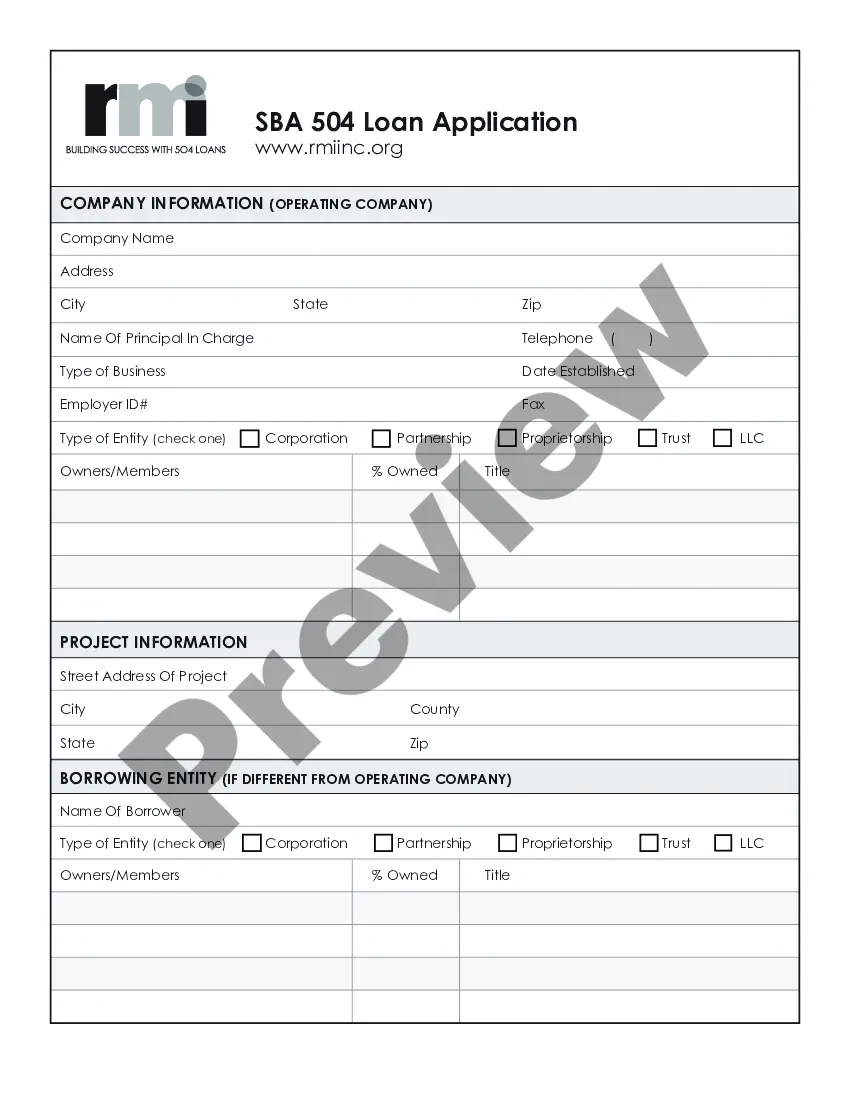

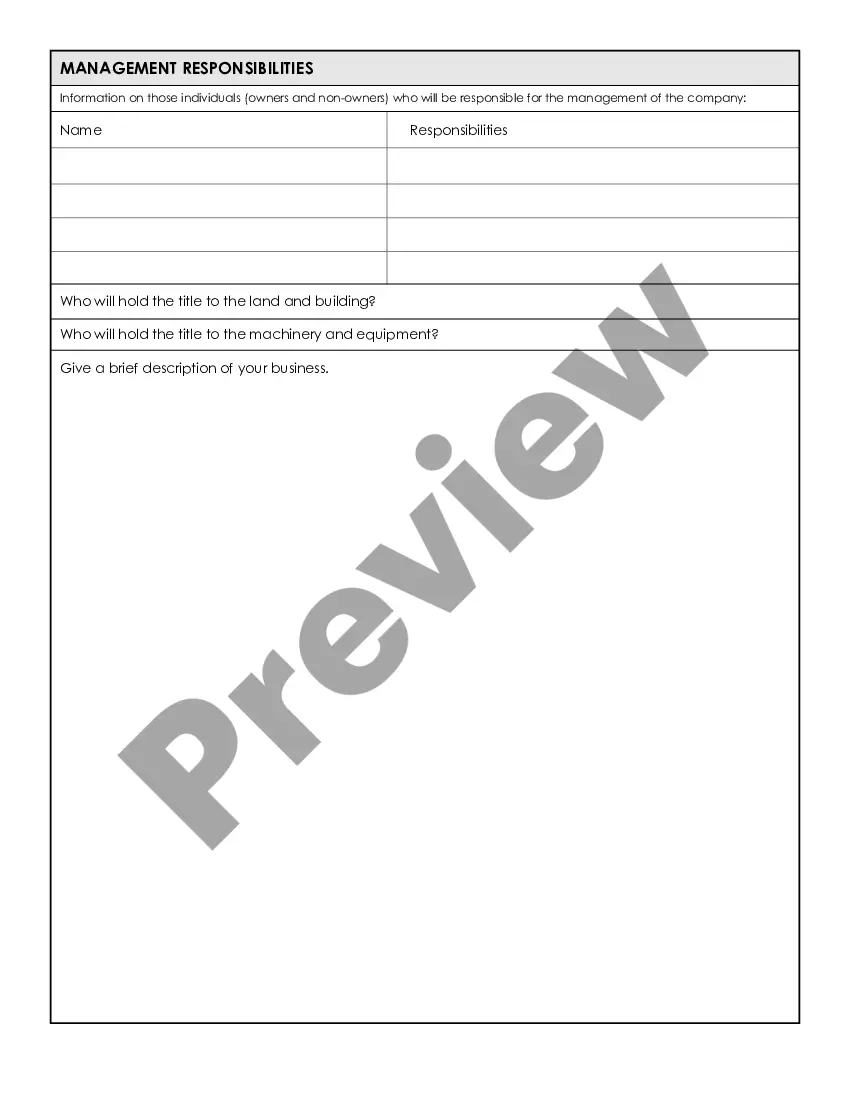

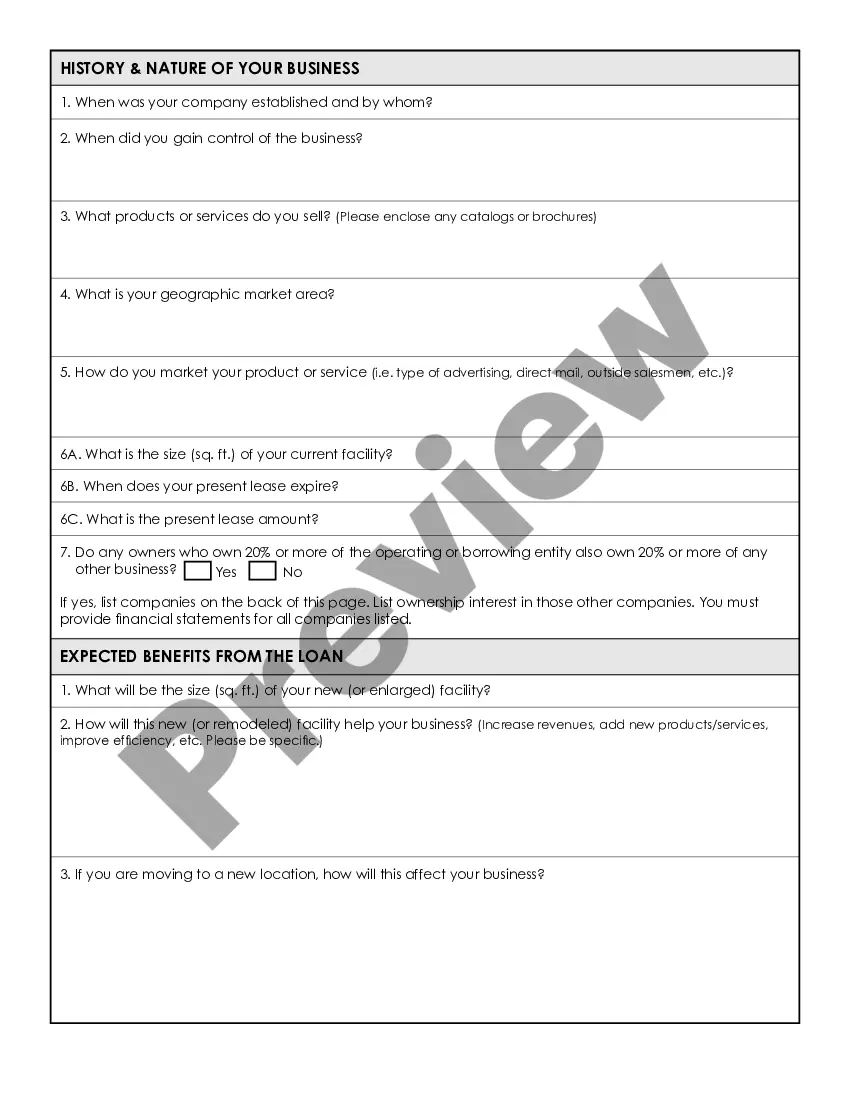

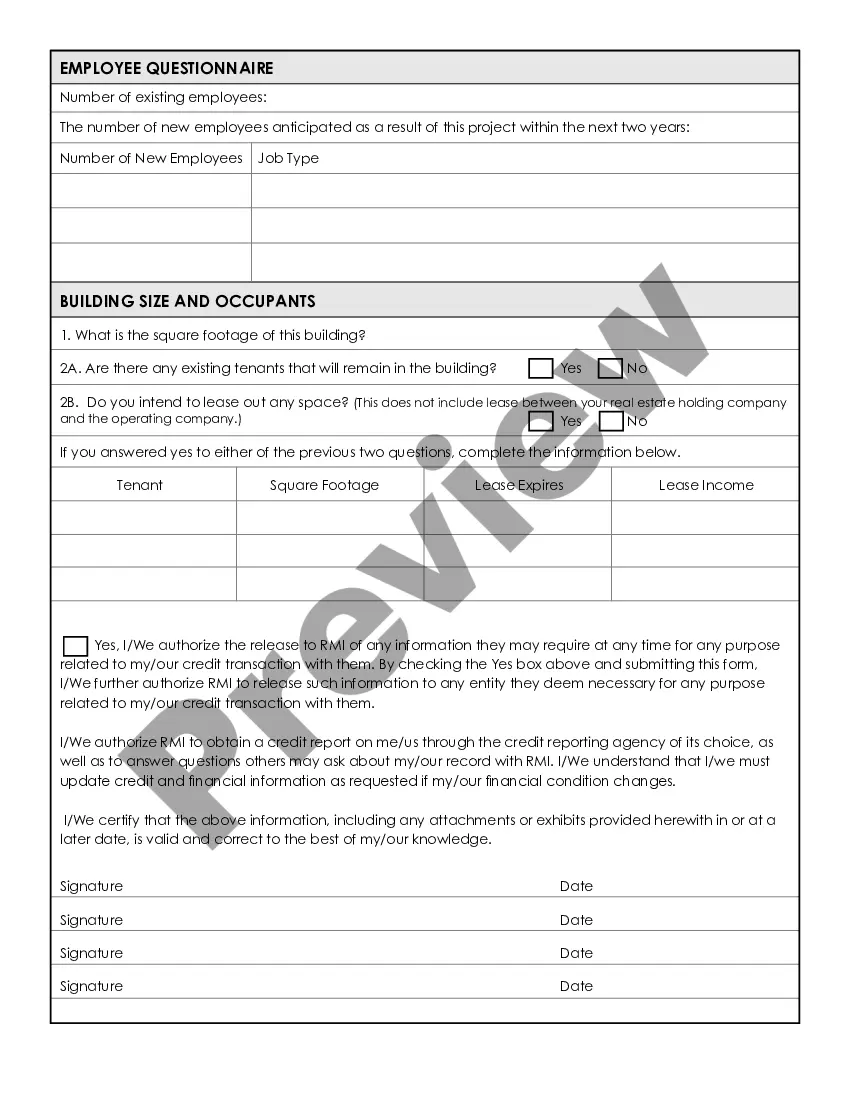

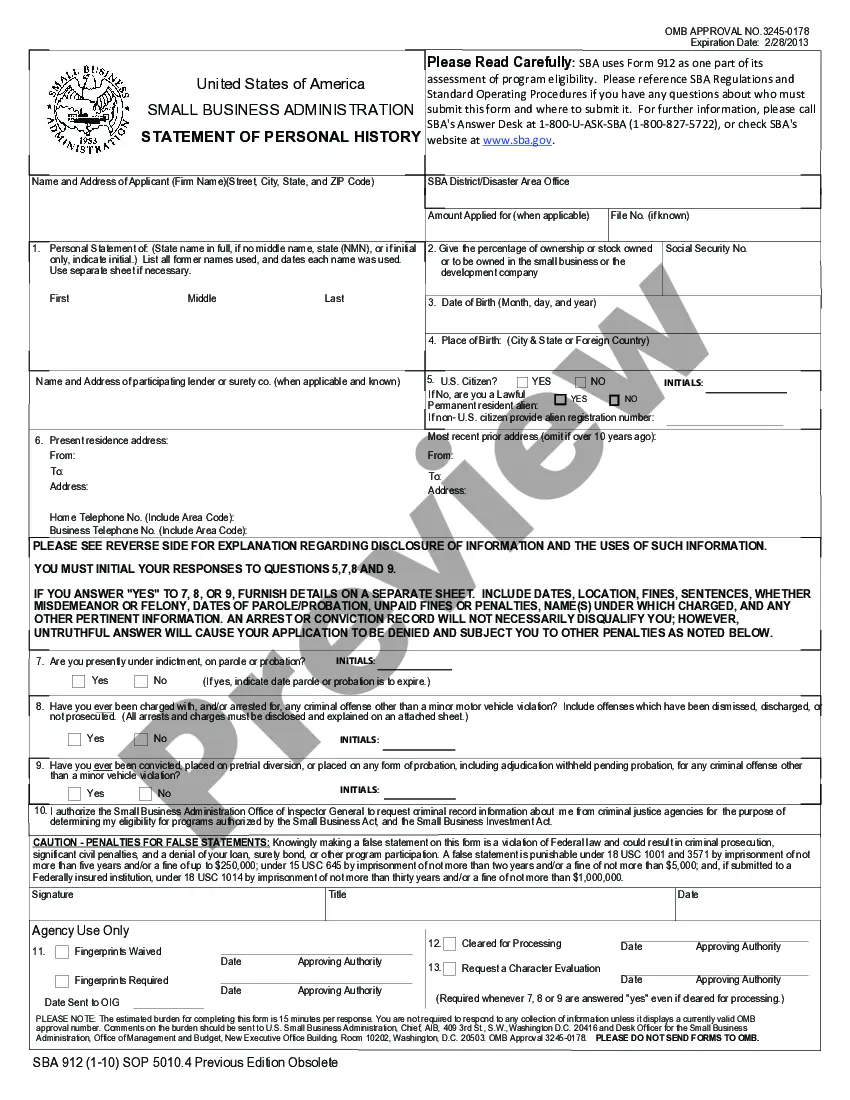

Description: The New York Small Business Administration Loan Application Form and Checklist are essential documents required for small business owners in New York who are seeking financial assistance through the Small Business Administration (SBA) loan program. These forms and checklists play a vital role in the loan application process by ensuring that applicants provide comprehensive and accurate information to the SBA. Keywords: New York, small business administration, loan application form, checklist, SBA loan program. There are different types of New York Small Business Administration Loan Application Forms and Checklists available, tailored to specific loan programs offered by the SBA. Some of these forms and checklists include: 1. SBA 7(a) Loan Application Form and Checklist: This form is the most common and versatile SBA loan program available to small businesses, providing them with funds for working capital, equipment purchase, expansion, or refinancing. The checklist ensures that applicants include all the necessary supporting documents, such as financial statements, business plan, tax returns, and personal financial statements. 