A Transmutation Agreement is a marital contract that provides that the ownership of a particular piece of property will, from the date of the agreement forward, be changed. Spouses can transmute, partition, or exchange community property to separate property by agreement. According to some authority, separate property can be transmuted into community property by an agreement between the spouses, but there is also authority to the contrary.

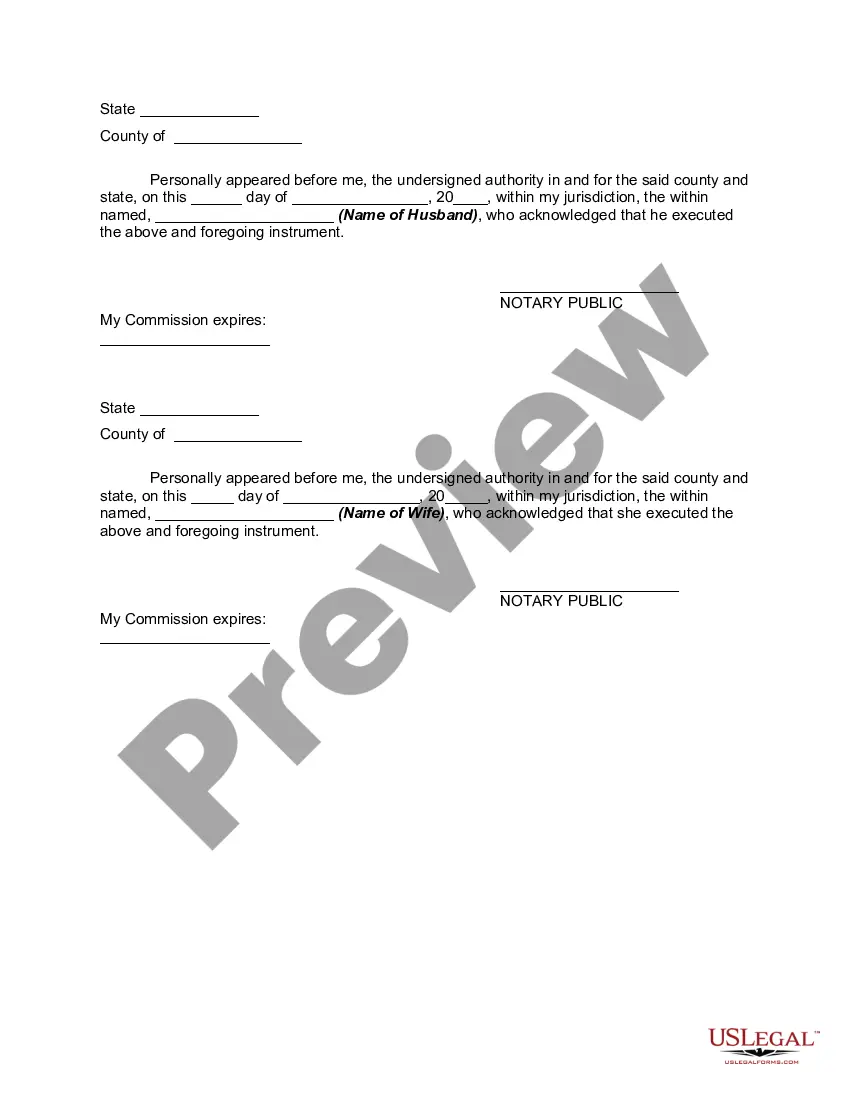

New York Transmutation and Postnuptial Agreement: Converting Community Property into Separate Property In New York State, a transmutation or postnuptial agreement is a legally binding contract that allows spouses to convert their community property into separate property. This agreement can be especially useful for couples who wish to redefine the ownership of their assets and debts acquired during their marriage. By renouncing their rights to specific properties or assets, couples can protect their separate property interests and clarify their financial situations. Types of New York Transmutation or Postnuptial Agreements: 1. Voluntary Transmutation Agreement: This agreement involves both spouses voluntarily waiving their rights to certain assets or property acquired during their marital relationship. It allows them to convert these joint assets into separate property, ensuring that respective ownership rights are clearly defined. It is essential to note that this agreement must be carefully drafted, adhering to New York State laws, to ensure its enforceability. 2. Conversion Agreement for Debt Separation: This type of agreement primarily focuses on separating marital debts. Spouses may choose to convert community debts into separate obligations, allowing them to take individual responsibility for specific debts. By doing so, they protect their personal credit and financial stability in case of any future financial hardships. 3. Business Asset Transmutation Agreement: In situations where one spouse owns or operates a business, a postnuptial agreement can be used to convert community ownership interests into separate property. This is particularly important when seeking to shield the business from any potential future claims or protecting the non-owner spouse's assets from business-related liabilities. 4. Asset Equalization Agreement: In some cases, spouses may decide to equalize their assets upon divorce or separation. This agreement allows them to convert community property into separate property while ensuring both parties receive an equitable distribution. It can be a useful option when one spouse wishes to retain specific high-value assets or properties by offsetting them against other marital assets. Key Considerations: 1. Legal Assistance: Creating a New York Transmutation or Postnuptial Agreement involves complex legal requirements. It is highly recommended consulting with a qualified family law attorney who specializes in this area. They can guide you through the process, ensure compliance with New York laws, and protect your rights and interests. 2. Full Disclosure: Transparent disclosure of all assets, debts, and financial information is crucial to minimize future disputes and challenges to the agreement's enforceability. Both parties must fully disclose all assets and liabilities, warranting accurate information exchange. 3. Voluntary Consent: For any New York Transmutation or Postnuptial Agreement to be valid, both spouses must enter into it voluntarily, without any undue influence, coercion, or deception. Each party should have an opportunity to seek independent legal counsel and evaluate the agreement's terms and implications before signing. 