Stock Certificate Legend refers to wording found on the front or back of a stock certificate which serves as notice of and a brief explanation of certain restrictions affecting the stock shares represented by that stock certificate.

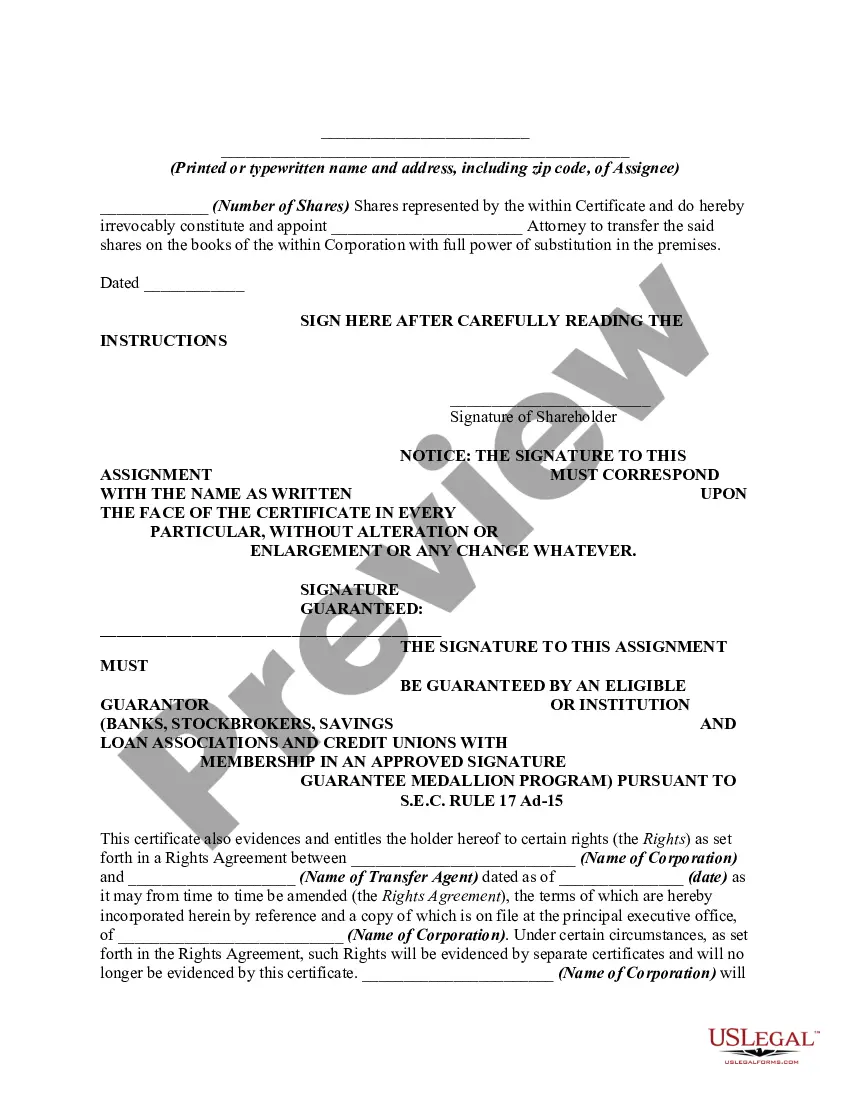

The reverse side of a stock certificate generally bears a form of assignment, which, when properly executed, transfers title to the stock represented by the certificate.

A New York Stock Certificate Legend — Common Stock is a legal statement or notation that appears on the physical stock certificate of a company's common stock, indicating important details and restrictions associated with the ownership and transferability of the stock. This legend serves as a safeguard to protect the rights and interests of the shareholders, as well as provide clarity regarding the stock's characteristics and limitations. The New York Stock Certificate Legend — Common Stock typically includes crucial information such as the name of the issuing company, the class of stock (common stock), and any specific shareholder rights or restrictions. It may also contain disclaimers, notifications, and disclosures required by relevant regulatory bodies or stock exchanges. Depending on the specific circumstances and regulations, there may be different types of New York Stock Certificate Legend — Common Stock used. Some of these types may include: 1. Standard Legend: This is the most common type of stock certificate legend, incorporating the necessary information as mentioned above. It typically includes basic shareholder rights and transferability provisions. 2. Restricted Stock Legend: This type of legend is utilized for stock certificates that represent restricted common stock. Restricted stock often has limitations on its transferability or sale, such as vesting periods, lock-up agreements, or specific shareholder approval requirements. 3. Special Circumstance Legend: In certain situations, unique circumstances may demand the inclusion of additional information in the stock certificate legend. For example, if the common stock is subject to pending litigation, SEC investigations, or regulatory compliance, a special circumstance legend may be required to adequately inform potential buyers. 4. Preferred Stock Conversion Legend: In cases where a company's common stock can be converted into preferred stock based on certain conditions or events, a conversion legend may be used to outline the conversion terms and conditions. 5. Anti-Dilution Legend: If a company has implemented an anti-dilution provision for its common stock, an anti-dilution legend on the stock certificate may be necessary. This legend would define the mechanism through which the common stock's price or quantity is protected against dilution. The precise wording and content of a New York Stock Certificate Legend — Common Stock can vary from company to company, as each organization may have specific requirements or provisions. These legends play a crucial role in ensuring transparency, protecting investors, and maintaining compliance with applicable laws and regulations.A New York Stock Certificate Legend — Common Stock is a legal statement or notation that appears on the physical stock certificate of a company's common stock, indicating important details and restrictions associated with the ownership and transferability of the stock. This legend serves as a safeguard to protect the rights and interests of the shareholders, as well as provide clarity regarding the stock's characteristics and limitations. The New York Stock Certificate Legend — Common Stock typically includes crucial information such as the name of the issuing company, the class of stock (common stock), and any specific shareholder rights or restrictions. It may also contain disclaimers, notifications, and disclosures required by relevant regulatory bodies or stock exchanges. Depending on the specific circumstances and regulations, there may be different types of New York Stock Certificate Legend — Common Stock used. Some of these types may include: 1. Standard Legend: This is the most common type of stock certificate legend, incorporating the necessary information as mentioned above. It typically includes basic shareholder rights and transferability provisions. 2. Restricted Stock Legend: This type of legend is utilized for stock certificates that represent restricted common stock. Restricted stock often has limitations on its transferability or sale, such as vesting periods, lock-up agreements, or specific shareholder approval requirements. 3. Special Circumstance Legend: In certain situations, unique circumstances may demand the inclusion of additional information in the stock certificate legend. For example, if the common stock is subject to pending litigation, SEC investigations, or regulatory compliance, a special circumstance legend may be required to adequately inform potential buyers. 4. Preferred Stock Conversion Legend: In cases where a company's common stock can be converted into preferred stock based on certain conditions or events, a conversion legend may be used to outline the conversion terms and conditions. 5. Anti-Dilution Legend: If a company has implemented an anti-dilution provision for its common stock, an anti-dilution legend on the stock certificate may be necessary. This legend would define the mechanism through which the common stock's price or quantity is protected against dilution. The precise wording and content of a New York Stock Certificate Legend — Common Stock can vary from company to company, as each organization may have specific requirements or provisions. These legends play a crucial role in ensuring transparency, protecting investors, and maintaining compliance with applicable laws and regulations.