Subject: Important Changes in the Rate Regulation Rules in New York — Sample Letter Dear [Recipient's Name], I hope this letter finds you in good health and high spirits. We are writing to inform you about the recent and significant changes regarding rate regulation rules in the state of New York. As a valued customer, we want to ensure that you are well-informed about these updates and how they may impact your business operations. Firstly, we would like to highlight that the New York State Department of Financial Services (NY DFS) has released new rate regulation rules that are designed to enhance consumer protection and promote fair market practices. These revised regulations aim to create a level playing field for businesses operating in the insurance sector and establish a more transparent and accountable framework. Under the new rate regulation rules, insurance carriers are required to adhere to stricter guidelines when determining their rates. These rules encompass various aspects such as rate filings, rate setting methodologies, and consumer disclosure requirements. Insurance companies must clearly demonstrate the factors and data used in calculating their rates, ensuring that they are reasonable, justified, and not unfairly discriminatory. Additionally, the rate regulation rules stipulate that insurance carriers need to provide comprehensive and accessible information to policyholders. This includes clear explanations of the coverage being offered, any changes in rates, the factors affecting these changes, and options available to policyholders if they wish to contest the rate adjustments. Furthermore, the NY DFS has introduced a standardized rate review process to ensure consistency across the industry. This process aims to protect consumers from excessive rate increases and unjustified practices. Under this framework, insurance carriers are required to submit rate filings to the NY DFS for approval, allowing for a thorough review of their justifications and practices. By implementing these changes, the NY DFS intends to establish a fair and competitive insurance marketplace in New York, where consumers can make more informed decisions and have a greater say in the rate setting process. We understand that these changes may have an impact on your current insurance policies and rates. To assist you in navigating through these adjustments, we have prepared a detailed document outlining the specific changes and how they will affect your coverage. This document also includes instructions on how to contest rate adjustments, if needed. We encourage you to review the attached document thoroughly and familiarize yourself with the new rate regulation rules. Should you have any questions or require further clarification, please do not hesitate to contact our dedicated customer support team. We are here to guide you through these changes and provide you with the assistance you need. We value your continued trust and will continue to prioritize your best interests as we strive to adapt to these new regulations. Thank you for your attention, and we look forward to serving you in the best possible manner. Sincerely, [Your Name] [Your Title/Position] [Your Company/Organization Name] Keywords: New York, rate regulation rules, changes, NY DFS, insurance sector, consumer protection, market practices, rate filings, rate setting methodologies, consumer disclosure requirements, reasonable rates, discriminatory practices, standardized rate review process, excessive rate increases, competitive insurance marketplace, coverage adjustments, contest rate adjustments, customer support.

