New York Letter to Foreclosure Attorney — Payment Dispute Keywords: New York, letter, foreclosure attorney, payment dispute, types 1. Introduction to the New York Letter to Foreclosure Attorney — Payment Dispute— - A comprehensive letter designed for addressing payment disputes in foreclosure cases in New York. — Intended to seek resolution through formal communication between the borrower and the foreclosure attorney. 2. Importance of a New York Letter to Foreclosure Attorney — Payment Dispute— - A vital document to outline the borrower's concerns regarding payment discrepancies. — Offers an opportunity to resolve issues before legal actions are pursued. 3. Structure and Format: — Start with a professional salutation and introduction. — Clearly state the purpose of the letter, i.e., addressing a payment dispute related to a foreclosure case. — Provide a concise and accurate account of the disputed payment and supporting documentation. — Offer a proposed resolution or requests for further investigation. — End the letter with a polite closing and contact information for follow-up. 4. Types of New York Letter to Foreclosure Attorney — Payment Dispute: a) Standard New York Letter to Foreclosure Attorney — Payment Dispute— - Appropriate for cases where borrowers believe there is an error or discrepancy in payment calculations. — Seeks clarification and request for adjustments or corrections. b) Late Payment New York Letter to Foreclosure Attorney — Payment Dispute— - Suitable for situations where the borrower acknowledges late payments, but disputes associated penalties or foreclosure threats. — Asserts the borrower's intention to catch up on payments and avoid foreclosure. c) Partial Payment New York Letter to Foreclosure Attorney — Payment Dispute— - For cases where the borrower has made partial payments, but the lender alleges default or non-compliance. — Provides documentation to demonstrate regular partial payments and seeks a resolution to avoid foreclosure. d) Interest Calculation New York Letter to Foreclosure Attorney — Payment Dispute— - Relevant when the borrower contests the lender's calculation of interest rates or the failure to apply agreed-upon terms. — Seeks clarification and requests adjusting the interest calculations. e) Unaccounted Payments New York Letter to Foreclosure Attorney — Payment Dispute— - Suitable for cases where the borrower claims to have made payments that were not accurately recorded or credited by the lender. — Demands an investigation into the missing payments and adjustment of the account. Remember, the specifics and content of the letter may vary depending on the individual's circumstances and the nature of the payment dispute.

