New York Sample Letter for Letter Requesting Extension to File Business Tax Forms

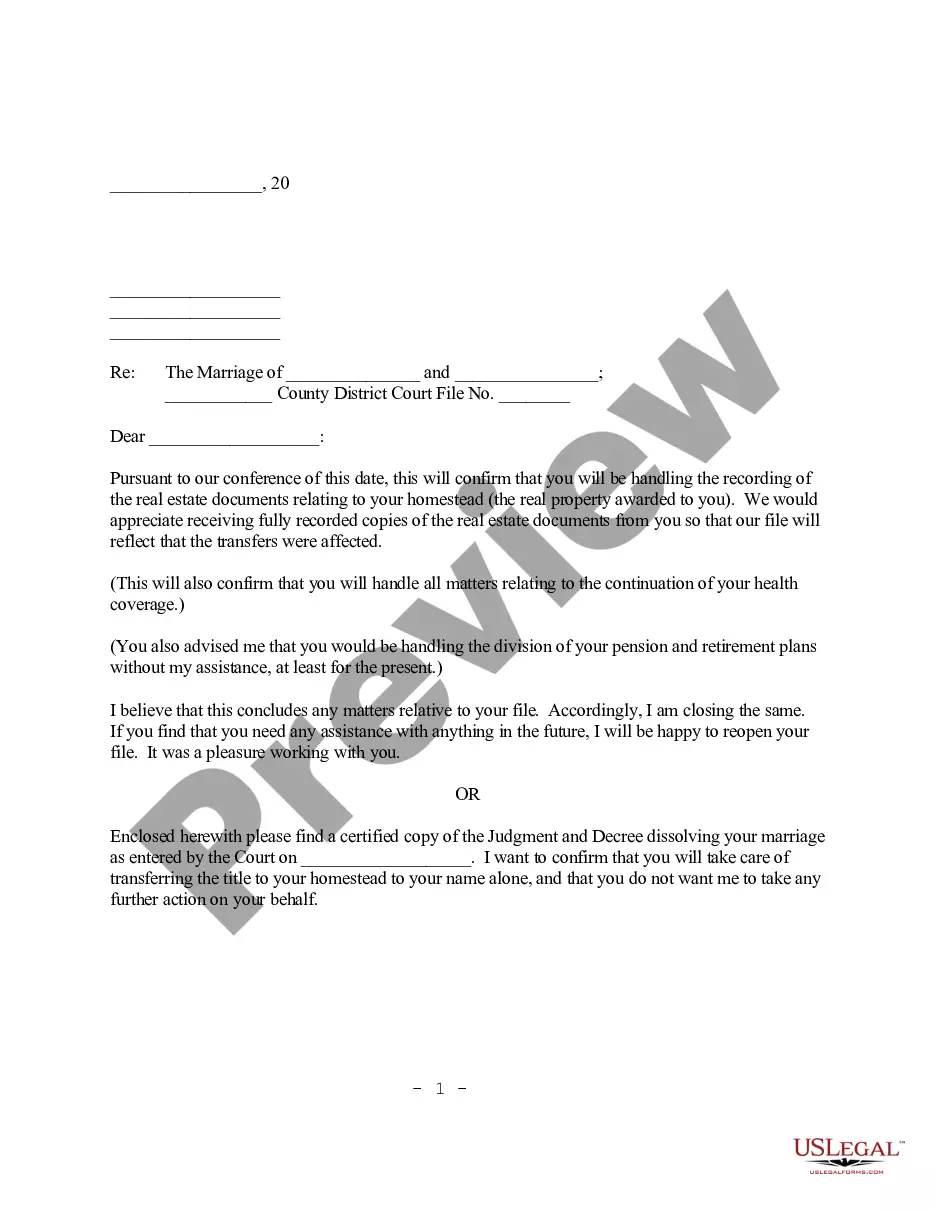

Description

How to fill out Sample Letter For Letter Requesting Extension To File Business Tax Forms?

