The New York Agreement to Incorporate as an S Corp and as a Small Business Corporation with Qualification for Section 1244 Stock is a legal document that outlines the process and requirements for incorporating a business under the specific designations of an S Corporation and a Small Business Corporation with qualification for Section 1244 Stock in the state of New York. This agreement is crucial for small businesses looking to establish themselves as S Corporations while enjoying the tax benefits offered by Section 1244 Stock. When incorporating as an S Corporation in New York, businesses can take advantage of the benefits provided by this specific tax status. An S Corporation is a pass-through entity that allows owners to report business profits and losses on their personal tax returns rather than paying corporate taxes, thus avoiding double taxation. Additionally, qualifying for Section 1244 Stock offers certain advantages for small businesses, primarily in the form of potential tax deductions for losses incurred during the initial stages of business development. There aren't typically different types of New York Agreements to Incorporate as an S Corp and as a Small Business Corporation with Qualification for Section 1244 Stock. However, customization is possible based on specific requirements or preferences outlined by the business owners and their legal advisors or incorporating entity. The agreement will typically include clauses related to the business's preferred name, its purpose, the board of directors structure, ownership percentages, shareholder rights and obligations, procedures for issuing and transferring stock, and the distribution of profits and losses among shareholders. Incorporating as an S Corporation and qualifying for Section 1244 Stock in New York involves several steps and requirements. Some key factors to consider are: 1. Eligibility criteria: There are certain conditions that a business must meet to qualify for S Corporation status. It must be a domestic corporation, have only allowable shareholders (including individuals, some trusts, and estates), maintain a maximum of 100 shareholders, and have only one class of stock. 2. Filing the necessary paperwork: To incorporate as an S Corporation in New York, businesses must file the appropriate documents with the New York Department of State, usually the Articles of Incorporation or a Certificate of Incorporation. 3. Applying for Section 1244 Stock qualification: Businesses can elect to qualify their stock under Section 1244 by meeting specific criteria outlined by the Internal Revenue Service (IRS). This section allows shareholders to deduct losses on stock investments if the business fails, potentially reducing their tax liability. 4. Compliance with ongoing requirements: Once incorporated, businesses must adhere to certain ongoing requirements, such as filing annual reports, holding shareholder and board of directors meetings, and maintaining corporate records. 5. Seeking professional advice: Incorporating as an S Corporation and qualifying for Section 1244 Stock involves complex legal and tax considerations. It is essential to consult with legal and financial professionals with expertise in New York business law and tax regulations to ensure compliance and maximize the benefits of these designations. In summary, the New York Agreement to Incorporate as an S Corp and as a Small Business Corporation with Qualification for Section 1244 Stock is a crucial legal document for businesses seeking to incorporate under specific designations in New York. By incorporating as an S Corporation and qualifying for Section 1244 Stock, businesses can enjoy tax advantages and potential deductions while operating with the legal structure and benefits provided by these designations.