New York Letter to Foreclosure Attorney - Payment Dispute

Description

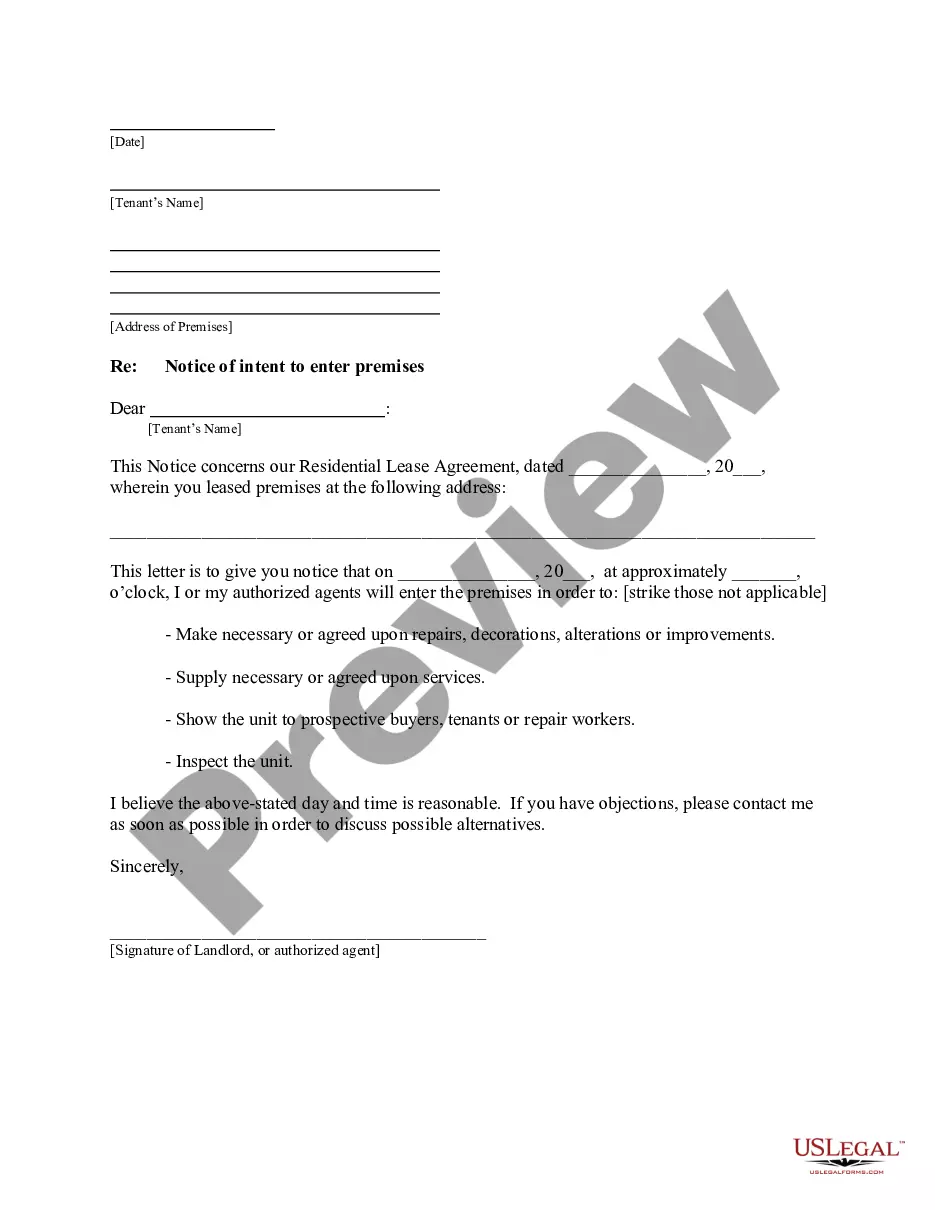

How to fill out New York Letter To Foreclosure Attorney - Payment Dispute?

You are able to spend several hours on-line trying to find the authorized record web template which fits the federal and state needs you need. US Legal Forms supplies 1000s of authorized forms that happen to be evaluated by professionals. It is simple to down load or produce the New York Letter to Foreclosure Attorney - Payment Dispute from your services.

If you already possess a US Legal Forms bank account, you may log in and click the Down load button. Following that, you may full, change, produce, or indicator the New York Letter to Foreclosure Attorney - Payment Dispute. Every single authorized record web template you get is the one you have for a long time. To get another version of the purchased form, check out the My Forms tab and click the corresponding button.

If you use the US Legal Forms internet site initially, adhere to the basic recommendations listed below:

- Initially, make sure that you have chosen the proper record web template for the state/city of your choosing. See the form explanation to ensure you have selected the proper form. If readily available, utilize the Review button to appear with the record web template too.

- If you would like find another model in the form, utilize the Research discipline to find the web template that meets your requirements and needs.

- After you have discovered the web template you desire, just click Get now to continue.

- Choose the pricing strategy you desire, type in your references, and register for a merchant account on US Legal Forms.

- Full the purchase. You can use your credit card or PayPal bank account to purchase the authorized form.

- Choose the file format in the record and down load it to the product.

- Make modifications to the record if possible. You are able to full, change and indicator and produce New York Letter to Foreclosure Attorney - Payment Dispute.

Down load and produce 1000s of record templates utilizing the US Legal Forms Internet site, that offers the largest variety of authorized forms. Use professional and state-certain templates to deal with your company or person needs.

Form popularity

FAQ

If you cannot reach an agreement with your bank and you are unable to make your payments, the lender may begin action to take your property. Before this happens, you should contact a lawyer to determine all of your options.

For Residential Cases. ... Lender must mail you information on getting help at least 90 days before starting a court case. ... Lender asks court for a judgment on default and to appoint a Referee to decide the amount you owe and write a report. ... Lender asks court to accept the Referee's findings. ... Judge orders sale of your home.

Most lenders will allow three missed payments before considering foreclosure. It's best to speak with your lender if you're going to miss a payment as most consider foreclosure a last resort. Many may be willing to defer payments to help you regain control of your finances.

New York is a judicial foreclosure state, which means that the lender has to sue the borrower in order to enforce their rights under the mortgage and note. If the lender wins the lawsuit, it obtains a judgment from the court, which allows the lender to sell the property at an auction.

It takes at least 6 to 8 months for a fore- closure lawsuit to go from summons and complaint to auction ? even if you ignore the court case. In reality, however, the process is taking much longer. If you file an Answer and appear at the mandatory settlement conference, it is taking lenders 1 to 3 years to foreclose.

Defaulting on your mortgage Mortgage default happens when you don't follow the terms of your mortgage agreement, like missing a regular payment. When this happens, your bank has the legal right to recover the amount you owe them. This may eventually lead to the forced sale of your home.

In general, mortgage companies start foreclosure processes about 3-6 months after the first missed mortgage payment. Late fees are charged after 10-15 days, however, most mortgage companies recognize that homeowners may be facing short-term financial hardships.

You could avoid foreclosure by selling your property for an amount more than the amount necessary to pay off your mortgage loan. If your problems aren't temporary, you may need to sell your home. A foreclosure will result in the bank taking possession of your home and you will be left with nothing.