A New York sublease agreement for commercial property is a legal document that outlines the terms and conditions for subleasing a commercial space in New York. It allows the original tenant, known as the sublessor, to rent out a portion or the entire commercial property to a third party, known as the sublessee, for a specified duration within the original lease term. This comprehensive agreement includes key details such as the names and contact information of all parties involved, the property address, the start and end dates of the sublease, and the agreed upon rent amount. Additionally, it covers various aspects related to the use and maintenance of the commercial property, ensuring a transparent and mutually beneficial arrangement between the sublessor and sublessee. The New York sublease agreement for commercial property also covers important clauses covering liabilities, repairs and maintenance responsibilities, alterations to the premises, insurance requirements, default conditions, and dispute resolution procedures. These clauses provide legal protection and clarity for both parties involved, minimizing potential conflicts or misunderstandings. There are several types of New York sublease agreements for commercial property, each serving specific needs: 1. Gross Sublease Agreement: Here, the sublessee pays a fixed amount of rent to the sublessor, which typically covers all operating expenses, including utilities, taxes, and insurance. This simplifies the financial arrangement for the sublessee. 2. Percentage Sublease Agreement: With this type of sublease, the sublessee pays a percentage of their gross sales as rent, providing flexibility based on the success or revenue generated by the sublessee's business. 3. Modified Gross Sublease Agreement: This agreement involves the sublessee paying a base rent along with additional costs such as taxes, insurance, or maintenance fees. The specific expenses to be borne by the sublessee are clearly defined in the agreement. 4. Net Sublease Agreement: In this arrangement, the sublessee is responsible for paying a base rent as well as a portion of the operating expenses incurred. Typically, the sublessee covers a share of costs such as taxes, insurance, utilities, and maintenance. A New York sublease agreement for commercial property plays a crucial role in establishing a clear understanding between the sublessor and sublessee. By outlining all relevant terms, rights, and obligations, it helps foster a professional and harmonious subleasing relationship, benefiting both parties involved.

New York Sublease Agreement for Commercial Property

Description

How to fill out Sublease Agreement For Commercial Property?

If you need to acquire, obtain, or print out legal document templates, utilize US Legal Forms, the foremost collection of legal forms available online.

Leverage the site’s straightforward and user-friendly search to find the documents you require. Various templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to secure the New York Sublease Agreement for Commercial Property with just a few clicks.

Every legal document template you purchase is yours forever. You will have access to every form you acquired within your account. Click the My documents section and choose a form to print or download again.

Stay competitive and obtain, and print the New York Sublease Agreement for Commercial Property with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to obtain the New York Sublease Agreement for Commercial Property.

- You can also access documents you previously acquired from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct city/state.

