The New York Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is a document that homeowners in New York can obtain to claim an exemption from reporting the sale or exchange of their principal residence to the state tax authorities. This certification serves as proof that the transaction falls under the exemption criteria set by the state, ensuring that the homeowner is not required to report the details of the sale or exchange for tax purposes. Keywords: New York, Certification of No Information Reporting, Sale or Exchange, Principal Residence, Tax Exemption There are two main types of New York Certifications of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption available: 1. Regular Certification: The regular certification is obtained by homeowners who meet the eligibility criteria for the tax exemption on the sale or exchange of their primary residence. This certification requires homeowners to provide necessary supporting documents and information requested by the New York State Department of Taxation and Finance. 2. Streamlined Certification: The streamlined certification is a simplified version of the regular certification. It is designed for homeowners who are eligible for the tax exemption and meet specific criteria that make them eligible for a streamlined process. This type of certification requires less documentation and is generally quicker to obtain. When applying for either type of certification, homeowners must provide relevant details about the sale or exchange of their principal residence, including the address, date of sale, purchase price, and any applicable exemptions or exclusions. Additionally, they may need to provide supporting documentation such as a copy of the deed, closing documents, or a residency certificate. It is important to note that obtaining the New York Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption does not exempt homeowners from reporting the sale or exchange to the Internal Revenue Service (IRS). Homeowners may still need to report the transaction for federal tax purposes, following the guidelines set by the IRS. By obtaining the certification, homeowners can benefit from the tax exemption provided by the state of New York, while also ensuring compliance with the reporting requirements. This certification offers peace of mind for homeowners who are selling or exchanging their principal residence, knowing that they have fulfilled their tax obligations in accordance with the state regulations. In summary, the New York Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption provides homeowners in New York with an opportunity to claim an exemption from reporting the sale or exchange of their principal residence to the state tax authorities. By meeting the eligibility criteria and providing the necessary documentation, homeowners can obtain either a regular or streamlined certification, allowing them to enjoy the tax exemption while complying with state regulations.

