New York Invoice Template for Independent Contractor: A Comprehensive Overview Keywords: New York, invoice template, independent contractor, billing, payment, freelance, self-employment, taxation, contract, services. Overview: The New York Invoice Template for Independent Contractor is a structured document designed to assist freelance professionals and self-employed individuals operating in New York State in efficiently managing their billing and payment processes. This versatile template provides a standardized format that streamlines invoicing procedures, ensuring accurate invoicing, prompt payments, and compliance with relevant laws and regulations. Features: 1. Professional Layout: The New York Invoice Template for Independent Contractor offers a clean and professional layout, featuring designated sections for company information, client details, services provided, payment terms, and more. This ensures clarity and professionalism in your invoicing process. 2. Personalized Branding: Freelancers and independent contractors can customize this template by adding their logo, company name, slogan, and other branding elements. This helps establish a consistent professional image and builds brand recognition. 3. Clear Service Description: This template enables independent contractors to provide a detailed breakdown of the services rendered, including project dates, hourly rates, quantities, and a comprehensive description of the scope of work. Clarity in service descriptions helps avoid ambiguity and disputes in the future. 4. Transparent Payment Terms: The New York Invoice Template for Independent Contractor includes a clear outline of payment terms, such as due dates, payment methods accepted, late payment fees, and client responsibilities. This helps maintain a transparent payment process and deters delayed or non-payment issues. 5. Sales Tax Compliant: For independent contractors operating in New York, this template allows for the inclusion of sales tax, if applicable, ensuring compliance with state tax regulations. This feature simplifies the taxation process and ensures accurate reporting. Types of New York Invoice Templates for Independent Contractor: 1. Basic Invoice Template: A straightforward template that includes standard sections for essential information, such as company details, client details, services provided, payment terms, and total amount due. 2. Time-Based Invoice Template: Designed for contractors who charge based on hourly rates, this template includes additional fields for tracking the duration of each task performed and calculating the total amount due based on the hours worked. 3. Project-Based Invoice Template: Ideal for individuals offering fixed-rate services, this template allows independent contractors to describe the project's details, milestones, and corresponding payment terms, ensuring clarity and project management efficiency. 4. Retainer Invoice Template: This template is suitable for contractors who receive a retainer fee upfront. It enables contractors to outline the retained amount and the billing process for the project or specific period. 5. Recurring Invoice Template: For contractors with recurring clients or retainer-based agreements, this template facilitates the invoicing process by automating the generation of invoices at regular intervals. It helps ensure consistent cash flow and eliminates repetitive administrative tasks. In conclusion, the New York Invoice Template for Independent Contractor is a valuable tool for freelancers and self-employed individuals operating in New York State. It not only simplifies and organizes the billing process but also ensures compliance with relevant taxation laws. These templates come in various types to suit different invoicing needs, making them an essential resource in the realm of independent contracting.