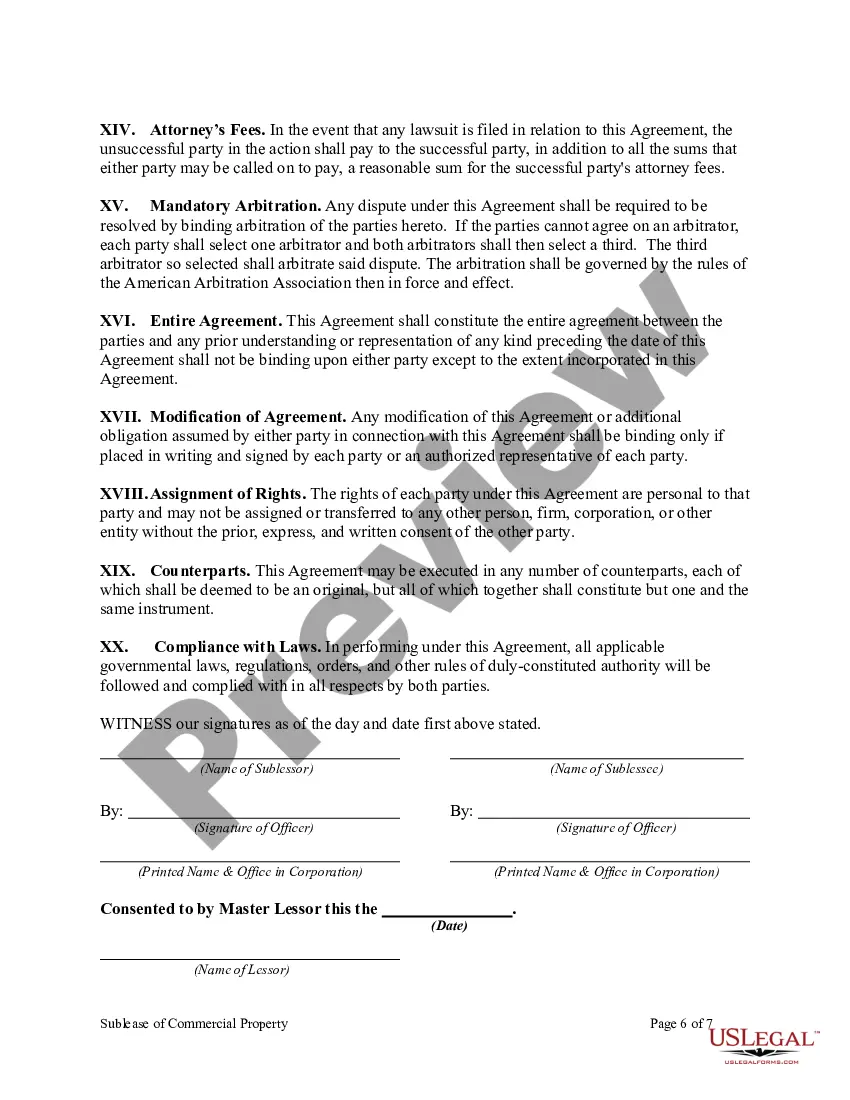

- Step 2. Use the Preview option to review the form's content. Don't forget to read the instructions.

- Step 3. If you are not satisfied with the type, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing option you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it onto your device.

- Step 7. Complete, modify, and print or sign the New York Sublease Agreement for Commercial Property.

Form popularity

FAQ

Is Subletting Illegal? In most cases, subletting is legal if the tenant obtains the landlords permission to let out the rental property. However, if the tenant sublets without written permission, they could come into legal difficulties.

Typically, you must obtain written consent from your landlord before you can sublet a property. In most cases, a landlord will state in the master lease that subletting is either not permitted or is allowed with consent of the landlord.

Sublet Cons for LandlordsInconsistent screening procedures. If you don't require that all subtenants must be screened by the landlord, you'll have no idea about the caliber of tenant subleasing your property.Subtenant may not be reliable.Property damage.Lease violations or eviction.

A sublease occurs when the original owner does not lease the premises to you, but there is another person or entity in between you and the landlord. That is, the property owner rents to someone else, and then that person rents to you. Subleases are common in both commercial and residential properties.

Most commercial leases forbid subletting. There is a good reason for that. As soon as more than two parties are involved, agreement becomes more difficult and conflict more likely. Furthermore, the head landlord, who of course owns the property, is less able to enforce his rights.

A notary can play an important role in making sure that a contract is legally enforceable, even if notarization isn't necessary. Just like wills, there is generally no requirement that a contract be notarized in order to be legally binding.

Subletting is legal in NYC. However, there are certain restrictions to navigate before you put ads on Craigslist. For example, you can only sublet your NYC apartment if the building has four or more units. Additionally, some tough restrictions make it difficult to sublease to a short-term resident.

The short answer is No a witness does not need to sign But, there are some exceptions and things to consider. Most agreements do not need witnesses to sign them. Most agreements do not even need to be signed by the parties entering into the agreement. Most agreements do not even need to be in writing.

According to New York State law, most tenants have the legal right to sublet their apartment. However, you still have to ask your landlord for permission to sublet your apartment. The first thing you should do is to notify your landlord of your desire to sublet as they will likely have a procedure in place.

No, lease agreements do not need to be notarized in New York. Since leases are treated much the same as a standard contract in this state, notarization is not necessary.