New York Sample Letter to Debt Collector Re Fair Debt Collection and Practices Act

Description

How to fill out Sample Letter To Debt Collector Re Fair Debt Collection And Practices Act?

It is possible to spend several hours on-line trying to find the authorized file web template that fits the state and federal needs you will need. US Legal Forms gives a huge number of authorized forms which can be evaluated by pros. You can easily download or print out the New York Sample Letter to Debt Collector Re Fair Debt Collection and Practices Act from the services.

If you currently have a US Legal Forms accounts, you may log in and click the Acquire key. After that, you may comprehensive, modify, print out, or indicator the New York Sample Letter to Debt Collector Re Fair Debt Collection and Practices Act. Each and every authorized file web template you purchase is the one you have eternally. To obtain another backup of the bought type, check out the My Forms tab and click the corresponding key.

Should you use the US Legal Forms web site the very first time, adhere to the basic recommendations beneath:

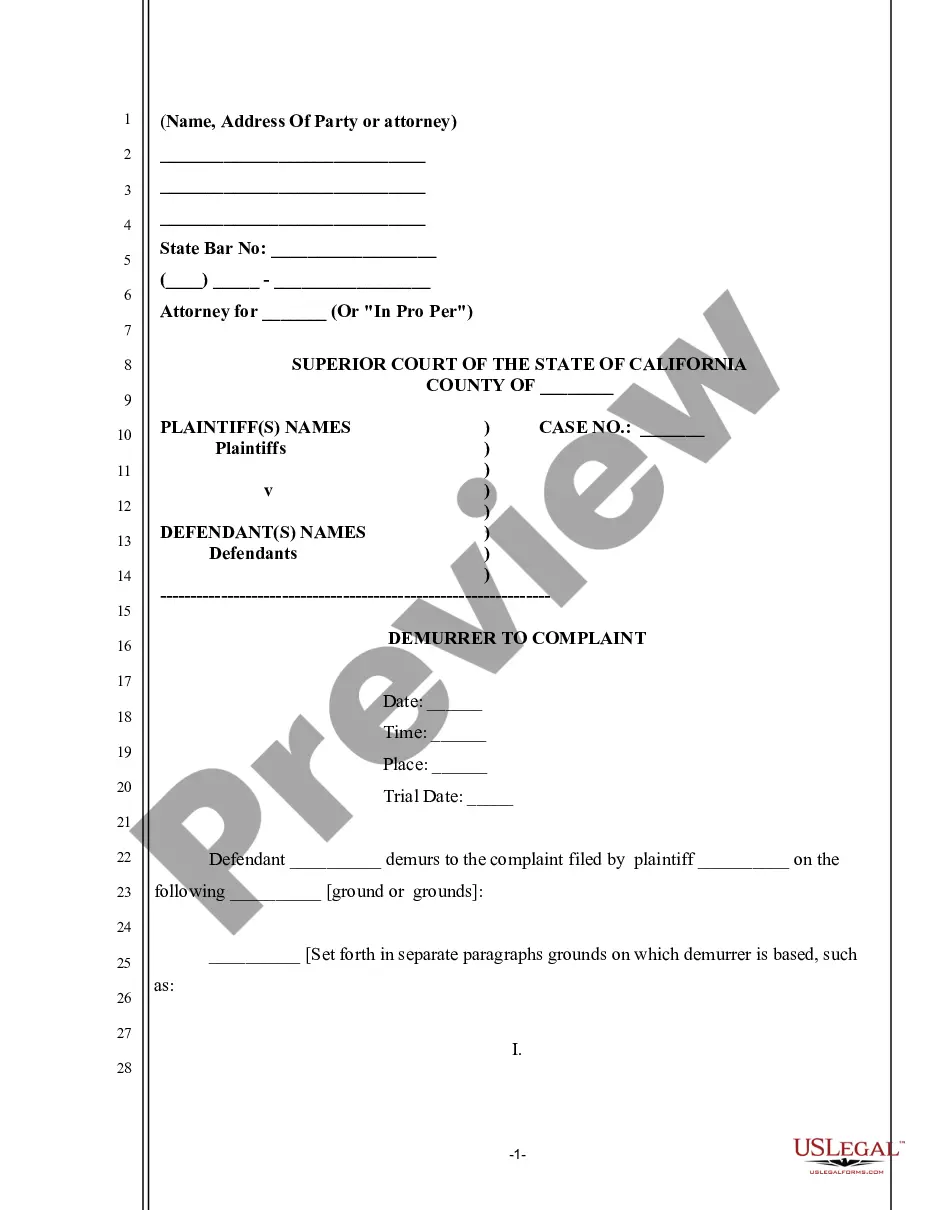

- Initially, be sure that you have selected the right file web template for the county/metropolis of your choosing. See the type information to ensure you have chosen the correct type. If offered, make use of the Review key to check through the file web template as well.

- If you wish to find another variation in the type, make use of the Look for field to obtain the web template that meets your needs and needs.

- After you have found the web template you need, just click Get now to move forward.

- Pick the prices strategy you need, type in your accreditations, and sign up for an account on US Legal Forms.

- Total the deal. You can utilize your credit card or PayPal accounts to fund the authorized type.

- Pick the file format in the file and download it in your product.

- Make adjustments in your file if necessary. It is possible to comprehensive, modify and indicator and print out New York Sample Letter to Debt Collector Re Fair Debt Collection and Practices Act.

Acquire and print out a huge number of file themes utilizing the US Legal Forms site, that offers the most important selection of authorized forms. Use skilled and status-specific themes to deal with your business or specific requirements.

Form popularity

FAQ

Effective April 7, 2022, the New York statute of limitations for debt collection lawsuits arising out of a consumer credit transaction is reduced from six years to three years. Also, payment toward the debt or written or oral affirmation of the debt by the consumer does not revive or extend the limitations period.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

The Fair Debt Collection Practices Act (FDCPA) is the main federal law that governs debt collection practices. The FDCPA prohibits debt collection companies from using abusive, unfair, or deceptive practices to collect debts from you.

Collectors are required by Fair Debt Collection Practices Act (FDCPA) to send you a written debt validation notice with information about the debt they're trying to collect. It must be sent within five days of the first contact. The debt validation letter includes: The amount owed.

Statute of Limitations in New York Thanks to a law passed in 2021, the statute of limitations of debt in New York is three years, which means that's how much time a debt collector has to file a lawsuit to recover the debt through the court system.

What Is the New York Fair Debt Collection Practices Act? New York's version of the FDCPA (sometimes referred to as the New York Debt Collection Procedures Act) is similar to the federal FDCPA. Congress passed the FDCPA back in 1978 to stop abusive debt collection practices used by certain debt collectors.

An effective debt collection letter should include all of the following: The total amount the client owes you. The original date the balance was due. Instructions detailing how to make the overdue payment. The new due date, whether a specific date or as soon as possible.

What Is the New York Fair Debt Collection Practices Act? New York's version of the FDCPA (sometimes referred to as the New York Debt Collection Procedures Act) is similar to the federal FDCPA. Congress passed the FDCPA back in 1978 to stop abusive debt collection practices used by certain debt collectors.