New York Bill of Sale by Corporation of all or Substantially all of its Assets

Description

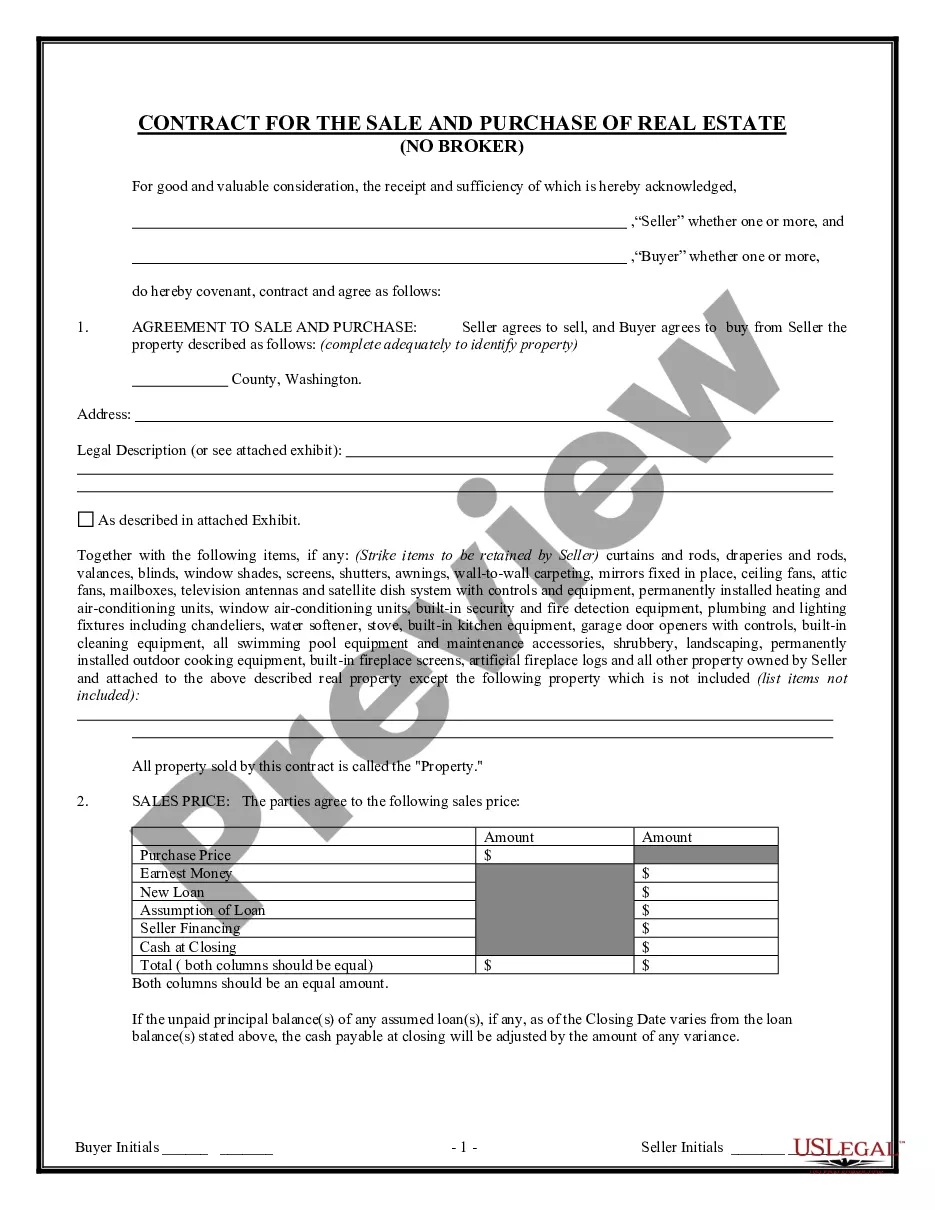

How to fill out Bill Of Sale By Corporation Of All Or Substantially All Of Its Assets?