New York Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock

Description

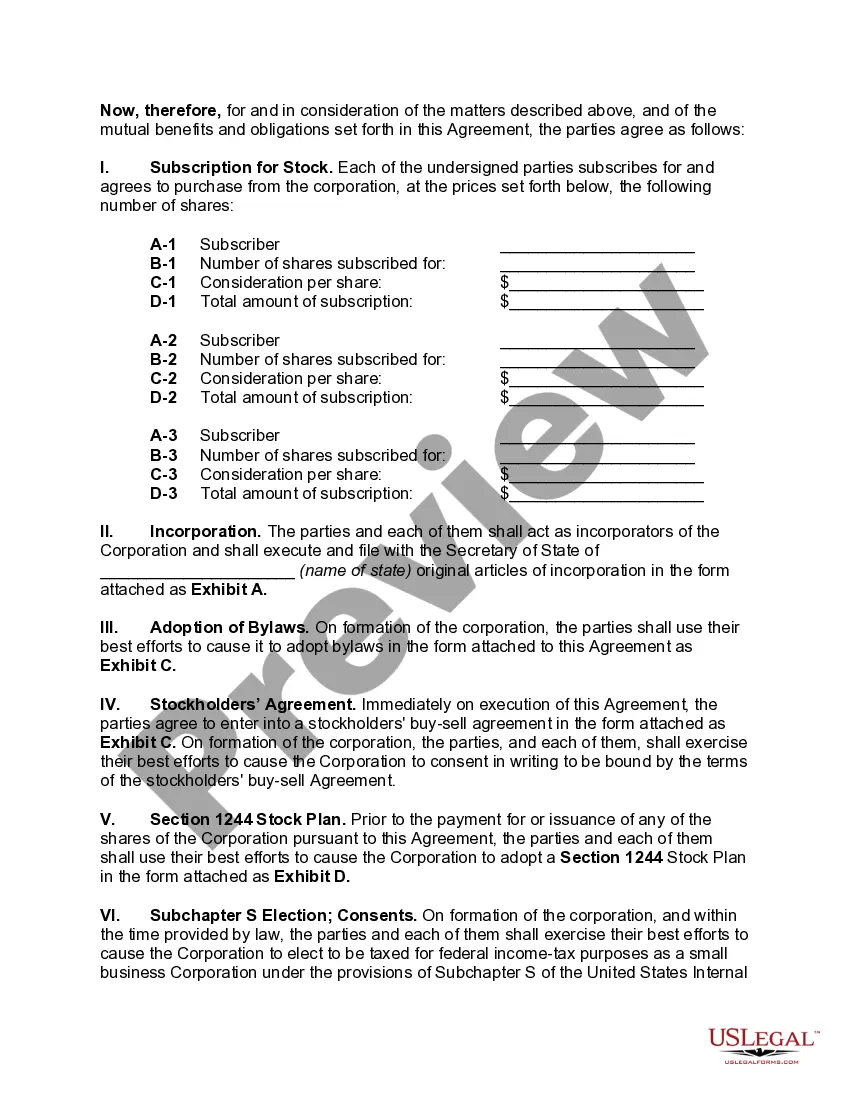

How to fill out Agreement To Incorporate As An S Corp And As Small Business Corporation With Qualification For Section 1244 Stock?

Are you presently in a position where you require documents for both professional or personal purposes almost all the time.

There are numerous legal document templates accessible online, but finding ones you can trust is not simple.

US Legal Forms offers a vast collection of form templates, such as the New York Agreement to Incorporate as an S Corporation and Small Business Corporation with Qualification for Section 1244 Stock, designed to comply with state and federal regulations.

Utilize US Legal Forms, the most extensive selection of legal documents, to save time and prevent errors.

The service provides professionally crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you'll be able to download the New York Agreement to Incorporate as an S Corporation and Small Business Corporation with Qualification for Section 1244 Stock template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct state/region.

- Utilize the Review button to examine the form.

- Read the details to confirm you have selected the correct form.

- If the form isn’t what you are looking for, use the Search field to locate the form that meets your needs.

- Once you obtain the appropriate form, click Purchase now.

- Choose the pricing plan you prefer, fill in the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- Select a suitable file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain another copy of the New York Agreement to Incorporate as an S Corporation and Small Business Corporation with Qualification for Section 1244 Stock at any time, if needed. Simply click on the required form to download or print the document template.

Form popularity

FAQ

Under the current 2020 tax tables, a long-term capital gain that results from the sale of this Section 1244 stock will be taxed at the regular preferential rate of 15% for most individuals or 20% for high-income individuals with taxable income over $441,450. The 3.8% Net Investment Income Tax (NIIT) may also be due.

1244 stock is available only to individuals and partners in partnerships. The ruling held that if IRC Sec. 1244 stock is issued to S corporations, such corporations and their shareholders may not treat losses on such stock as ordinary losses. This is so notwithstanding IRC Sec.

1244(b)). Any loss in excess of the limit is a capital loss, subject to the capital loss rules. Thus, if the potential loss exceeds the $50,000 (or $100,000) limit, the stock should be disposed of in more than one year to maximize the ordinary loss treatment.

Qualifying for Section 1244 StockThe shareholder must have purchased the stock and not received it as compensation. Only individual shareholders who purchase the stock directly from the company qualify for the special tax treatment. A majority of the corporation's revenues must come directly from operations.

S corporations as small business corporations. S corporations can issue Section 1244 stock.

Section 1244 stock is a stock transaction pursuant to the Internal Revenue Code provision that allows shareholders of an eligible small business corporation to treat up to $50,000 of losses (or, in the case of a husband and wife filing a joint return, $100,000) from the sale of stock as ordinary losses instead of

Qualifying for Section 1244 StockThe stock must be issued by U.S. corporations and can be either a common or preferred stock.The corporation's aggregate capital must not have exceeded $1 million when the stock was issued and the corporation cannot derive more than 50% of its income from passive investments.More items...

Section 1244 of the Internal Revenue Code allows eligible shareholders of domestic small business corporations to deduct a loss on the disposal of such stock as an ordinary loss rather than a capital loss. Eligible investors include individuals, partnerships and LLCs taxed as partnerships.