New York Startup Costs Worksheet

Description

How to fill out Startup Costs Worksheet?

Locating the appropriate legal document template can be quite challenging. Certainly, there are numerous designs available online, but how can you find the legal form you require? Access the US Legal Forms website.

The service offers a multitude of templates, including the New York Startup Costs Worksheet, which you can utilize for business and personal purposes. All of the documents are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to access the New York Startup Costs Worksheet. Use your account to browse through the legal documents you have previously purchased. Proceed to the My documents section of your account to get an additional copy of the document you need.

Choose the submission format and download the legal document template to your device. Complete, edit, print, and sign the obtained New York Startup Costs Worksheet. US Legal Forms is the largest collection of legal templates where you can find various document designs. Utilize the service to acquire properly-crafted papers that adhere to state requirements.

- First, ensure that you have selected the correct form for your area/state.

- You can preview the form using the Preview button and review the form description to confirm that it is suitable for you.

- If the form does not meet your requirements, use the Search field to find the appropriate form.

- Once you are confident that the form is correct, click on the Purchase now button to obtain the form.

- Select the pricing plan you prefer and enter the necessary details.

- Create your account and pay for your order using your PayPal account or credit card.

Form popularity

FAQ

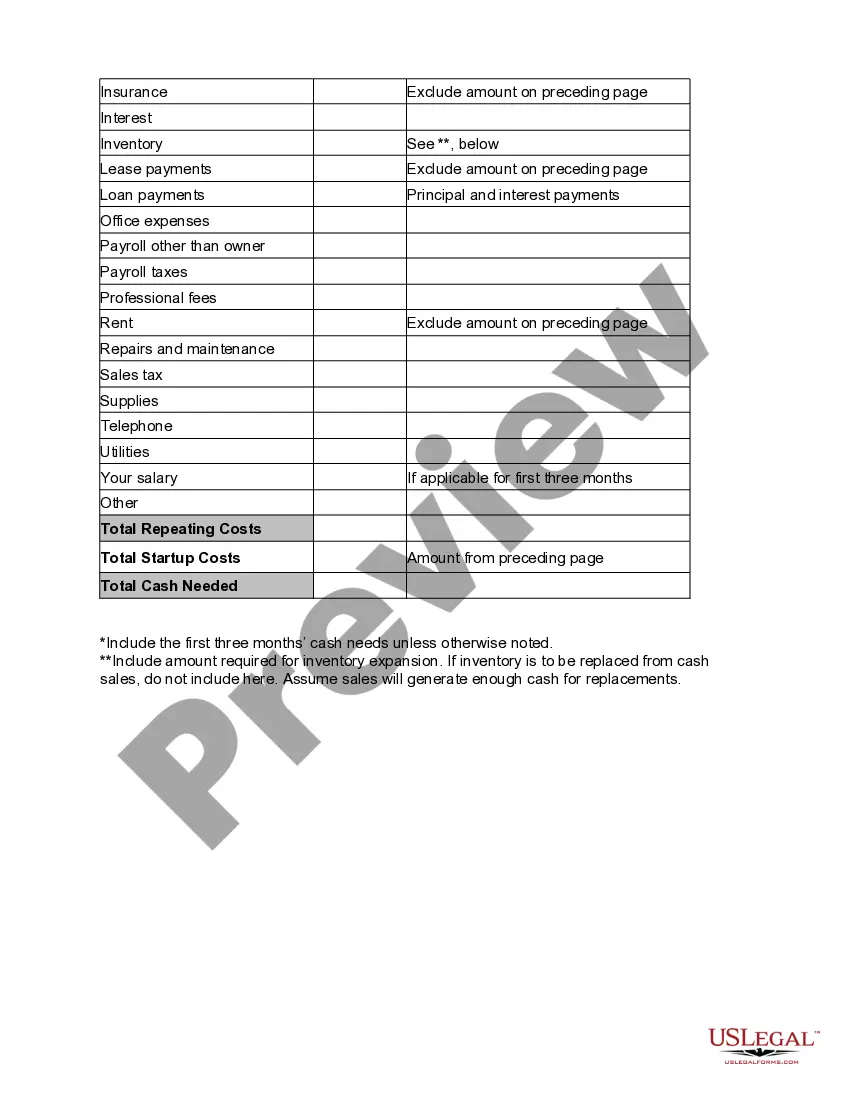

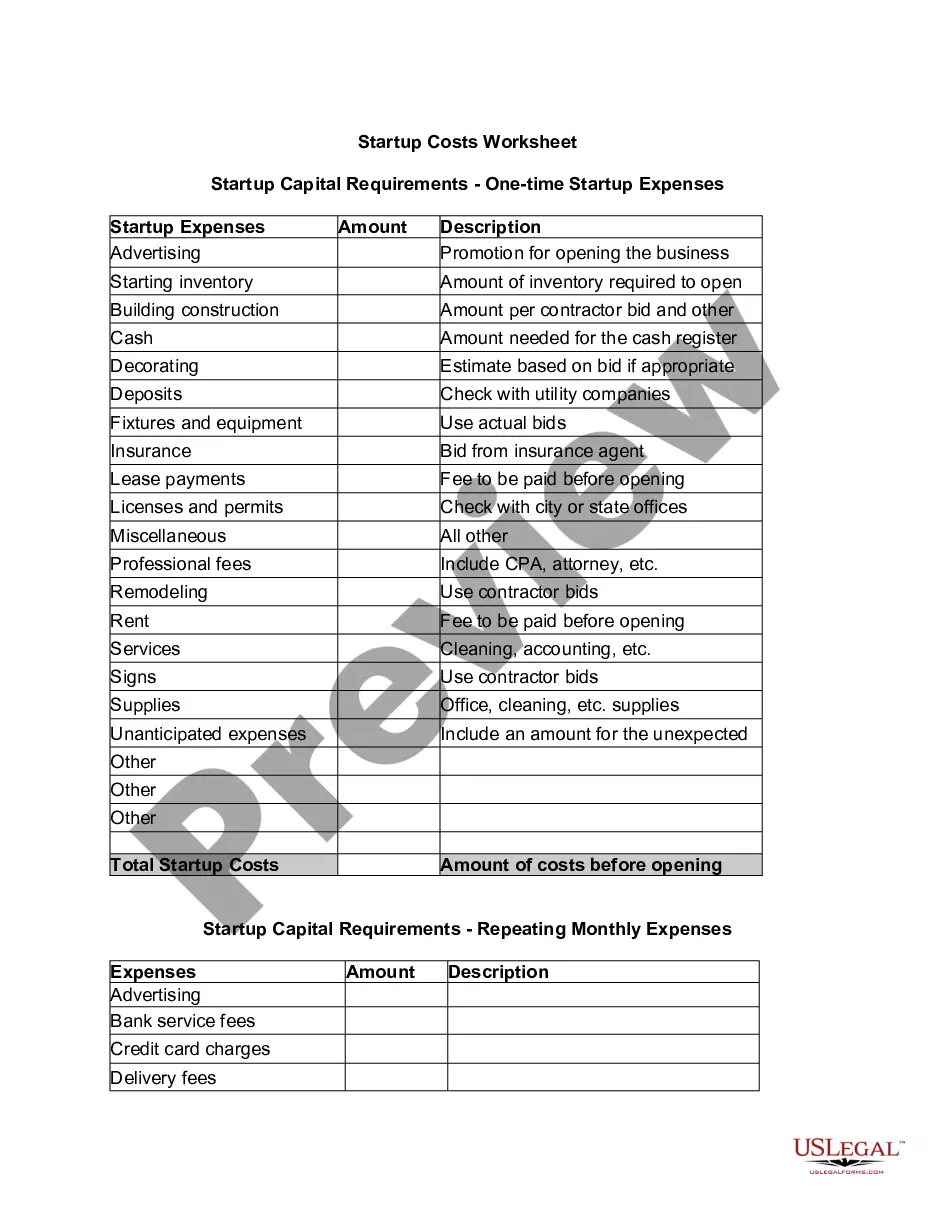

To report startup costs, document them on your tax returns as either business expenses or capital investments, depending on your situation. The IRS provides guidelines for reporting these costs. Using the New York Startup Costs Worksheet will keep your records organized, making filing easier and more efficient.

