New York Commercial Watercraft Rental Insurance Application is a comprehensive insurance application specifically designed for individuals or businesses engaged in the rental of watercraft in New York. This insurance coverage ensures protection against various risks and liabilities associated with renting watercraft for commercial purposes. Keywords: New York, commercial, watercraft rental, insurance application, coverage, risks, liabilities. There are different types of New York Commercial Watercraft Rental Insurance Applications available, including: 1. Liability Insurance Application: This type of insurance coverage focuses on providing financial protection against third-party claims for bodily injury or property damage that may arise during the rental period. It safeguards the business owner or individual from potential legal battles and hefty monetary settlements. 2. Property Insurance Application: This insurance application is crucial for protecting the physical assets of the rented watercraft, including the boat itself, motors, trailers, navigational equipment, and other accessories. It covers damages or loss caused by fire, theft, collision, vandalism, storm, or any other covered perils. 3. Hull Insurance Application: Watercraft hull insurance covers damages to the watercraft's hull and associated structures, such as keel, mast, rigging, and sails. It typically includes accidental damage, collision, grounding, sinking, vandalism, and fire, ensuring that the rented watercraft is financially safeguarded throughout its usage. 4. Pollution Liability Insurance Application: This insurance application offers coverage against any unexpected pollution-related incidents caused by the rented watercraft. It protects the business owner or individual from the financial consequences of environmental damage resulting from fuel spills, oil leaks, or other pollutant discharges. 5. Personal Injury Insurance Application: This application provides coverage for bodily injuries sustained by the individuals renting the watercraft. It includes medical expenses, hospital bills, rehabilitation costs, lost wages, and other related expenses incurred due to accidents happening on the rented vessel. 6. Uninsured/Under insured Watercraft Application: This type of insurance coverage protects the business owner or individual from damages caused by other watercraft operators who either have minimal or no insurance coverage. It ensures that the rental business is adequately compensated if it suffers losses due to an uninsured or under insured watercraft operator. 7. Workers' Compensation Insurance Application: For businesses operating with employees, this insurance coverage is vital. It protects the employees in case of injuries or illnesses occurring during the course of their employment. Workers' compensation insurance provides medical treatment, rehabilitation, lost wages, and other benefits to the affected workers. Overall, New York Commercial Watercraft Rental Insurance Application is a crucial step for any individual or business involved in the rental of watercraft. Choosing the appropriate insurance applications based on specific needs ensures comprehensive coverage and financial protection against potential risks and liabilities in the dynamic and unpredictable world of commercial watercraft rentals.