New York Sample Letter for Important Changes in the Rate Regulation Rules

Description

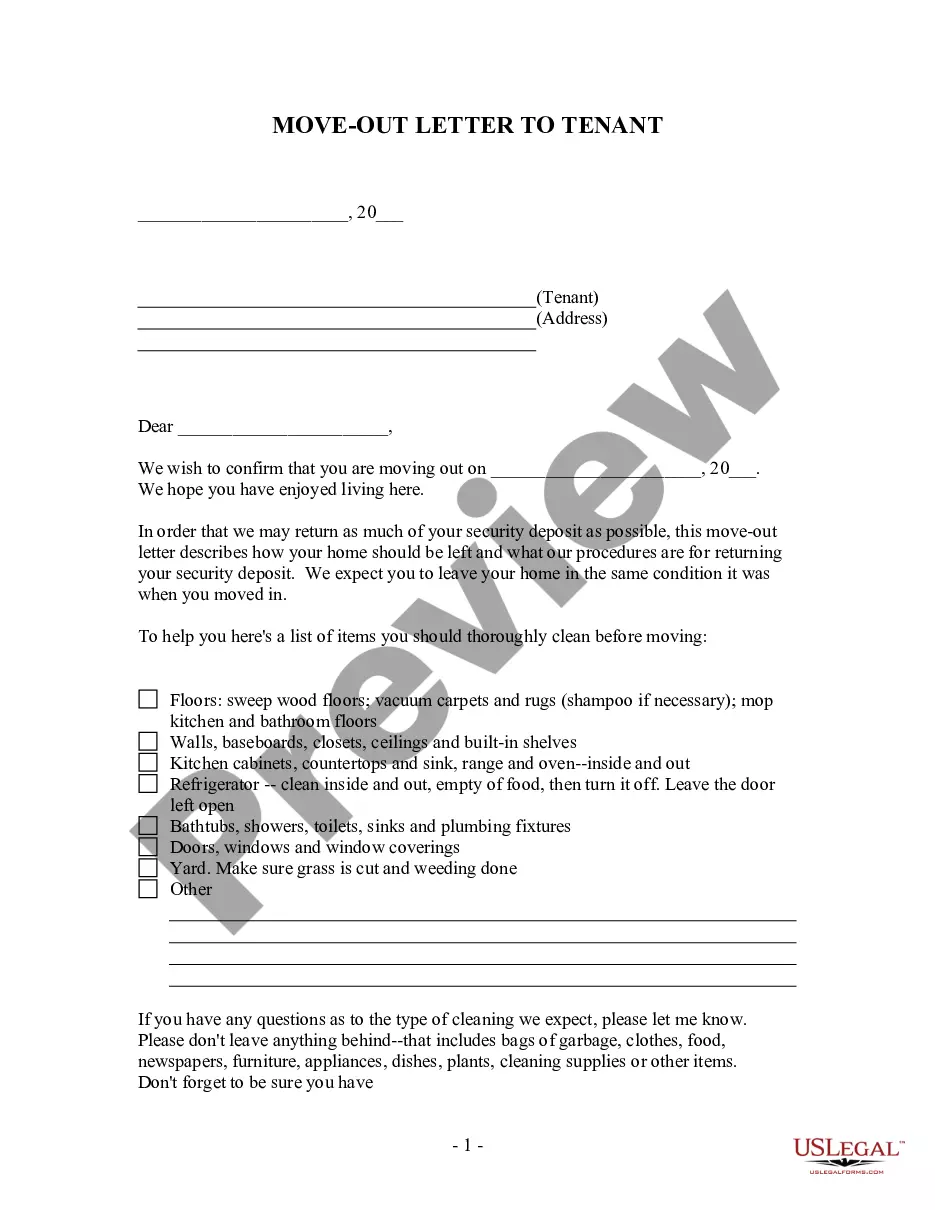

How to fill out New York Sample Letter For Important Changes In The Rate Regulation Rules?

Discovering the right legitimate document template can be a have a problem. Needless to say, there are a variety of themes available on the net, but how would you discover the legitimate form you need? Utilize the US Legal Forms web site. The assistance delivers 1000s of themes, for example the New York Sample Letter for Important Changes in the Rate Regulation Rules, which you can use for enterprise and personal needs. All the kinds are inspected by professionals and meet up with federal and state requirements.

When you are already registered, log in to the account and then click the Acquire button to have the New York Sample Letter for Important Changes in the Rate Regulation Rules. Make use of your account to appear throughout the legitimate kinds you possess bought previously. Proceed to the My Forms tab of your respective account and obtain yet another duplicate of your document you need.

When you are a whole new end user of US Legal Forms, listed below are easy guidelines that you can comply with:

- First, be sure you have selected the proper form for your metropolis/state. You can look over the shape making use of the Review button and browse the shape outline to make sure this is basically the best for you.

- In the event the form does not meet up with your requirements, make use of the Seach discipline to obtain the correct form.

- When you are certain that the shape would work, click on the Buy now button to have the form.

- Select the rates program you would like and enter in the necessary info. Design your account and pay for the transaction using your PayPal account or Visa or Mastercard.

- Select the file format and down load the legitimate document template to the system.

- Full, edit and produce and signal the received New York Sample Letter for Important Changes in the Rate Regulation Rules.

US Legal Forms is the largest catalogue of legitimate kinds where you can discover numerous document themes. Utilize the company to down load expertly-produced paperwork that comply with state requirements.