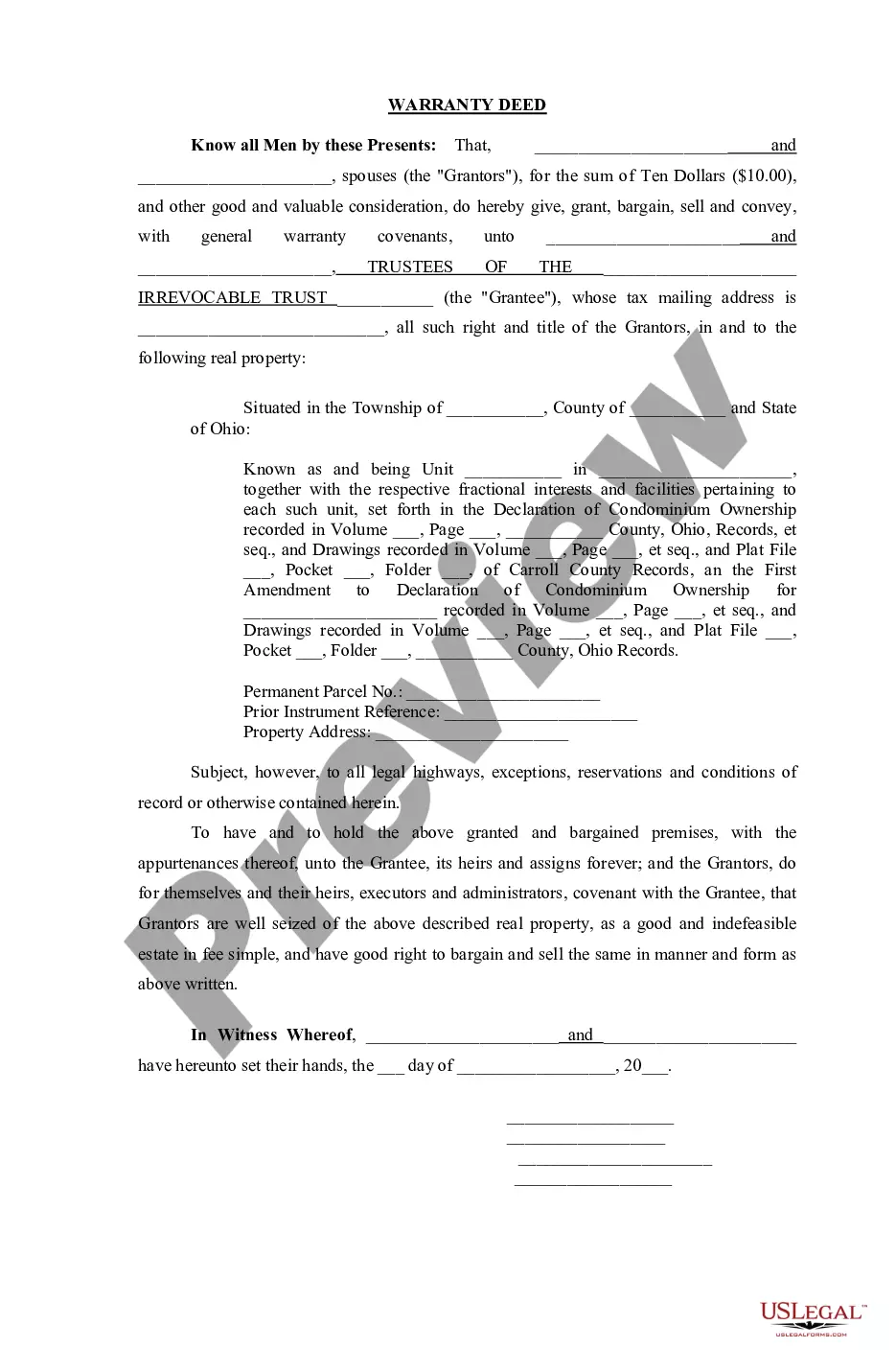

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The New York Income Affidavit or Affidavit of Income from Employer of Spouse Responsible for Child Support — Assets and Liabilities is a legal document used in divorce or child support cases in the state of New York. It serves as a comprehensive statement detailing the financial situation of the party responsible for child support payments. This affidavit aims to ensure transparency and accuracy when determining child support amounts. The New York Income Affidavit requests detailed information about the disclosing party's income, assets, and liabilities, providing a complete financial picture that helps determine child support obligations. By disclosing this information, it helps estimate the party's ability to financially support their child adequately. Keywords: New York, Income Affidavit, Affidavit of Income from Employer, Spouse Responsible for Child Support, Assets, Liabilities, divorce, child support, financial situation, transparency, accuracy, determining child support amounts, income, financial picture, child support obligations, ability to financially support. In addition to the general New York Income Affidavit or Affidavit of Income from Employer of Spouse Responsible for Child Support — Assets and Liabilities, there may be different types of affidavits that are specific to certain situations or requirements. Some of these variations may include: 1. Supplemental Income Affidavit: This affidavit is used when the disclosing party has additional sources of income besides their primary employment. It provides a breakdown of income from investments, rental properties, businesses, or any other revenue streams. 2. Self-Employed Income Affidavit: This type of affidavit is used when the disclosing party is self-employed or operates their own business. It includes information about their business income, deductions, expenses, and assets related to the self-employed activities. 3. Unemployed or Underemployed Income Affidavit: This affidavit is used when the disclosing party is currently unemployed or not earning their full earning capacity. It requires an explanation for the unemployment or underemployment along with any available income and potential job prospects. 4. Affidavit of Assets and Liabilities: This affidavit specifically focuses on the disclosing party's assets and liabilities, providing a comprehensive overview of their financial worth. It includes details about properties, vehicles, savings accounts, investments, outstanding debts, loans, and any other financial obligations. These variations ensure that specific circumstances and financial situations are adequately addressed and considered during child support calculations. It is crucial to provide accurate and truthful information in all types of New York Income Affidavits to ensure fairness and