This is a triple net lease between two Churches. A triple net lease is a lease agreement on a property where the tenant or lessee agrees to pay all Real Estate Taxes (Net), Building Insurance (Net) and Common Area Maintenance (Net) on the property in addition to any normal fees that are expected under the agreement (rent, etc.). In such a lease, the tenant or lessee is responsible for all costs associated with repairs or replacement of the structural building elements of the property.

New York Lease Agreement Between Two Nonprofit Church Corporations

Description

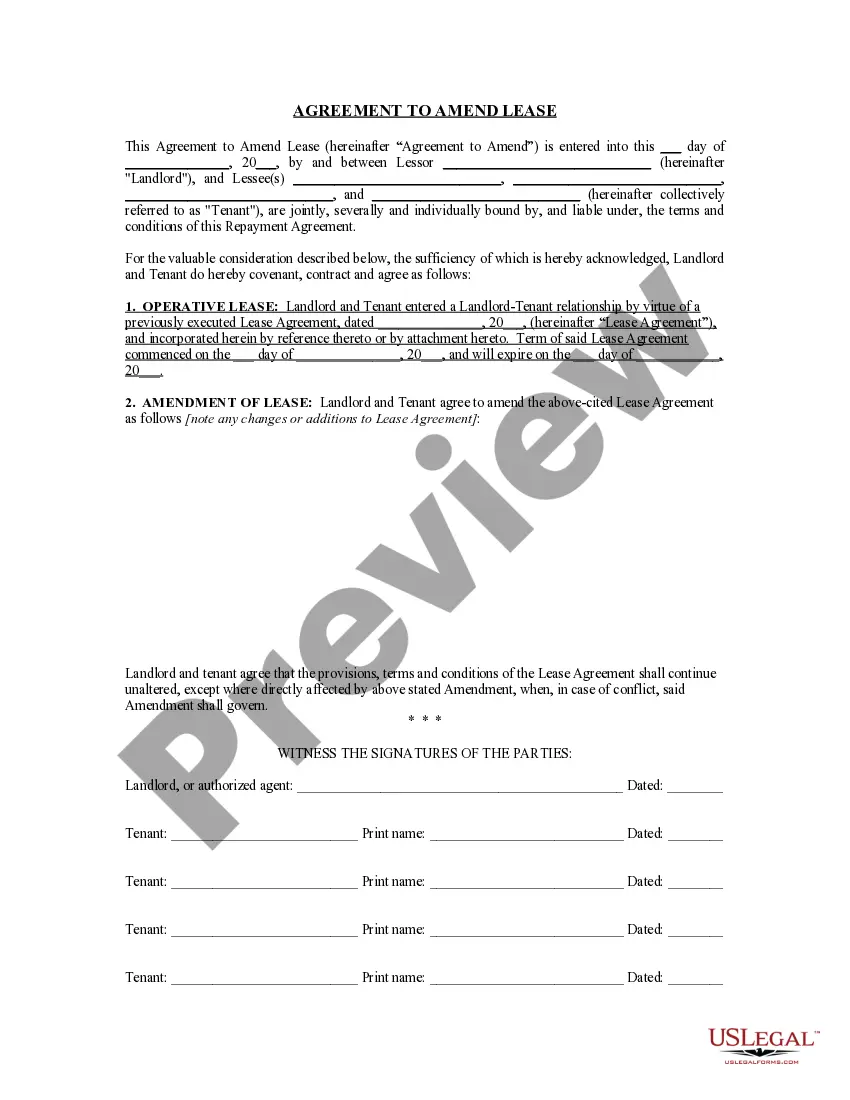

How to fill out Lease Agreement Between Two Nonprofit Church Corporations?

Finding the correct legal document template can be challenging.

Certainly, there are numerous templates available online, but how do you locate the legal form you require.

Utilize the US Legal Forms website. This service offers a vast array of templates, such as the New York Lease Agreement Between Two Nonprofit Church Corporations, suitable for both business and personal use.

