New York Affidavit of Domicile for Deceased

Description

How to fill out Affidavit Of Domicile For Deceased?

If you have to comprehensive, download, or printing legitimate record themes, use US Legal Forms, the largest selection of legitimate types, that can be found on the web. Utilize the site`s simple and handy look for to get the papers you will need. Various themes for enterprise and person functions are sorted by classes and claims, or search phrases. Use US Legal Forms to get the New York Affidavit of Domicile for Deceased in just a few click throughs.

When you are presently a US Legal Forms buyer, log in to your account and then click the Obtain switch to have the New York Affidavit of Domicile for Deceased. You can even gain access to types you previously delivered electronically inside the My Forms tab of your respective account.

If you work with US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Make sure you have selected the form to the right city/land.

- Step 2. Utilize the Preview solution to examine the form`s information. Don`t forget to read the information.

- Step 3. When you are unhappy with all the kind, utilize the Research area near the top of the monitor to discover other variations of your legitimate kind web template.

- Step 4. Upon having discovered the form you will need, click the Purchase now switch. Choose the rates plan you prefer and add your accreditations to register for the account.

- Step 5. Procedure the transaction. You may use your bank card or PayPal account to perform the transaction.

- Step 6. Select the format of your legitimate kind and download it on the gadget.

- Step 7. Comprehensive, revise and printing or indication the New York Affidavit of Domicile for Deceased.

Every legitimate record web template you acquire is your own eternally. You have acces to each and every kind you delivered electronically inside your acccount. Select the My Forms portion and choose a kind to printing or download yet again.

Contend and download, and printing the New York Affidavit of Domicile for Deceased with US Legal Forms. There are millions of professional and status-specific types you may use for the enterprise or person demands.

Form popularity

FAQ

Ing to the provisions of the Probate Code, a Tennessee Affidavit of Heirship must be signed by two witnesses who were acquainted with the deceased person and their family history but do not have any financial interest in the estate.

If the decedent has died in Arkansas within the last five years, it is not too late to probate his or her estate, allowing the courts to handle administration of the estate. If more than five years has passed, an Heirship Affidavit may help heirs transfer the decedent's property.

The affidavit identifies each possible ?distributee? of the estate, and describes their relationship to the decedent. The affidavit must be signed by a disinterested person, meaning someone who has no financial interest in the estate's assets.

What Is An Affidavit Of Heirship in Oklahoma. Under Oklahoma law, successors (usually children) can file an affidavit of heirship if the deceased individual's estate qualified as a ?small estate.? The affidavit of heirship must contain specific information if its to be used to avoid the probate process.

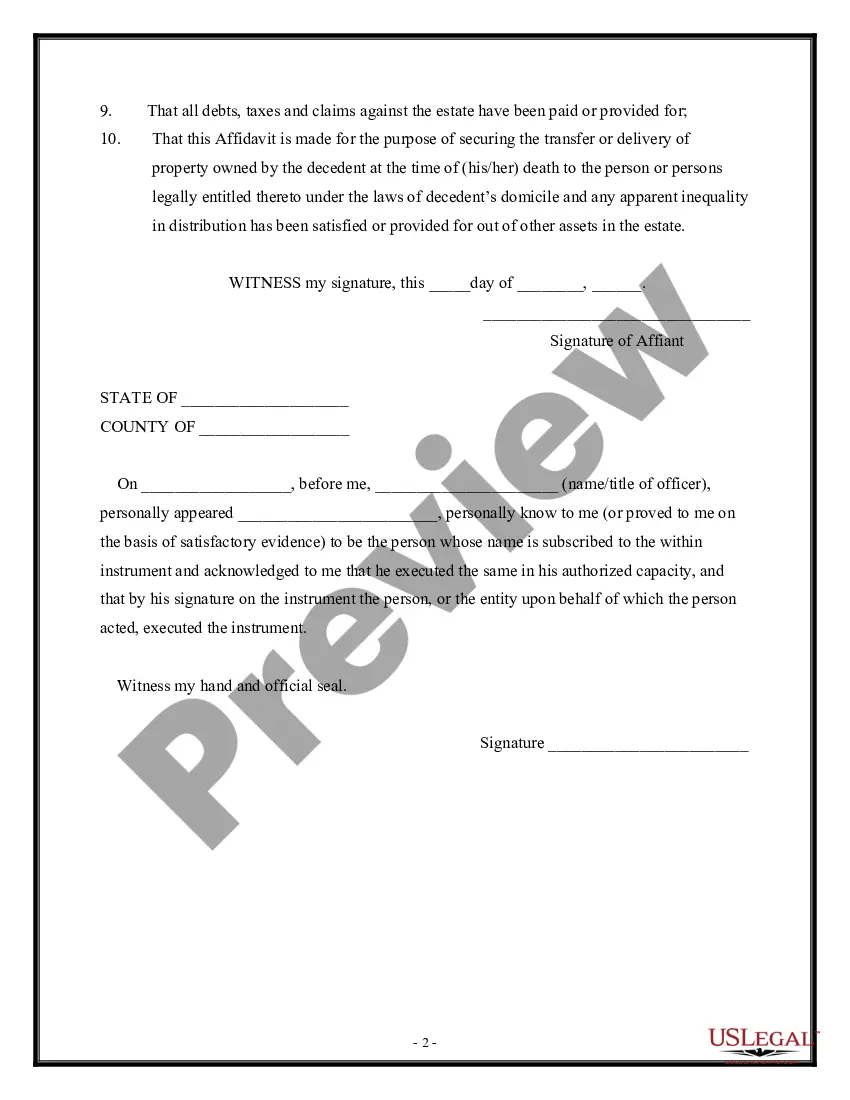

An Affidavit of Domicile is a legal document that you can use to verify the home address of a person who has died. As the executor or administrator of an estate, you are required to produce an Affidavit of Domicile when transferring or cashing in stocks or other investment assets of a deceased person.

Use Form ET-85 when. ? The estate is not required to file a New York State estate tax return (see filing requirements below), and either an executor or administrator has not been appointed, or if appointed, nine months has passed since the date of death. ? The estate is required to file a New York State estate tax.

Knowing where the decedent's domicile (where the decedent had his or her primary residence) was at date of death is key when figuring out where you must probate the assets and what state you must pay taxes to (although real estate is subject to state estate or inheritance tax, if any, in the state in which it's located ...

While affidavits of heirship are typically used as an alternative to probate to determine heirship, it is limited only to the title transfer of real property. Also, unlike probate, an affidavit of heirship is not conclusive; it's only considered a presumption.