If you require complete, obtain, or printing legal document templates, utilize US Legal Forms, the largest collection of legal documents available online. Take advantage of the site’s straightforward and useful search tool to locate the forms you need.

A selection of templates for business and personal purposes is organized by categories and states, or keywords. Use US Legal Forms to find the New York Sample Letter for Letter Requesting Extension to File Business Tax Forms with just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click on the Download button to access the New York Sample Letter for Letter Requesting Extension to File Business Tax Forms. You can also view forms you previously downloaded in the My documents section of your account.

Each legal document template you acquire is yours permanently. You have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Compete and download, and print the New York Sample Letter for Letter Requesting Extension to File Business Tax Forms with US Legal Forms. There are countless professional and state-specific documents available for your business or personal needs.

- Step 1. Make sure you have selected the form for your specific city/state.

- Step 2. Use the Preview option to review the content of the form. Always remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal document template.

- Step 4. After you have located the form you desire, click the Buy now button. Choose the pricing plan you prefer and provide your details to register for an account.

- Step 5. Complete the payment. You may use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the New York Sample Letter for Letter Requesting Extension to File Business Tax Forms.

Form popularity

FAQ

To request a business tax extension, you should submit the necessary form to the New York State tax authorities. You can utilize the New York Sample Letter for Letter Requesting Extension to File Business Tax Forms to facilitate this process. Make sure to provide accurate details and documentation to ensure your extension is approved without issues.

Yes, New York does accept a federal extension for corporations, but it's crucial to follow up with the state requirements. You may still need to submit the New York Sample Letter for Letter Requesting Extension to File Business Tax Forms to provide detailed information. Ensure that your federal extension aligns with state regulations to avoid complications.

Your NYS extension form should be mailed to the address specified in the form's instructions. Usually, this involves directed routing to a specific P.O. box or tax office. A New York Sample Letter for Letter Requesting Extension to File Business Tax Forms can guide you through the process and ensure you have the correct address.

The NYS extension form IT-370 should be sent to the specific address provided on the form. Generally, this will vary based on your business tax type and should be clearly indicated in the instructions. Using a New York Sample Letter for Letter Requesting Extension to File Business Tax Forms can help clarify the necessary details while submitting your extension.

NYS 201 V is typically mailed to the address indicated on the form itself. This form is used to request an extension for corporate taxes, so ensure you refer to the correct mailing guidelines. Review the New York Sample Letter for Letter Requesting Extension to File Business Tax Forms for more context on submission procedures.

Your NYS extension request should be mailed to the address outlined on the specific extension form you are using. For instance, if you are filing a business extension, look for the business-related addresses on the New York Sample Letter for Letter Requesting Extension to File Business Tax Forms. It's essential to follow the correct submission guidelines to avoid delays.

You can mail your tax extension request to the appropriate address specified by the New York State Department of Taxation and Finance. Typically, extensions should be sent to a designated P.O. box or processing center. Refer to the instructions on the New York Sample Letter for Letter Requesting Extension to File Business Tax Forms for detailed mailing addresses.

To obtain a tax extension approval letter, you need to file the appropriate extension form with the New York State tax authorities. This generally involves submitting a New York Sample Letter for Letter Requesting Extension to File Business Tax Forms, which outlines your request for an extension. Ensure you provide accurate information and any required documentation to expedite the process.

To ask for an extension on your taxes, you can use the New York Sample Letter for Letter Requesting Extension to File Business Tax Forms. Start by clearly stating your business name and tax ID number. In the letter, explain your circumstances and request the extension with a specific timeline. For guidance, consider using platforms like US Legal Forms, which provide templates and resources to help you create an effective letter.

Yes, New York City accepts federal extensions for corporations as well. Corporations need to file their extension requests accurately to avoid issues with local tax authorities. A New York Sample Letter for Letter Requesting Extension to File Business Tax Forms is a great tool to ensure your request aligns with both federal and city requirements.