You can review the form using the Preview option and check the form summary to confirm it’s the correct one for you.

- All the forms are evaluated by specialists and fulfill state and federal regulations.

- If you are already a member, Log In to your account and click on the Download button to obtain the New York Lease Agreement Between Two Nonprofit Church Corporations.

- Use your account to view the legal forms you have purchased previously.

- Navigate to the My documents section of your profile to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the right form for your city/region.

Form popularity

FAQ

Yes, churches in New York must register as nonprofit organizations to gain tax-exempt status. This registration allows them to operate legally and be recognized for their charitable activities. When managing a property, consider using a New York Lease Agreement Between Two Nonprofit Church Corporations to ensure compliance with state regulations and protect your church's interests.

A type B not for profit corporation in New York serves charitable purposes and can engage in various activities to fulfill its mission. These corporations must operate primarily for the benefit of the public or specific groups, such as educational or religious organizations. If your church is considering entering into a lease agreement, you may want to look into a New York Lease Agreement Between Two Nonprofit Church Corporations to ensure all legal aspects are addressed.

In New York, a 501(c)(3) nonprofit organization must have at least three board members who are not related to each other. This requirement ensures proper governance and accountability within the organization. When you establish a New York Lease Agreement Between Two Nonprofit Church Corporations, having an adequate board can influence decision-making and the overall effectiveness of your church's operations.

A religious corporation under New York law is an organization formed primarily for religious purposes. This type of corporation operates without the goal of generating profits and focuses instead on serving its community through spiritual and charitable activities. Understanding the legal definition helps when navigating agreements, such as a New York Lease Agreement Between Two Nonprofit Church Corporations, ensuring that your church operates within legal bounds.

Article 10 of the Religious Corporations Law provides regulations on the governance and administration of religious corporations in New York. It addresses issues like membership, meetings, and financial management. Understanding this article is vital if you are involved in a New York Lease Agreement Between Two Nonprofit Church Corporations, as these agreements must comply with the established regulations within this framework.

Yes, churches in New York are required to register with the Secretary of State if they are forming a corporation. Registration helps ensure legal recognition and compliance with state regulations. It is an essential step for a church that plans to manage property or enter into significant agreements, such as a New York Lease Agreement Between Two Nonprofit Church Corporations. This step protects the church's assets and supports its mission.

Section 12 of the New York Religious Corporation Law governs the powers and limitations of religious corporations in New York. It outlines how these entities can operate, including the authority to hold real property, enter contracts, and manage financial assets. This section is crucial for nonprofits, especially when forming agreements like a New York Lease Agreement Between Two Nonprofit Church Corporations, as it clarifies what your corporation can legally do.

A nonprofit religious corporation is an organization established for religious purposes without the intention of making a profit. These corporations are typically formed to promote religious activities, provide community services, or create a place of worship. They enjoy certain tax exemptions and legal protections provided under state and federal law. It is important to understand that when drafting a New York Lease Agreement Between Two Nonprofit Church Corporations, these legal characteristics create specific obligations and benefits.

To form a religious corporation in New York, start by choosing a unique name that complies with state guidelines. Next, prepare and file the Certificate of Incorporation with the New York Department of State. This document must include a statement of purpose and specific organizational details, such as the duration and office address. Finally, obtaining an Employer Identification Number (EIN) from the IRS is essential for operating as a nonprofit entity, especially if you are planning to create a New York Lease Agreement Between Two Nonprofit Church Corporations.

Article 12A of the New York State Real Property Law governs the leasing of real property, focusing on the rights and duties of landlords and tenants. This article stipulates key aspects of lease agreements, including duration, rental payments, and termination procedures. For those creating a New York Lease Agreement Between Two Nonprofit Church Corporations, familiarity with Article 12A ensures both parties uphold their legal obligations and protect their interests.