2. SBA 504 Loan Application Form and Checklist: This form is specifically designed for businesses seeking long-term financing for major fixed assets, such as real estate or equipment. The checklist outlines the required documents, including business financials, borrower information, property details, and personal financial statements. 3. SBA Microloan Program Application Form and Checklist: The microloan program offers smaller loans (up to $50,000) to help startups, newly established businesses, or economically disadvantaged entrepreneurs. The application form and checklist cover vital elements such as personal background, business description, financial projections, and collateral information. 4. SBA Economic Injury Disaster Loan (IDL) Application Form and Checklist: During times of declared disasters, such as hurricanes, floods, or pandemics, the SBA offers Economic Injury Disaster Loans to help businesses recover. The IDL application form and checklist focus on providing detailed information about the impact of the disaster on the business's operations, financials, and mitigation efforts. 5. SBA Veterans Advantage Loan Application Form and Checklist: To support military veterans and their families, the SBA offers loan programs with favorable terms. The Veterans Advantage Loan application form and checklist cater to the unique needs of veteran-owned businesses, including military service histories, business qualifications, financial statements, and credit reports. It is crucial for small business owners in New York to carefully review these specific forms and checklists pertaining to their desired loan program. Adhering to the requirements outlined in each form and checklist significantly increases the chances of having a successful loan application with the SBA.

New York Small Business Administration Loan Application Form and Checklist

Description

How to fill out New York Small Business Administration Loan Application Form And Checklist?

If you wish to full, down load, or print out lawful record templates, use US Legal Forms, the largest selection of lawful types, which can be found online. Make use of the site`s easy and convenient search to get the files you require. Numerous templates for company and person reasons are categorized by types and suggests, or search phrases. Use US Legal Forms to get the New York Small Business Administration Loan Application Form and Checklist with a number of click throughs.