4. Enforceability: New York courts have specific requirements for these agreements to be enforceable. They must be in writing and signed by both parties before being notarized. Additionally, the agreement should not be unconscionable or promote illegal activities. In summary, a New York Transmutation or Postnuptial Agreement is a valuable legal tool allowing spouses to convert their community property into separate property. By employing various types of agreements tailored to their unique circumstances, couples can protect their individual interests, ensure asset clarity, and mitigate potential disputes during divorce or separation. Seeking professional legal advice is crucial to ensure compliance with New York State laws and enhance the enforceability of these agreements.New York Transmutation and Postnuptial Agreement: Converting Community Property into Separate Property In New York State, a transmutation or postnuptial agreement is a legally binding contract that allows spouses to convert their community property into separate property. This agreement can be especially useful for couples who wish to redefine the ownership of their assets and debts acquired during their marriage. By renouncing their rights to specific properties or assets, couples can protect their separate property interests and clarify their financial situations. Types of New York Transmutation or Postnuptial Agreements: 1. Voluntary Transmutation Agreement: This agreement involves both spouses voluntarily waiving their rights to certain assets or property acquired during their marital relationship. It allows them to convert these joint assets into separate property, ensuring that respective ownership rights are clearly defined. It is essential to note that this agreement must be carefully drafted, adhering to New York State laws, to ensure its enforceability. 2. Conversion Agreement for Debt Separation: This type of agreement primarily focuses on separating marital debts. Spouses may choose to convert community debts into separate obligations, allowing them to take individual responsibility for specific debts. By doing so, they protect their personal credit and financial stability in case of any future financial hardships. 3. Business Asset Transmutation Agreement: In situations where one spouse owns or operates a business, a postnuptial agreement can be used to convert community ownership interests into separate property. This is particularly important when seeking to shield the business from any potential future claims or protecting the non-owner spouse's assets from business-related liabilities. 4. Asset Equalization Agreement: In some cases, spouses may decide to equalize their assets upon divorce or separation. This agreement allows them to convert community property into separate property while ensuring both parties receive an equitable distribution. It can be a useful option when one spouse wishes to retain specific high-value assets or properties by offsetting them against other marital assets. Key Considerations: 1. Legal Assistance: Creating a New York Transmutation or Postnuptial Agreement involves complex legal requirements. It is highly recommended consulting with a qualified family law attorney who specializes in this area. They can guide you through the process, ensure compliance with New York laws, and protect your rights and interests. 2. Full Disclosure: Transparent disclosure of all assets, debts, and financial information is crucial to minimize future disputes and challenges to the agreement's enforceability. Both parties must fully disclose all assets and liabilities, warranting accurate information exchange. 3. Voluntary Consent: For any New York Transmutation or Postnuptial Agreement to be valid, both spouses must enter into it voluntarily, without any undue influence, coercion, or deception. Each party should have an opportunity to seek independent legal counsel and evaluate the agreement's terms and implications before signing. 4. Enforceability: New York courts have specific requirements for these agreements to be enforceable. They must be in writing and signed by both parties before being notarized. Additionally, the agreement should not be unconscionable or promote illegal activities. In summary, a New York Transmutation or Postnuptial Agreement is a valuable legal tool allowing spouses to convert their community property into separate property. By employing various types of agreements tailored to their unique circumstances, couples can protect their individual interests, ensure asset clarity, and mitigate potential disputes during divorce or separation. Seeking professional legal advice is crucial to ensure compliance with New York State laws and enhance the enforceability of these agreements.