Title: New York Employment Agreement — Executive with Car Allowance: A Comprehensive Overview Keywords: New York, employment agreement, executive, car allowance, types Introduction: A New York Employment Agreement — Executive with Car Allowance is a legally binding contract that outlines the terms and conditions of employment for executives in New York, along with the additional provision of a car allowance. This detailed description aims to provide an in-depth understanding of this type of agreement, including various types that may exist within this category. 1. Important Components of the New York Employment Agreement — Executive with Car Allowance: The New York Employment Agreement — Executive with Car Allowance typically includes the following essential components: a) Position and Responsibilities: This section clearly defines the executive's role, title, and associated responsibilities within the organization. b) Compensation and Benefits Package: The agreement outlines the executive's base salary, additional incentives, bonuses, retirement plans, health benefits, and other perks specific to the company's policies. c) Term and Termination: Details regarding the duration of the agreement and circumstances under which termination can occur are specified in this section. d) Non-Compete and Confidentiality: To protect the company's interests, these clauses restrict the executive from engaging in competing activities and require the maintenance of strict confidentiality. e) Intellectual Property and Inventions: This provision specifies ownership rights and responsibilities regarding any intellectual property or inventions developed during the executive's employment. f) Dispute Resolution: This section details the process for resolving any legal disputes that may arise between the parties. 2. Types of New York Employment Agreement — Executive with Car Allowance: Different types of New York Employment Agreements — Executive with Car Allowance may exist, depending on individual company policies and industry-specific requirements. Some notable examples include: a) Tiered Car Allowance: In this type, the car allowance provided is divided into tiers based on the executive's seniority or level within the organization. The allowance amount may increase as the executive moves up the hierarchy. b) Mileage Reimbursement Car Allowance: Under this arrangement, the executive is compensated for the mileage expenses incurred while using the personal vehicle for work purposes. The reimbursement rate is determined by company policy and in line with the Internal Revenue Service (IRS) guidelines. c) Company Car Lease: In certain cases, the company may provide a leased vehicle to the executive. This type of agreement includes the car's maintenance and insurance expenses, ensuring the executive's seamless business travel. Conclusion: A New York Employment Agreement — Executive with Car Allowance is a specialized contract designed to establish the terms and conditions of employment for executives, while also providing them with a car allowance benefit. With various types available, companies can tailor these agreements to meet specific job requirements and organizational needs.

New York Employment Agreement - Executive with Car Allowance

Description

How to fill out Employment Agreement - Executive With Car Allowance?

You can dedicate hours online searching for the legal document template that satisfies the federal and state stipulations you require. US Legal Forms offers thousands of legal forms that can be reviewed by experts.

You can conveniently download or create the New York Employment Agreement - Executive with Car Allowance using their service.

If you already possess a US Legal Forms account, you can Log In and click the Acquire button. Subsequently, you can complete, modify, create, or sign the New York Employment Agreement - Executive with Car Allowance. Each legal document template you obtain is yours forever. To retrieve another copy of the purchased form, navigate to the My documents tab and click the corresponding button.

Make modifications to your document if necessary. You can complete, modify, and sign and print the New York Employment Agreement - Executive with Car Allowance. Access and print thousands of document templates via the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal requirements.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

