New York Reorganization of Partnership by Modification of Partnership Agreement

Description

How to fill out Reorganization Of Partnership By Modification Of Partnership Agreement?

You can dedicate time online looking for the legal document template that fits the state and federal requirements you will need.

US Legal Forms offers thousands of legal templates that are verified by experts.

You can obtain or create the New York Reorganization of Partnership by Modification of Partnership Agreement from their services.

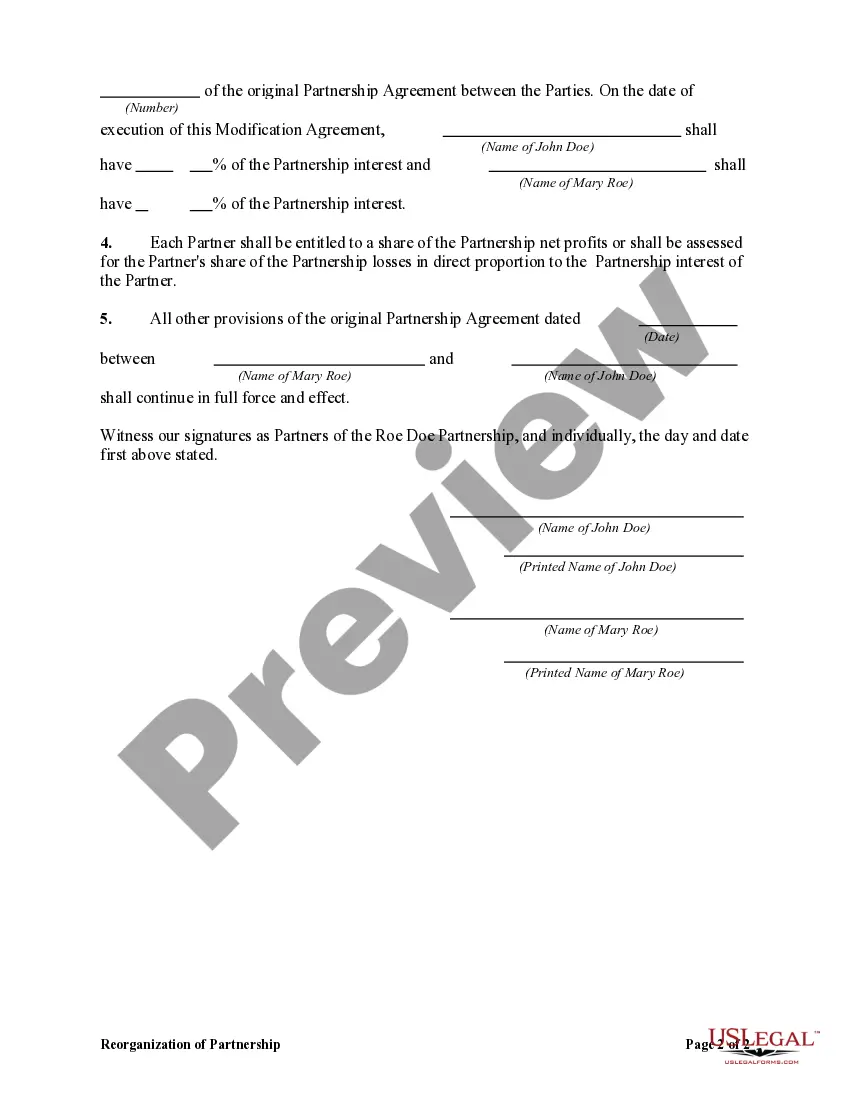

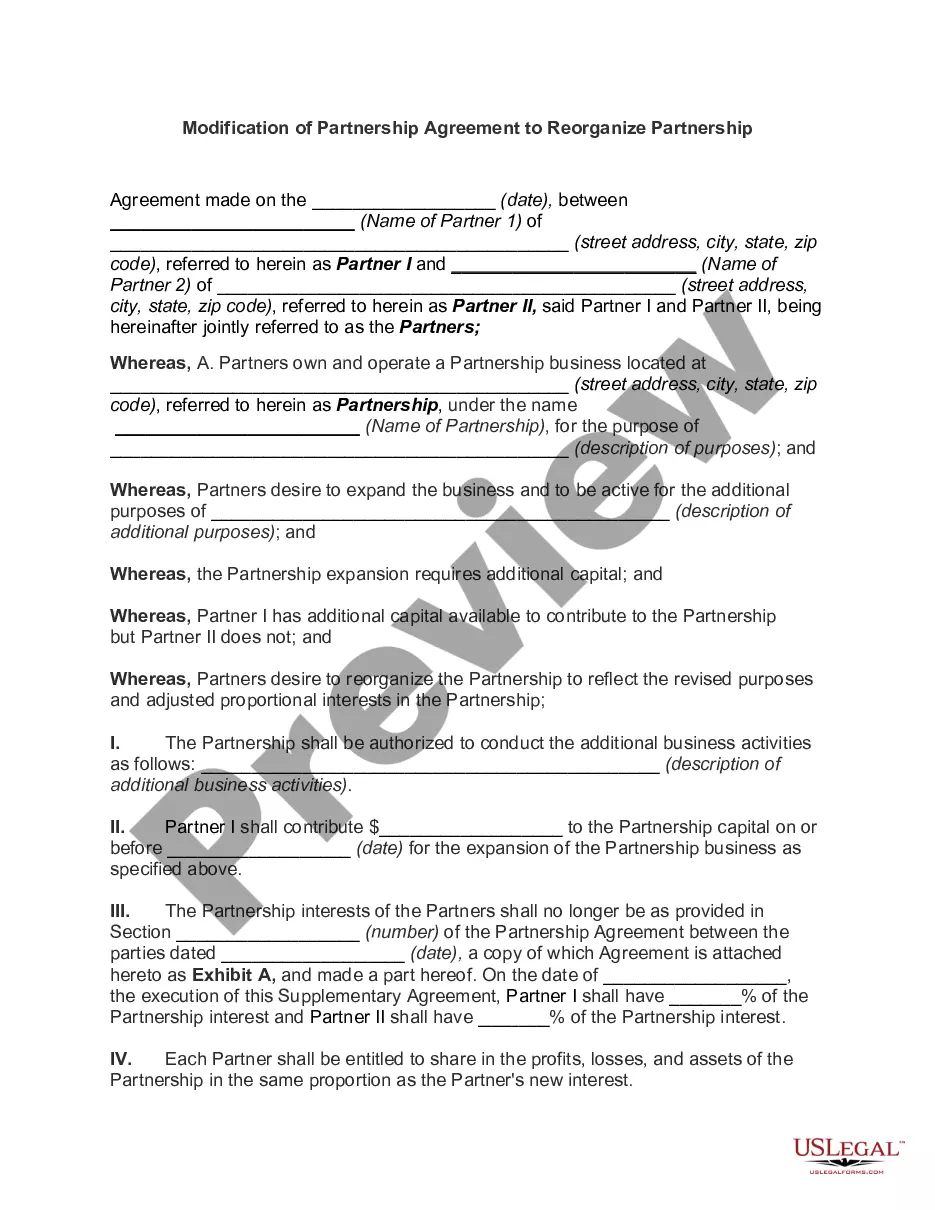

If available, use the Preview button to look through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can fill out, edit, create, or sign the New York Reorganization of Partnership by Modification of Partnership Agreement.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for the state/city you choose.

- Read the form information to ensure you have selected the correct form.

Form popularity

FAQ

The key difference lies in how income is taxed. An S Corporation is a separate legal entity that can pass income directly to its shareholders, avoiding double taxation. In contrast, partnerships report income on individual tax returns of the partners, which can be beneficial in certain situations. When exploring options like the New York Reorganization of Partnership by Modification of Partnership Agreement, it is essential to weigh these tax implications carefully.

The IT-204 IP must be filed by partnerships that have chosen to be treated as corporations under New York law for tax purposes. This filing is crucial for partnerships that have restructured under the New York Reorganization of Partnership by Modification of Partnership Agreement. If you're in this category, ensuring you file the IT-204 IP will help maintain regulatory compliance.

NY IT-204 CP is a tax return form that partnerships in New York use to report their income, gains, losses, and deductions. This form is essential for properly filing and ensuring all tax liabilities are met. When considering the New York Reorganization of Partnership by Modification of Partnership Agreement, using the IT-204 CP correctly can facilitate smooth compliance with state tax laws.

An Article 22 partner refers to a partner in a partnership that qualifies under New York's tax laws. These partners typically benefit from specific tax treatments and obligations defined under Article 22 of the New York Tax Law. If you are involved in the New York Reorganization of Partnership by Modification of Partnership Agreement, knowing the nature of Article 22 partnerships can help you optimize your tax strategy.