reliability in determining child support payments.The New York Income Affidavit or Affidavit of Income from Employer of Spouse Responsible for Child Support — Assets and Liabilities is a legal document used in divorce or child support cases in the state of New York. It serves as a comprehensive statement detailing the financial situation of the party responsible for child support payments. This affidavit aims to ensure transparency and accuracy when determining child support amounts. The New York Income Affidavit requests detailed information about the disclosing party's income, assets, and liabilities, providing a complete financial picture that helps determine child support obligations. By disclosing this information, it helps estimate the party's ability to financially support their child adequately. Keywords: New York, Income Affidavit, Affidavit of Income from Employer, Spouse Responsible for Child Support, Assets, Liabilities, divorce, child support, financial situation, transparency, accuracy, determining child support amounts, income, financial picture, child support obligations, ability to financially support. In addition to the general New York Income Affidavit or Affidavit of Income from Employer of Spouse Responsible for Child Support — Assets and Liabilities, there may be different types of affidavits that are specific to certain situations or requirements. Some of these variations may include: 1. Supplemental Income Affidavit: This affidavit is used when the disclosing party has additional sources of income besides their primary employment. It provides a breakdown of income from investments, rental properties, businesses, or any other revenue streams. 2. Self-Employed Income Affidavit: This type of affidavit is used when the disclosing party is self-employed or operates their own business. It includes information about their business income, deductions, expenses, and assets related to the self-employed activities. 3. Unemployed or Underemployed Income Affidavit: This affidavit is used when the disclosing party is currently unemployed or not earning their full earning capacity. It requires an explanation for the unemployment or underemployment along with any available income and potential job prospects. 4. Affidavit of Assets and Liabilities: This affidavit specifically focuses on the disclosing party's assets and liabilities, providing a comprehensive overview of their financial worth. It includes details about properties, vehicles, savings accounts, investments, outstanding debts, loans, and any other financial obligations. These variations ensure that specific circumstances and financial situations are adequately addressed and considered during child support calculations. It is crucial to provide accurate and truthful information in all types of New York Income Affidavits to ensure fairness and reliability in determining child support payments.