New York Living Trust with Provisions for Disability

Description

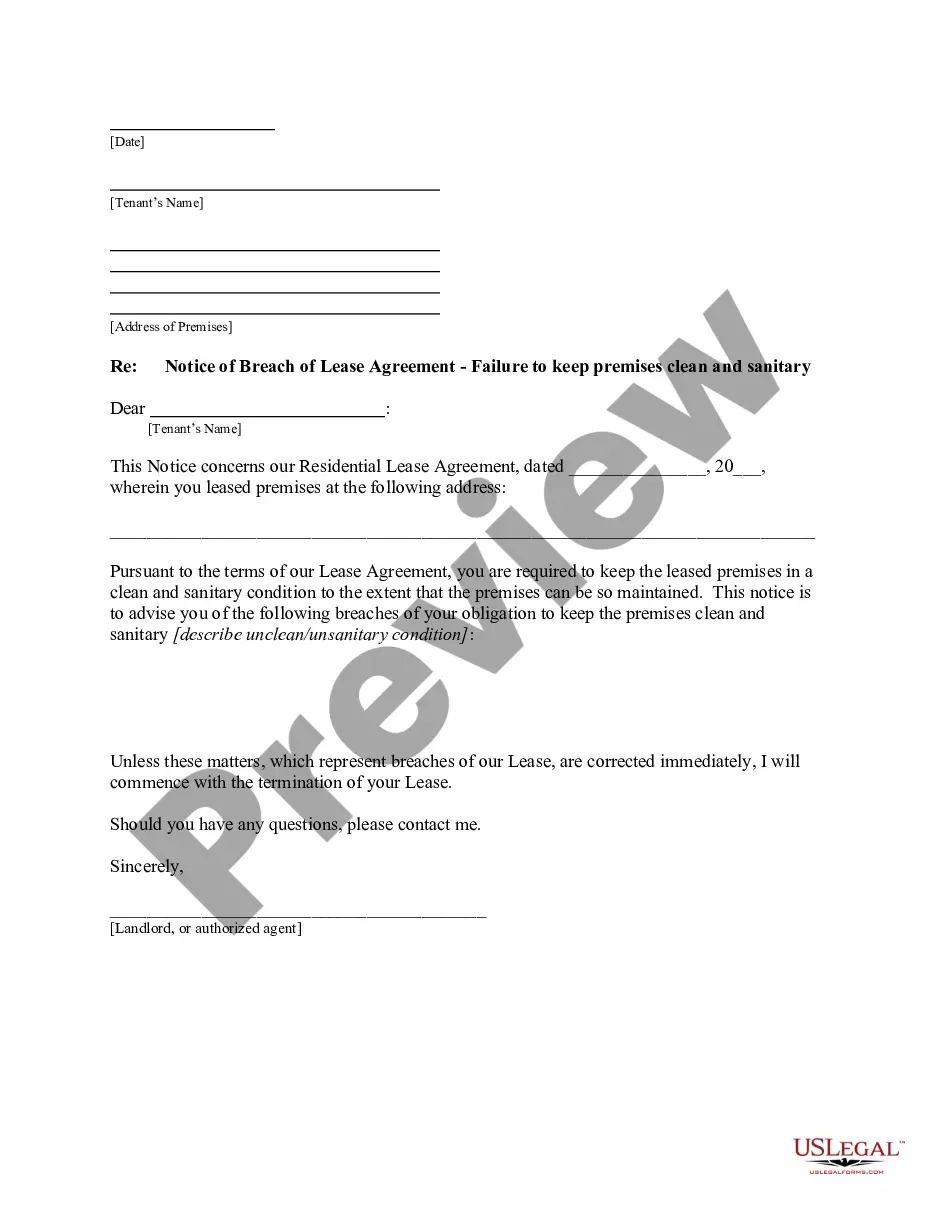

How to fill out Living Trust With Provisions For Disability?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad selection of legal document templates that you can download or create.

By using the website, you can access thousands of forms for business and personal use, sorted by categories, states, or keywords. You can retrieve the most recent versions of forms like the New York Living Trust with Provisions for Disability in just moments.

If you already have a subscription, Log In and download the New York Living Trust with Provisions for Disability from your US Legal Forms library. The Download button will be visible on every form you view. You can access all previously downloaded forms from the My documents section of your account.

Choose the file format and download the form to your device.

Edit. Fill out, modify, print, and sign the downloaded New York Living Trust with Provisions for Disability.

- Ensure you have selected the right form for your city/county. Select the Preview option to review the form’s content.

- Check the form description to confirm you have chosen the correct form.

- If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking on the Buy now button.

- Then, select the pricing plan you prefer and provide your information to register for an account.

- Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the transaction.

Form popularity

FAQ

Unlike SSI, there are no income or asset limits for SSDI eligibility. Instead, to qualify for SSDI, enrollees must have a sufficient work history (generally, 40 quarters) and meet the strict federal disability rules. SSA uses the same rules to determine disability for both the SSI and the SSDI programs.

A special needs trust can keep a person eligible for government benefits, such as Medicaid and SSI, while also paying for services in addition to what the government offers. The funds used to create a special needs trust are tax deductible.

The SSDI program does not limit the amount of cash, assets, or resources an applicant owns. An SSDI applicant can own two houses, five cars, and have $1,000,000 in the bank. And the SSDI program doesn't have a limit to the amount of unearned income someone can bring in; for instance, dividends from investments.

The first $20 of income received each month is not counted. In addition, with respect to earned income, the first $65 each month is not counted, and one-half of the earnings over $65 in any given month is not counted.

SSDI is not a needs-based benefit. If you are on that program for two years, you will also qualify for Medicare. Because SSDI is not needs-based, a special needs trust is not necessary to qualify for it.

With a supplemental needs trust, New York families and guardians can create a financial safe haven for a person with special needs without leaving that person ineligible for SSI and Medicaid benefits. In fact, the first supplemental needs trust was in created in New York in 1978.

A special needs trust (SNT) is a trust that will preserve the beneficiary's eligibility for needs-based government benefits such as Medicaid and Supplemental Security Income (SSI). Because the beneficiary does not own the assets in the trust, he or she can remain eligible for benefit programs that have an asset limit.

Some of the benefits of utilizing an SNT include asset management and maximizing and maintaining government benefits (including Medicaid and Supplemental Security Income). Some possible negatives of utilizing an SNT include lack of control and difficulty or inability to identify an appropriate Trustee.

A Special Disability Trust (SDT) is a special type of trust that allows parents and immediate family members to plan for current and future needs of a person with severe disability. The trust can pay for reasonable care, accommodation and other discretionary needs of the beneficiary during their lifetime.

HOW DOES MONEY FROM A TRUST THAT IS NOT MY RESOURCE AFFECT MY SSI BENEFITS? Money paid directly to you from the trust reduces your SSI benefit. Money paid directly to someone to provide you with food or shelter reduces your SSI benefit but only up to a certain limit.