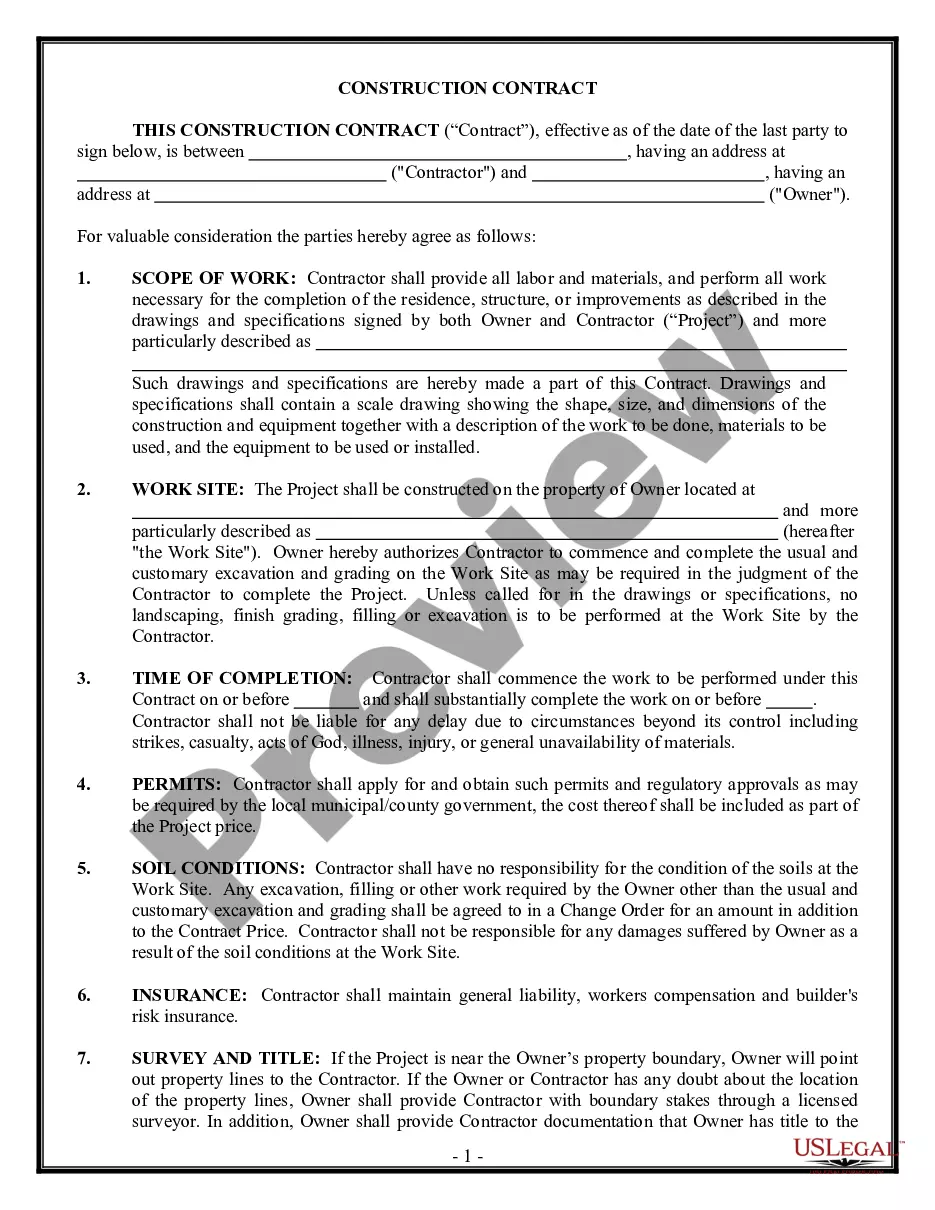

- First, ensure that you have selected the correct document template for the locality/city of your choice. Check the form description to confirm that you have selected the proper form. If available, utilize the Review button to examine the document template as well.

- If you want to find another version of the form, use the Search field to locate the template that fits your needs and requirements.

- Once you have discovered the template you want, simply click Buy now to proceed.

- Select the pricing plan that suits you, enter your details, and register for an account on US Legal Forms.

- Complete the transaction. You can use your Visa or Mastercard or PayPal account to purchase the legal document.

- Select the format of the document and download it to your device.

Form popularity

FAQ

An executive compensation contract outlines the financial remuneration and benefits provided to an executive. This type of document includes salary, bonuses, stock options, and allowances such as a car allowance. For executives in New York, a well-drafted New York Employment Agreement - Executive with Car Allowance is vital for ensuring fair and competitive compensation.

The executive level agreement is a formal contract designed for senior management roles. It encapsulates job responsibilities, compensation, and perks, including a car allowance. In the context of a New York Employment Agreement - Executive with Car Allowance, this agreement is essential for establishing a transparent relationship between the employer and the executive.

A C level executive contract is a legal document specifically for top executives, such as Chief Executive Officers and Chief Financial Officers. It details expectations, compensation, and benefits like bonuses or a car allowance. Ensuring clarity in a New York Employment Agreement - Executive with Car Allowance is crucial, as these positions come with significant responsibilities and expectations.

An executive employment agreement is a specialized contract tailored for high-level management positions. It defines the scope of work, compensation packages, and other important terms such as a car allowance. This type of agreement is pivotal for ensuring both the employer and the executive understand their commitments, particularly in a New York Employment Agreement - Executive with Car Allowance.

Yes, employment contracts are generally enforceable in New York, provided they meet certain legal requirements. These contracts, including the New York Employment Agreement - Executive with Car Allowance, must be clear, mutual, and contain valid terms. Courts uphold these agreements as long as they comply with state laws and ethical standards.

An executive agreement is a formal arrangement between an employer and an executive. It outlines the terms of employment, including roles, responsibilities, and compensation. Specifically, a New York Employment Agreement - Executive with Car Allowance typically includes benefits like a car allowance, ensuring that executives have essential resources to perform their duties effectively.

The average car allowance can range widely, but many executives receive between $600 and $1,200 monthly. This allowance takes into account vehicle lease payments, insurance, fuel, and maintenance costs. In crafting a New York Employment Agreement - Executive with Car Allowance, understanding these averages assists in setting a fair and competitive allowance.

To report a car allowance, you typically need to include it as taxable income on your tax return. This procedure can depend on your specific employment situation and local regulations. Seeking professional guidance and using resources like uslegalforms can simplify the process when you’re dealing with a New York Employment Agreement - Executive with Car Allowance.

An employee vehicle allowance agreement is a contract that outlines the terms under which an employee receives a vehicle allowance. This document specifies the allowance amount, payment frequency, and conditions for use. If you need to create a comprehensive New York Employment Agreement - Executive with Car Allowance, incorporating a clear vehicle allowance agreement can help prevent misunderstandings.

A good car allowance typically reflects the needs of the executive and the demands of their role. Generally, it should cover both the expenses of vehicle operation and provide adequate compensation for maintenance. When establishing a New York Employment Agreement - Executive with Car Allowance, aim for an amount that balances fairness and market competitiveness.