Federal tax aspects of a revocable inter vivos trust agreement should be carefully studied in considering whether to create such a trust and in preparing the trust instrument. There are no tax savings in the use of a trust revocable by the trustor or a non-adverse party. The trust corpus will be includable in the trustor's gross estate for estate tax purposes. The income of the trust is taxable to the trustor.

New York Revocable Trust Agreement with Husband and Wife as Trustors and Income to

Description

How to fill out Revocable Trust Agreement With Husband And Wife As Trustors And Income To?

Selecting the finest sanctioned document template can be challenging. Of course, there are numerous templates accessible on the web, but how do you find the legal form you need? Utilize the US Legal Forms website. This service offers a vast array of templates, including the New York Revocable Trust Agreement with Husband and Wife as Trustors and Income to, suitable for corporate and personal purposes. All forms are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to retrieve the New York Revocable Trust Agreement with Husband and Wife as Trustors and Income to. Use your account to review the legal documents you have previously obtained. Navigate to the My documents section of your account to get another copy of the document you need.

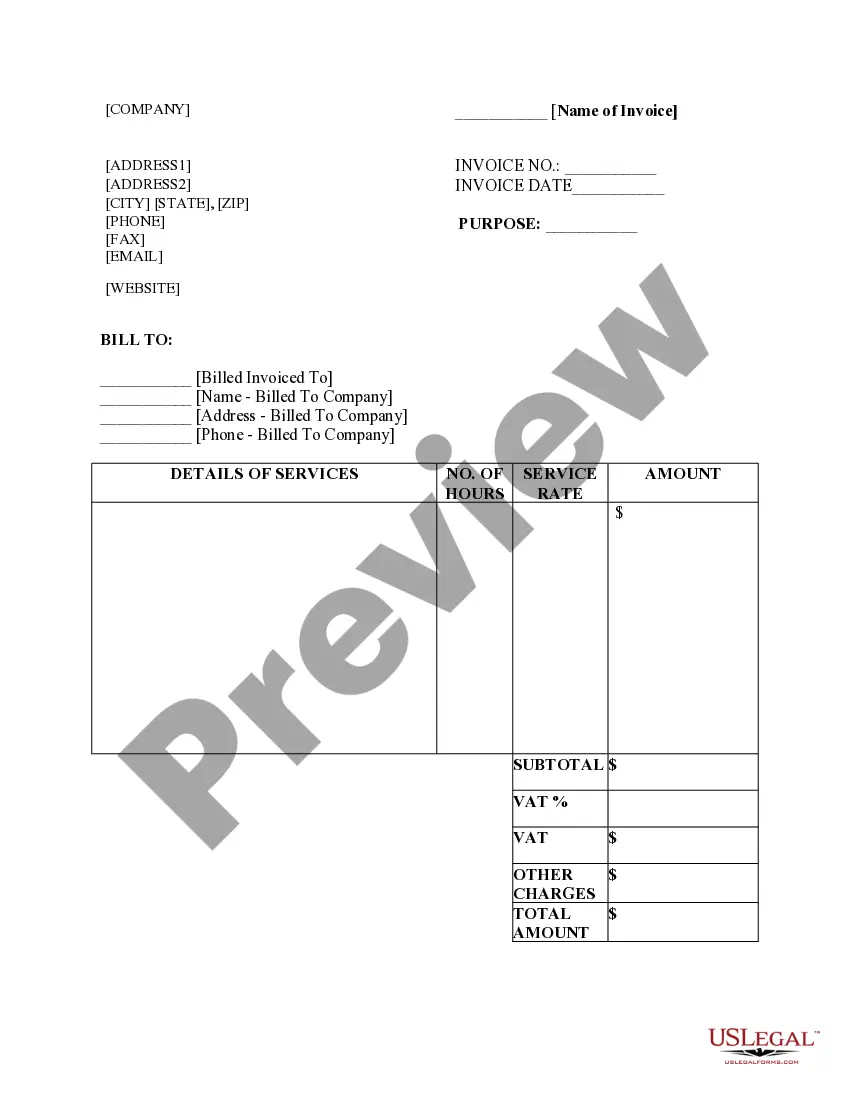

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your jurisdiction. You can preview the document using the Preview option and read the document description to confirm this is the right one for you. If the form does not meet your requirements, use the Search box to find the appropriate form. Once you are confident that the form is suitable, choose the Get now option to download the form. Select the pricing plan you want and enter the required information. Create your account and purchase the order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Fill out, modify, print, and sign the finalized New York Revocable Trust Agreement with Husband and Wife as Trustors and Income to.

