Title: New York Sample Letters for Collection Notices for Unpaid Bills — Detailed Descriptions and Varied Types Introduction: In the hustle and bustle of New York City, managing bills and debts can sometimes be challenging. When faced with unpaid bills, sending a collection notice is a crucial step to remind individuals or businesses of their outstanding obligations. This article will provide you with a detailed description of what a New York sample letter for collection notice for an unpaid bill entails. Additionally, it highlights different types of collection notices commonly used in New York. 1. New York Sample Letter for Collection Notice for Unpaid Bill: The New York sample letter for a collection notice serves as a formal communication to individuals or businesses who have failed to pay their outstanding debts. This letter emphasizes the overdue payment, the details of the bill, and informs the recipient of the consequences of non-payment. It also provides a deadline for payment and instructs the recipient on how to make the payment. 2. Personal Unpaid Bill Collection Notice: This type of collection notice is specifically intended for unpaid bills related to personal expenses, such as credit card bills, medical bills, utilities, or personal loans. The letter emphasizes the personal consequences of non-payment, including potential credit damage, late fees, or legal action. 3. Business Unpaid Bill Collection Notice: For businesses dealing with unpaid bills from their clients or customers, a collection notice tailored for business use is essential. This letter highlights the overdue payment, potential damage to the business relationship, and may offer alternative payment options or negotiation possibilities to encourage resolution. 4. Legal Unpaid Bill Collection Notice: In certain cases, when other collection efforts have failed, businesses or individuals may choose to send a collection notice that includes legal implications. This type of letter underscores the potential involvement of legal action, such as hiring a collection agency, filing a lawsuit, or reporting the unpaid debt to credit reporting agencies. 5. Final Notice Collection Letter: If previous collection attempts have been unsuccessful, a final notice may be necessary to warn the debtor that legal actions may be taken. This type of collection letter reiterates the outstanding balance, the consequences of continued non-payment, and usually provides the last chance or a specific deadline to settle the debt before further actions are initiated. Conclusion: Managing unpaid bills is a common challenge in New York, and using sample collection notices can help individuals and businesses streamline their debt collection efforts. This article has outlined a detailed description of New York sample letters for collection notices, which include personal unpaid bill collection notices, business unpaid bill collection notices, legal unpaid bill collection notices, and final notice collection letters. By tailoring the letters to the intended recipients and incorporating relevant keywords, debtors can be encouraged to address their unpaid bills more promptly.

New York Sample Letter for Collection Notice for Unpaid Bill

Description

How to fill out New York Sample Letter For Collection Notice For Unpaid Bill?

Are you in the place in which you need to have paperwork for either organization or individual functions nearly every day time? There are a lot of legal papers templates accessible on the Internet, but locating kinds you can depend on is not straightforward. US Legal Forms gives a large number of type templates, such as the New York Sample Letter for Collection Notice for Unpaid Bill, that are created in order to meet federal and state demands.

Should you be already acquainted with US Legal Forms site and also have a merchant account, simply log in. Next, it is possible to download the New York Sample Letter for Collection Notice for Unpaid Bill design.

Should you not offer an profile and want to start using US Legal Forms, abide by these steps:

- Find the type you will need and ensure it is for the proper city/county.