New York Commercial Watercraft Rental Insurance Application

Description

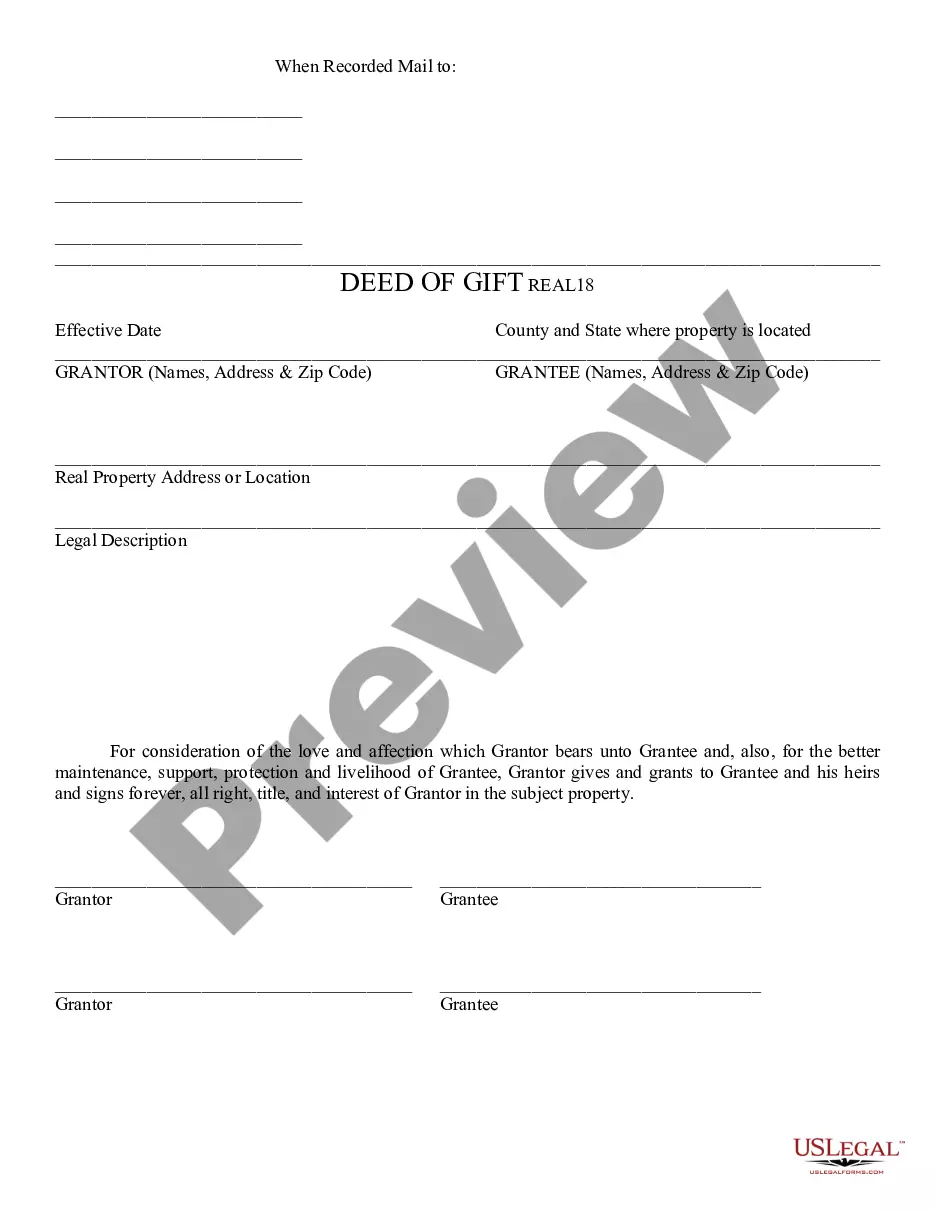

How to fill out New York Commercial Watercraft Rental Insurance Application?

It is possible to commit time online looking for the legitimate document template which fits the state and federal needs you need. US Legal Forms provides a large number of legitimate kinds which are reviewed by specialists. It is possible to obtain or print the New York Commercial Watercraft Rental Insurance Application from our support.

If you have a US Legal Forms bank account, you are able to log in and click the Download button. Following that, you are able to total, change, print, or indication the New York Commercial Watercraft Rental Insurance Application. Every single legitimate document template you get is the one you have for a long time. To acquire another copy of the bought form, proceed to the My Forms tab and click the corresponding button.

If you use the US Legal Forms internet site the first time, stick to the basic recommendations under:

- Very first, make sure that you have chosen the correct document template for that state/town that you pick. Browse the form explanation to make sure you have picked the correct form. If offered, utilize the Review button to appear throughout the document template also.

- If you wish to locate another model of your form, utilize the Lookup area to obtain the template that fits your needs and needs.

- After you have identified the template you need, simply click Get now to carry on.

- Find the rates prepare you need, type your references, and sign up for a merchant account on US Legal Forms.

- Total the transaction. You can use your charge card or PayPal bank account to pay for the legitimate form.

- Find the formatting of your document and obtain it in your gadget.

- Make changes in your document if possible. It is possible to total, change and indication and print New York Commercial Watercraft Rental Insurance Application.

Download and print a large number of document themes making use of the US Legal Forms site, which provides the most important selection of legitimate kinds. Use specialist and state-particular themes to tackle your company or individual needs.

Form popularity

FAQ

In New York, boats (watercraft) without a motor do not need to be registered. If you use a motor (electric or fuel-driven), regardless of the size of your boat or the motor, you must register your boat.

Anyone operating a Personal Watercraft (JetSki?, Wave Runner?, etc.) must have a boating safety certificate, and be at least 14 years of age or older.

New York law doesn't require you to have boat insurance. But whether you own a boat or personal watercraft, a boat insurance policy can help protect it.

Unlike car insurance, there are no federal or state laws that require you to have jet ski insurance. However, it is recommended that you have insurance to protect you if an accident or damage happens. The coverage usually outweighs the premium you'll pay.

California law requires a person to be 16 years of age or older and in possession of his/her California Boater Card to legally operate a vessel powered by a motor of 15 hp or more, including personal watercraft (PWCs).