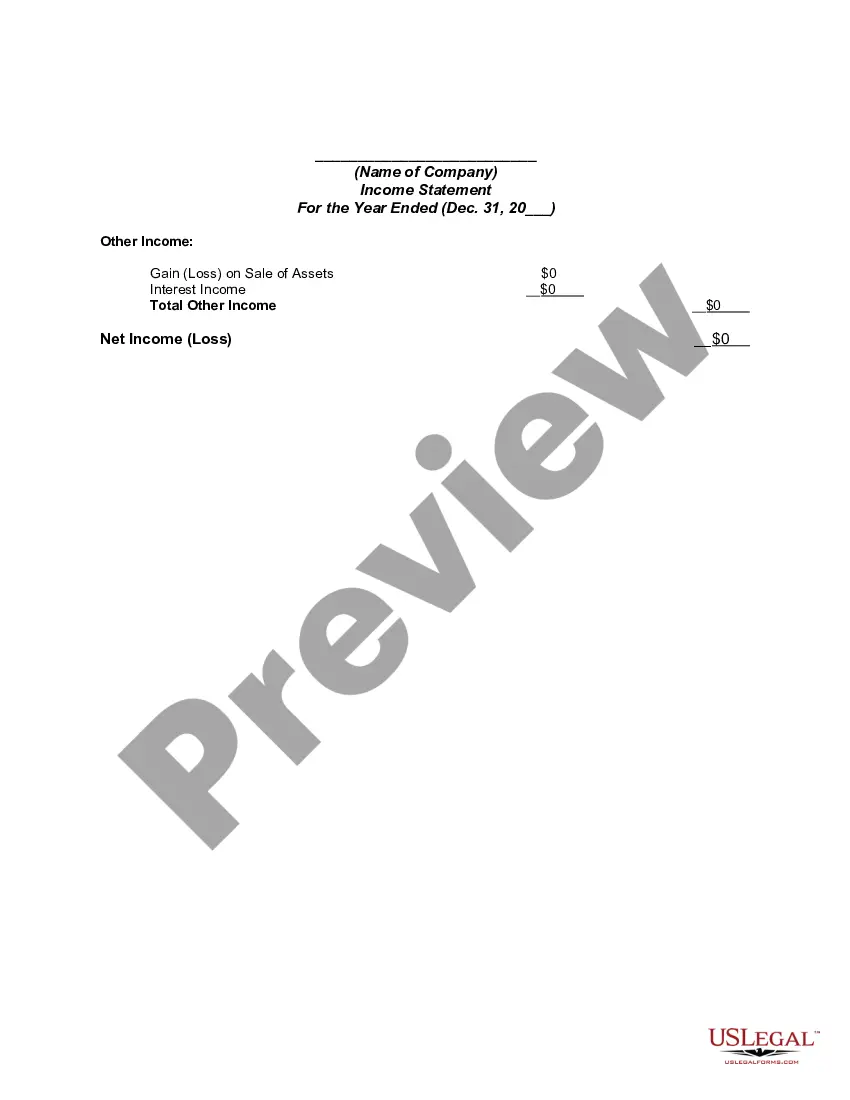

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

New York Income Statement

Description

How to fill out Income Statement?

You might spend numerous hours online searching for the legal document format that meets the federal and state standards you require.

US Legal Forms provides thousands of legal templates that have been reviewed by experts.

It is easy to obtain or print the New York Income Statement through our service.

To discover another version of the form, use the Search field to find the template that meets your needs and specifications.

- If you possess a US Legal Forms account, you can Log In and then click the Acquire button.

- Subsequently, you can complete, modify, print, or sign the New York Income Statement.

- Every legal document template you obtain belongs to you indefinitely.

- To obtain an extra copy of the purchased form, proceed to the My documents tab and click the relevant button.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- Firstly, ensure that you have selected the correct format for the area/region of your choice.

- Review the form description to confirm that you have chosen the right template.

- If available, use the Preview button to examine the document format as well.

Form popularity

FAQ

You can pick up tax forms at several locations, including state tax offices and authorized tax preparation service providers. Additionally, online options are available through the New York State Department of Taxation and Finance, which offers easy access to forms. For efficient filing, make sure to use the correct forms relevant to your New York Income Statement.

It is unlikely that your local post office carries specific New York state tax forms. Instead, you should either download forms from the New York State Department of Taxation and Finance website or visit a nearby tax office. Having the correct forms is vital for the accuracy of your New York Income Statement and overall tax compliance.

You can request your New York state tax transcript through the New York State Department of Taxation and Finance website. They have an online portal that makes accessing your transcripts easy and convenient. Having your tax transcript on hand can be helpful for preparing your New York Income Statement or when applying for loans or other financial services.

Local IRS offices typically do not provide New York state tax forms directly. However, they may offer federal tax forms and guidance on filing. To access your New York state tax forms, your best bet is to visit the New York State Department of Taxation and Finance website or a local tax office. Accurate documents are crucial for preparing your New York Income Statement.

You can easily obtain New York state tax forms at various locations, including state tax offices and online resources. The New York State Department of Taxation and Finance website offers downloadable forms that are convenient and accessible. Using the right forms is essential for accurate reporting on your New York Income Statement and ensuring your tax returns are processed smoothly.

New York state source income includes income generated from activities or properties located within New York. This takes into account wages earned, business profits, and investment income sourced in the state. Understanding these details is critical for your New York Income Statement, as it directly influences how you report your tax obligations. Always consult with a tax professional to ensure compliance.

To mail your New York State income tax payment, you should send it to the address specified on the payment voucher you receive with your tax return. Typically, this will be the address for the specific tax processing center for New York State. Double-check the details before mailing to ensure timely processing of your payment. Properly documenting your payment on your New York Income Statement is key to maintaining accurate records.

You are considered a New York State resident for income tax purposes if you maintain a permanent home in New York for more than 183 days within the tax year. Additionally, if your primary business or personal ties are in New York, you may also qualify as a resident. Checking your residency status is essential, as it affects how you report your earnings in your New York Income Statement. U.S. Legal Forms can help clarify your residency status.

To write a check for income tax, begin by filling in the date, the name of the recipient, and the correct payment amount. Include your information in the memo section, such as your tax identification number, to ensure it is processed correctly. Additionally, sign the check to validate it. Keeping accurate records in your New York Income Statement will help streamline your tax payment process.

When writing a check for your New York State income tax, first make it payable to the "New York State Department of Taxation and Finance." Write your Social Security number or Employer Identification Number on the memo line to ensure proper credit. Make sure to date your check and ensure it covers the correct amount due. Using the correct information on your New York Income Statement helps facilitate a smooth payment process.