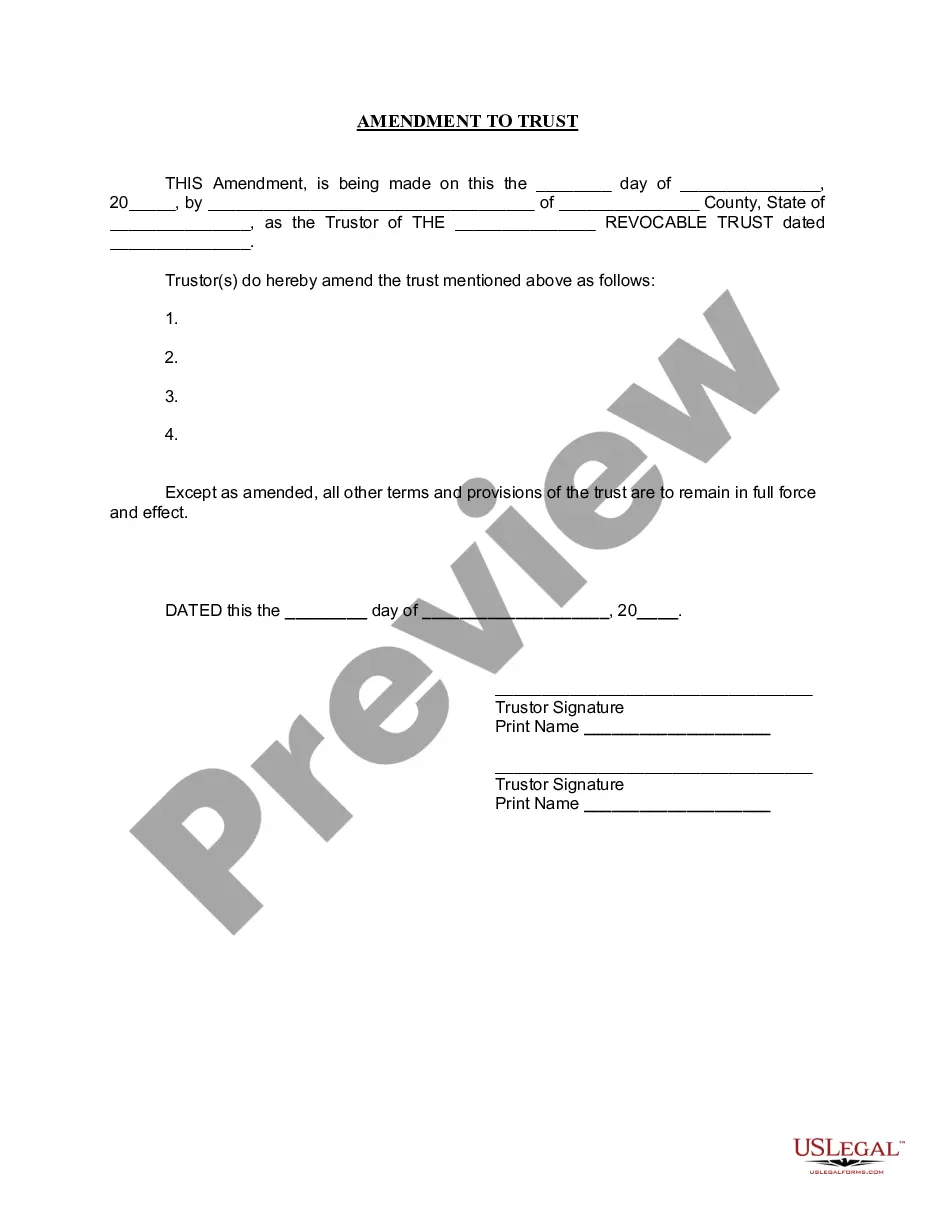

- Utilize the Review button to review the form.

- Look at the outline to actually have chosen the correct type.

- When the type is not what you`re looking for, utilize the Lookup discipline to obtain the type that fits your needs and demands.

- Whenever you get the proper type, simply click Acquire now.

- Select the pricing prepare you desire, fill out the necessary information to create your money, and pay for your order utilizing your PayPal or credit card.

- Pick a hassle-free file format and download your version.

Locate every one of the papers templates you may have purchased in the My Forms menu. You can obtain a further version of New York Sample Letter for Collection Notice for Unpaid Bill any time, if needed. Just go through the needed type to download or printing the papers design.

Use US Legal Forms, by far the most extensive collection of legal kinds, to save time as well as steer clear of faults. The support gives professionally made legal papers templates which can be used for a selection of functions. Make a merchant account on US Legal Forms and initiate producing your daily life easier.

Form popularity

FAQ

Dear debt collector, I am responding to your contact about collecting a debt. You contacted me by phone/mail, on date and identified the debt as any information they gave you about the debt. I do not have any responsibility for the debt you're trying to collect.

How to Write An Effective Collection LetterReference the products or services that were purchased.Maintain a friendly but firm tone.Remind the payee of their contract or agreement with you.Offer multiple ways the payee can take action.Add a personal touch.Give them a new deadline.

A debt collection letter should include the following information:The amount the debtor owes you.The initial due date of the payment.A new due date for the payment, whether ASAP or longer.Instructions on how to pay the debt.More items...?

Best Practices for Writing a Collection LetterInclude your contact information, including phone number, email address, and mailing address. Type the letter; don't handwrite it. Use company letterhead. Include a copy of the invoice(s) or a summarized statement for multiple outstanding invoices.

Collection Letter on Company Dear (name), We are writing you this letter to remind you that the payment for our services dated 23rd March 2020 is still due and we haven't received any payments till now. The due date for this payment was on 31st March 2020, but we didn't receive any check before that.

That information includes:The name of the creditor.The amount owed.That you can dispute the debt.That if you don't dispute the debt within 30 days the debt collector will assume the debt is valid.That if you dispute the debt in writing within 30 days the debt collector will provide verification of the debt.More items...?

It's imperative that you say as much as you can with as little text as possible. Remember to include the exact amount owed, the invoice number and the due date. Since this is a reminder email, no need to warn them about any penalties just yet. Please always remember to attach a copy of the invoice.

A collection letter is a written notification to inform a consumer of his due payments. It is an official message to a borrower. A collection letter may include reminders, inquiries, warnings or notification of possible legal actions.

It's imperative that you say as much as you can with as little text as possible. Remember to include the exact amount owed, the invoice number and the due date. Since this is a reminder email, no need to warn them about any penalties just yet. Please always remember to attach a copy of the invoice.

The Third Collection LetterMention of all previous attempts to collect.Invoice number and amount.Original invoice due date.Current days past due.Instructions on what they should do next.A warning of the impending consequences.Your contact information and final request to contact you.