New York Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years is a specific legal arrangement that allows individuals to provide for their loved ones while also making charitable donations. This type of trust is established in a person's last will and testament and takes effect only upon their death. The purpose of the New York Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years is to ensure that a portion of the individual's estate is dedicated to charitable causes, while still providing a fixed income to named beneficiaries for a specific period of time. This arrangement allows individuals to support charitable organizations they are passionate about and potentially provide their loved ones with regular income. Some important keywords related to this type of trust include: 1. Testamentary provisions: Refers to the clauses or provisions included in a person's last will and testament that dictate how their assets will be distributed after their death. 2. Charitable remainder annuity trust: A trust designed to provide a fixed income (annuity) to beneficiaries for a designated term of years, followed by the remaining assets going to a charitable organization(s) of the individual's choice. 3. Term of years: This refers to the specific duration or length of time for which the trust will provide income to the beneficiaries. It could be a fixed number of years or a specific event, such as the beneficiaries reaching a certain age. 4. Charitable organizations: These are nonprofit entities that aim to provide services or support various causes. Examples include educational institutions, healthcare organizations, environmental advocacy groups, and more. Different types of New York Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years can include: 1. Fixed term charitable remainder annuity trust: This type of trust provides a fixed income to beneficiaries for a specific number of years, after which the remaining assets are donated to charity. 2. Measuring life charitable remainder annuity trust: In this arrangement, the trust distributes a fixed income to beneficiaries for the term of their life. Once the beneficiary passes away, the trust assets are transferred to the charitable organization(s). 3. Multiple-life charitable remainder annuity trust: This type of trust provides an income to multiple beneficiaries for their lifetimes. After the death of the last beneficiary, the remaining assets are then transferred to charity. New York Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years serves as an effective tool for individuals who wish to support charitable causes and leave a lasting impact on organizations that align with their values. By including such provisions in their wills, individuals can leave behind a legacy that benefits both their loved ones and the community at large.

New York Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years

Description

How to fill out Testamentary Provisions For Charitable Remainder Annuity Trust For Term Of Years?