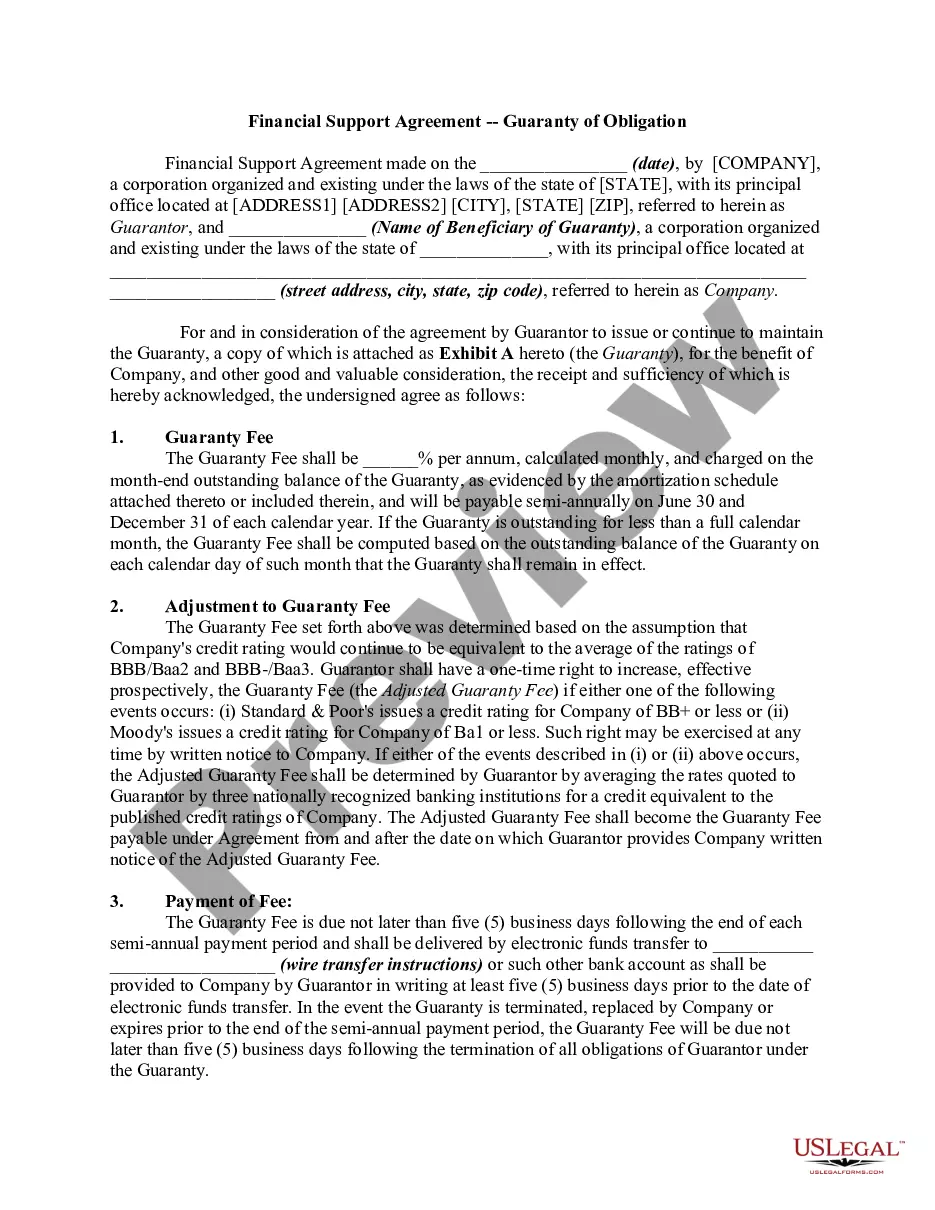

New York Invoice Template for Independent Contractor

Description

How to fill out New York Invoice Template For Independent Contractor?

It is possible to commit hours on-line attempting to find the legitimate papers template that fits the federal and state requirements you want. US Legal Forms provides 1000s of legitimate types which are examined by experts. You can actually down load or produce the New York Invoice Template for Independent Contractor from our assistance.

If you already possess a US Legal Forms profile, it is possible to log in and click the Download button. Afterward, it is possible to complete, modify, produce, or signal the New York Invoice Template for Independent Contractor. Each and every legitimate papers template you buy is yours for a long time. To get another duplicate of any bought develop, go to the My Forms tab and click the related button.

Should you use the US Legal Forms site for the first time, stick to the straightforward recommendations beneath:

- First, ensure that you have chosen the best papers template for that region/city that you pick. Browse the develop explanation to make sure you have picked the correct develop. If available, utilize the Preview button to check through the papers template as well.

- If you would like discover another edition of your develop, utilize the Lookup industry to discover the template that suits you and requirements.

- When you have located the template you need, just click Buy now to move forward.

- Choose the prices plan you need, key in your references, and sign up for an account on US Legal Forms.

- Total the transaction. You may use your Visa or Mastercard or PayPal profile to purchase the legitimate develop.

- Choose the structure of your papers and down load it to your system.

- Make adjustments to your papers if needed. It is possible to complete, modify and signal and produce New York Invoice Template for Independent Contractor.

Download and produce 1000s of papers layouts utilizing the US Legal Forms website, which offers the greatest assortment of legitimate types. Use specialist and condition-certain layouts to handle your small business or personal needs.