If you need to finalize, obtain, or create sanctioned document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the website's straightforward and user-friendly search feature to find the documents you need.

Various templates for commercial and personal purposes are categorized by groups and categories, or keywords.

Step 4. Once you have located the form you need, choose the Purchase now option. Select the payment plan you prefer and enter your details to register for the account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the payment.

- Use US Legal Forms to find the New York Bill of Sale by Corporation for all or nearly all of its Assets in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the New York Bill of Sale by Corporation for all or nearly all of its Assets.

- You can also access forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific area/region.

- Step 2. Utilize the Review feature to browse through the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

An asset sale can present several challenges, such as tax implications for both the buyer and seller. Additionally, it may take longer to negotiate and finalize compared to other types of sales. Furthermore, without a proper New York Bill of Sale by Corporation of all or Substantially all of its Assets, the transaction may encounter legal complications or disputes, complicating the overall sale process.

In New York, a bulk sale involves the sale of all or most of a seller’s business assets to a buyer. This process is regulated by New York law to protect creditors, ensuring they receive notice of the sale. Using a New York Bill of Sale by Corporation of all or Substantially all of its Assets can help formalize the transaction, providing a clear record of what has been sold and ensuring compliance with legal standards.

A bulk sale refers to the transfer of a significant portion of a business's assets to a buyer outside the ordinary course of business. This type of sale often occurs when a corporation decides to liquidate or sell most, if not all, of its assets. For such transactions in New York, it is important to utilize a New York Bill of Sale by Corporation of all or Substantially all of its Assets to ensure all legal requirements are met and to protect both parties involved.

Substantially all assets generally refer to a significant majority of a corporation's valuable resources and property. In the context of the New York Bill of Sale by Corporation of all or Substantially all of its Assets, this includes not just tangible items but also intellectual properties, customer lists, and more. Defining what constitutes ‘substantially all’ can vary by situation, so consulting legal resources can enhance clarity.

Section 623 of the New York Business Corporation law outlines the procedures for obtaining shareholder approval for significant asset transactions. This section is critical when crafting the New York Bill of Sale by Corporation of all or Substantially all of its Assets, as it ensures that shareholders have a say in the sale, leading to transparency and trust in the process. Adhering to this requirement helps avoid potential legal challenges.

Section 615 of the New York Business Corporation law deals with the transaction processes involving mergers and consolidations of corporations. This section provides important guidelines that corporations must follow, especially when transferring assets through the New York Bill of Sale by Corporation of all or Substantially all of its Assets. Familiarizing yourself with this section helps in making informed decisions during asset transfers.

The substantially all requirement refers to the legal threshold that defines what constitutes 'all or substantially all' of a corporation's assets during a sale. In the context of the New York Bill of Sale by Corporation of all or Substantially all of its Assets, this means that the transaction should encompass a large majority of the assets, ensuring that the corporation continues its core operations. Understanding this requirement can prevent legal disputes and ensure compliance with regulations.

A substantial sale of assets refers to the transfer of a significant portion of a corporation's assets to another entity. Specifically, in the context of the New York Bill of Sale by Corporation of all or Substantially all of its Assets, it involves selling items that can include physical assets, intellectual properties, and more. This type of transaction typically requires careful compliance with state laws to ensure that both the buyer and seller fulfill their obligations.

Section 404 of the Companies Act generally pertains to regulations surrounding the ownership and management of corporate assets during significant transactions. While specific provisions may differ by jurisdiction, this section serves as a framework to protect stakeholders and ensure healthy corporate governance. Companies considering a New York Bill of Sale by Corporation of all or Substantially all of its Assets need to be aware of such regulations to maintain compliance across various laws and jurisdictions.

Section 404 of the New York Business Corporation Law primarily addresses matters related to mergers and asset transfers. It details the requirements for corporate decisions regarding asset sales and the necessary shareholder approval processes. Understanding this section is crucial for companies looking to execute a New York Bill of Sale by Corporation of all or Substantially all of its Assets, as it helps ensure legal adherence and protect corporate interests.