Should you be already a US Legal Forms buyer, log in in your account and click the Acquire option to have the New York Small Business Administration Loan Application Form and Checklist. You may also gain access to types you previously delivered electronically from the My Forms tab of your account.

If you are using US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have selected the shape for your right area/nation.

- Step 2. Take advantage of the Preview choice to check out the form`s content. Never forget about to see the explanation.

- Step 3. Should you be not satisfied with the kind, make use of the Research field at the top of the monitor to discover other types from the lawful kind web template.

- Step 4. When you have discovered the shape you require, click on the Acquire now option. Opt for the rates plan you like and put your qualifications to sign up to have an account.

- Step 5. Procedure the deal. You can use your bank card or PayPal account to complete the deal.

- Step 6. Pick the structure from the lawful kind and down load it on your own product.

- Step 7. Total, revise and print out or indicator the New York Small Business Administration Loan Application Form and Checklist.

Every single lawful record web template you buy is your own property forever. You possess acces to each and every kind you delivered electronically within your acccount. Click the My Forms segment and choose a kind to print out or down load again.

Remain competitive and down load, and print out the New York Small Business Administration Loan Application Form and Checklist with US Legal Forms. There are millions of professional and state-particular types you may use to your company or person requires.

Form popularity

FAQ

Some of the documents you'll be asked to provide include, copies of your state- or government-issued ID, copies of paystubs, tax returns or bank statements. Having these documents on hand will not only make the application process smoother but will increase your chances of getting approved in a timely manner.

Although the SBA Form 912 is no longer required, if an individual owner answers ?yes? to question 18 or 19, the individual must provide the details to Page 3 PAGE 3 of 6 EXPIRES: 9-1-21 SBA Form 1353.3 (4-93) MS Word Edition; previous editions obsolete Must be accompanied by SBA Form 58 Federal Recycling Program ...