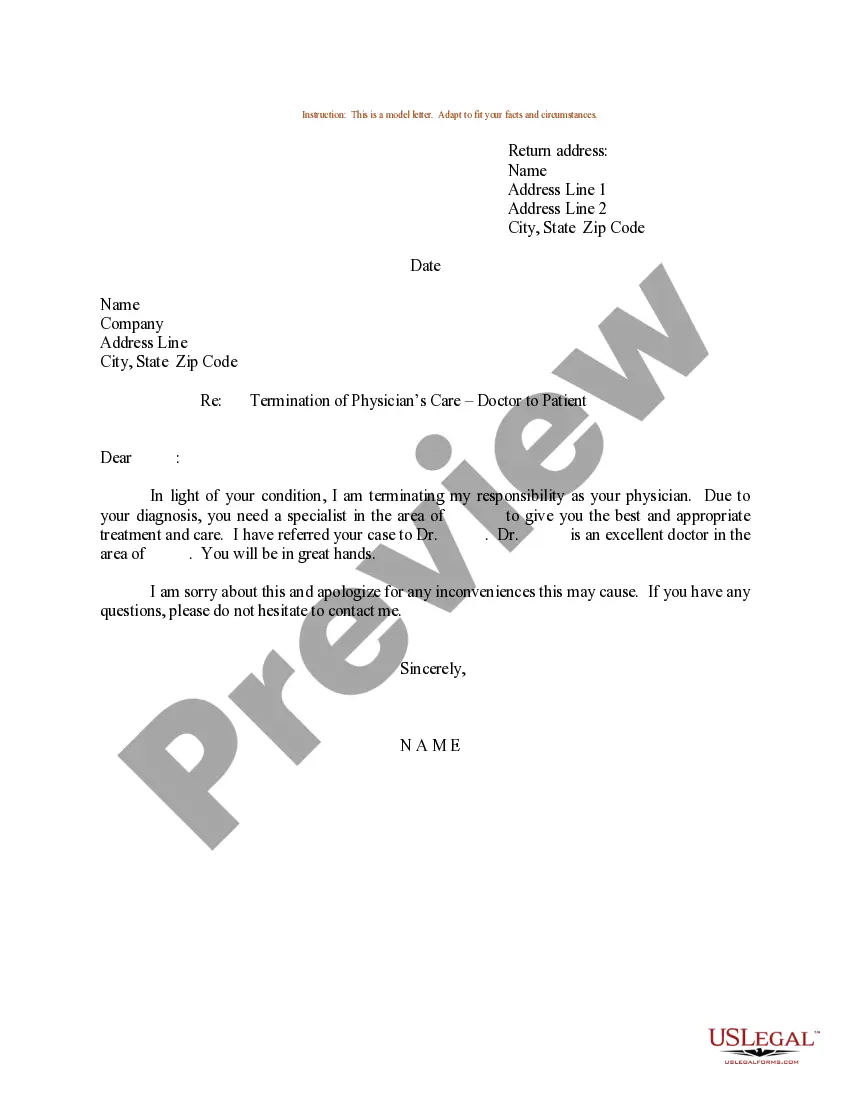

It is possible to commit hours on-line searching for the legal record format that meets the state and federal needs you need. US Legal Forms supplies thousands of legal kinds which are evaluated by specialists. It is possible to download or print out the New York Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years from my support.

If you already have a US Legal Forms bank account, you are able to log in and then click the Obtain switch. Following that, you are able to complete, modify, print out, or indicator the New York Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years. Each and every legal record format you get is your own eternally. To obtain another backup of any obtained kind, go to the My Forms tab and then click the corresponding switch.

If you work with the US Legal Forms internet site initially, stick to the basic guidelines listed below:

- First, make sure that you have chosen the right record format to the state/area of your choice. See the kind explanation to make sure you have picked out the right kind. If offered, make use of the Preview switch to look throughout the record format too.

- If you want to locate another variation in the kind, make use of the Look for area to discover the format that fits your needs and needs.

- Upon having located the format you would like, simply click Buy now to move forward.

- Select the rates strategy you would like, key in your credentials, and register for a merchant account on US Legal Forms.

- Full the purchase. You can use your bank card or PayPal bank account to pay for the legal kind.

- Select the structure in the record and download it to your system.

- Make adjustments to your record if possible. It is possible to complete, modify and indicator and print out New York Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years.

Obtain and print out thousands of record templates while using US Legal Forms website, that provides the largest variety of legal kinds. Use specialist and state-certain templates to take on your business or personal requires.

Form popularity

FAQ

A CRT lets you convert a highly appreciated asset like stock or real estate into lifetime income. It reduces your income taxes now and estate taxes when you die. You pay no capital gains tax when the asset is sold. It also lets you help one or more charities that have special meaning to you.

A charitable lead trust (CLT) is like the reverse of a charitable remainder trust. This type of trust disperses income to a named charity, while the noncharitable beneficiaries receive the remainder of the donated assets upon your death or at the end of a specific term, similar to a CRT.

The trust can also be used to reduce estate tax liabilities and ensure professional management of the assets. A disadvantage of a testamentary trust is that it does not avoid probatethe legal process of distributing assets through the court.

How Long Can a Charitable Trust Last? Charitable Remainder Trusts can either last the lifetime of another beneficiary, or for a specified term (usually 20 years). At that point, any remaining value would go to your designated charitable organization. Learn more about Charitable Trust tax rules.

To help you get started on understanding the options available, here's an overview the three primary classes of trusts.Revocable Trusts.Irrevocable Trusts.Testamentary Trusts.More items...?

Charitable remainder unit trust (CRUT) pays the beneficiary a fixed percentage of the trust at least annually, often for life or a period up to 20 years. 2. Charitable remainder annuity trust (CRAT) pays the beneficiary a fixed amount, or annuity, for the term of the trust.

A testamentary charitable remainder trust is created with assets upon your death. The trust then makes regular income payments to your named heirs for life or a term of up to 20 years.

A CRT may last for the Lead Beneficiaries' joint lives or for a term of years (the term may not exceed 20 years).

How does it save tax? A testamentary trust allows the person who controls it to split the income generated by the trust between family members. Importantly, children who receive income from a testamentary trust are taxed at adult tax rates, instead of penalty rates (up to 66%) which apply to other types of trusts.

Any income that you receive from your charitable trust could reduce the total contribution that you end up leaving to your charity. You may risk leaving nothing to your charity if you plan to receive high payments from the trust while you're alive.