Certification For No Information Reporting

Description

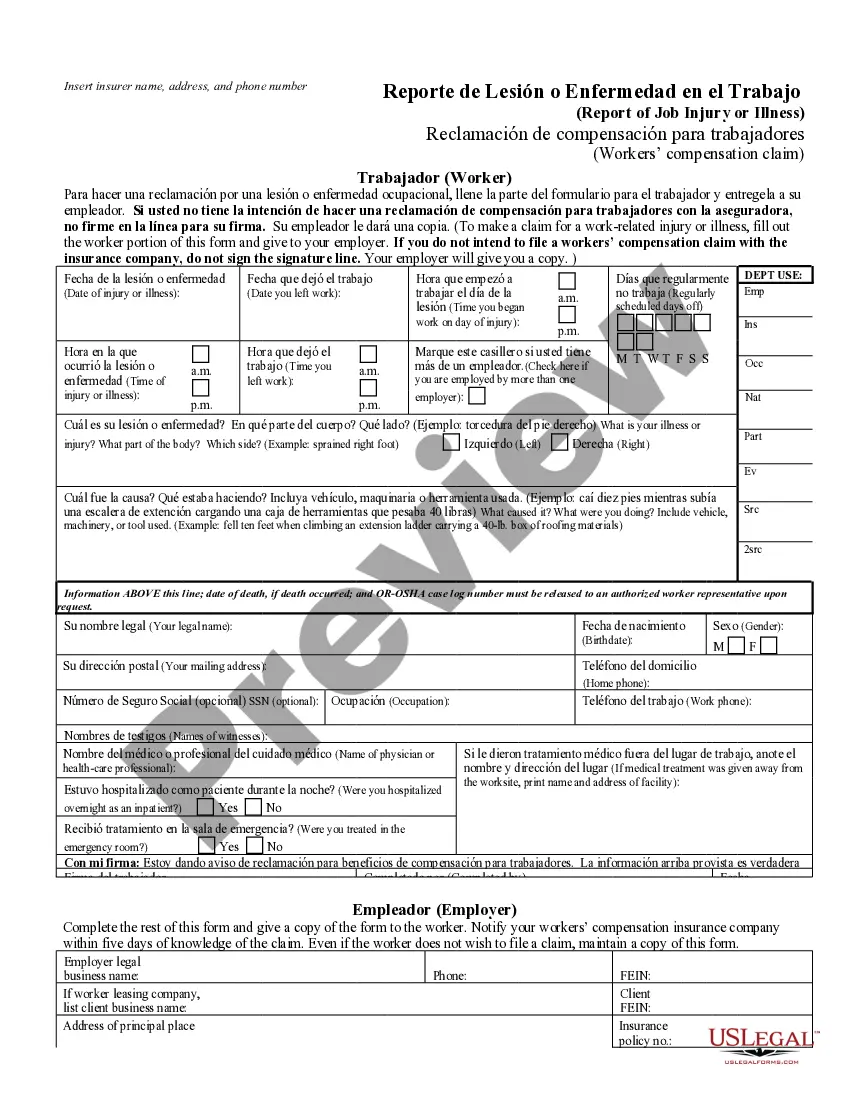

How to fill out New York Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

US Legal Forms - one of the biggest libraries of legitimate types in the USA - provides a variety of legitimate file web templates you may obtain or printing. Using the internet site, you may get a huge number of types for enterprise and personal reasons, categorized by groups, states, or key phrases.You will discover the latest versions of types much like the New York Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption in seconds.

If you already have a subscription, log in and obtain New York Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption from your US Legal Forms library. The Acquire button will appear on each type you look at. You gain access to all previously saved types inside the My Forms tab of your respective profile.

In order to use US Legal Forms for the first time, listed below are easy instructions to get you started out:

- Ensure you have picked out the right type for your area/state. Select the Review button to analyze the form`s content. See the type outline to actually have selected the appropriate type.

- If the type doesn`t satisfy your requirements, utilize the Lookup field at the top of the display to discover the one which does.

- Should you be satisfied with the shape, confirm your selection by clicking on the Acquire now button. Then, choose the prices prepare you like and provide your references to register to have an profile.

- Method the transaction. Make use of your Visa or Mastercard or PayPal profile to perform the transaction.

- Find the file format and obtain the shape on your system.

- Make modifications. Complete, change and printing and sign the saved New York Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption.

Each format you included in your money does not have an expiry date and is your own eternally. So, if you wish to obtain or printing an additional backup, just visit the My Forms portion and click about the type you will need.

Gain access to the New York Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption with US Legal Forms, the most extensive library of legitimate file web templates. Use a huge number of expert and status-particular web templates that fulfill your company or personal demands and requirements.

Form popularity

FAQ

The State of New York does have a 4% state sales tax and permits local authorities to obtain a 4.875% local choice sales tax. There are 640 local tax authorities in the state, with a median local tax of 4.254%.

In New York, the seller of the property is typically the individual responsible for paying the real estate transfer tax. However, if the seller doesn't pay or is exempt from the tax, the buyer must pay.

The only way to minimize the transfer tax for sellers is through the use of a purchase CEMA, which is also known as a splitter.

The NY transfer tax rate is computed at two dollars for every $500 of consideration. If the property sale price is $1 million or more, an additional tax of 1% of the sale price is applied. This is often referred to as a mansion tax. The seller pays NY transfer tax in a sale transaction.

Generally, however, the taxes are 15% for residents of the United States who live in New York State. In addition, approximately 10% is added for city taxes. Some individuals will be able to qualify for not having to pay Capital Gains.

As far as the effect the length of time you've owned a home is concerned, any real estate in New York that is purchased and sold within a year is subject to being taxed as ordinary income at the applicable 35% rate.

Estimated Income Tax Payment Form. For use on sale or transfer of real property by a nonresident of New York State.

New York City residents must pay a Personal Income Tax which is administered and collected by the New York State Department of Taxation and Finance. Most New York City employees living outside of the 5 boroughs (hired on or after January 4, 1973) must file Form NYC-1127.

(a) The following shall be exempt from payment of the real estate transfer tax: 1. The state of New York, or any of its agencies, instrumentalities, political subdivisions, or public corporations (including a public corporation created pursuant to agreement or compact with another state or the Dominion of Canada). 2.

Form IT-2663 must be signed by the nonresident transferor/seller (an individual, a trustee, an executor, or other fiduciary of an estate or trust).