New York Sample Letter for New Business with Credit Application

Description

How to fill out Sample Letter For New Business With Credit Application?

You can spend time online searching for the appropriate legal document template that meets the federal and state requirements you have.

US Legal Forms offers thousands of legal forms that have been examined by experts.

You can download or print the New York Sample Letter for New Business with Credit Application from the service.

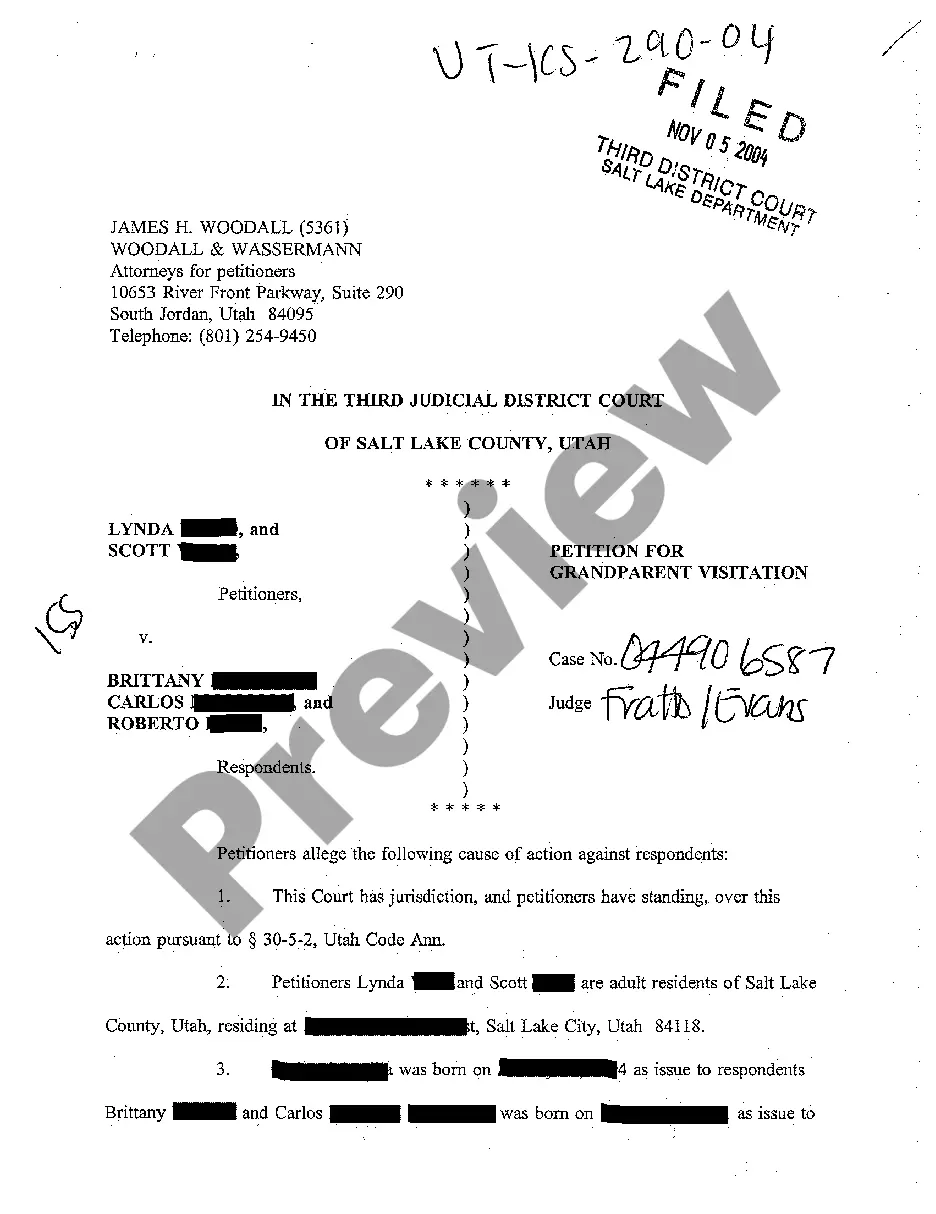

First, ensure you have selected the correct document template for the state/region of your choice. Review the form description to confirm you have chosen the right document. If available, utilize the Review button to preview the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the New York Sample Letter for New Business with Credit Application.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of any acquired form, visit the My documents section and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

Form popularity

FAQ

Two common negatives associated with a letter of credit include costs and complexities. The fees for establishing a letter of credit can add up, affecting overall transaction costs. Additionally, navigating the terms can be complicated, requiring careful attention to detail. To simplify your process, consider using the New York Sample Letter for New Business with Credit Application, which provides a straightforward approach to drafting essential documents.

A confirmed letter of credit is one that includes an additional guarantee from a second bank. This ensures that the payment will be made, even if the issuing bank fails. For businesses, it adds an extra layer of security, making transactions smoother and more predictable. If you need help drafting such documents, the New York Sample Letter for New Business with Credit Application can serve as a useful guide.

A letter of credit for a business is a financial document that provides a guarantee for a payment between a buyer and a seller. It assures the seller that they will receive payment as long as they meet specific terms outlined in the letter. This document is crucial for businesses looking to establish trust and streamline transactions. Using the New York Sample Letter for New Business with Credit Application can help you create a solid foundation for these financial agreements.

Writing a letter of credit involves clearly outlining the terms between the buyer and seller. Start by including essential details such as the parties' names, the amount of credit, and expiration date. You can refer to the New York Sample Letter for New Business with Credit Application for structure and language. By following this format, you ensure clarity and professionalism in your communication.

The four types of letters of credit include revocable, irrevocable, confirmed, and unconfirmed. Each type serves different needs depending on the transaction's nature and parties involved. Understanding this can help you choose the right option for your business, and leveraging a New York Sample Letter for New Business with Credit Application can aid in presenting your requests effectively.

Applying for a letter of credit (LC) requires you to submit an application to your bank, detailing the transaction specifics. It is often beneficial to attach a New York Sample Letter for New Business with Credit Application to provide clarity. This submission helps expedite your application process and outlines expectations for all parties involved.

To request a letter for credit information, reach out directly to your bank and specify what details you need. You can use a New York Sample Letter for New Business with Credit Application to guide your request, ensuring you include all necessary data. This preparation allows the bank to provide accurate and comprehensive information.

A letter of credit for a new business acts as a guarantee of payment from the bank to a supplier. It is particularly useful for new ventures that may lack a strong credit history. Incorporating a New York Sample Letter for New Business with Credit Application can help formalize your request, establishing trust with your suppliers.

To request a letter of credit, start by gathering essential information, including the purpose of the letter and involved parties. Submit this information to your financial institution along with a New York Sample Letter for New Business with Credit Application. This helps streamline the approval process and ensures clarity in your request.

Initiating a letter of credit involves completing an application with your bank, specifying the terms of the letter. You may need to include a detailed New York Sample Letter for New Business with Credit Application to support your request. This application allows the bank to understand your business's specifics and manage the process smoothly.