Startup costs typically appear in the 'Assets' section of your balance sheet, specifically under 'Other Assets' or 'Deferred Costs.' These costs should be recorded until your business starts generating revenue. To simplify this process, consider utilizing the New York Startup Costs Worksheet to ensure accurate placement and documentation of each expense.

How to calculate startup costsIdentify your expenses. Start by writing down the startup costs you've already incurred but don't stop there.Estimate your costs. Once you've developed a list of your business needs, note the average cost for each category.Do the math.Add a cushion.Put the numbers to work.

Under Generally Accepted Accounting Principles, you report startup costs as expenses incurred at the time you spend the money. Some of your initial expenses, such as buying equipment, are not classified as startup costs under GAAP and have to be capitalized, not expensed.

Start-Up Expenses are reported in aggregate - one amount equal to the total of all expenses incurred. For active business activities, these costs are entered either under Assets/Depreciation or under Business Expenses depending...

Begin by adding up all your startup costs and costs for organizing your new business. Subtract the costs for the of $5,000 for startup costs and $5,000 for organizational costs that you can deduct in the first year.

Start-Up Expenses are reported in aggregate - one amount equal to the total of all expenses incurred. For active business activities, these costs are entered either under Assets/Depreciation or under Business Expenses depending...

The IRS allows you to deduct $5,000 in business startup costs and $5,000 in organizational costs, but only if your total startup costs are $50,000 or less. If your startup costs in either area exceed $50,000, the amount of your allowable deduction will be reduced by the overage.

To qualify as startup costs, the costs must be ones that could be deducted as business expenses if incurred by an existing active business and must be incurred before the active business begins (Sec. 195(c)(1)).

For those companies reporting under US GAAP, Financial Accounting Standards Codification 720 states that start up/organization costs should be expensed as incurred.