US Legal Forms is the largest collection of legal forms available where you can find various document templates. Take advantage of this service to download professionally crafted paperwork that adheres to state requirements.

- Choosing the perfect authorized template can be tough.

- The website provides an extensive collection of forms.

- All templates are vetted by experts.

- Check your account for previously downloaded forms.

- Preview the template before selection.

- Confirm you have the right form before downloading.

Form popularity

FAQ

Distributions from a trust, including those from a New York Revocable Trust Agreement with Husband and Wife as Trustors and Income to, may count as income, but this largely depends on the nature of the distribution. For instance, if the trust has generated earnings before the distribution, those earnings may be taxable. However, distributions from your principal often do not count as income. Staying informed about what constitutes income from your trust can help you plan better financially.

A joint revocable trust, such as the New York Revocable Trust Agreement with Husband and Wife as Trustors and Income to, is generally treated as a pass-through entity for tax purposes. This means that the income generated by the trust is reported on the tax returns of the individual trustors. As long as the trust remains revocable and the trustors are alive, the trust income typically does not incur separate taxation. Consulting a tax professional can provide clarity on your specific tax situation.

Yes, you usually need to report income generated from a trust. If the New York Revocable Trust Agreement with Husband and Wife as Trustors and Income to generates income, you must report this on your tax return. The trust itself may also need to file a tax return depending on its structure. Accurate reporting helps you comply with tax laws while benefitting from the advantages that trusts offer.

Inheritance from a trust, such as a New York Revocable Trust Agreement with Husband and Wife as Trustors and Income to, typically does not count as taxable income. When you receive assets from a trust upon a beneficiary's passing, it is considered an inheritance. However, if the trust generates income prior to distribution, that income may be taxable. Understanding how trust distributions work can help you manage your tax obligations effectively.

One of the biggest mistakes parents make is failing to communicate their intentions clearly with their children. When setting up a trust fund, particularly a New York Revocable Trust Agreement with Husband and Wife as Trustors and Income to, it is crucial to explain the trust's purpose and benefits to heirs. This can prevent misunderstandings and disputes down the line, ensuring a smoother transition of assets.

Yes, a revocable trust can have two grantors, which is common in spousal trusts. A New York Revocable Trust Agreement with Husband and Wife as Trustors and Income to allows both partners to contribute to the trust's funding and management. This structure promotes shared control and benefits for both grantors.

Filling out a revocable living trust involves several steps, including identifying assets and beneficiaries. For a New York Revocable Trust Agreement with Husband and Wife as Trustors and Income to, you will need to clearly list all assets you wish to transfer to the trust. Platforms like uslegalforms offer user-friendly templates to guide you through the process effectively.

A revocable trust can have multiple trustors, but typically, it is most effective with two individuals. In a New York Revocable Trust Agreement with Husband and Wife as Trustors and Income to, having both spouses as trustors streamlines management and ensures cohesive decision-making. Additionally, you can designate various beneficiaries to receive income from the trust.

Absolutely, two individuals can own a revocable trust as co-trustors. In the context of a New York Revocable Trust Agreement with Husband and Wife as Trustors and Income to, both parties can make decisions about trust management and changes. This collaboration enhances family harmony and financial planning.

Yes, a revocable trust can be jointly owned by both spouses. In a New York Revocable Trust Agreement with Husband and Wife as Trustors and Income to, both partners can contribute assets and manage the trust together. This arrangement allows for flexibility in control and distribution of income, making it an effective planning tool.