Title: Exploring the Types and Importance of New York Notice of Public Sale of Collateral (Consumer Goods) on Default Introduction: New York Notice of Public Sale of Collateral (Consumer Goods) on Default is a crucial document that plays a significant role in protecting the rights of lenders and borrowers in the state of New York. This article aims to provide a detailed description of this notice, its types, and their importance in ensuring a fair and efficient resolution in case of loan defaults. 1. Understanding the New York Notice of Public Sale of Collateral (Consumer Goods) on Default: The New York Notice of Public Sale of Collateral (Consumer Goods) on Default is a legal notification required by the Uniform Commercial Code (UCC) when a debtor defaults on their loan obligations. It serves as a formal announcement, alerting interested parties about the intention to sell the collateral to recover the outstanding debt. 2. Types of New York Notice of Public Sale of Collateral (Consumer Goods) on Default: a) General Notice of Public Sale: This type of notice states the intent to conduct a public sale of the collateral after the debtor's default. It includes details such as the date, time, and location of the sale, allowing interested parties an opportunity to participate or bid on the collateral. b) Notice to Secured Parties: In certain cases, a lender may be required to provide a specific notice to other secured parties who hold an interest in the same collateral. This notice ensures that all interested parties are aware of the intention to sell and have an opportunity to protect their interests accordingly. c) Notice to Debtor: A notice sent directly to the defaulting debtor, informing them of the intention to sell the collateral. This notice serves as a final warning or legal requirement before the sale takes place, urging the debtor to fulfill their obligations or seek a resolution. d) Notice of Time and Place of Public Sale: This notice provides interested parties with specific information about the date, time, and location of the public sale. It is critical for transparency, enabling potential bidders to plan their participation and ensuring fairness in the sale process. 3. Importance of New York Notice of Public Sale of Collateral (Consumer Goods) on Default: a) Protects Lenders' Rights: By issuing a New York Notice of Public Sale of Collateral (Consumer Goods) on Default, lenders protect their rights to recover the outstanding debt by selling the collateral. This notice also encourages the debtor to fulfill their obligations promptly. b) Ensures Transparency: The notice provides all interested parties with essential details regarding the upcoming sale, promoting transparency in the process. This transparency reduces the likelihood of disputes and upholds the principles of fair dealing. c) Allows Debtor a Chance to Remediate: Receiving the notice allows the debtor an opportunity to rectify the default, negotiate repayment terms, or object to the sale. It serves as a formal notification and often acts as a final warning before the sale proceeds. d) Encourages Competitive Bidding: Publicly announcing the sale of collateral enables multiple interested parties to participate, encouraging competitive bidding and potentially maximizing the recovery for the lender. Conclusion: In the realm of debt recovery and loan default resolutions, the New York Notice of Public Sale of Collateral (Consumer Goods) on Default holds immense significance. By understanding the various types of this notice and its importance, lenders, borrowers, and other interested parties can navigate the legal framework effectively, ensuring fair dealings and swift resolutions.