The IT-204-IP and IT-204-CP are forms related to partnership taxation in New York. The IT-204-IP is used for partnerships that elect to be treated as a corporation for New York tax purposes, while the IT-204-CP is for the regular partnership status. If you're navigating the New York Reorganization of Partnership by Modification of Partnership Agreement, understanding these forms helps ensure compliance with tax regulations.

Form IT-225 is used to report and allocate business income and deductions for New York partnerships. This form is especially relevant during a New York Reorganization of Partnership by Modification of Partnership Agreement, as it allows partnerships to clarify their financial situation and tax obligations. Accurately completing this form can influence your overall tax responsibilities. For ease in filing, many partnerships turn to solutions like uslegalforms for assistance.

The new NYS small business modification adjustment allows partnerships and sole proprietors to adjust their income based on certain modifications. This adjustment can be essential during a New York Reorganization of Partnership by Modification of Partnership Agreement, as it helps businesses align their reported income with new operating realities. It’s advisable to keep abreast of these changes to maximize your tax efficiency. For detailed instructions, uslegalforms offers valuable resources.

If you want to remove form IT-225 from TurboTax, start by opening your return and navigating to the 'Forms' section. Locate the IT-225 form, select it, and there should be an option to delete or remove it. Keep in mind that if you are involved in a New York Reorganization of Partnership by Modification of Partnership Agreement, ensure that removing this form won’t negatively impact your tax prep. If you run into trouble, seek guidance from uslegalforms.

NYC 204 must be filed by partnerships operating in New York City that have generated income. This form is crucial for partnerships making any changes, such as those involved in the New York Reorganization of Partnership by Modification of Partnership Agreement. Filing this form accurately can help your partnership maintain its tax standing. For assistance, consider using platforms like uslegalforms.

CT 225 is a tax form that New York businesses file for the calculation of their New York corporate income tax. This form is especially relevant for partnerships undergoing a New York Reorganization of Partnership by Modification of Partnership Agreement, as it reports income, deductions, and tax owed. Properly completing CT 225 ensures compliance and helps avoid penalties. Consult resources like uslegalforms for simplified guidance.