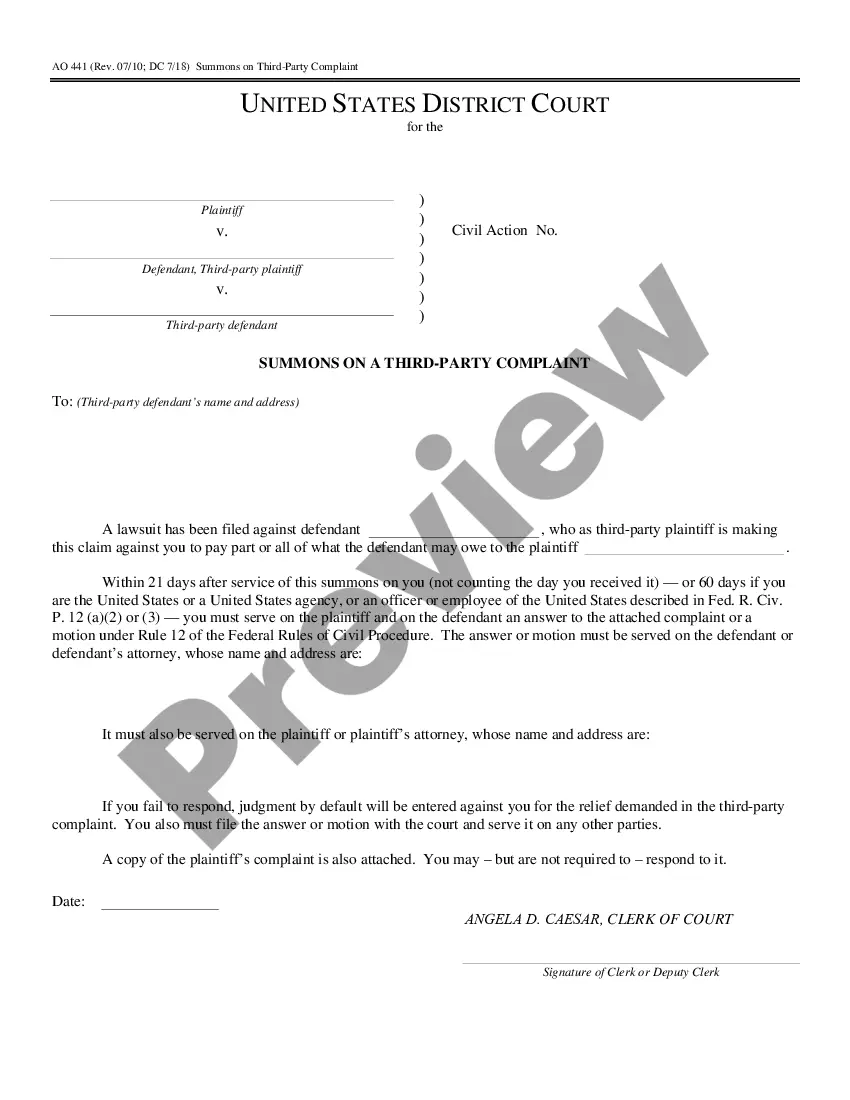

These documents are used by the lenders to evaluate whether or not they will provide you with a loan. Loan documents are necessary to initiate a loan approval process by a lender. Some documents that may be required are tax returns, bank statements, pay stubs, W2, and a proof of income.

Creditagreement_300ps. jpg Loan Application Form. Forms vary by program and lending institution, but they all ask for the same information. ... Resumes. ... Business Plan. ... Business Credit Report. ... Income Tax Returns. ... Financial Statements. ... Accounts Receivable and Accounts Payable. ... Collateral.

Get your financials in order. To this end, you should generally try to have three years' worth of business and personal tax returns on hand as well as year-to-date profit and loss figures, balance sheets, accounts receivable aging reports, and inventory breakdowns, if possible.

The SBA Checklist Borrower Information Form. Personal Background and Financial Statement. Business Financial Statements. Business Certificate/License. Loan Application History. Income Tax Returns. Resumes. Business Overview and History.

KYC documents - Any government-issued KYC document such as an Aadhaar card, PAN card, passport or driving licence. Your employee ID card. Salary slips for the last three months. Bank account statements of your salary account for the previous three months.

In general, eligibility is based on what a business does to receive its income, the character of its ownership, and where the business operates. Normally, businesses must meet SBA size standards, be able to repay, and have a sound business purpose. Even those with bad credit may qualify for startup funding.