New York Notice of Public Sale of Collateral (Consumer Goods) on Default

Description

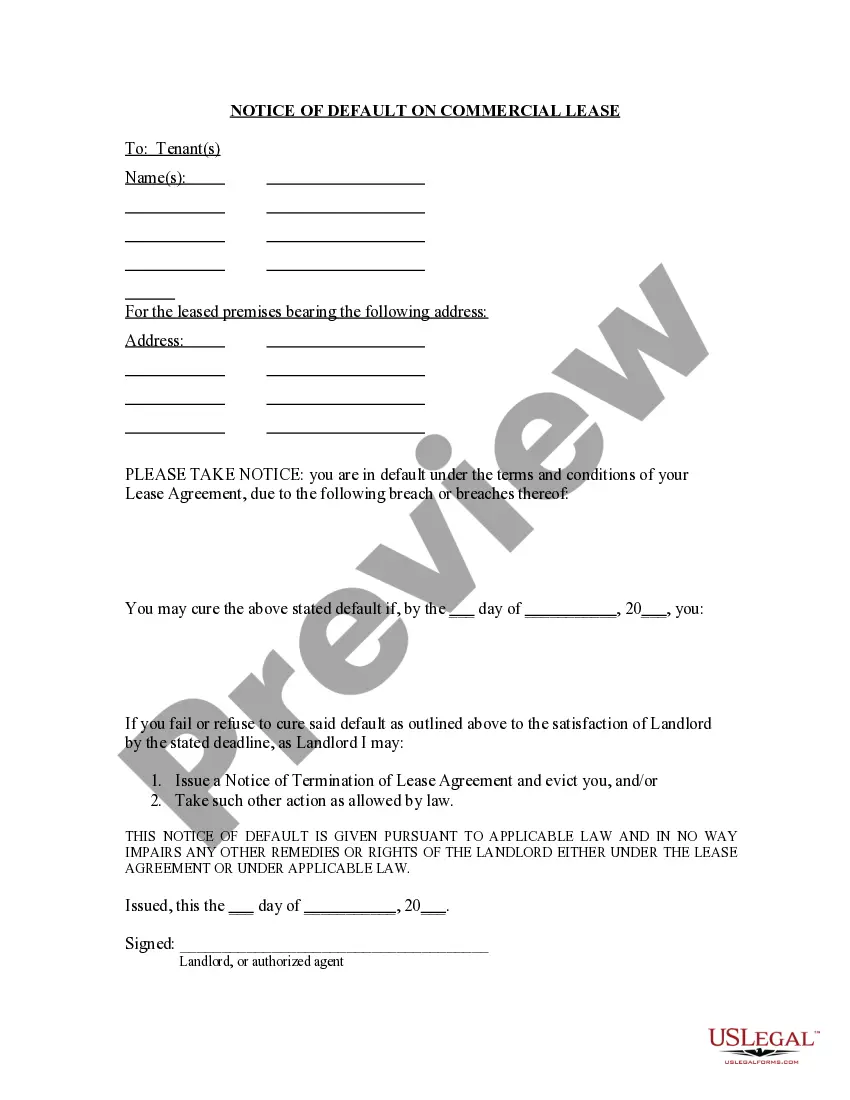

How to fill out New York Notice Of Public Sale Of Collateral (Consumer Goods) On Default?

It is possible to invest time on the web trying to find the authorized file web template which fits the federal and state demands you need. US Legal Forms offers a large number of authorized varieties that happen to be reviewed by professionals. You can easily down load or print the New York Notice of Public Sale of Collateral (Consumer Goods) on Default from our support.

If you have a US Legal Forms accounts, you may log in and then click the Acquire button. After that, you may complete, modify, print, or sign the New York Notice of Public Sale of Collateral (Consumer Goods) on Default. Every authorized file web template you acquire is yours permanently. To get one more version for any purchased form, visit the My Forms tab and then click the corresponding button.

If you are using the US Legal Forms web site the first time, keep to the simple instructions beneath:

- Initially, make certain you have chosen the best file web template to the state/town of your liking. Read the form information to make sure you have picked the proper form. If available, take advantage of the Preview button to check from the file web template as well.

- If you wish to find one more model of your form, take advantage of the Research field to find the web template that fits your needs and demands.

- Upon having discovered the web template you want, just click Acquire now to move forward.

- Find the prices strategy you want, type in your references, and register for your account on US Legal Forms.

- Total the deal. You should use your bank card or PayPal accounts to cover the authorized form.

- Find the format of your file and down load it to your device.

- Make changes to your file if necessary. It is possible to complete, modify and sign and print New York Notice of Public Sale of Collateral (Consumer Goods) on Default.

Acquire and print a large number of file templates while using US Legal Forms web site, that offers the biggest assortment of authorized varieties. Use expert and condition-certain templates to tackle your organization or individual requires.

Form popularity

FAQ

As noted in Chapter 3 (The Nature of Secured Credit under Article 9), Article 9 generally governs only consensual liens on personal property, i.e., security interests in personal property created by agreement. The creation of most other types of liens is largely outside the scope of Article 9.

Article 9 is an article under the Uniform Commercial Code (UCC) that governs secured transactions, or those transactions that pair a debt with the creditor's interest in the secured property.

On the debtor's default, a secured party can take possession (peacefully or by the court order) of the collateral covered by the security agreement. This provision, because it occurs without the use of the judicial process, is often referred to as the "self-help" provision of article 9.

Article 9 is a section under the UCC governing secured transactions including the creation and enforcement of debts. Article 9 spells out the procedure for settling debts, including various types of collateralized loans and bonds.

Under Section 9-611 of the Uniform Commercial Code, a secured creditor is required, in most circumstances, to send a reasonable authenticated notification of disposition. The notice is intended to provide the debtor, and other interested parties, an opportunity to monitor the disposition of the collateral, purchase

Collateral Disposition means any sale, transfer or other disposition (whether voluntary or involuntary) to the extent involving assets or other rights or property that constitute Collateral.

Section 9-609 of the Uniform Commercial Code (UCC) permits the secured party to take possession of the collateral on default (unless the agreement specifies otherwise):

Generally, a secured creditor may seek to enforce its rights on its collateral upon a borrower's default. A secured creditor's remedies include an Article 9 sale, the right to sell the collateral to a third party in a private or public sale without judicial proceedings.

In "consumer-goods transactions," Revised Article 9 contains specific provisions delineating the proper notice which secured parties must give regarding the disposition of collateral upon default.

A PMSI is created in goods when a seller retains a security interest in the goods sold on credit by a security agreement. A debtor need not sign the financing statement. Attachment must occur in order to make a security interest enforceable against the debtor and against third parties.